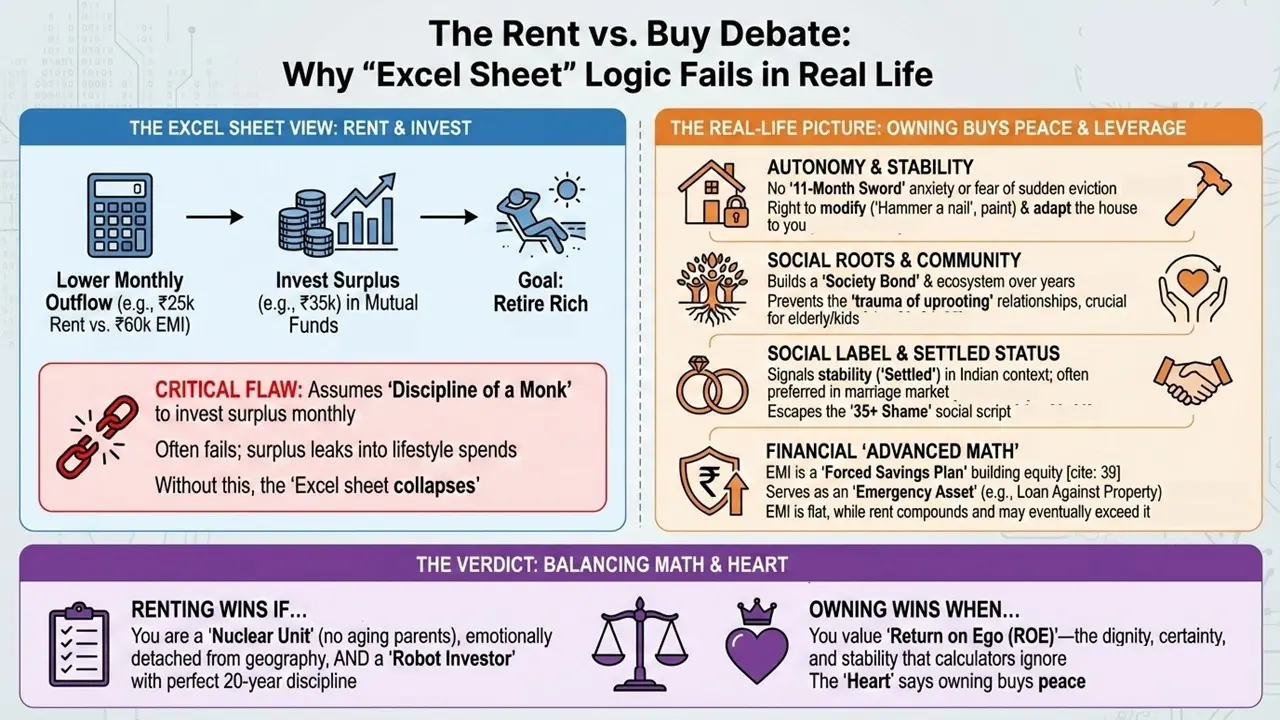

If you open YouTube or Instagram today, the financial verdict is unanimous: Don’t buy a house. Rent it. The logic is seductive. Why pay an EMI of ₹60,000 for an apartment that rents for ₹25,000? The math says you should rent, invest the difference (the ₹35,000 surplus) in a mutual fund, and retire rich. Mathematically, the influencers are right. But there is a flaw in this logic: Humans don’t live in Excel sheets.

About the author: Ajay Pruthi is a fee-only SEBI-registered investment advisor. He can be contacted via his website plnr.in. Ajay is part of the freefincal list of fee-only advisors and fee-only India.

We live in communities and chaos. In the Indian context, a home is not just an asset class or a line item on a balance sheet. It is an emotional anchor. Here is the Missing Emotional Picture that the calculators ignore.

- The Nest Instinct: Autonomy & Logistics

The biggest hidden cost of renting is the Psychological Tax of living in someone else’s space.

- The 11-Month Sword: Every tenant lives with the low-level background anxiety of the 11-month agreement. The fear that the landlord might suddenly decide to sell the flat or move his son in, forcing you to pack up your entire life in 30 days.

