The freefincal robo-advisor tool will now feature equity glide paths for retirement buckets, providing enhanced risk management. We also have an updated video user guide. The updated version has already been sent to all existing users. Those who did not receive the notification can contact us.

Those unfamiliar with the tool’s features can refer to the full list of features below. The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary. More than 3000 investors and financial advisors are using the tool. The tool was featured in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

To understand how glide paths work, we must first understand the retirement bucket structure used in the robo-advisor tool. Let us do this with an example. Thanks to reader Asish Prabhakar for inspiring this update with his interesting questions.

New video user guide

Sample financial plan calculation using the freefincal robo advisor

A 35-year-old reader hopes to retire by the age of 50. He is married to a homemaker aged 30. We shall plan for retirement income from when he reaches 50 to when his wife (or, generally, the younger spouse) reaches 90. Therefore, he has 15 years to invest and needs to plan for inflation-protected retirement income for 45 years.

We will consider a 6% inflation rate before and after retirement. It is better to determine how much your expenses are increasing yearly and use that rate. You can use our Personal Inflation Calculator.

Inputs and assumptions

- Monthly expenses of Rs. 50,000

- Another Rs. 50,000 annual expenses.

- Existing assets: Rs. 65 lakhs in stocks, mutual funds, and 50 lakhs in EPF

- The expected return from equity is approximately 10% (post-tax), and the return from EPF is 7% (this is after 15 years, so it is better to err on the side of caution).

Output:

- The average monthly expenses at the time of retirement will be approximately Rs. 1.3 lakhs.

- The total corpus required (excluding existing investments) is about Rs. 4.9 Crores!

- Factoring in existing investments, the net target corpus to be achieved is only Rs. 81 Lakhs. That is the power of starting early and accumulating a sizeable corpus by age 35.

- The monthly investment (including mandatory EPF or NPS deductions) is Rs. 22,000! If he can increase the investments by 10% a year, the initial investment decreases to Rs. 12,000!

