Last Updated on April 26, 2025 at 9:27 pm

Yesterday (Sep 24th) saw the birth of Fee-only India, a coming-together of SEBI registered fee-only financial planners at Mumbai. Ashal Juahari, admin of Facebook group Asan Ideas of wealth and I spent the day listening to and discussing with the fee-only financial planners from my list.

An organisation of financial planners who do not sell any products (get no commissions) and work for and with the clients they serve is an idea proposed by Piyush Khatrri. After discussions, fee-only India, was identified as a catchy and representative name for the organisation.

The participants & founding members

Standing from L to R:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Chandan Singh Padiyar (Pune): Padiyars.com

Piyush Khatri (Hyderabad): Sahastha.com

Sukhvinder Sidhu (Karnal, near NCR): Finlifecare.com. You can check out his guest post: Illustration: Financial Plan Creation for Rajeev Goswami

Swapnil Kendhe (Nagpur): vivektaru AIFW members will know him 🙂

Vikram Krishnamoorthy (Coimbatore): Insightful

Sitting from L to R:

Shilpa Wagh (Mumbai): Waghfinancials

Pattu (yours truly for those who don’t know)

Ashal: AIFW Blog and AIFW FB page

Melvin Joseph (Mumbai): finvin He is one of the first fee-only financial planners and one of the most successful. Check out his guest posts:

How to become a Registered Investment Adviser (RIA) in India

Investment Options for Non-resident Indians (NRIs).

Nuggets from the discussion

Firstly, I am pleasantly surprised and if you don’t mind, quite proud that the freefincal fee-only list has led to many clients for the planners. The credit for this goes to Google. It sends in about 1000 people per month to that page alone. Even queries like “best financial advisor in India” show this page right at the top.

Secondly, despite many problems and struggles these planners are quite clear that they will not sell any product, get no commission and provide a professional service. They are at different stages of evolution: about to start, just started, about to break even, realised small gains, considerable gains etc.

Thirdly, the meet exceeded my expectations. I was so glad I attended because if I, who has no desire to become a fee-only planner found the talks inspiring, I can imagine the impact it would have had on the planners. We strongly believe other financial service professionals tired of selling products and their souls along with it, will be inspired by fee-only India and work towards fee-only advisory after Sebi registered as an “individual” investment adviser (no jugaad where relatives sell products and the commission stay in the family and many do – investors beware).

Melvin Joseph discussed his journey from a cushy PSU job to a sought-after fee-only planner. His meticulous record keeping and how he wields it to generate good word-of-mouth referral systematically is commendable and inspiring.

Sukvinder Sidhu talked about how he approaches clients and get them comfortable and aware of their finances and only them initiates talk of goal-based investing.

Shilpa Wagh explained the expenses associated with running the financial planning service as a profession and the challenges from preventing it slipping into a business. Her clarity of thought was noteworthy.

Vikram discussed his approach to handling clients, methodology and pointed out that many DIYers also consult fee-only planners for a validation of their money management strategy.

Piyush described his ongoing effort to create a unified tool (data gathering, risk profiling, plan creation, investment analysis and report generation) for planners to work with and increase productivity. Also, his vision for fee-only India and how it should be run was discussed.

I spoke about my experience with freefincal and simple ways by which one can systematically market our competence in a fast-paced world. Now have enough material to make a short handbook out of it.

I could not listen to Swapnil (“beginners expectations”), Chandan Singh Padiyar (“planner-client gap”) and Ashal (“what clients want”) as I had to leave early.

Fee-only India: Vision & Objective

Enhanced visibility of fee-only planners making it easy for clients to learn more about them at one place and contact them.

A resource for new and old fee-only planners to build a client base, increase productivity and as a source of continuing education.

Be the first advisor body to actively involve investors as patrons/trustees/guardians of other investors. The patrons should not only promote fee-only planning as the most logical investment (as Vikram put it) a person can make when it comes to money management but also ensure that the members of fee-only India remain purely fee-only. Any evidence of product selling would result in elimination.

You can consult any of the planners mentioned above for guidance:

If you are sitting on the fence about registering with SEBI and starting a fee-only practice,

If you a DIY money manager looking for a professional opinion on your investments or if you want help, you can consult

Support these purely fee-only planners by engaging them or suggesting them to your friends and relatives. May their tribe grow.

NOTE: Neither Ashal nor I receive any kind of compensation for promoting fee-only financial planning.

Use this form to ask Questions or reg. the robo template ONLY (For comments/opinions, use the form at the bottom)

And I will respond to them in the next few days. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

GameChanger– Forget Startups, Join Corporate & Live The Rich Life You want

My second book, Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want, co-authored with Pranav Surya is now available at Amazon as paperback (₹ 199) and Kindle (free in unlimited or ₹ 99 – you could read with their free app on PC/tablet/mobile, no Kindle necessary).

It is a book that tells you how to travel anywhere on a budget (eg. to Europe at 50% lower costs) and specific investment advice for young earners.

The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (you will be emailed the pdf after payment)

You Can Be Rich Too with Goal-Based Investing

My first book with PV Subramanyam helps you ask the risk questions about money, seek simple solutions and find your own personalised answers with nine online calculator modules.

The book is available at:

Amazon Hardcover Rs. 271. 32% OFF

Infibeam Now just Rs. 270 32% OFF. If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Flipkart Rs. 279. 30% off

Kindle at Amazon.in (Rs.271) Read with free app

Google PlayRs. 271 Read on your PC/Tablet/Mobile

Now in Hindi!

Order the Hindi version via this link

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

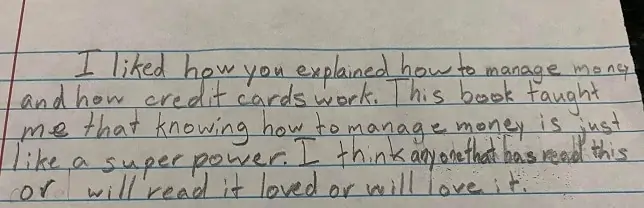

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)