Last Updated on August 22, 2022 at 11:20 pm

A few weeks back, an article in a mutual fund distributor’s blog caught my attention. The article listed the price of 10 gms of gold from 1925.

The author wanted us to observe the huge increase in gold price from 1925 (Rs. 18.75) to today Rs. 29,190 (average price of FY 2013-14). It was therefore concluded that investment in gold can never go wrong and the price was always bound to increase! To access such articles search for “gold price India 1925”

In this post, let us stare at some historical gold and stock market returns. You might just about be convinced that buying gold as an investment is riskier than buying stocks!

As an investment, mind you, and not for consumption or as hedge against hyperinflation during war and economic collapse

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

We will look at two groups of data:

Group A

- Gold price in INR (10 gms) from 1925 (source) (Original source is supposedly RBI but I am not able to locate it)

- Gold price in USD (1 troy ounce = 31.1034768 grams!) from 1925 (source)

- US stock index S&P 500 (CNX 500 can be thought of as an approximate analogue?) data from 1925 (source)

Group B

- Gold price in INR (10 gms) for each FY since 1972-73 from RBI

- Sensex data from 1979-80 (Subra shared privately)

The nature of the groups should be self-evident. The first group analyses data from 1925 to present and the second group from the 1970s to the present.

S&P 500 and Gold price in USD as available from 1871 and 1850 respectively! I truncated the data set at 1925 to match the starting date of the INR gold price data.

Before we begin, an interesting quote from nma.org

The price of gold remained remarkably stable for long periods of time. For example, Sir Isaac Newton, as master of the U.K. Mint, set the gold price at L3.17s. 10d. per troy ounce in 1717, and it remained effectively the same for two hundred years until 1914. The only exception was during the Napoleonic wars from 1797 to 1821. The official

U.S. Government gold price has changed only four times from 1792 to the present. Starting at $19.75 per troy ounce, raised to $20.67 in 1834, and $35 in 1934. In 1972, the price was raised to $38 and then to $42.22 in 1973. A two-tiered pricing system was created in 1968, and the market price for gold has been free to fluctuate since then.

Method:

We will look at long term returns from gold – 5Y, 10Y, 15Y, 20Y and 25Y. Suppose we have data from 1925 to 2013, and would like to determine 5Y returns (CAGR), we use,

CAGR = (price-after-5Y / initial-price )^(1/5) -1

The CAGR is determined for every possible 5 year period (1925-30; 1926-31; 1927-32 and so on).

The average of all such returns is calculated along with the standard deviation.

This is repeated for the other durations – 10,15,20 and 25 years.

The standard deviation is a measure of how much individual returns deviate from the average. Higher this number, more the variation.

The idea is to understand how much the returns have varied for different periods and for a given period, the amount by which individual returns can vary.

So let us begin,

Results: Group A

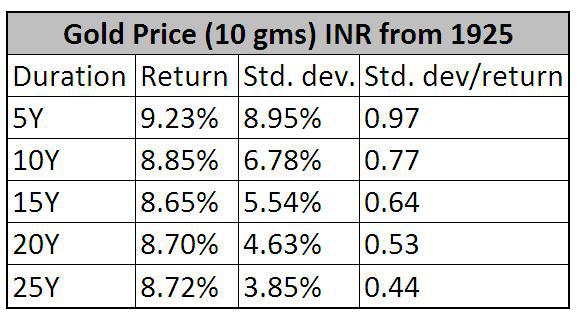

Let us start with the gold price in INR from 1925

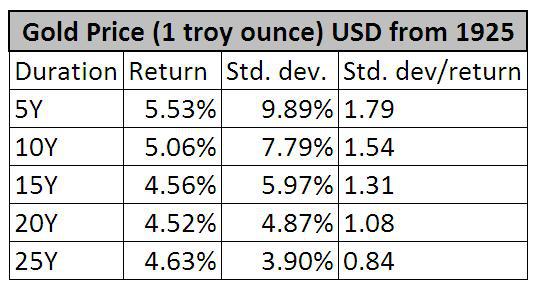

Now for the gold price in USD from 1925

- Notice that, while there is not a huge difference in returns for change durations, the standard deviation is larger for lower durations.

- This means, lower the duration, higher the deviations from the ‘average’. That is, the risk of attaining a return close to the average is higher for smaller durations

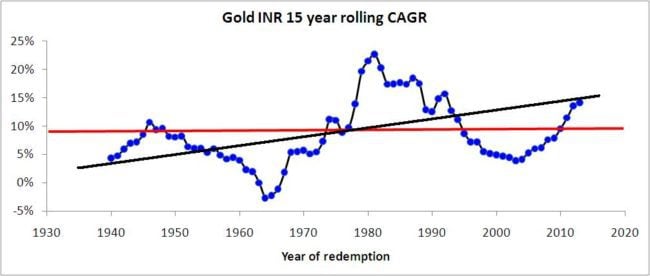

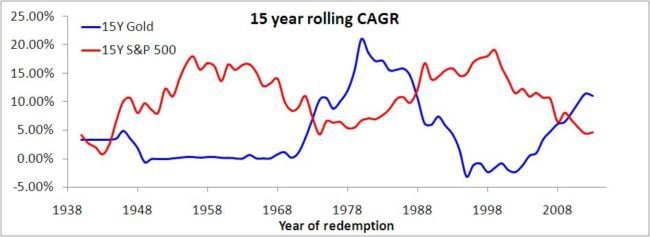

To understand this better, have a look at how the 15 year averages have evolved

Notice the wave like nature of the returns. They seem to be moving away from the tilted black line and heading back to it. The red line represents the ‘average’ of the data set. The extent of deviation from this red line is given by the standard deviation.