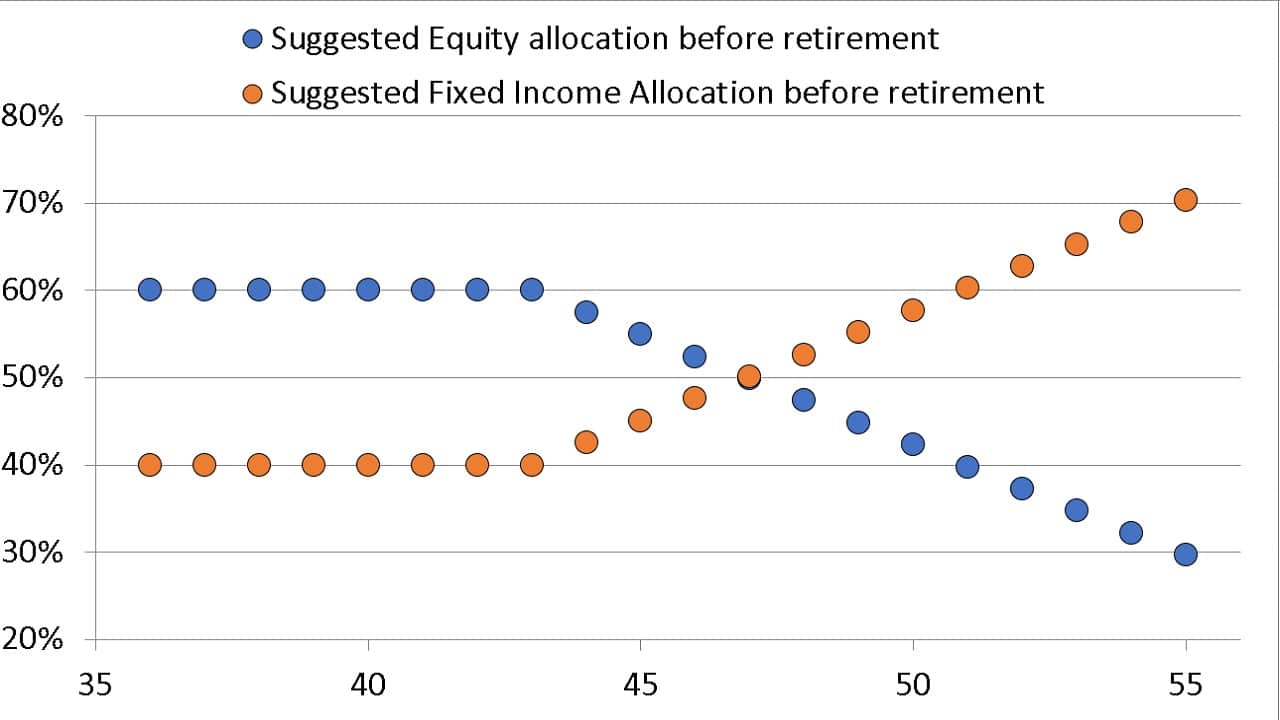

To ensure the portfolio is adequately de-risked and the actual retirement corpus is close to the expected corpus at any time, the robo tool recommends a variable asset allocation, as shown below. This is known as an asset allocation glide path or an equity glide path. This automated feature is designed for investments made before retirement. We have now updated the robo tool to include this feature post-retirement as well.

As the portfolio’s equity exposure decreases, so too does the expected net return from the portfolio. This is factored in from day one in the above calculation.

This is only one part of the retirement calculation. What about after retirement? The second part determines how the corpus will be divided into buckets. A retirement bucket strategy refers to how a retiree invests their corpus in various investments and attempts to generate inflation-protected income.

The robo tool divides the retirement corpus into five buckets. That is, the retirement corpus will be divided into five parts. This is only one of many ways to construct a bucket strategy. This assumes 45 years in retirement.

- An emergency bucket to handle unexpected expenses. Example: 5%

- An income bucket that provides guaranteed income for the first 15 years of retirement. During this period, investments are allocated across the following three categories.

