Last Updated on December 18, 2021 at 10:39 pm

As an offshoot to yesterday’s post, Non-intrusive term insurance comparison portals, let us look at simple ways to protect our online privacy.

I am no expert. I write as someone who has repeatedly made mistakes in this area.

First, it is important to recognise that every business is out to get your email and mobile no. They are building themselves a ‘lead list’. Their aims is to periodically, if not frequently, let you know about themselves so that, sooner or later you will ‘buy’.

Second, after listening to Sucuri security speaking at Yoastcon, I understood the following:

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

It is not possible to be 100% secure online. All we can do is to eliminate the known risks. I think the same applies to online privacy.

Online privacy is perhaps a subset of online security.

Here are (in my uninformed opinion) some simple ways to eliminate known risks and nuisances when it comes to online privacy.

1) Have an exclusive email for online ‘use’

Most of us have two emails: one official and one personal (there was a time when aseparate gmail account was considered prestigious!)

I think another email for online use will save us a lot of trouble. That can be used whenever we wish to buy from any online portal. We don’t need to access it regularly, but would need it for activating accounts. The advantage is, promotional offers received will not come to our main email accounts. There are other benefits as noted below.

PS. please use your primary email to subscribe freefincal posts. I will protect it with my life 🙂

2) Beware of logging in via Social Media

Today social media engagement is crucial for the growth of a website. When you wish to register to a new service, instead of filling up a registration form, it is tempting to login via Facebook or Twitter.

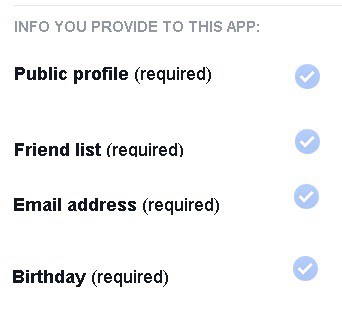

We must realize that when we do so, we install an ‘app’ in out Facebook or Twitter accounts. This ‘app’ can access our email, mobile number and can even post on our behalf.

The convenience of social media login need not be shunned because of this. The alternative email mentioned above will come in handy here. You can set this as your primary Facebook or Twitter accounts.

Apps that access only email are then okay. Nowadays apps can access mobile numbers also. Avoid any app that want to do this unnecessarily. I login to Goibibo via FB. They get my mobile number. That is necessary because I need SMS alerts about flight schedule changes.

If the App wants to post on your behalf, choose “only to me”.

Taking a moment to read what the app can access will solve many privacy issues like email promotions and frequent telemarketing calls.

If you are uncomfortable, then the standard registration form wth only mandatory fields filled in, is the only way out.

Note: I use Facebook and Twitter apps for logging into the DIY investors’ forum

FB app: Your profile information age, gender, language, country will be accessed by the app (not me) by default. I don’t know about birthday.

Your email is not necessary and you can uncheck it. In any case, I don’t know how to access that!

Twitter app: Will be able to see who you follow and read your tweets. Again I don’t know how to access that. Don’t want to either.

Freefincal has a FB comment plugin. It displays who you are at the blog. It also tracks how many times you used FB comments. No other information is passed on to me.

Google and Facebook have tonnes of private data and usage statistics which app developers and their clients (business’s) can access to target products better. Entire organisations are engaged in building ways in which user habits can be tracked (legally!) from mobile apps. This will help build persuasive ads.

I advertised the workshop on strategic personal finance via facebook. It allowed me to select, age group, interests of the audience (mutual funds, stocks etc.) and their location so that ad would be fed to a relevant audience. The ad campaign was not that successful, but I could get a few ‘likes’ for freefincal’s FB page

3) Beware of cookies!

Cookies are small files that are stored in your computer (mobiles too, I guess). They goal is to track your browsing habits and store your login profile.

Facebook and Google Adsense use this to serve “relevant” content in the sites that you visit, in your FB feed or on the sidebar.

I once read a story that a pedophile was caught because FB monitors chat messages. I was served up real estate ads and camera lens ads after I mentioned that on chat!

I visited a bloggers site and stayed there for about 30 seconds. Did nothing else. Just browsed.

Soon my Facebook feed had an ad that said, ” You visited my site. Let us connect…”!!

So, if I am not mistaken, this means that a cookie downloaded from the site is in my computer, and is communicating with this blogger’s FB ad campaign! That is scary!

There are a few ways to handle this:

1) In your browser’s privacy settings disable “third party cookies”. These are ones from websites other than the main domain.

