Dr M Pattabiraman (PhD), aka Pattabiraman Murari, aka pattu, is the founder, managing editor and primary author of freefincal. He is an associate professor at IIT, Madras, and the author of three personal finance books. He has over thirteen years of experience publishing news, analysis, research, and financial product development. Several of his calculators and a financial health check tool have been published on SEBI’s investor awareness website.

He has over 28 years of teaching and research experience. He was awarded the “Young Faculty Recognition Award” by IIT Madras in 2012 for his passionate teaching, which students love. He has also received gold medals for academic distinction during his MSc and PhD, both at IIT, Madras. Learn more about Pattu’s unique approach to teaching.

Pattu has conducted money management sessions at the Quora World Meetup and for employees of the World Bank, CFA Society, TamilNadu Investors Association, RBI, Nuclear Power Corporation of India Limited, BHEL, Asian Paints, PayPal, RBS India, Societe General, Honeywell, Cargill Corp. and many other institutions.

He has also been interviewed by leading financial media outlets and news channels. For speaking engagements or interview enquiries please use this contact form.

Expertise and Experience

Dr Pattabiraman’s expertise includes mutual fund analysis, investment risk, retirement planning, stock valuation and personal finance.

He has been profiled in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

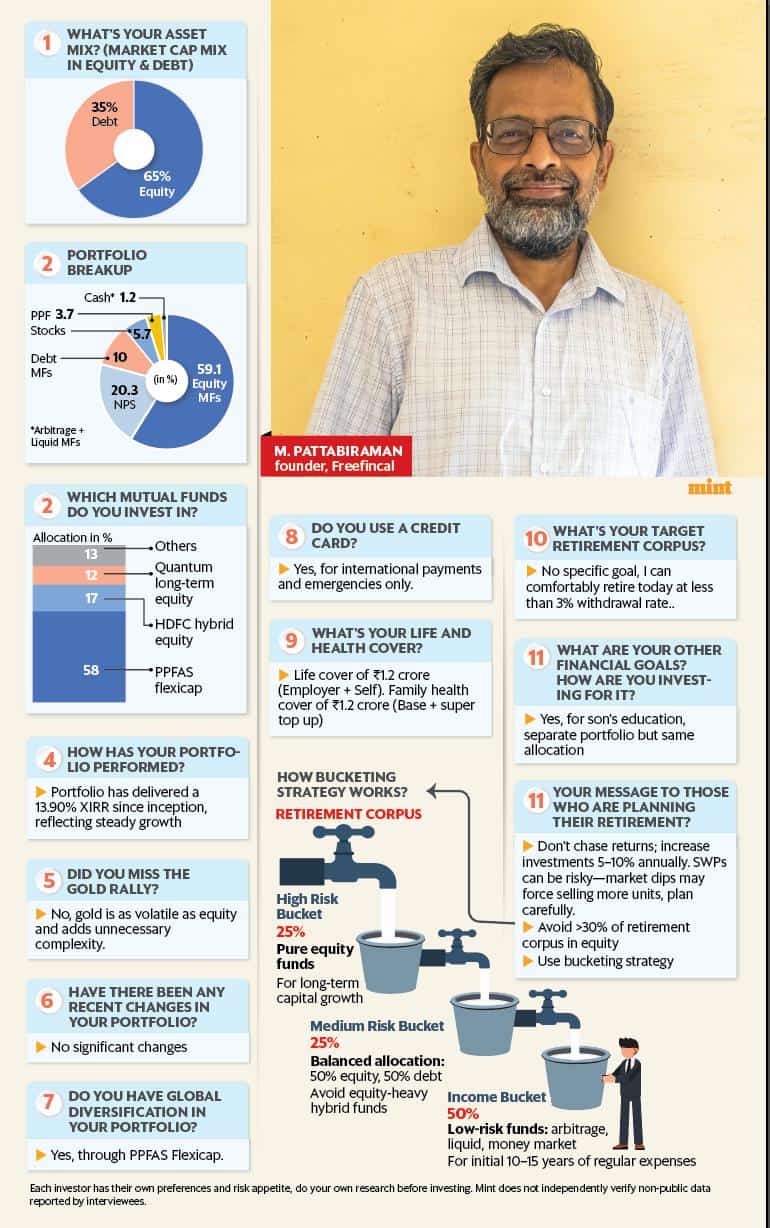

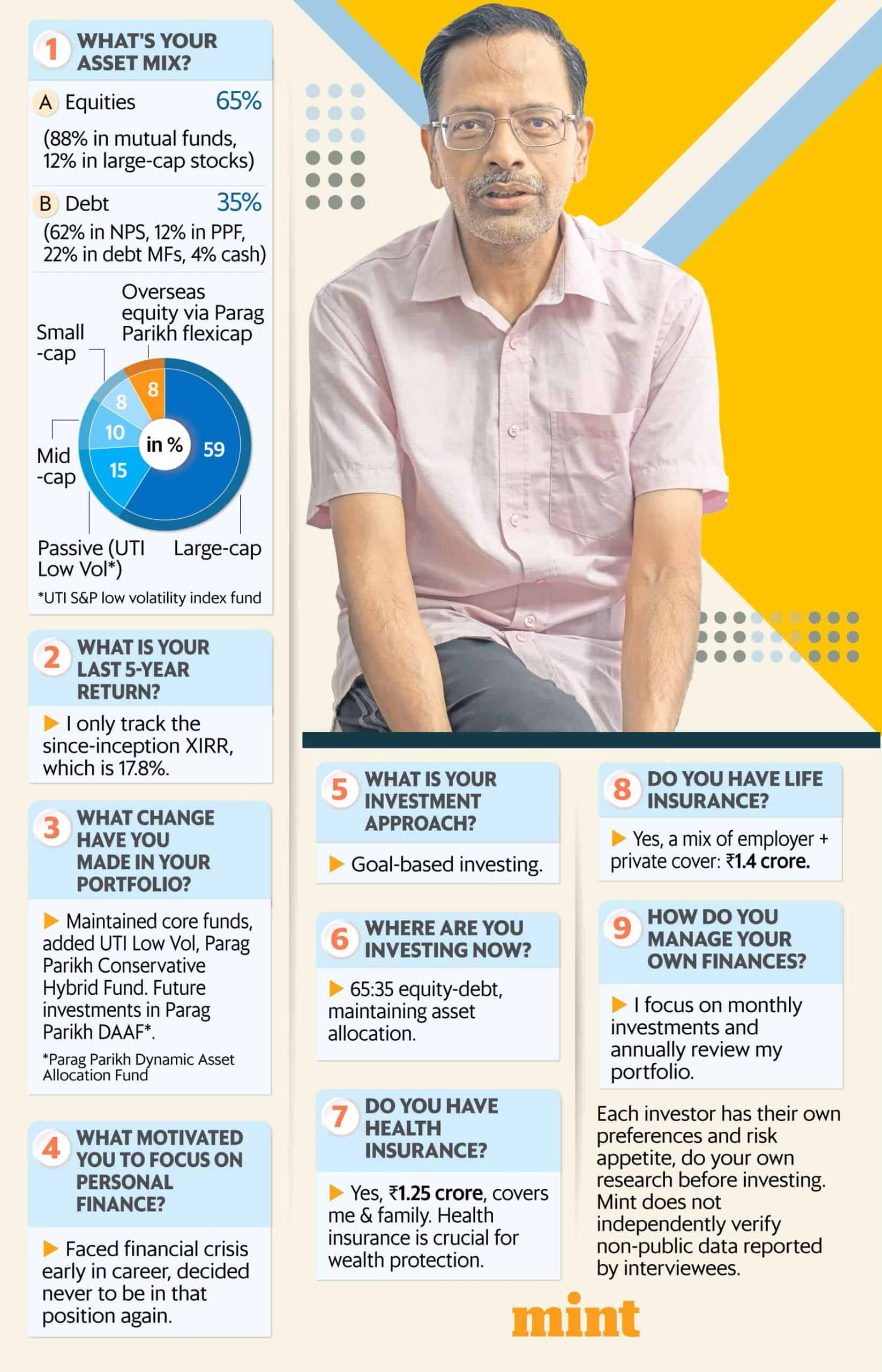

Pattu was also profiled for the Guru Portfolio series of LiveMint in March 2024 and June 2025.