Sometimes investors end up with returns higher than the average and some other times lower than the average. For the purposes of this article we will refer to this risk. In reality it represents volatility and not risk. The title of this post should actually read, Gold is volatile than stocks!

Now let us get back to comparing the above tables,

- Notice the difference in returns between INR and USD gold prices. Can we assume this stems from the INR:USD conversion rate? Seems to be so (do correct me if I am wrong).

- The fall in INR standard deviation (risk) with an increase in duration is higher than that for USD standard deviation.

- This means, the risk associated with buying gold in USD is much higher than for INR. Almost twice as high! This can be inferred by looking at the ratio of standard deviation/return

- When people sell gold as an investment (etfs, fund of funds, e-gold), they say, ‘gold is a hedge against inflation’. Do you think returns from gold after taxes has beat inflation whether the purchase was made in INR or USD?

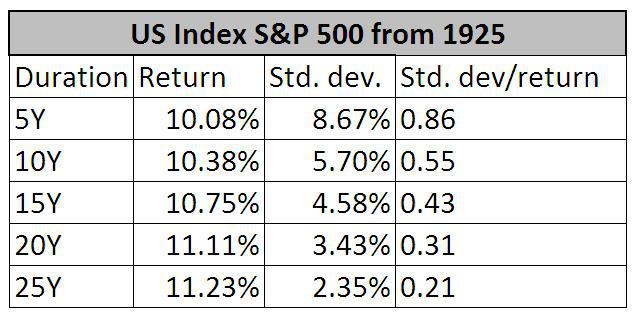

Now let us look at the corresponding numbers for S&P 500 stock index

- Do not let the higher returns bother. Stocks have always returned higher than gold. Even the most hard-core gold fan knows this.

- Focus instead on the fall of the standard deviation with increase in investment duration and the std. dev./return ratio. Both of these represent the associated risk.

- Would you believe that the risk associated with investing in US stocks is one-half of that associated with buying gold in USD for 5,10 year durations?!

- The US stock-risk is one third of the gold-risk (USD) for 15,20 year durations and one-fourth for 25 year durations!!

- The US stock-risk is also significantly lower than the gold-risk(INR) although the comparison may not be appropriate.

Results: Group B

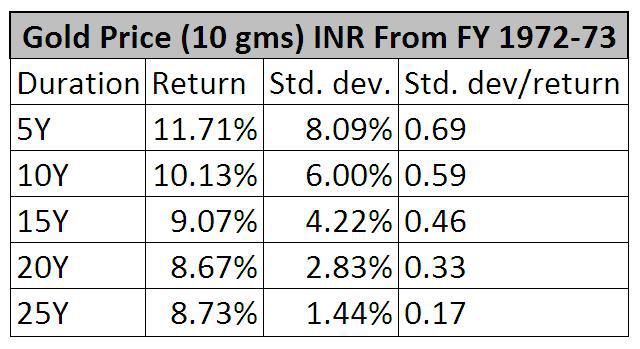

Now let us look at similar data for Gold price in INR (10 gms) for each FY since 1972-73

Now for Sensex data

- Investing in gold for 5 years is about 20% less risky than stocks. Nothing to shout out though!

- For higher durations, the risk associated with gold investment is higher and is more than twice that of stock investments for 25 year periods!

Let us remind ourselves that risk in the present context refers to the extent of deviation from the average return for a given duration.

Even if we don’t look at exact numbers and point out, group B data suggests that gold investing is as volatile as equity investing, it would still be news to our largely gold mad population who shy from stocks thinking that they would lose their capital. Such people should go and check the performance of gold ETFs and gold funds in the last two years.

What of it?

The volatility associated with gold returns is not worth it, considering the quantum of reward associated for any investment duration.

Add to this the fact that long-term capital gains from gold etfs and golds funds will be taxed like debt mutual funds (10.3% flat or 20.3% with indexation benefit), gold is not at all an appealing investment.

Should not gold be part of a diversified portfolio?

Well the reason people say that in the first place is because of this

Notice the negative correlation between gold and stocks. So if gold is part of a well diversified folio (equity, bonds and gold), it can lower the volatility of the net portfolio.

However, in a developing country like ours, where interest rates are high and rewards from equity are much higher than inflation, choosing 65:35 (equity:debt) asset allocation like an equity oriented balanced mutual fund is all one needs to get good returns with low volatility.

Typically including a volatile asset in the folio poorly correlated with existing assets lowers the volatility of the portfolio (counter-intuitive!).

However, if we overdo it, we will end up lower returns. We will also not be able to gain from a market rally like the present one. This is the disadvantage of too much gold in the folio – keep an eye on the performance of funds listed under Hybrid: others category in VR online.

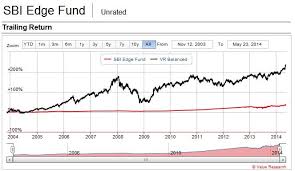

For example, here is how SBI Edge fund which holds approximately equal proportions of equity, debt and gold, fared since 2003

No volatility, but no performance either! The fund no longer exists.

No volatility, but no performance either! The fund no longer exists.

What about the 10% gold allocation that ‘experts’ recommend via ETFs and fund of funds?

ETFs are not the clean product that most of us think they are. See here and here (Links from facebook group, Asan Ideas for Wealth). Google for ‘gold ETF scandal’ to become uncomfortable with ETFS!

I think with equity and debt allocation with year rebalancing and some tactical calls, most of us manage to contain portfolio volatility and get decent returns without gold.

What do you think?

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)