Last Updated on August 30, 2021 at 3:41 pm

A review of Amit Trivedi’s new book, Riding The Roller Coaster -Lessons from financial market cycles we repeatedly forget.

I was fortunate to listen to Amitji on March 1st 2015 at the Mumbai Investor Workshop. We were short of a speaker and Subra requested Amitji to speak on debt mutual funds.

Amit Trivedi is a renowned BFSI trainer who runs the Karmayog Knowledge Center

I am a fan of anyone who can objectively talk about investment risk. His talk was various risks associated with debt mutual funds and how to keep it simple. He has a calm and collected persona which shines through his work.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Before we head to the review, I would like to point out that I rarely complete books. I just don’t have the attention span to do that. “Riding The Roller Coaster -Lessons from financial market cycles we repeatedly forget” is a book I completed because it is a compelling read. I also don’t know how to write a proper review. I am just going to cover the gist of the book and my experience reading it.

What is the book about?

“Lessons from financial market cycles we repeatedly forget” is an apt title. That is just what the book is about. Don’t feel the same way about ‘riding the roller coaster’.

Don’t feel the same way about ‘riding the roller coaster’. There are too many books with that name or close variants.

This is a book about greed. About asset bubbles, about market crashes and my favourite phrase in finance – investment risk. It is to the author’s credit that he has managed to convey a complex subject in simple, easy-to-understand language.

It is a book meant for the retail investor to understand, compare and contrast the reasons behind the major stock market, bond market and commodity market crashes that we have seen so far. The book emphasizes the importance of being diversified at all times and avoid leveraged investing.

The Contents

The book can be divided into two parts.

Part 1

A series of past economic bubbles and past market crashes are discussed. I present below a brief snippet of each (Pictures here are provided for context, are from Wikipedia and not part of the book).

For those who are not familiar with these economic bubbles, the book is the quickest way to understand the reasons behind the rise and fall.

Tulip mania: In the 1630s, the Dutch started speculating on the price of Tulips bulbs. Tulip bulb contracts (promise to deliver) were changing hands at ever increasing prices without any actual deliverable in sight. It is believed that bubonic plague resulted in abrupt reduction in trading and bursting the bubble.

“Tulip price index1” by JayHenry – Own work from data of Thompson.

The south sea bubble In 1710, the South Sea Company was formed in England and claimed that it had a monopoly to trade with Spanish territories in the South seas.

Investors gave up regular income from government bonds and exchanged them for company stock in the hope of rich and regular dividends. The company carried out no business, manipulated stock price and soon the price came crashing down. This is crash made popular by Benjamin Graham in the Intelligent Investor – the one in which Sir Isaac Newton lost a fortune.

The Great Depression

The 1920s was a decade of innovations and productivity. In order to participate in surging stock market, investors, including Ben Graham purchased stocks on borrowed money. When banks realized it was dealing with bad debt, it started selling shares which triggered the crash.

“1929 wall street crash graph” by Lalala666

The book details how Ben Graham quickly realized his mistakes and save his partnership from ruin.

