Last Updated on October 25, 2024 at 8:30 am

Create your own personal financial plan with this excel-based financial planning template. Ever since I made my first retirement calculator, I have had several requests to make an integrated financial plan creation tool.

The only reason I took this long to make it is sheer boredom. I thought, since I had already made most of the calculators found in a financial plan, it would be boring from a mathematical point of view to put it all together. How wrong I was!

I have always wanted to make a financial planning template with a one-page input and one-page output. A template in which all future cash flow entries are displayed on a single cash flow chart.

I have managed to pull if off, except for the one-page input part, as I have realised that would make it too cluttered and clumsy. Making the integrated cash flow chart turned out to be pretty exciting and at times exhausting.

Do excuse the crummy sounding title. There are certain things a blogger must do to get a search engines attention!

That quite enough blah-blah. Without further ado, here are the features of the financial planning template:

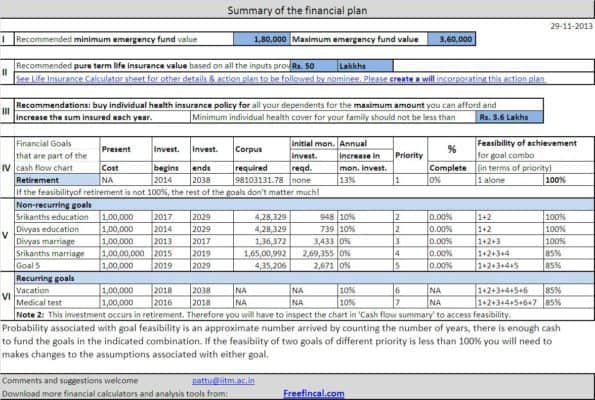

- Create a financial plan for retirement, 5 non-recurring financial goals (child’s education, marriage etc.) and 2 recurring financial goals (vacation, annual medical tests etc.)

- Calculate the life insurance needed for financial independence of your family after your time. Important goals like children’s education and marriage are also accounted.

- The life insurance calculator has a clear set of instructions for the nominee as to how the insurance sum should be invested. It would be useful if a set of such instructions are found inwill of the insured.

- Retirement calculator with the possibility to include two passive income streams in employment (rent, dividend/business income) and in retirement (pension, rent)

- Recurring and non-recurring financial goals calculator. You can assign a priority to each goal and determine the feasibility of achieving each goal relative to retirement (number 1 priority) and to each other.

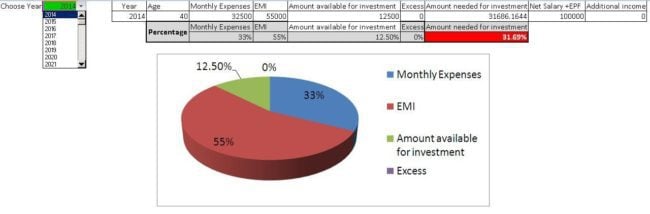

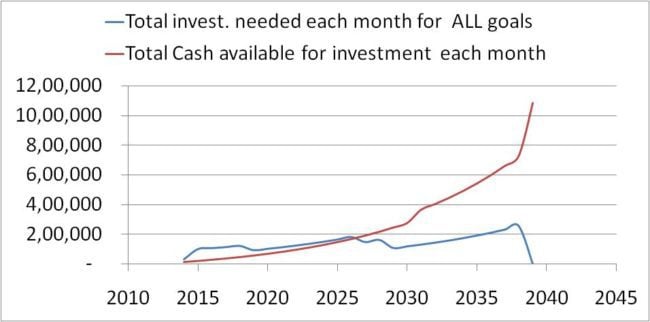

- Integrated cash flow chart which accounts for income, expenses, EMI, investment and pension schedule

- Cash flow summary to analyse the feasibility of retirement – the number one financial goal and other goals relative to retirement and to each other.

- One-page report this contains all the results serves as quick reckoner for initiating an action plan

Important

- A financial plan is a just a piece of paper if you don’t act on it

- You will need to review the financial year once a year.

Requests

- Feedback, suggestions for improvement and requests for specific modifications are welcome.

- If you are a member of the financial planning community, I will be delighted if you could help me tweak this tool and make it better.

- Please do share this post with your friends and colleagues.

The financial planning template

The template has been significantly modified and is now available as a Robo Advisory Software Template which both investors and advisors can use.