Last Updated on October 1, 2023 at 8:11 pm

Here is why one or more sources of passive income is an important part of our retirement plan. Not only can it boost our income and reduce capital market risk in retirement, but it can also keep us engaged and agile. Here is how we plan for it. With August 1st called “World Wide Web Day”, it is a perfect time to get started!

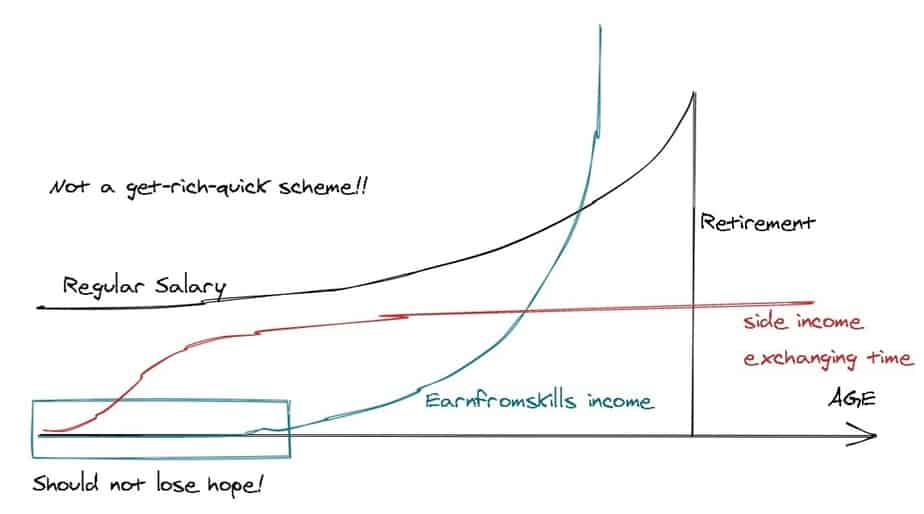

First of all, we need to be clear about what is actually passive about passive income. There are so many misconceptions about this in popular social consciousness. No income is truly “get it started and forget about it”. The best way to define the “passive” part is via examples.

I have examples of both passive and active income right on the menu of this site! Take for instance, the monthly stock and mutual fund screeners. An entirely new screener needs to be created each month. My data sources can rescind access anytime, and it may not be possible to publish it anymore.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

This is the very opposite of passive income. The actual product or service needs to be modified or recreated each time a sale has to be made. The old product – for example, the May 2020 screeners – have a short shelflife. Although the process of creating the screener is 90% automated, I still need to complete the 10% to create the final product. This is not passive income.

Passive income refers to any income source that requires minimal maintenance of the actual product or service. The costs associated with keeping the product alive and selling it should be as low as possible. This effort can be regular, say once a year or occasional modifications to comply with shifting laws, trends and technology.

The product or service need not be digital. A person designing mattresses and receiving a royalty for it also enjoys passive income. If there is a new development in the science of sleep, a new design can be released. There is no need to pick on the old.

Take, for example, the freefincal robo template or the lectures on goal-based investing. These are evergreen products. The overhead costs are trivially small, and virtually no effort is necessary to maintain the product (unless Facebook changes its group rules).

The point that most people fail to understand about passive income is, the “passive” part (minimal effort) refers only to the product or service sold. Sustained, disciplined effort is necessary for the “income” part.

Imagine freefincal is a small community blog. The number of new readers who comes across the blog is minuscule compared to the “regulars”. Imagine if I introduce a new product in such a scenario. Within a couple of weeks, the regulars would have seen the product post, decided to buy it or give it a miss. After that, the income would drop thick and fast.

For passive income to work, yes the product should be evergreen have low running cost and require little maintenance, but that is only one side of the coin. Passive income also means regular income. To get a steady income from any product it needs to meet new sets of eyes consistently.

I need to get up each morning and write new articles so that the readership grows consistently. How I do this will be the subject of a new course ;). For every 100 new readers, about 2-3 may end buying products. So the mouth of the “conversion funnel” should be broad and increasing all the time. Ps. The reason why I never listen to unsolicited feedback on what I should write about or how the site layout should be, is because they have little appreciation for my circumstances and goals. In the age of analytics, random “let me help you” feedback is useless.

Passive income that arises from human endeavour requires active, growing visibility. The passive only refers to the commodity sold. The income requires for it to be regular and substantial. This may sound like a bad deal. It is not. It could be a fantastic deal.

Imagine yourself as a blogger, YouTuber, social influencer etc. You have created a passive product and realised the importance of active visibility. You build content consistently. Content that is helpful and not directly related to the products. This is not labour; this is not tiresome as long as you genuinely love what you do. You think about what to do next when you go to sleep and wake up pumped.

This is not labour. It is engagement. The best way to kill time. Time to insert the obligatory Confucious quote (paraphrased): “Create a passive product you love, and you will never have to work a day in your life,” This is also a great way to spend our retirement – a part of it.

