Last Updated on September 4, 2018 at 9:59 am

Should disciplined long-term goal based investors use mutual fund systematic investment plans (SIPs) or rupee cost averaging?

This question has been bugging me for long and personally, I hate a SIP I think it is a product tailor made for mutual fund distributors and sold to lazy people.

Should intelligent investors buy SIPs? Here is why my vote is a vehement NO.

I PE-based investing

Investing has to be goal-based. If you have no expense in mind, why would you need the money anyway! Even for the idiots who think they have no goal in mind, retirement is a goal!

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Very few of us can afford to plan for a goal with realistic inflation and a constant monthly investment. The latter would be too big for comfort. So the only way out is to include a realistic rate at which investment could increase each year hopefully as income increase

Such an assumption if followed through can dramatically reduce the monthly investment needed in the first few years of investment.

For example, if 5 Crores is required after 25 years with 10% returns, you would need to invest 42361 each month if you don’t increase investments each year.

If you can manage to increase investments by 10% each year you only need to 16919 in the first year. An incredible 60% decrease! Only after 10 years will this the monthly investment exceed the constant investment amount of 42361!

The downside is that after 15 years, the monthly investment will be as high as 70675.

This may or may not be a downside with respect to affordability but with respect to a SIP – assuming one is started, and topped up at 10% in the same SIP or with additional ones (think about all the work involved in setting that up!).

Why use a hypothetical example? Let me let you my story. When I started out investing in mutual funds, I had a SIP of Rs. 1500. Today on a good month, my mf investments can be higher than 65% of the 80C deduction limit.

Do you expect me to invest this sum in stocks each month regardless of index valuations? That is, do you expect me to invest when the index PE is 10 (an excellent idea) or when it is 15 (decent idea) or when it is 25 (a terrible idea) all in the name of rupee cost averaging?

Each monthly investment in a mutual fund either manually or via a SIP grows in its own pace. If you invest when the market is overvalued (high PE ratio), that instalment is likely to provide a lower return and pull down the net CAGR.

When investing at high index PE values (>22 or more) has historically given poor returns, why should I invest monthly completely disregarding the market?

Why should I not time the market or the index?

Why invest when a monthly instalment is guaranteed to provide low returns? Why not pool the uninvested sum together, wait for a month or two, wait for the index to come down and invest all of it in one go?

Suppose I start a SIP in HDFC Top 200 on April 3rd 2006. I invest on the SIP date (3rd) each month only if the Sensex (or BSE 200) PE is lesser than 20.

If it is higher than 20, I do not invest that month and keep aside the money. If the PE is less than 20 on the 3rd of next month, I invest the money kept aside as well as that months instalment. If there is a gap of 8 months in investing because the PE is greater than 20, in the 9th month, I invest all the uninvested money in one go.

I would like to call this SI-PE! Obviously this is a crude strategy and one designed for back-testing in Excel. In reality, one can monitor the PE more closely and invest at times that are more opportune.

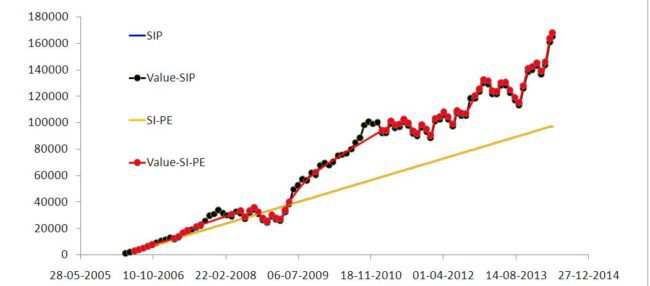

An SI-PE from 3rd Apr 2006 till date in HDFC Top 200 would have got a higher return by nearly 1% and an extra corpus of about 3K.

This is how the investments would have grown. SIP or SI-PE total investment amounts are identical. Each point in the graph is an investment.

Notice that SI-PE skips investing whenever the SIP value exhibits a peak. There are periods of time when the Index PE is greater than 20. Even by skipping several instalments, and postponing investments, the SIP-PE value is higher. Notice the lower volatility in the investment.

I am not tying to prove the superiority of SI-PE. The cut off value of PE = has been arbitrarily chosen with not much thought. Perhaps you could do better if the cut off was higher ~22.

One could argue that I am using the benefit of hindsight to state all this. Well, all of equity investing is based on hindsight. That is if past long-term returns are not so promising I will not be investing in equity in the first place!

SI-PE is a dumb method used for back-testing. I am trying to point out that one can do so much better than a SIP.

Why invest when the market is overvalued and lower the net CAGR? Why not wait for a more opportune time?

In the present example the difference between SIP and SI-PE is not significant and rupee cost averaging is a pretty decent concept. My point is, one could do much better by manually tracking the index PE and invest on any convenient date (instead of only the SIP date as assumed in SI-PE)

What about longer durations?

