Understanding risk is essential to effective investing and money management. The way investment risk is perceived and handled has a pervasive impact on investment performance. Hence, it would be beneficial to develop a holistic understanding of how investment risk works. Let us now look at answers to some of the most commonly asked questions about investment risk. The answers would give us a realistic understanding of investment risk.

About the author: Akshay holds an MBA in Finance from Great Eastern Management School, Bangalore. His website is akshaynayakria.com. His articles on personal finance and investing can be accessed here: akshaynayakria.com/blog. Akshay is part of freefincal’s list of curated flat-fee only SEBI registered investment advisors and fee-only India*

* Fee-only India is an informal association of pure fee-only financial advisors. Launched in September 2017, it helps connect investors with SEBI-registered investment advisors without conflict of interest. Dr M Pattabiraman is one of the founder-patrons of fee-only India.

What Is Risk? Every incident that happens around us can be termed as an event. All events have a range of possible outcomes. But only one of those outcomes would actually occur for each event. Risk is simply the probability that a negative outcome occurs to an event from the set of possible outcomes. For instance, assume an individual eats chaat at their favourite roadside chaat stall. They enjoy their meal and go home with their taste buds satisfied. This event may give rise to the following possible outcomes :

- They remain healthy a few days after the meal

- They develop an upset stomach a few days after the meal

In this case risk is the probability that outcome B materialises in the real world after the event, which is the individual eating chaat from the roadside stall. Negative outcomes form a part of the set of possible outcomes for all events. Therefore every single event comes with a degree of risk built into it.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Let us now understand how the concept of risk applies to investing. Investing our money in a particular asset represents an event. There is one particular negative outcome to this event that affects investors more than others. It is the permanent loss of their invested capital. Investment risk is therefore symbolised by the probability of the permanent loss of the money parked in a particular investment. Every investment carries a certain probability of permanent loss of capital. Each investment therefore comes with an inherent degree of risk. Investments where the risk of permanent loss is low are broadly termed as low risk investments. And investments where the probability of permanent loss is high are broadly termed as high risk investments.

Where Does Risk Come From? Every event has a range of possible outcomes. Some outcomes are positive while others are negative. But the actual result of the event cannot be forecasted accurately and consistently in advance. This is because we do not know which particular outcome will occur from within the range on a particular occasion. This is also true with regard to our investments.

When we make an investment, the outcome from making the investment is uncertain. There is no way to accurately and consistently predict whether the Investment would turn out to be profitable in advance. This uncertainty is one of the major sources of risk. The world we live in is reasonably predictable most of the time, but not always. Therefore there are times when we may not even know the entire range of possible outcomes to an event.

Most of us are usually cognisant of outcomes that are highly likely to happen. We may even be cognisant of outcomes that are reasonably likely to happen. But very few of us (if any) are cognisant of outcomes that are highly unlikely to happen, but could. Such outcomes are called tail events (events such as the global financial crisis, COVID – 19 for instance). Such events have a pervasive and lasting impact on markets and our investments. Being inadequately prepared for such events is therefore another major source of risk.

Does A Positive Outcome To An Event Imply The Absence Of Risk In The Event?

The short answer is no. The inherent risk of an event is independent of the outcome. Take the instance of a batsman batting on a green pitch. There is a packed slip cordon. The bowler bowls a tempting ball just outside the off stump. The batsman goes for a cover drive. But the ball takes the outside edge and goes between the slips for a boundary.

Here the outcome is positive for the batsman (scoring a boundary). But that does not mean that there was no risk in the shot he played. If the batsman were to play the same shot to a similar ball again, there is a material chance of him getting caught in the slips. Let us now understand how this applies to investing and money management.

Take investing in penny stocks for instance. Penny stocks are usually available at considerably low valuations. This is because most penny stocks have weak fundamentals. This makes investing in them a risky proposition. Let us say an investor takes up a concentrated position in a penny stock during a bull market. He realises a bumper profit on the stock when he sells it a year later.

