Last Updated on December 29, 2021 at 6:23 pm

In this episode of “how I increased my income with side-hustles”, we meet Ayushi Mona who has ten years of versatile side-hustle experience in content writing, marketing, teaching and coaching. She is also financially savvy and helps young earners with the basics of money management. She discusses how side hustles helped her learn many new skills and opened several doors. Regular readers may remember Ayushi from her excellent guide: Education Loan 101: All you need to know

About this series: We all appreciate the importance of a higher income but increasing our income is not easy. It requires time, effort, sacrifice, dedication and opportunities. In these articles, we showcase inspirational stories about people who have increased their income, their station in life via self-improvement, upskilling or side-hustles.

This idea started when I had asked members of Facebook, Asan Ideas for Wealth, to share real-life stories of how they or someone they knew increased their income by upskilling, self-growth (personal development), or side-hustles.

Many of the stories were quite extraordinary. These are stories published earlier:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

- How my mother moved up the corporate ladder with constant self-growth.

- How I started a side hustle at 16 by blogging and web development

We have similar stories lined in the coming weeks. If you have increased your income and changed your station in life, please share it with our community. It will inspire and motivate many. Contact us at freefincal {AT} Gmail {DOT} com with a short outline to take it forward. It can be published anonymously if you prefer. Now over to Ayushi.

“If you love what you do, you don’t have to work a single day in your life.”

I am a 27-year-old woman and currently work as a Communications and Patient Engagement Manager in a large pharmaceutical company. While there are many batchmates and peers who would have similar profiles professionally as me, I think I have persistently done and used side hustles in my life from a very young age.

Some people are alcoholics, some are workaholics, I am definitely a side-hustle-olic. I will take you back to my teenage years to share my journey so far.

After graduating from high school, I was insistent that I wanted to live in another city to be independent. Hence, I joined St. Xavier’s College in Kolkata. This was a financial strain on my mother who had to manage the increased load of living expenses, but who supported my wishes to join a top commerce college in the country.

At St. Xavier’s, I had college from only 4 PM to 8 PM every day. While most of my friends started doing CA/CS/CFA or articleships during mornings and afternoons – my heart wasn’t in it. So, I would go to the library every day and read for 6-7 hours at a stretch.

One day, I discovered that different bulletin boards across the institution would carry department specific projects or internships. I came across a content writing internship from a PR agency based out of London. I wrote them an email and got the job!

Now my challenge was different. Having said yes, I had to figure out how to write. I did not have a laptop at that point but my college had a sort of cyber room or cyber cafe which was only available for 30 minutes at a stretch. Scarcity brings out the best and like a machine, I started churning out perfect articles for top UK publications in 30 minutes.

After doing this for a few months, I realized that I would need a device of my own. I requested my mother (who was already working extended night shifts to manage expenses) for a laptop. She bought me an HP mini (photo below). I funded the dongle and recharge expenses from the 100% savings of the content writing job.

My project duration with the first company had ended and now with enough experience, I joined LinkedIn (I was 18) and listed myself as a content writer. Got a writing gig with a social media analytics agency, who needed someone to churn content for their blog.

I took it up. While the money was peanuts (I would get Rs. 400 per article) – I learnt how to raise an invoice, do content SEO and the guy who I would report to for the articles, became a thought leader in the marketing & advertising industry (which is where I ended up so in hindsight – this was a good opportunity!)

Thanks to this I went and applied for a PAN card of my own, opened a bank account on my own and built the confidence to follow up for payments.

I used the money from this for leading a comfortable lifestyle, watching a movie every weekend, and going to eat out at good restaurants. I still travelled back home occasionally on a train during holidays to save(then high airfare) expenses but the income from a side hustle helped me to make friends and hang out. This was important for my social growth and happiness as most of my friends came from extremely affluent families.

After 1.5 years of writing, I realized that I was getting bored (and also, I was good at it – so there was nothing to learn). This is an example of a post I wrote for them.

“I went back to the library and walked around aimlessly in the corridors of my college once again (since LinkedIn was only getting me content writer jobs). One fine day, I came across a volunteer opportunity at the Indian Institute of Cerebral Palsy near the Social Service Department. I had to teach them Hindi. Without much thinking, I took it up.

Here is a picture of what the classes were like (faces hidden to protect privacy).

While I was good at writing, I was terrible at teaching. I was a student myself – it really put me out of my comfort zone to teach children who were battling Cerebral Palsy. As an academically gifted young girl, I never even needed tuition and I had to patiently teach the alphabet to 12-year-olds!