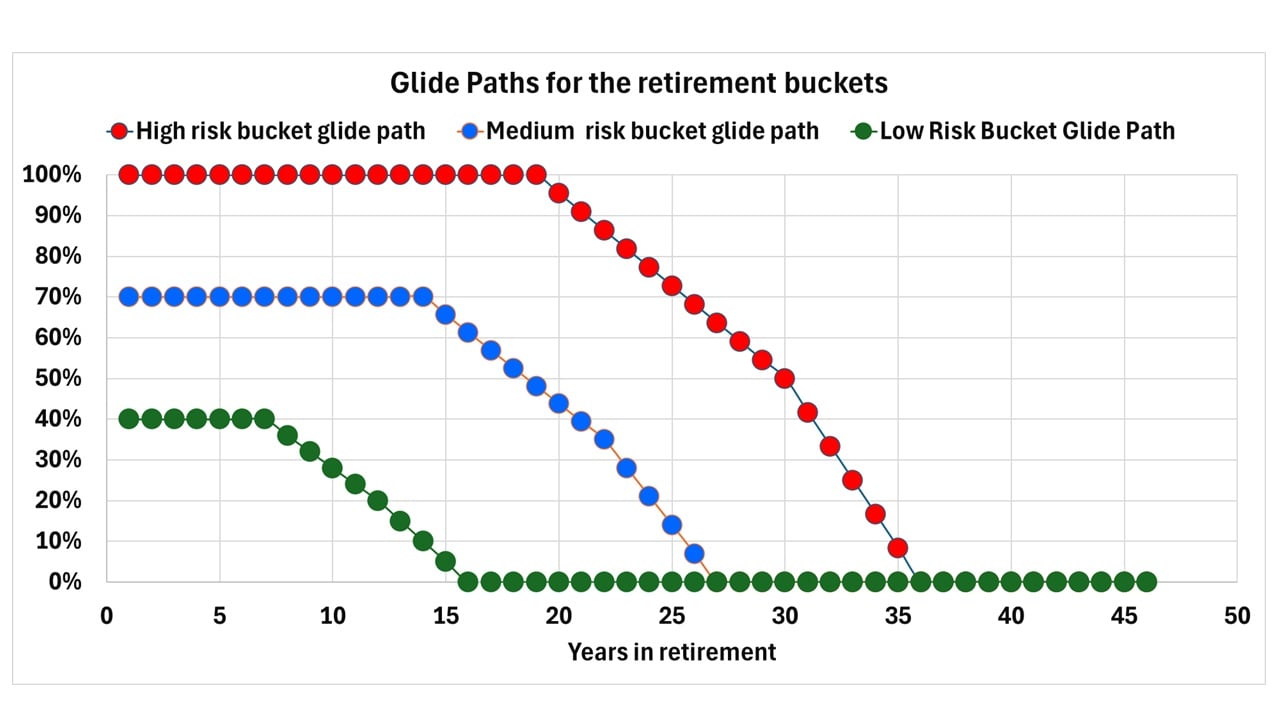

- Corpus from a low-risk bucket that provides retirement income from year 16 to year 26. To provide this income, the low-risk bucket will have an asset allocation of 50% in equities and 50% in debt during the investment period (years 1 to 15 of retirement). This corpus weighs about 25%.

- Corpus from a medium-risk bucket will provide retirement income from years 27 to 35. To generate this income, the bucket shall have an asset allocation of 70% equity and 30% debt during the investment period (years 1 to 27). This corpus weighs about 15%.

- Corpus from a high-risk bucket will provide retirement income from years 36 to 45. To provide this income, the bucket shall have an asset allocation of 100% equity during the investment period (years 1 to 36). This corpus accounts for approximately 9-10%.

What about retirement bucket management? The present update!

There are two ways to manage the retirement buckets.

Option 1 – Actively: The retiree ensures that the income bucket always has enough money to provide inflation-indexed income for the next 10-15 years at all times. This reduces sequence risk significantly.

Option 2 – Passively: Here, the retiree uses one bucket after exhausting the other. For example, after 15 years, the low-risk bucket can be turned into 100% debt and provide income for about 11 years. After that, the other buckets can also be progressively used.

How does one make the switch? The other buckets will hold a significant portion in equity; should they not be progressively reduced to lower risk? How can the 50% equity held in the low-risk bucket be gradually decreased? If we do not decrease it gradually, the overall equity allocation of the corpus may increase with time.

To address these issues, we have updated the freefincal robo advisor tool with equity glide paths for the low-risk, medium-risk and high-risk buckets.

Suppose the retiree wants to adopt a passive bucket strategy. In that case, the tool now automatically calculates an asset allocation schedule for the low, medium and high-risk buckets as shown below for the above example.

This information is available in a new sheet called “bucket backend”.

If the retiree follows this asset allocation schedule, then they do not have to worry about shifting funds from one bucket to another each year in retirement. Naturally, the price to pay for this is a gradual lowering of the equity allocation. However, considering that this will significantly reduce the risk of a poor sequence of returns, it is worthwhile.

This will effectively lower the return expectation from each bucket and marginally increase the corpus required for the investment. Still, it is well worth it in our opinion for the associated peace of mind.

Not all users may want these glide paths for the buckets so that they can be turned on or off in the “Low Stress Buckets” sheet cells B28, B29, and B30. Users can enable or disable the glide path option individually for each bucket for greater flexibility.

If the glide paths are used, the corpus required increases from Rs. 4.90 Crores to Rs. 5.31 Crores. The initial investment amount (increasing by 10% per year) is Rs. 18,215. Considering the extra layer of safety and protection, this increase is quite reasonable in our opinion.

One can argue that the bucket glide path is also an “active” bucket strategy, where, instead of transferring money from one bucket to another, we adjust the asset allocation within each bucket. This is true, but it is useful for those who prefer the safest option. Practically, some transactions among buckets are inevitable, if not indispensable.

Even if you do not like the glide path option, we suggest keeping it ‘on’ as it will enable conservative planning.