Earning the bumper profit represents a positive outcome for the investor. But there was no change in the fundamental soundness of the stock over the course of the year. Therefore the degree of risk inherent to the stock is the same. It is only because the investor was participating in a bull market that the gamble paid off. But they may not be as lucky if they were to repeat such a gamble on another occasion. Therefore a positive outcome to an event does not imply the absence of risk. It simply means none of the possible negative outcomes to that event occurred on that particular occasion. Also, a positive outcome achieved on the back of a flawed process is not indicative of skill. It implies that luck was the predominant force at play rather than skill.

Is Volatility A Measure Of Risk?

Academicians and investment theorists use volatility as a measure of risk. This is because volatility can easily be quantified using mathematical formulae. But risk is abstract in nature. Anything that is abstract cannot be reliably quantified. This is no different when it comes to risk. The inherent risk of an event cannot be quantified either in advance or in hindsight. Volatility is a symptom of risk. In other words volatility is simply an indicator of the presence of risk.

How Are Risk And Asset Quality Related?

Asset quality refers to the fundamental soundness of a particular investment. There is a reasonably strong correlation between risk and asset quality. But risk is not directly a function of asset quality. In other words, the fundamental soundness of an investment does not always define how risky it is. A fundamentally sound investment would be risky if it is acquired at an exorbitant price. The best example of this is that of buying bluechip stocks at the peak of a bull market. The underlying company may be fundamentally sound. But the market price of its stock may be too high to justify the degree of its fundamental soundness.

On the other hand, an investment that is fundamentally unsound can sometimes be cheap enough to be safe. The best example of this would be high yield bonds. These are also called junk bonds. High yield bonds would normally represent risky investments. But every now and again there may be bonds where the price understates the fundamental soundness of the company issuing the bond. Investors with a discerning eye may be able to identify and pick such bonds. Sooner or later the bond markets will take cognisance of the actual fundamentals of the bond. This would bring the market price of the bonds in line with their fundamentals. Those who bought the bonds at understated prices would profit in such a situation.

This points to a very clear inference. No asset is fundamentally sound enough to justify being a sensible investment at any price. And very few assets would be so fundamentally unsound that they would represent a bad investment regardless of their price. This shows that risk is not necessarily born from the quality of the assets that we buy. It is born from the price we pay for the asset quality that we get.

How Are Risk And Return Related?

The general perception of the relationship between risk and return is that taking higher risk results in higher returns. This relationship can be represented graphically as shown in the graphic below. The horizontal axis represents the degree of risk taken over time. The vertical axis represents the return earned over a period of time.

The upward sloping line implies a positive and linear relationship between risk and return. But such an understanding of the relationship between risk and return is completely flawed. This is because if investing in riskier assets meant getting a higher return, there would essentially be no risk. There is a more mature way to understand the relationship between risk and return. Some investments offer a higher expected return than others. But the actual return delivered may be lower than than the expected return. And that is where the risk comes from.