This job was social work and did not pay so I would take a bus to and fro to save money (18 km travel every day with college, assignments and exams!). Often on public transport, I would get ogled/leered at as a single girl but looking at the challenges of young children battling cerebral palsy – I thought I will continue.

This job taught me a lot of things:

- Empathy but also being able to be compassionate without emotional involvement

- Public Speaking (I had debated in school but the real challenge is to communicate to someone and help them not just listen, but understand)

- Being able to hustle and work hard – preparing classes on the bus, waiting in the sun, focusing on my own accounting and tax class, all at the same time.

By the time the last semester of my college came, I had to do an official internship! While most of my friends in college were begging their relatives for an internship – I knew the secret power of official bulletin boards at my college that no one read and had come across an internship at State Bank of India – I applied and got the job! The multiple experiences up to that point were impressive to the interviewers.

For 3 months, I was interning at the State Bank of India, Ballygunge. It was an exciting opportunity for me. I would sit in an air-conditioned office in front of the branch head and be able to learn practical basics of excel, retail banking products, cross-sell products, documentation. My colleagues were gracious and foodies (like most Bengalis), and would feed me. So, that also reduced my expenses.

My internship presentation and project went really well. I had no idea how well till I got my stipend! It was triple the amount of the application (turns out I had got the best internship project). That amount became my first Fixed Deposit.

After three eventful years in college, I got job offers through my college placement cell (to be a risk analyst at Ernst & Young in Calcutta or to take up a Graduate Trainee role in Mumbai at Axis Bank). I chose the latter and landed my first job at the age of 20.

Thanks to my SBI experience – I understood the importance of basic financial management. I researched heavily and got myself term insurance and started a PPF. At 20 itself.

I was learning and getting a lot of exposure at my job. However, I still did not want to spend my weekends partying and ‘chilling.’ Now, with more financial wisdom, I started writing basic articles for online content publications like Women’s Web, content websites that pay decently. This helped me to grow my knowledge but also helped fund discretionary expenses of my high-flying Mumbai lifestyle, way more expensive than Kolkata.

I came across a Securities Law course from the National Institute of Securities Market and decided to take it up. The course was expensive, not financially supported by my employer, nor was it related to my job (I work in Business Banking/ Merchant Payments and this was a regulatory capital markets course!). Plus, the course was every weekend and I had to travel to Vashi (35 km from my house). However, I just decided to take it up.

Taking that course changed my financial life! I got introduced to AGMs, read Company Law, content on capital markets, jargon like derivatives, F&O, studied with senior people from SEBI, who worked at AMCs etc. Most importantly, I never got into the “ishq hai toh risk hai” mindset that a lot of young people my age have with respect to equity. We also got the opportunity to visit the Securities Appellate Tribunal and see the DLF case live in action.

After 2 years of working in banking, I decided to do a post-graduation in Management. There were no funds for higher education so I took a loan and had to withdraw my savings for 2 years of living expenses and emergency requirements. I had a lot of anxiety about paying it off but thanks to my mother’s emotional support, I took it up. Here is a guide on education loans.

Here too, I kept up the side hustles despite how exhausting a 2 year MBA program is. I started ghostwriting a book for one of my older clients. My MBA institute, MICA, had a committee dedicated to live, paid projects. During the 2 years – I worked with them on the following:

- Text mining project

- Qualitative interviews with marketing leaders

- Social media content creation project for a religious book, which was a New York Times Bestseller

- A campus ambassador program for an EduTech startup

- A campaign for Sandesh News in Gujarat for elections

As we all know, academic learning in India can be restrictive – so these courses truly helped me to grow. None of them got me a job but paid for expenses and helped to not let my PPF die down).

After graduating – I continue to keep doing different things as side hustles. One is my book club, Broke Bibliophiles. It is free and mostly to meet like-minded people who love reading. Since the book club did well, I started doing some podcasts which helped me meet some of my favourite authors!

This is a Times of India article featuring a Halloween special Book Club meetup, we did. I am the one in the white jacket with the pointy hat.

While book club and podcasts don’t pay me, I get to meet new people and get advanced review copies of books which is always nice. In fact, I have hired a young girl from Jamshedpur to manage some editing for me and I hope to be able to hire a few more people for my side hustles.