According to firefox,

Third-party cookies are cookies that are set by a website other than the one you are currently on. For example, cnn.com might have a Facebook like button on their site. That like button will set a cookie that can be read by Facebook. That would be considered a third-party cookie.

Some advertisers use these types of cookies to track your visits to the various websites on which they advertise. If you are concerned about this, you can disable third-party cookies in Firefox.

Disabling third-party cookies in Firefox can stop some types of tracking by advertisers, but not all. Some websites (for instance, Microsoft’s Hotmail, MSN, and Windows Live Mail webmail) use third-party cookies for purposes that are not necessarily privacy concerns, and disabling third-party cookies may cause problems with those sites.

2) Enable the “do not track” feature in your browser. Chrome says, some websites may still track and some amount of tracking is necessary to plug future security holes in browsers and other products.

3) Choose “clear all cookies on exit” option and close your browser at least once a day!

4) Choose “private browsing”.

5) If you have doubts, locate a person who enjoys watching er … child unsafe ‘stuff’. I find them to be privacy experts!

4) Beware of offline threats!

Do not participate in raffles or lucky dips. There is no free lunch.

Think twice before divulging your email to others. Never give it telemarketers. Never enter it any form unless absolutely necessary.

I think it is okay if an authorized* call centre personnel wants your email or mobile for verification.

(*) Run by someone you have an account with.

5) Beware of snooping

Irritating by calls from your bank, reduce your bank balance. They will never bother you.

Two incidents related by friends (A and B) (hope you don’t mind) :

A was browsing through the pages of an online distributor and clicked on a product page. Had a look and closed the window. Shortly, there was a call from them if he wanted that product!

B was holding cash in a liquid fund waiting for a suitable time to invest. No one else knew about this. He got a call from the AMC saying that it was not a good time to shift to equity!

At the cost of sounding paranoid, I think it is safe to say that EVERYONE is snooping on us!

I don’t think this can be avoided. Can anyone comment on this?

6) Use your credit card sparingly

In this day and age, I think we don’t need credit cards. Call me primitive, but I see no benefit in using a credit card just for purchase points.

Credit companies are among the worst cold callers and emailers. I don’t have a credit card. My wife has one.

We use it sparingly. I typically pay in full, as soon as the purchase is made. If we make a big ticket purchase, we get a call from them, asking if we want a personal loan!

Card protection policies and health insurance policies is the new nuisance. When she recently got a new card, it came with a pin and has to be used like a debit card. I think, no CPP is necessary with such cards,

Come to think of it, there is no Card Privacy Policy. Credit companies could well be doing research with our card research statistics. Some even claim that such data could be sold to other businesses.

7 ) Other lessons I have learnt

1) Do not ‘unsubscribe’ SPAM*! It will lead to more SPAM. Simply mark it as SPAM.

(*) From totally unknown senders like Nigerian princes!

Unsubscribe emails only from known senders: banks, amcs etc.

2) Review your Facebook and twitter apps. Ever got angry with a friend who wants you to play a game?

Well, it is not them doing that. It is the game app. Ask them to review their apps and what they can do.

I was shocked to find that the 4shared app collects my birthday (something I hide), my friends list, my email and my profile!

Many times a Facebook app collects information that is not necessary.

- The quora app wants to know my custom friends lists.

- The blogmint app wants to see my newsfeed

- I had an apps called Appypie and Addthis which took my email.

- Coursera can see my friends list

- Academia.edu is the worst app. It needs only public profile but collects everything else!

Facebook does not bother to say this when we install the app. We need to go to settings and check each of them to find out what is unnecessary.

8) Beware of what you share in social media!

Do I really need to know that my FB friend went to ABC restaurant or XYZ resort with his family? If I am not wrong, this is done with the geo-tag option in a smartphone?!

The FB page of the resort or restaurant tells me which of my friends have been there. What a fantastic way to persuade me to do the same! Similar things apply to several online purchases.

9) Beware of your smartphone!

I don’t have one, but I know some guys who make apps. They say:

- Beware of the apps in your smartphone. Many of them are silently recording your location, habits, even your files and passing them onto analysts. Who in turn tell developers how to target a demographic. Remove anything unnecessary or sparingly used apps.

- Disable the Wi-fi and GPS when not necessary.

- Understand what the app can do before installing it.

————-

It is no longer about us finding the products we want. It is all about the products finding us, before we even want it!

Can you suggest other ways of privacy protection?

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)