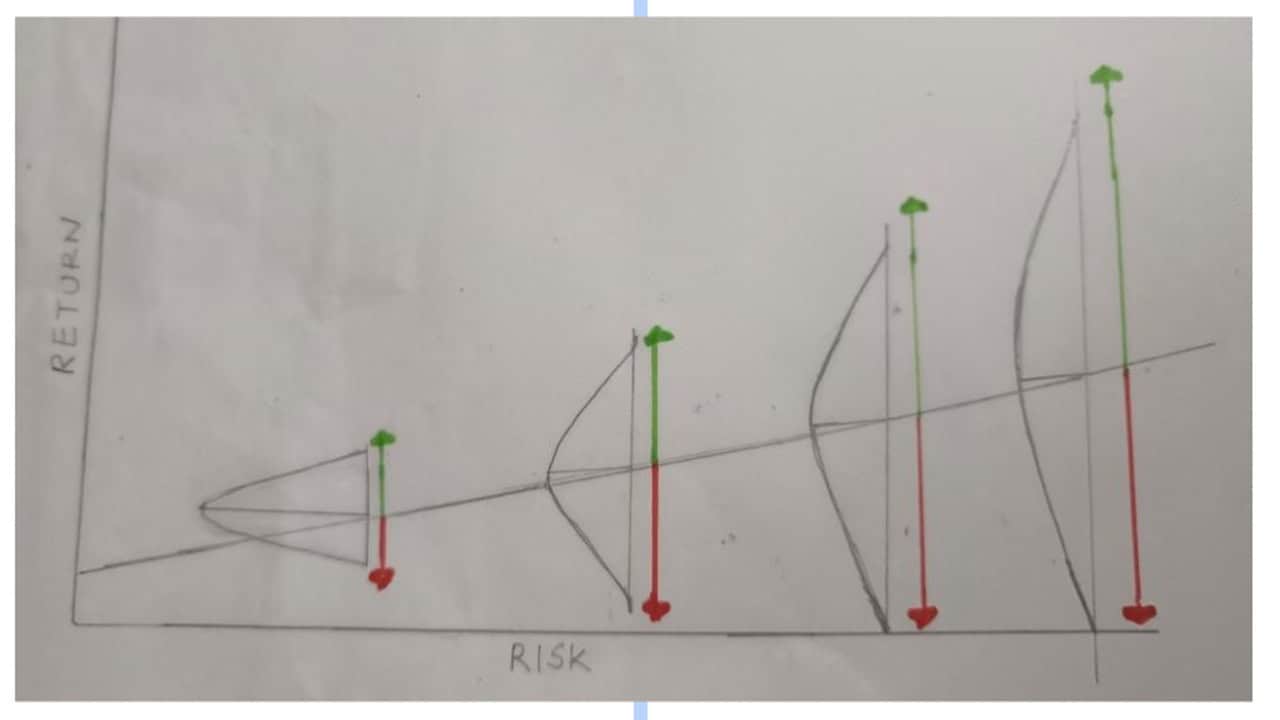

Understanding the relationship between risk and return in terms of events and possible outcomes is also important. The range of possible outcomes for an event can typically be represented using a bell-shaped curve (normal distribution). Positive outcomes fall on the right side of the bell-shaped curve, and negative outcomes fall on the left side. When the bell-shaped curve pertaining to a particular event is superimposed on the risk-return graph given above, we get the resultant graph, as shown below.

Notice that as we move higher on the risk-return line, the width of the base of the bell-shaped curve increases. This implies a wider range of possible outcomes to an event over longer time horizons. It also indicates that the positive outcomes to an event are progressively more rewarding over time. This is reflected by the increasing length of the green line to the right of each bell curve. It also indicates that the negative outcomes to an event are progressively more severe over time. This is reflected by the increasing length of the red line to the left of each bell curve. So our chances of earning a positive return are better over longer time horizons. But the range and severity of risks we are exposed to are also greater. And that is where the risk comes from for investors.

What Is The Nature Of Risk?

Risk is counterintuitive. Risk remains low when most people are conscious of its presence. Risk is heightened when most people perceive that there is no risk. Let us look at a couple of examples to substantiate this point.

In a particular town in the Netherlands, an experiment was carried out as part of a study on road safety. All traffic signals in the town were shut down. All road safety signs were taken down. All road markings were erased. This should ideally have led to an increase in road accidents. But it actually reduced the number of road accidents. The absence of road safety aids automatically made people more cognisant of the possibility of accidents. This saw them make a conscious decision to drive more carefully. And it naturally reduced the occurrence of accidents. Similar measures were later implemented in the United Kingdom. Those interested can read more about it in the article linked here : The Removal Of Road Markings Is To Be Celebrated. We Are Safer Without Them – Simon Jenkins

On the other hand, consider the case of risky outdoor activities like hiking or skiing. Better safety gear is constantly developed for hikers and skiers. This should ideally reduce the number of injurious or fatal accidents associated with these activities. But it actually does not contribute towards lowering the risk of accidents. The availability of better quality gear may lull hikers and skiers into a false sense of security. This encourages them to try riskier things when hiking or skiing. Naturally, the risk of accidents would remain the same. It may even increase.

