Last Updated on October 30, 2023 at 2:51 pm

A provided fund for the general public came into being by an act of parliament in “in the nineteenth Year of the Republic of India” (1968) and has since evolved with the Indian economy. In this post, let us consider the way in which the interest rates of the public provident fund (PPF) has changed since inception. The PPF ACT 1968

The idea is to understand the factors (at least a couple of them) that affect the interest rate so that we can react to future rate changes with better perspective.

The way PPF interest was/is determined

It is such a pity that I am not able to find an authoritative source on how the PPF interest rate was set before 1998!

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Since 1991 the government had constituted committees from time to review small savings schemes and recommend interest benchmarks.

The first such committee in 1991 chaired by Dr Rangarajan only said

The existing pattern of administering Small Saving Schemes may continue.

The second committee chaired by R V Gupta (1998) noted

The rate of interest on PPF would be set at par with the rate of interest on GPF.

Reddy Committee (2001)

Yearly average secondary market yield on G-secs of comparable maturity as the appropriate benchmark with a positive spread of up to 50 bps depending on the maturity and liquidity of the instrument. Periodicity of revision to be on annual basis.

The Rakesh Mohan Committee (2004) suggest a more elaborate formula based on the above lines.

The money collected under small savings schemes goes to the National Smal Savings Fund. From here, the Central government lends money to the states for different durations. The interest of these loans was anywhere between 2-3% higher than the interest of the small savings schemes (of which PPF is one)!!

Thus, the cost of borrowing from the centre is much higher than the cost of borrowing directly from citizens. The Rakesh Mohan committee noted that unless this spread of 2-3% is not lowered by benchmarking the small saving schemes to government bonds, the states cannot handle the fiscal strain.

Broadly speaking this is the reason why interest rates are now fixed each quarter. The 0.5% extra interest wrt the GOI bonds has come down to 0-0.5% depending on the scheme.

The quarterly reset was recommended by the Shyamala Gopinath committee in 2011, who also agree with the previous two committees,

secondary market yields on Central government securities of comparable maturities should be the benchmarks for the various small savings instruments

PPF Interest History

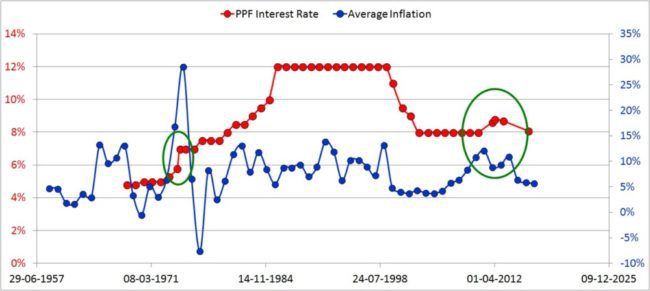

Even though the exact interest calculation method before 1998 is not known and only 2001 benchmarking with G-secs began, it is not a bad approximation to assume the PPF rate evolves the same way as the 10-Y G-sec yield.

There are main factors that drive bond yields – inflation and credit worthiness. In the case of PPF, economic drivers like fiscal deficit, corporate earnings should also determine the attractiveness of small savings schemes. I wish I can write with more authority on this, but I am only a student of this exceedingly interesting subject: The history of the Indian Financial System. (page 331)

Sources:

- The PPF rule book from nsiindia.gov.in

- Historic inflation India – CPI inflation

Notice that the PPF rate has steadily increased since inception up to 1990, remained flat at an astonishing 12%, fell down sharply to a plateau at 8% and then reacted to inflation.

The sharp increase in from 5.8% to 7% in 1974 was most likely triggered by the four-fold increase oil prices due to an embargo triggered by Americal aid to Israel. Read more: 1973 oil crisis

After the inception, we have had the Bangladeshi liberation war (1971), the emergency (75-77) and Indias worst economic crisis ever – balance of payments crisis (Mid 80s- early 90s): 1991 Indian economic crisis

India was importing more than it was exporting. It had no forex reserves and it was on the verge of defaulting on payments. The IMF lent Indian 2 Billion USD with its gold reserve as collateral. The economy was opened up and the great Indian story was all set to begin … with a big hiccup.

As a result of the economic crisis, Indians credit worthiness failed. It is due to this, coupled by the need for increasing borrowing, the PPF rate shot up to 12%.

Why it remained there at 12% for a decade is a mystery to me. The initial half of the 90s was spent in consolidation of forex reserves. Meanwhile, another story was unfolding – The Harshad Mehta scandal. A decade after this, the Sensex was flat – our very own lost decade (like Japan). Although inflation was not alarming, perhaps because of lack of productivity, the interest rates were quite high in the late 90s too. I am still searching for confirmation on this.

In the early 2000s the situation improved. Inflation fell sharply ~ 5-6%. The govt dramatically dropped interest rates and the great Indian bull run began. Debt funds gave 15-17% returns because of the rate cut!!

Inflation increased gradually and probably healthily as the market reached all-time highs (then). Soon came the 2008 crisis, recession, inflation and the now the rates have started to fall again.

Could this be the start of another bull run? Let us hope so. When the PPF rate was decreased by 0.6% there was an ‘outcry’. Let us look back at history and recognise that we are a slave to the economic machinery. Much larger changes have taken place before … when there was no social media!

A high PPF rate does not always mean things are rosy!

Reference: EPF Interest Rate History The EPF (and GPF) rates have followed PPF rates closely. Typically the EPF rate has been about 0.5% on average higher than the PPF.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)