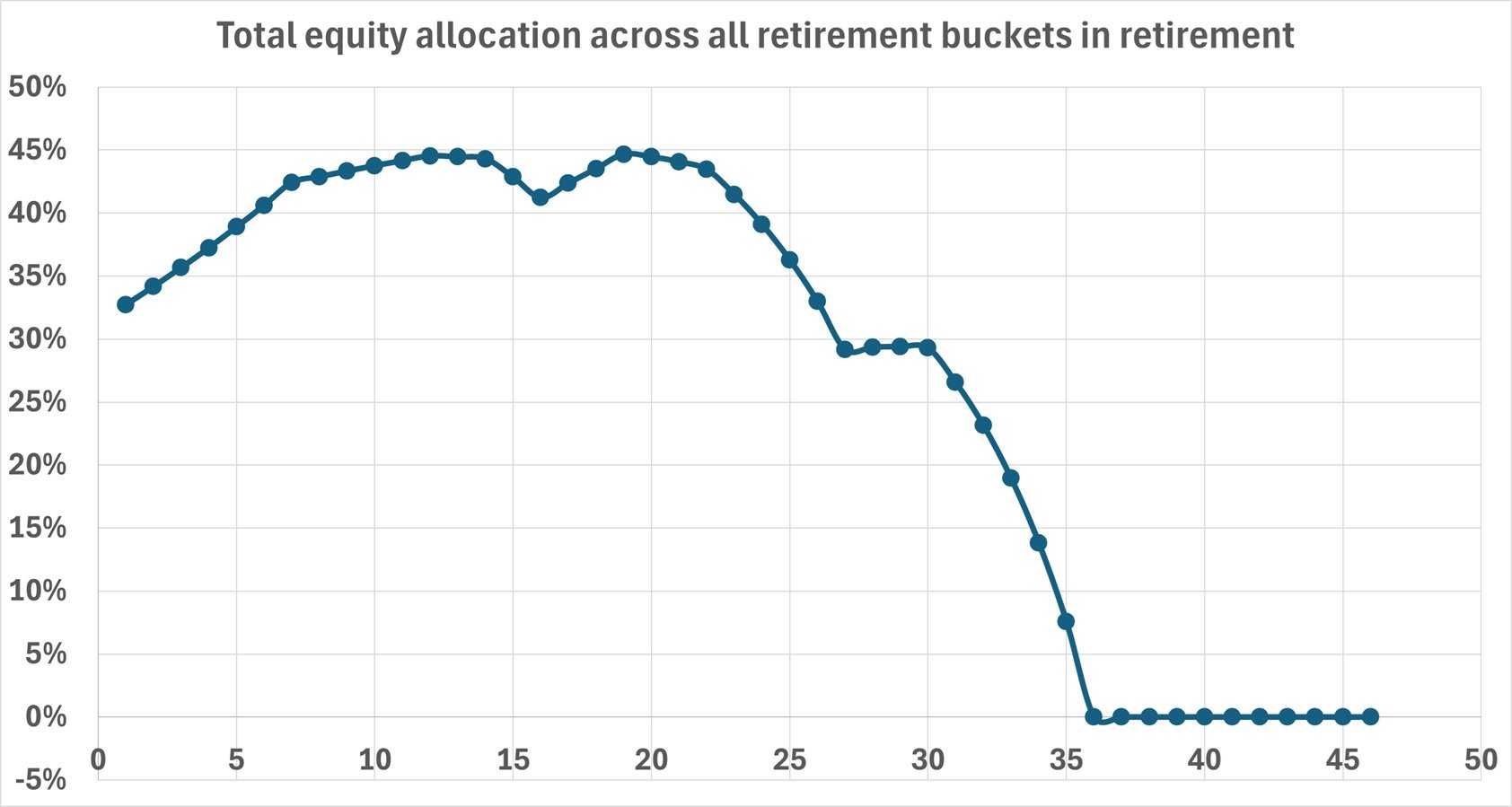

You can visualise the evolution of the total equity allocation across all retirement buckets in retirement and the way the total corpus changes in retirement in the “bucket backend” sheet.

Please note that if the bucket glidepaths are turned off, the equity allocation in the chart above will increase over time. While this may seem alarming at first, the active approach of ensuing 10-15 years of inflation-indexed expenses in the income bucket will negate this risk. Such an action will depend on future return sequences and cannot be projected.