This makes it abundantly clear that risk is not born from an event or activity. It is born from the way people participate in it. Applied to investing, this implies that risk is not born from the market or an investment asset in itself. It is born from the way people participate in the markets and invest in various assets. If investors were to remain prudent and display balanced behaviour when investing, risk would remain low. But all investors are emotional and display polarised investment behaviour from time to time. This is what creates excesses and heightens investment risk on various occasions.

What Is Risk Management?

Risk management is the ultimate test of our investment skill. Looking solely at our investment returns does not realistically reflect our investment skill. The key question we must ask ourselves is: How much risk did I bear to earn this return?. To understand this better, look at the graphic given below. It represents the returns earned by five investors when :

- The market rises 10%

- The market falls 10%

These results may be interpreted as follows :

Investor A: Matches the market both on the upside as well as the downside. This may indicate that investor A is an index investor. But he does not need to exhibit any degree of discernable skill to earn these returns.

Investor B: Enjoys outsized gains on the upside, but suffers disproportionate losses on the downside. Again, there is no discernable skill on display here. It just means that investor B follows an overly aggressive strategy.

Investor C: Does better than the market on the downside, but also lags the market on the upside. Again there is no skill involved, just an overly defensive strategy

Investor D: Beats the market on the upside and matches it on the downside. This can be considered as a good result for the investor.

Investor E: Matches the market on the upside and loses less than the market on the downside. This is an excellent result for the investor.

But what is the reason behind the better results achieved by investors D and E? It is their ability to perceive and manage risk better than the other investors. They are able to do this because they have a better sense of the range of possible outcomes to various events. This allows them to prepare adequately for various outcomes possible to each event. Doing this requires a considerable degree of insight and skill. The fact that investors D and E have managed risk effectively shows that they are more skillful compared to the other investors.

When Is Risk Management Required? Risk management is required whenever a negative outcome occurs to an event. But it is impossible to predict exactly when a negative outcome would occur in advance. Therefore it would be prudent to be prepared for negative outcomes at all times. Doing this requires risk management to be proactive rather than reactive. Therefore risk management is a constant prerequisite for effective investing.

How Should Risk Be Managed? Managing risk is extremely challenging. This is because most events are dynamic. The conditions under which events happen keep changing in real time. And we get very little time to respond to them. Risk management must therefore be built into the way we plan for events and respond to them. In other words we must plan in such a way that we are prepared for negative outcomes, even though we don’t expect them to happen. This is a very big part of the reason why we purchase insurance.

Take health insurance for example. When one purchases health insurance, they don’t expect to develop major health issues that require hospitalisation. However, by purchasing health insurance, they would be well prepared if such a situation were to arise in the future. Managing investment risk works much the same way. Risk management must be built into the way a portfolio is constructed. A well-constructed portfolio should allow the investor to participate adequately in positive outcomes. But more importantly, it must allow them to effectively resist the adverse consequences of negative outcomes.

Managing risk in a portfolio requires investors to have a sense for when to be aggressive (i.e allocate more to risky assets like equity), and when to be defensive (i.e allocate more to safe assets such as bonds and fixed income investments). Very few investors (if any) have the knowledge and insight required to guage this accurately and consistently. This is why investors are advised to adhere to principles such as asset allocation, diversification and portfolio rebalancing. It prepares investors for a wider range of negative outcomes. This would help the portfolio survive over long periods of time. Being able to benefit from positive outcomes would be a natural consequence of this.

What Should The Reader Remember About Understanding And Managing Investment Risk?

There are a few essential lessons that every reader of this article can take away. Investors must not expect to profit if they do not bear investment risk. They must also not expect to be compensated just because they are willing and able to bear a certain degree of investment risk. Effective risk management requires investors to limit uncertainty while maintaining substantial potential for gains. Doing this requires two things. Investors must have a superior sense of the range of possible outcomes associated with an event. They must also be able to guage whether the reward on offer is worth the degree of risk being taken. Most investors are not capable of doing these two things accurately and consistently. They must therefore prepare themselves for as wide a range of outcomes as possible. This is the most well rounded way to understand and manage risk.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)