- You only need a fund where returns remain consistent: Freefincal’s Pattabiraman. The article went viral on X(formerly Twitter). Also, see LiveMint Best of the Week.

- Why Freefincal’s Pattabiraman doesn’t believe in beating the market. Post on X.

His journey to financial independence has been featured on LiveMint: Light the FIRE and lose the fear of getting fired. And Can your FIRE dreams get past the COVID-19 impact?

Pattabiraman specialises in financial goal-based portfolio management where the investment risk is gauged based on need alone, regardless of market movements. This has resulted in a unique open-source robo-advisory tool.

His analytical tools and research on mutual fund investing, stock selection, pre-retirement planning, post-retirement risk management, and portfolio management have been published regularly at freefincal since May 2012. The site serves over three million readers annually (5 million plus page views).

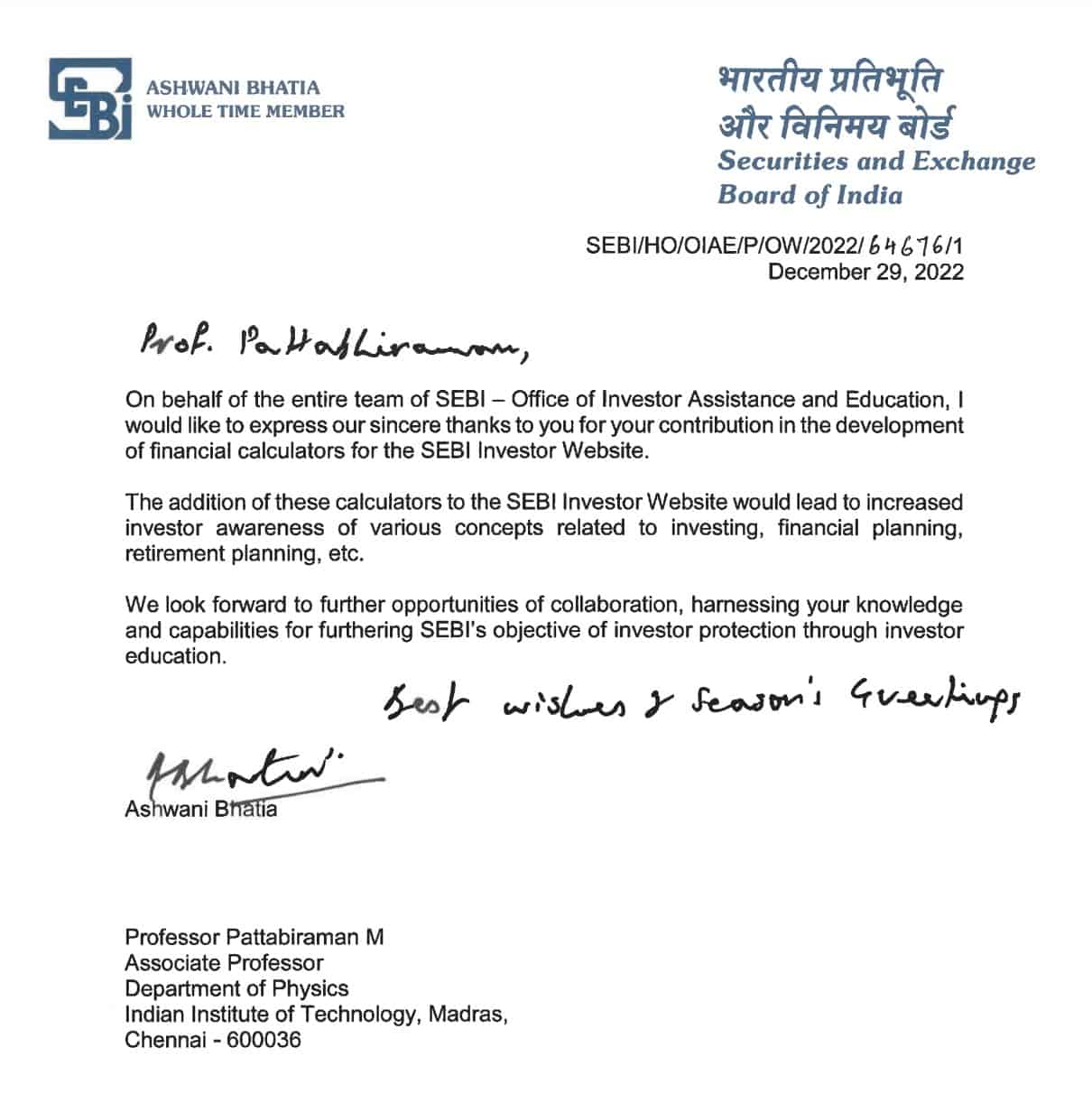

Work with SEBI

The SEBI Investor Protection Education Fund Advisory Committee recommended nine of his calculators be part of the SEBI Investor Education Website. Further details can be found in the announcement post.

A financial health check tool created by Pattabiraman is now part of the revamped SEBI Investor Education website.

Also, see Outlook Money article: Sebi Shares Calculator By IIT-M Professor That Allows Changing Asset Allocation Over Investment Tenure.

Sebi Incorporates Financial Health-Check Tool On Its Investor Education Portal.

Letter of appreciation from SEBI.