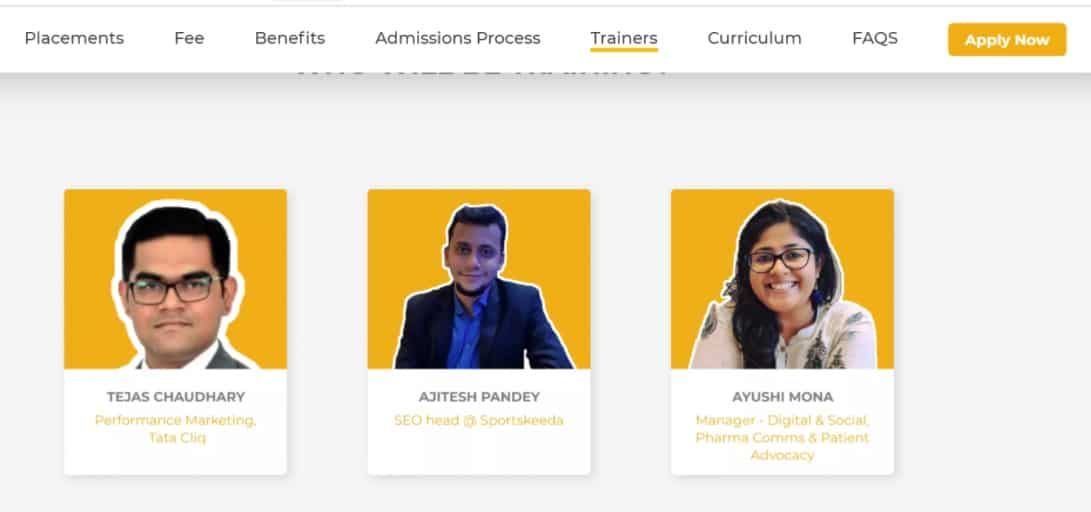

Lastly, to help young professionals out, I take out some time every weekend to coach them for a minimum fee. I am part of a Kraftshala, marketing boot camp program, where students have the opportunity to pay fees after getting placed. I also coach Professional Brand Managers, looking at career changes.

It’s only the diverse experience that I have had that help me contribute to them in any way. Mostly, I learn from them how the job market is and what the trending job market skills are.

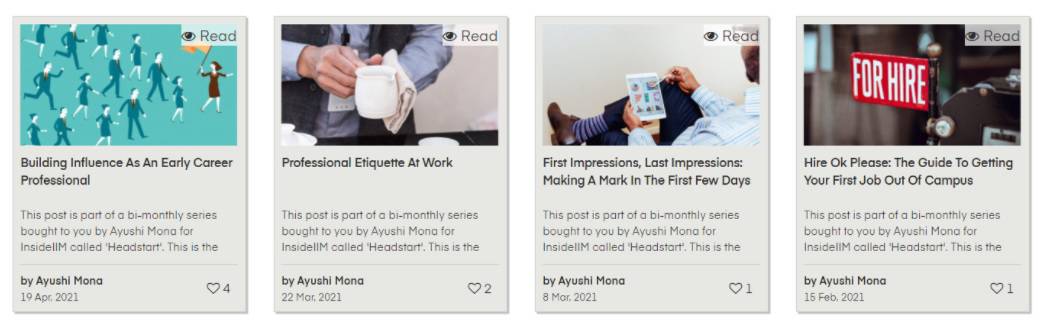

As usual, thanks to my love of writing, I try to contextualize my learning in the written form, coaching students shaped up in the form of a fortnightly article series that I write called “Headstart.”

Before the pandemic, I had even done training as a LinkedIn Localhost and hosted career-specific workshops. I hope to be able to do more!

I know this article has dragged on, but I hope you have enjoyed reading about my decade long side-hustle journey. I am summarizing a few things that I would recommend for anyone:

- Do not do side hustles for money. If you are good (or learn fast or build an audience), the money will come.

- You can’t miss the film to watch the interval. What I mean is that, you have to be good at your main job first! While it may not seem obvious from my article – but I got good opportunities from placement in college and had good grades. If I did not do well in my main gig, there is no point in side gigs. Unless – you are doing side gigs (like starting a business to eclipse your job.)

- Never bring your side hustle into your main hustle. I did everything in college in non-academic hours and everything I do with work is only on weekends. Respect your educator, employer etc.

- Everyone has different priorities. So, don’t feel guilty if you do not want to try something out.

- You can do side hustles for 4 reasons – yourself (eg: career growth), your family (eg: more money), your work (eg: have an edge in the job market) and for the community (eg: to help people). The last feels the best 🙂

Thank you for reading and thank you to Pattu sir and Ashal Sir for FreeFincal and AIFW!

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)