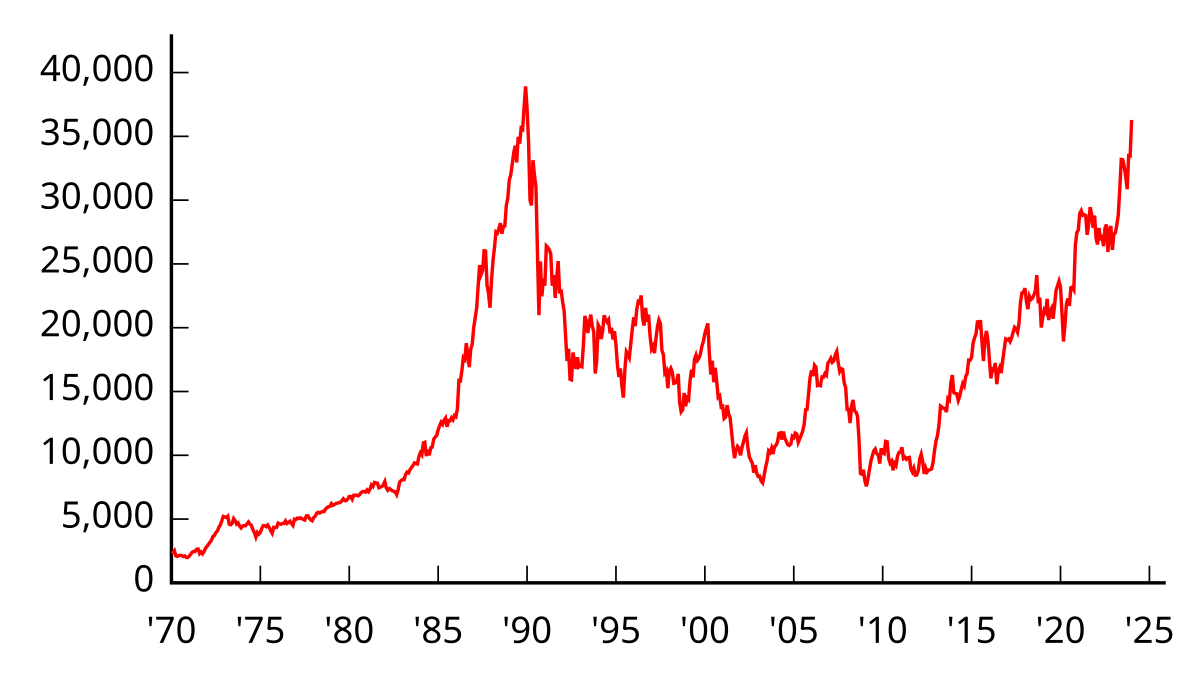

The Japanese Bubble when inflated real estate and stock prices came crashing down in 1990. If interested, you can read my study of Rupee Cost Averaging in a Sideways Market with the Nikkei.

“Nikkei 225(1970-)” di Monaneko – http://www.stat.go.jp/data/getujidb/zuhyou/d09.xls.

The Great Indian Securities Scam (1992) When Harshad Mehta became a broker in the debt market to finance his stock investments and started to misuse bank funds. How he jacked up stock prices with his definitions of ‘value’ in the early 1990s.

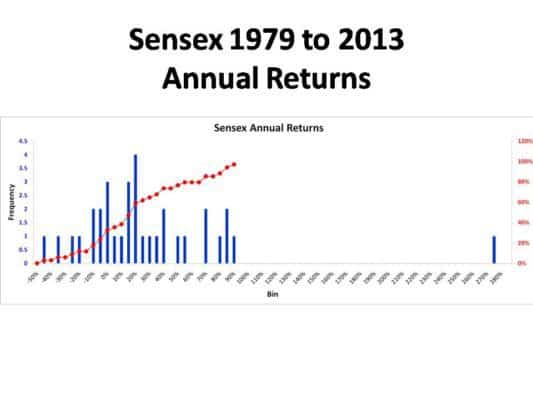

The lone point on the right is because of the price manipulation by Harsha Mehta. Read more: What Return Can I Expect From Equity Over the Long term? Part 2

The IPO Mania (1995) when investors were sold IPO application forms without any guarantee of allotment! The mania ended when IDBI deferred its IPO issue.

Long term capital management

This is a US Hedge fund which took on risky arbitrage positions driven by leverage.

If you wish to know more about what arbitrage means, you could consult these links:

How Do Arbitrage Mutual Funds Work?

Can You Think Of A Risk-Free AND Tax-Free Mutual Fund?

Risky arbitrage?! An arbitrage opportunity carries minimal risk only when the underlying security being traded in different markets is the same! Amitji warned that such a danger could well be present with arbitrage mutual funds as well during the Mumbai meet.

LTCM assumed the currencies of weaker and stronger European economies would converge in time. When Russian defaulted on its external and internal debt, the arbitrage spread widened and became larger than the cost of borrowing. The fund crashed.

“LTCM” by JayHenry – Own work.