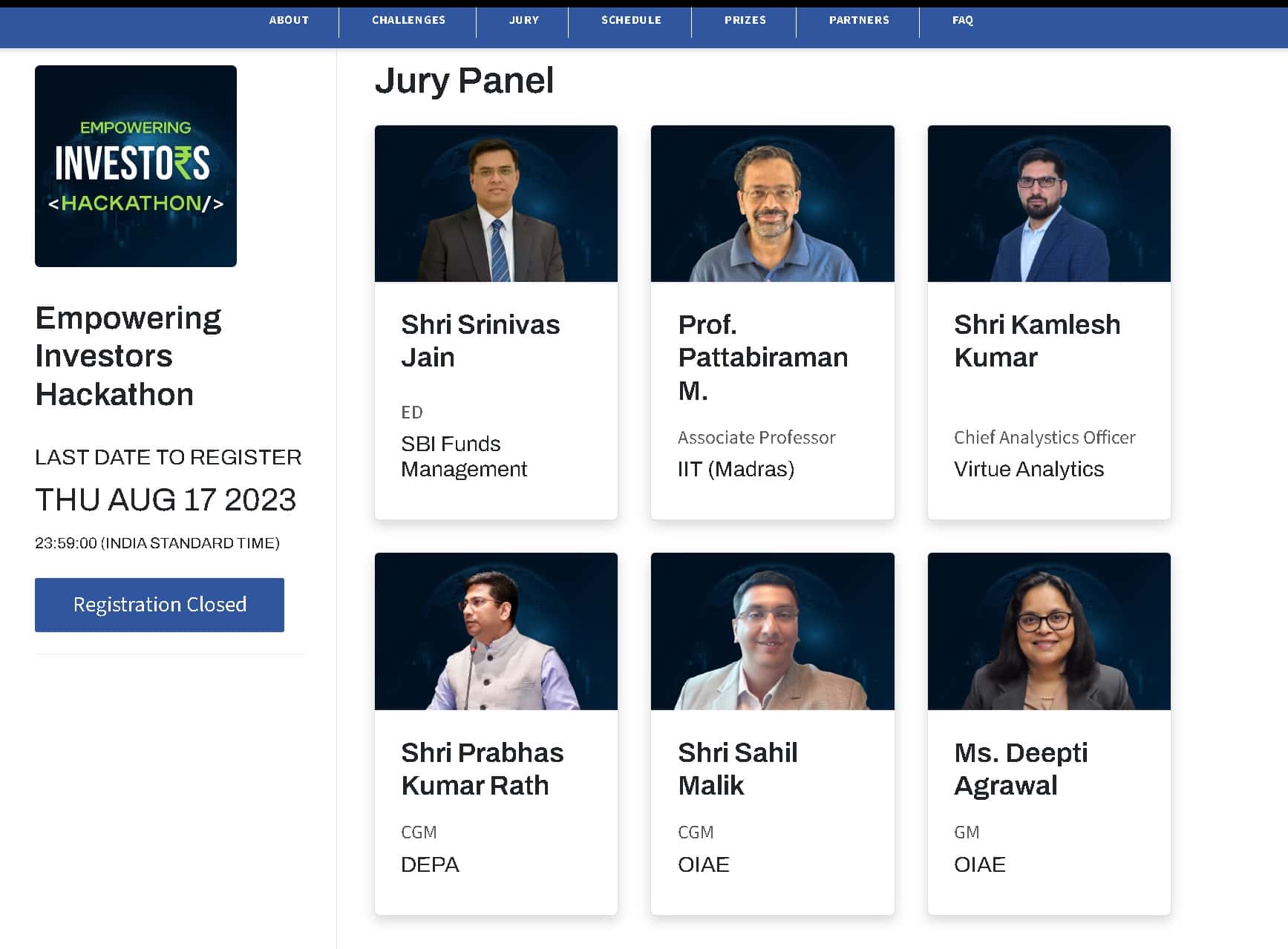

Dr. Pattabiraman was a Jury Member of the SEBI Empowering Investors Hackathon.

Dr M Pattabiraman has been a special invitee for the SEBI Investor Protection and Education Fund (IPEF) Advisory Committee meetings.

Books by M Pattabiraman

Popularly known as “Pattu”, Dr M. Pattabiraman has written three books:

Chichu Gets a Superpower! – teach your kids how to manage money responsibly.

You Can Be Rich Too With Goal-based Investing (CNBC TV18)

- You Can Be Rich Too With Goal-based Investing at Google Play

- You Can Be Rich Too With Goal-based Investing at Amazon

Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want

And seven other free e-books on various topics of money management.

Interview with Mandeep of Labour Law Advisors

Also see: Jagruk Talks with Dr Pattabiraman: How to plan for retirement

Interview with Wint Wealth

Interview with INDmoney

Podcast with Shubham and Hemanth

Interviews in Tamil

Interview with Venkatesh Anbumani for Vam Vodcast

Also, see Exploring the Depths of Finance Wisdom with M Pattabiraman

Interview by Boosan for Finance Boosan

Spotify link: How to Build Wealth – Financial Expert Reveals His 15 Yrs Journey

Interview with ET Tamil

Behindwoods Air interview

Interview with Mathangee for Wealth Cafe Tamil

Featured in

Interview for The Fifth Estate (official student media body of IIT Madras): A Passion for Teaching

Pattabiraman’s interview also appears in The Wisest Owl: Be your own financial planner by Anupam Gupta.