- The Nail Constraint: Can you drill a hole to hang a painting? Can you paint the kid’s room pink? In a rented house, you are a guest. You adapt to the house; the house does not adapt to you.

- The Friction of Address Proof: In India, shifting houses isn’t just about moving boxes; it’s a bureaucratic nightmare. It means changing your Aadhaar, updating your bank KYC, finding new domestic help, and rerouting your Amazon deliveries. It is a logistical tax that renters pay repeatedly.

- The Loss of Social Roots (The Community Capital)

This is perhaps the most undervalued aspect of renting.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

- The Society Bond: When you live in a society for 3-4 years, you build an ecosystem. You have your evening walk group, your gym buddies, and the trusted vegetable vendor who knows your order. Your children have their gang downstairs.

- The Trauma of Uprooting: If a landlord asks you to vacate, you aren’t just moving furniture; you are severing these relationships. You can find a new flat, but you cannot instantly replace the neighbour who has a spare key to your house or the friends your parents made in the park. For elderly parents or growing children, this dislocation is deeply isolating.

- The Settled Label: Sociology & Marriage

In the West, renting at 40 is a lifestyle choice. In India, it is often viewed as a failure to launch.

- The 35+ Shame: There is an unspoken social script. If you are 38 and still renting, family gatherings often involve the stinging question: Beta, when will you settle?

- Marriage Market Reality: Brutal but true—in the arranged marriage market, a groom with a home loan is often preferred over a groom with a high rental yield but no assets. The asset signals stability; the rental portfolio signals risk.

- The Definition of Settled: For many, paying the premium of an EMI is worth it just to escape the social stigma of being a drifter and to provide stability for their aging parents who live with them.

- The Forced Discipline of the EMI

The Rent and Invest the Difference strategy assumes you have the discipline of a monk.

- The Reality: If you save ₹30,000 by renting, do you actually invest it diligently every month? Or does it leak into a better car, a vacation, or a new iPhone?

- The EMI Guardrail: An EMI is a gun to your head. You have to pay it. It forces you to build equity. For the average indisciplined investor, a home loan is a forced savings plan.

- The Financial Blind Spots (The Advanced Math)

Even if we ignore the emotions and look strictly at the money, the standard Rent vs. Buy calculator misses critical variables that experienced investors know.

- The Leverage Advantage: Buying a home is the only time a bank lets you control a large asset with a small down payment. Renters investing small SIPs rarely get access to this kind of leverage.

- Rent Inflation vs. Flat EMI: The calculator assumes the rent gap stays constant. It doesn’t. Your EMI is locked (and eventually vanishes). Your rent compounds every year. In 10-15 years, the rent for your apartment will likely exceed the EMI you feared today.

- The Emergency Asset Factor: A home is a financial bunker. In a medical crisis or job loss, an owner can take a Loan Against Property (LAP) or downgrade to a smaller house to unlock cash. A renter has no asset to leverage when life hits hard.

- The Career Tax Counter-Argument: However, there is one financial win for renting: Mobility. Owners often get geo-locked, refusing better job offers in other cities because they can’t leave their house. Renters can move instantly for a 30% salary hike, treating their career as their primary asset.

The Verdict: When does Renting actually win?

Renting is the superior financial choice, but only if you meet this specific checklist. You should rent if:

- You are a Nuclear Unit: You don’t have ageing parents living with you who need the stability of a permanent address and a consistent doctor/social circle.

- You are emotionally detached from geography: You don’t mind shifting zip codes every 2 years.

- You are okay with your child changing playgroups or schools, and you don’t attach deep value to neighbour friends.

- You are a Robot Investor: This is the hardest part. You must possess the discipline to invest the surplus every single month for 20 years without fail. You cannot pause the SIP for a vacation or a wedding. If you miss this discipline, the Excel sheet collapses, and you end up with neither the house nor the corpus.

The Bottom Line:

The Math says: Renting saves money.

The Heart (and the Advanced Math) says: Owning buys peace and leverage.

When you pay an EMI, you aren’t just paying for bricks. You are paying for the right to hammer a nail into the wall, the certainty that your child won’t lose their best friend because of a lease expiry, and the dignity of never being asked to vacate by next month.

Sometimes, the Return on Investment (ROI) matters less than the Return on Ego (ROE).

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)