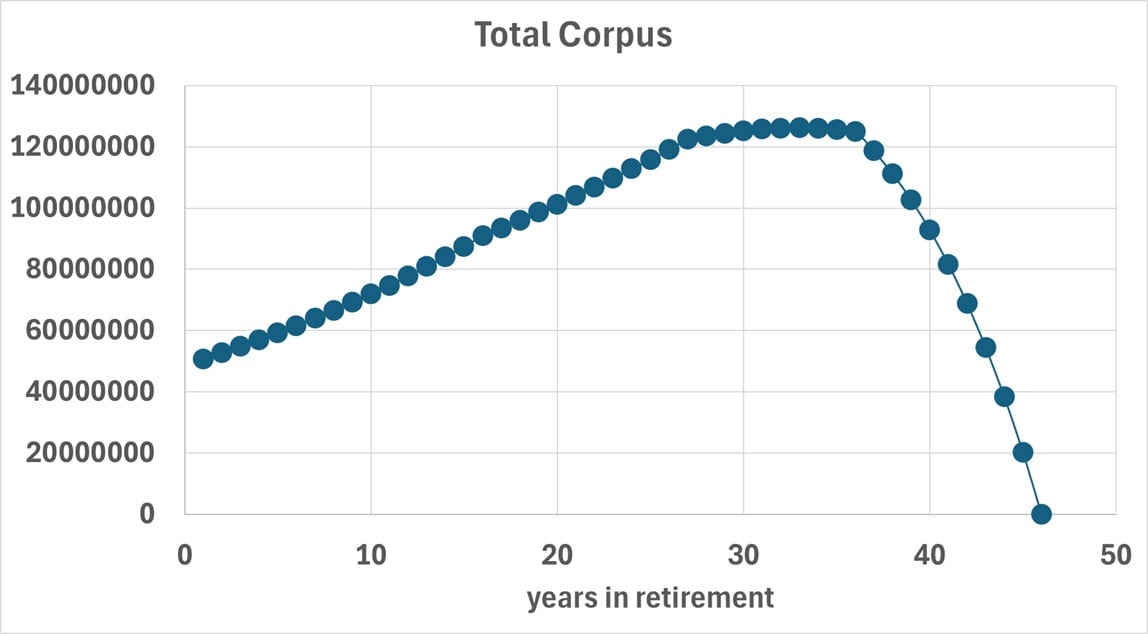

This is how the retirement corpus will evolve.

We hope this update will help alleviate the uncertainty associated with using retirement buckets. From a practical perspective, we still recommend maintaining 10 to 15 years of inflation-indexed income in the income bucket at least every few years during retirement. These glide paths will help the user maintain a conservative return expectation.

Existing users will receive this and all future updates.

Features of the Robo advisor tool

The tool would help anyone aged 18 to 80 plan for their retirement, six other non-recurring financial goals, and four other recurring financial goals with a detailed cash flow summary.

Retirement planning capabilities (illustrations are linked below)

- Can handle up to three post-retirement income streams

- Automated asset allocation schedule to reduce sequence of returns risk (poor returns that can derail our plans)

- Detailed bucket strategy calculation

- Options to include various levels of pension after retirement (income flooring)

- Option to DIY bucket strategy and use an annuity ladder.

- Fully customisable. No hidden formulae.

All the details are explained here: Robo Advisory Software Tool: Build a complete financial plan!

This is a video guide.

More than 2500 investors and financial advisors are using the tool. The tool was recently featured in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

- All inputs are fully customisable.

- It can be used for commercial/professional use as well. Many advisors use this to create financial plans for their clients.

- Users will get all future updates.

Presentation: The tool is available in two formats

- As an Excel file with macros. It will work on Mac Excel and Windows Excel.

- Or on Google Sheets with scripts.

All inputs are fully customisable. It can be used for commercial purposes as well. More than 3000 investors and financial advisors are using the tool. Users will also receive all future updates.

One-time purchase; lifetime access. Price includes future updates to the sheet.

Get the robo tool by paying Rs. 5625 (Google Sheets edition; Instant Download. No refunds allowed). Use the discount code: robo25

Use this link to get the tool to get the Robo Advisory Template Excel Sheets Edition at a 20% discount for Rs. 4500 only (the regular price is Rs. 5625). Use the discount code: robo25 (this will work on Mac and Windows Excel)

Outside India? Then use this Paypal link to pay USD 80 (Kindly write to freefincal [AT] Gmail [DOT] com after you pay).

Retirement planning Illustrations made with the robo tool:

- Retirement plan review: Am I on track to retire by 50?

- I am 30 and wish to retire by 50 how should I plan my investments?

- Can I retire by age 55? Retirement Planning Case Study

- Case Study: Achieving Financial Freedom for Early Retirement

- How should I plan if I want to retire in 20 years?

- Is it possible to combine a bucket strategy with income laddering after retirement?