Poster for CFA Society Talk

Podcasts

Let’s Get Rich with Pattu (English)

Let’s Get Rich with Pattu, produced by Ofspin is a weekly podcast on money management. Each episode will cover one aspect of money management – insurance, emergency funds, planning for retirement, financial independence and early retirement, buying vs renting and more.

Ways to listen (English edition):

- Let’s get rich with Pattu on YouTube

- Let’s get rich with Pattu on Audible

- Let’s get rich with Pattu on Google Podcasts

- Let’s get rich with Pattu on Spotify

- Let’s get rich with Pattu on Apple Podcasts

- Let’s get rich with Pattu on Amazon Music

- Let’s get rich with Pattu on JioSaavn

- Let’s get rich with Pattu on Gaana

- Let’s get rich with Pattu on iHeart

- Let’s get rich with Pattu on Deezer

Let’s Get Rich with Pattu (Tamil)

- Let’s get rich with Pattu in Tamil on YouTube

- Let’s get rich with Pattu in Tamil on Audible

- Let’s get rich with Pattu in Tamil on Spotify

- Let’s get rich with Pattu in Tamil on Apple Podcasts

- Let’s get rich with Pattu in Tamil on Amazon Music

- Let’s get rich with Pattu in Tamil on JioSaavn

- Let’s get rich with Pattu in Tamil on Deezer

ETWealth podcast: Investing for Retirement: How soon, how late.

Times of Indian Podcast on changes to the New Tax Regime proposed in Budget 2023

Paisa Vaisa Podcast with Anupam Gupta

- Ep. 137: Financial Freedom Part 1

- Ep. 138 What is financial freedom?