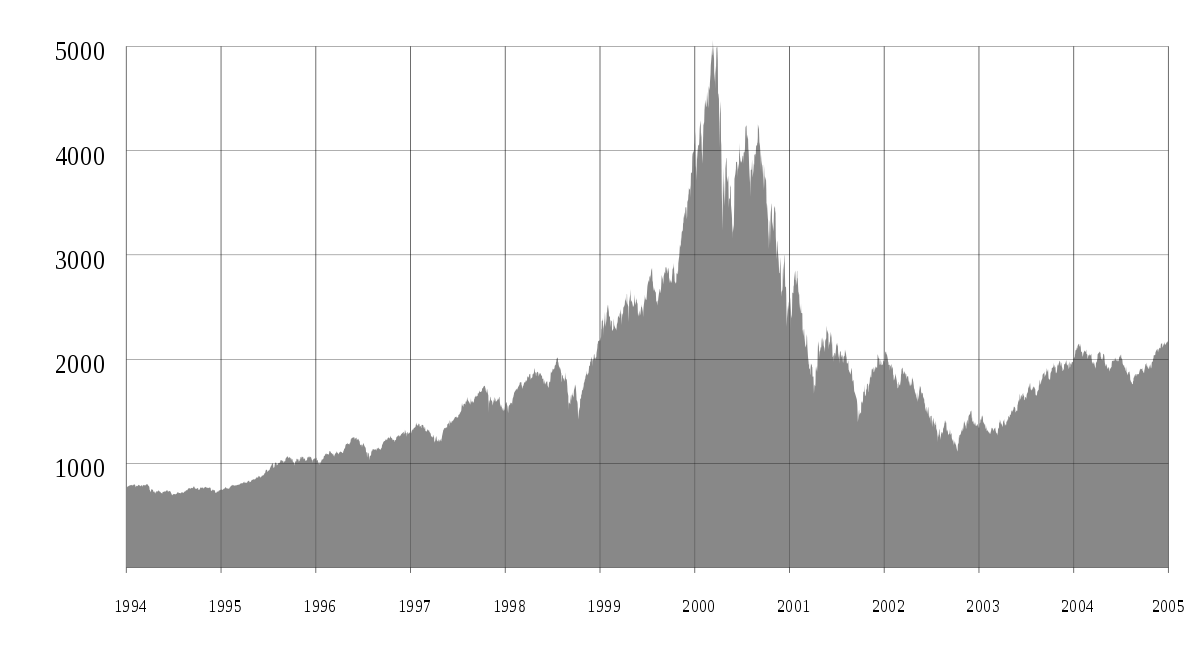

The dot-com crisis When every dot-com company was believed to be the ‘next best thing’.

“Nasdaq Composite dot-com bubble” by Lalala666

The sub-prime crisis When it was believed (again!) that real-estate could never crash and bad debt was creatively structured as a high-rated bond.

“Subprime mortgage originations, 1996-2008” by National Commission on the Causes of the Financial and Economic Crisis in the United States – Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States, p.70 figure 5.2.

Part 2

This is the most delectable part of the book. Given these crashes, Amitji goes about comparing and contrasting them to offer us patterns common to these economic bubbles: greed, leverage, ignoring basic notions of valuation, euphoria, a sense that this time it would be different!

This part would appeal to everyone – those familiar with the crashes and those reading about it for the first time.

The book is filled with anecdotes and interesting quotes. Here are my favorites:

“What we learn from history is that we don’t learn from history” – Bishop Desmond Tutu

Question to an expert: “What are the indicators of the next bubble?”

Response: “The day you stop thinking of this question!”

Incredibly, as the books opened for publication, the Chinese markets crashed! The 300% Instant Gains on China IPOs Are Suddenly Vanishing

I am sure that Amitji will include an account and analysis of this story in the second edition of this book.

The book is as enjoyable as it is enlightening. I strongly recommend it.

Buy it from Amazon. Hard Cover Rs. 450.0 Kindle: Rs 279.3 (not an affiliate link)

You can follow the author at the book’s website: RIDING THE ROLLER COASTER

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)