That brings us to the connection with retirement planning. Imagine creating a passive product that brings in only Rs. 2500 a month. This is small. No one is going to invite you as a keynote speaker to a passive income conference. Who cares? If you nurture it consistently it could grow to 10% of your monthly expenses, 30%, 60% and then it is something.

Why passive income is a crucial part of your retirement plan

Most investors will end up with a retirement corpus that is lower than what is need to combat inflation and emergencies. There are two key reasons for this: (1) They are spending more than they should and therefore not investing enough and (2) they are not investing it in the right asset allocation because of either fear or greed.

Imagine an income stream that slowly grows over decades and is equal to half the monthly expenses of a retiree. This can make a huger difference to a retirement. Enter an income source (up to 3 is possible) in the freefincal robo template and see the corpus drop.

With such an income source, a large chunk of the corpus can be left alone untouched for a longer time. If you have some exposure to equity, then you can handle a downturn with a lot more confidence. So it is a no brainer that an additional source of income would help.

Of course, that income can be active as well – via consulting or a second job. Just that reliance on active income in old age is not a good idea. It also a no brainer that those who wish to continue exchanging their time for money can/should do so. Just that they should not rely exclusively on it. Passive income requires effort too, but the obligations are lower.

How to get started towards creating a passive income stream?

Of course, it will take time and effort, which is why those who are decades from retirement should sow the seeds now – today. Time management is the only requirement. If you tell yourself, “I will allocate one hour per week to work on a future income stream (active/passive)”, then you have to put in that one hour, rain or shine.

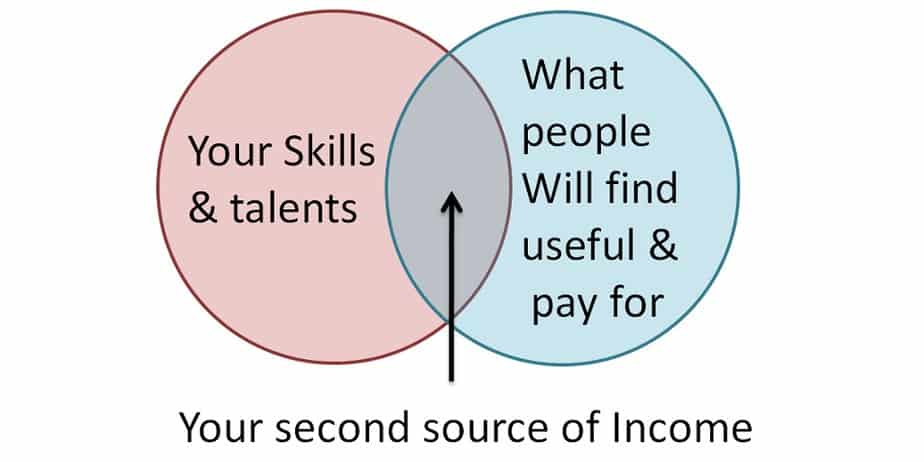

Theoretically, active or passive income is the overlap of skill and utiity. Practically it is all about consistency

- Which of your skills would solve a problem for others while making you happy and content? The answer is your passive income stream.

- Then you need to spend some time learning how others are monetizing this content and how you can do it differently. Why should someone pay you when there are others?

- Start an online presence: tweet about developments in your skill space. Write short articles on Facebook, in a blog, on Youtube. Create a community; create an identity (even if people hate your views, they should not be able to ignore you). Polarization works!

- Develop trust among your community

- Recognise their problems. This would not only inspire new content, but also new products.

- Do not start selling anything until people write to you saying: “I want you to help, how do I pay?”

- Recognise all this will take years and years.

Perhaps you studied a degree that you did not like. Worked a job only because you had to. You can correct those wrongs here with some introspection. With some planning.

We now have a course that can teach you how to build an income stream that will last a lifetime!

Course Objective: A complete framework to build online visibility with your skills; Create a community of readers and viewers based on expertise and trust and generate an income that will gradually grow to become significant and last a lifetime.

- Find a skill that you love and others will find useful

- Get better at this skill, find out problems that the community has and solve them for free

- Build trust

- Soon they will ask you to help them for a fee

- That is when the income gates open

- You can create a bucket of active + passive products and services, interlink them and keep the income coming slowly, steadily and then strongly.

Naturally, those who need extra income immediately should become part of the gig economy and could only help them learn more skills which can be leveraged towards long term income.

The cost of the “How to get people to pay for your skills” course, aka “Earn from Skills” is Rs. 5000.

I am happy to announce at the time of writing, 500+ members are now part of the exclusive Facebook group in which the course videos (24 units, 11+ hours of content upload so and more on the way!) are hosted. The fee is one-time and the access forever!

Course Fee: Rs. 5000 only (one-time) The fee is deliberately kept low to enable young earners and college students to participate. Enter the course via this link: How to get people to pay for your skills: A guide to win trust and build income.

The internet has transformed how business is done. When we talk about online success stories, we tend to focus only on those who make lakhs each month, anything that provides just a couple of thousands today (after a year of prep) is just as important. The reason being it can grow into something substantial with a consistent effort by the time we retire. Happy World Wide Web Day!

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)