- Ep. 139: Financial Freedom Part 2

- Ep. 140: Planning for financial freedom

- Ep 141: Financial Freedom Part 3

- Ep 142: Executing a financial freedom plan

Portfolio and experience

His portfolio details and experience can be found here:

- Fourteen Years of Mutual Fund Investing: My Journey and lessons learned

- Lessons from investing for my son’s future for the last 12+ years

- Stock Portfolio Analysis

Youtube Channel

The freefincal YouTube channel has over 1000 videos on personal finance and DIY investing. Regular viewers are accustomed to Pattu’s opening lines and callsign, “Hi, I am pattu from freefincal”!

Guest Articles

He is also a contributor to The Economic Times

- Why investing is not only about equity

- Mutual fund advisers earning commissions from AMCs may not give you the best advice.

- DIY investing is not everybody’s cup of tea

News Article Quotes and Other Media Mentions

Say no to NFOs, buy direct plans and seek suggestions from Sebi RIAs

Beating insurance mis-selling by banks: Use e-banking, reduce branch visits

IIT Madras Professor Warns Against Risky Investment Practices Amid Bull Market

Indian households falling for a dangerous money myth? An IIT professor sounds alarm

Indians’ craze for equity is scary, rude shock likely when bull run ends, says IIT professor

IIT Madras Professor Warns Against Risky Investment Practices Amid Bull Market

Is your PPF or Sukanya Samriddhi account at risk? Here’s what you need to know

Can a professor, lawyer or doctor give investment advice? Sebi has a plan

This is what Sandeep Tandon did in 72 hours after the Sebi rap that saved Quant MF from redemptions

What to consider in opting for a higher pension from EPS

Keep your money safe: Stick to systemically important banks for safety

Non-linked insurance plan: Surrender or stay? Do the math before deciding

The better way out of a troubled fixed maturity plan for investors

7 common money myths that are still doing the rounds

ITR filing: Don’t make these mistakes to avoid getting tax notice

These young professionals have a new motto- to retire early

My business grew after SEBI came up with direct plans

Direct plans of equity MFs can help negate the impact of LTCG tax

Forget direct plans, these ETFs charge only 0.05 per cent

Avoid mis-selling at banks, research before buying financial product

Article by SEBI RIA Avinash Luthria: The 8 most surprising stories in the Financial Planning profession in India

Full list: News Media Presence of M Pattabiraman and freefincal

Fee-only India

He is a patron and co-founder of “Fee-only India”, which promotes unbiased, commission-free investment advice.

Integrity and core principles

Pattabiraman focuses on reportage journalism and research. All freefincal articles are based only on factual information and detailed analysis by their authors. Credible and knowledgeable sources will verify all statements made before publication.

Pattabiraman does not provide individual investment advice and does not publish paid articles, promotions, PR, or satire. All opinions will be inferences backed by verifiable, reproducible evidence/data. He follows strict journalistic integrity defined by the freefincal’s Policies and Standards.

Corporate Sessions

He conducts free money management sessions for corporations and associations(see details below). Previous engagements include the RBI, BHEL, Nuclear Power Corporation of India Limited, Asian Paints, PayPal, RBS India, Societe General, Honeywell, Tamil Nadu Investors Association, Quora World Meetup, CFA Society, TamilNadu Investors Association etc.

Watch his talks

This talk was given to World Bank employees in Feb 2019: Common sense approach to managing money.

Index investing options in India: This talk was given to members of the Tamil Nadu Investors Association

Getting Started Guide: Re-assemble

Re-assemble is a free step-by-step guide to help you manage money.

Download Re-assemble: Step-by-step money management basics for beginners

Related Links

- Pattabiraman is listed on the Indian Research Information Network System

- Vidwan (Expert Database and National Researcher Network) Profile of M Pattabiraman

- IIT Madras, dept of Physics listing.

- IIT Madras Publications page

- Reddit AMA conducted by M. Pattabiraman

- Google Scholar Page

- Google Knowledge Panel link

- Amazon Author Page

- Amazon India Author Page

- ORCID Page

- Scopus Profile

- Mendeley Profile

- Personal web page: mpattabiraman.com

- IMDB page of M Pattabiraman (listed as Pattabiraman Murari)

Contact

- Follow Pattabiraman on Twitter

- Follow Pattabiraman on Facebook

- Connect with him on Linkedin

- Contact information: pattu {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

The views expressed on this website or elsewhere by Dr. M Pattabiraman are personal and not those of the Indian Institute of Technology, Madras.