If I have invested in Franklin India Blue Chip via SI-PE right from inception (1st Sep. 1995), I would gain about 50,000 more than a conventional SIP. Interestingly the SI-PE XIRR (19%) is only 0.4% higher than the SIP XIRR (18.6%).

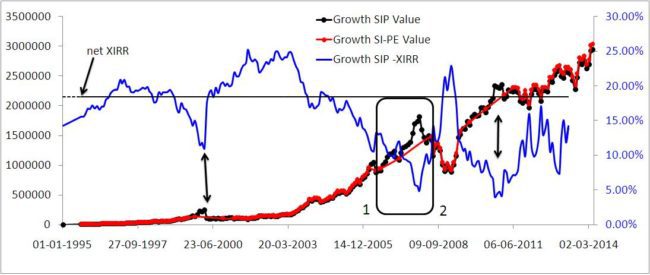

If I have increased my investment each year by 10%, also known as a growth-SIP, the SI-PE method would have given me ~ Rs. 85,836 more. The XIRR of the growth-SIP is 18.4% while the XIRR of growth SI-PE is 18.9%

Again rupee cost averaging does work in the long run. No question about that.

However, notice the evolution of the investments along with XIRR returns of each growth SIP investment. The horizontal line is the net XIRR = 18.4%.

A SIP investment done whenever the index PE > 20 has an XIRR much lower than the net returns.

Notice the boxed region. I could go from points 1 to 2 with just three growth SI-PE investments compared to monthly investments which do nothing but bring down the net returns.

Yes rupee cost averaging is a powerful technique and definitely works. No doubt about that. My question is this. Why not help the average by investing according to the PE instead of blindly following a SIP? That way you are avoiding potential bad apples.

I would like to reiterate that I am not claiming superiority of the SI-PE method. I am only pointing out that one can do much better without a SIP.

The SI-PE assumes that the uninvested instalments are pooled together, kept at zero interest and ploughed back into equity when PE falls below 20.

This is a crude approach and can be improved in so many ways. The pooled instalments can be invested in an ultra-short

term fund or liquid fund to get a little extra in case the wait for the PE to fall is long.

Alternatively, one could invest that amount into the debt component of the portfolio.

My point is, if your SIP amount is huge, why invest it regardless of the market situation when there are proven approaches to limit the portfolio volatility and gain at least a little more bang for the buck?

It is the investor’s duty to make their money work harder. The gains could be much more than what I have depicted in this crude approach.

II Rebalancing investments

Any long term folio must be rebalanced to lower volatility. Instead of locking money to SIPs, if the money is free to be invested anywhere, rebalancing can be done by adjusting investments instead of holdings. This frees me from tax and exit load issues.

See results from this wonderful study:

Some analysis using long term equity and debt funds in India (Part 2) The result of this study can be viewed here

Some analysis using long term equity and debt funds in India (Part 3) The result of this study can be viewed here

Obviously if you lock your money in a SIP you cannot do this!

III Unmatched flexibility

Most investors when they start SIPs and add funds later are clueless about a diversified equity folio. Use this tool to find out how diversified your equity portfolio is!

If the money were not locked in SIPs, the investments can easily be adjusted to make it more diversified and balanced. Read this wonderful suggestion given by Ramesh to me.

Same is true about fund performance. Lock your money in a SIP and you will have to go through the trouble of stopping it if the fund underperforms. Without a SIP you are free to invest in a better performing fund. What to know which funds are the laggards in your folio, use this automated mutual fund tracker.

The flexibility offered by manual monthly investing is matchless. Online investing in a mutual fund will take a 2-3 minutes per transaction in a low speed broadband connection. When I got my first online account I did not even know mutual fund distributors existed! So I contacted the AMC directly (pun intended!) for investing!

I have been manually investing for over 4 years now. I invest on days when the market drops by 1% for the first two weeks of the month. If it does not, I invest any way. This is not for higher gains. This is a regimen to train my mind to love market corrections

Unfortunately, the rally in March and April has upset my plans! I have just kept my investments on hold waiting for a correction to move in.

Since my investment amount is getting large, I am uncomfortable about investing it during rallies. How much difference will this make in the long run? Hard to tell! Life does not pan out like an Excel sheet. It entirely depends on how I play it.

Not using SIPs put me in charge. As a control freak I relish that idea.

I can pick and choose my funds and time. If I had locked all money in SIPs I would been too lazy to stop them and start investing in Quantum Long Term Equity or PPFAS LTVF – the stars of my folio. I could never have aggressively invested in both these funds which have not only stabilised my folio but have provided me with the necessary diversification.

My goal is to ensure that my net folio returns (estimated by the automated tracker), which have recently become healthy double digit numbers, stay that way.

I am not blindly relying on an averaging technique for that. Just cramps my style.

Rupee cost averaging is a proven idea and is likely to beat inflation in the long run. no argument there. However, it is not good enough for me.

What do you think? Do you agree? If you agree, please do not stop existing SIPs on account of me without proper planning. Check your portfolio health, check equity overlap and then make an informed choice.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)