Last Updated on October 8, 2023 at 1:41 pm

If you have attended one of the DIY investor meets, you might have heard me say, “the secret to ageing well is to surround ourselves with intelligent youngsters”. Be it investors like Krishna Kishore, Indraneal Balasubramanium or superior coders like Pranav Date, eloquent writers like Anish Mohan, I and hopefully the freefincal community has benefited immensely from their talents. Meet Pranav Surya, the latest member of this ‘club’. He approached me with an amazing book idea that convinced me to sign up as co-author. In this post, (1st of two parts), he explains about the how the book came to be and what one can expect from it.

Pranav is a mechanical engineer with an MBA in hospitality and tourism. He has worked in 4 countries across 3 continents and is currently working in the tourism industry. He is an expert backpacker with extensive travelling experience.

When we met the first time, he had listed his feedback on Subra’s first book: Retire Rich – that made me sit up and take notice. The second time, he had a book proposal titled Gamechanger aimed at young earners. It was so professional right from conception, content and implementation, that I agreed to co-author it.

Now over to Pranav. I urge you to sign up for Gamechanger book release notifications and some juicy offers using the link mentioned below.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

=-=-=-=-=-=

When I was 15, my high school teacher said, “I hope you take my place one-day; I hope you teach and only then you’ll know what a pain in the neck you are.” The farthest I got toward her wishes were telling my college friends to save and invest while we are young. I realized if people who cared and loved me weren’t interested one bit, teaching must be really hard. And so I called her to tell that people are really a pain in the neck when we ask them to listen. She said, “Perhaps you just had the wrong audience. Maybe try giving this advice to people you don’t know yet” That day, I decided to be a pain in the neck to countless unknown people. I became an author!

A few days back there was an interesting conversation in the AIFW facebook group. Like any other day, there were innocent people looking for genuine advice, new bloggers trying to pry attention, half-learned literates professing their gyan and a whole lot of silent-watchers, observing and absorbing the conversations. The reason that this conversation turned heads was because one person wanted to buy an iPhone that blew his budget and in a group of financial literates, you’re going to have fun with the opinions.

While good-natured in its merit, the mind kept returning to “Should a small purchase be so hard in life? Aren’t we allowed some leeway?”

- If making us financially literate was leaving us miserable, what was the point of learning so much in the first place?

- And if the literate person has to suffer so much through life, what are the tribulations that a financially inept person goes through?

In a world where the odds are always tilted toward the person in-the-know, being over-bred on personal finance isn’t all that enticing.

One of my favorite prfavourite at University told that if I memorized the formula for CapM and make clear predictions about earnings into the future, we’d ace the exams, run out with A’s and get the best jobs into travel or real estate consulting firms. She’d often say, ‘smart people finish rich’ by which she subtly meant get an A and you’d be able to buy those Cartier glasses because you work at CBRE. Well, most of us cleared the subject by the skin of our posterior and still can afford those expensive eye-wear.

Back in school, the answer to anything was ‘Padlo! Baad bada aadmi ban gaya’. I didn’t know what I wanted when I was 15, so I studied. I studied night and day so that I could become rich some day and ape the things my parents had: buy a home, a car with blaring speakers and a special social status among the family. Well, I have most of them already and I’m only 24.

The big difference was: I did not anticipate the ‘experiencing things’ part when I envisioned those dreams. What mattered to me in a car when I was 15 was it should be black, muscular and ‘cool’. What I didn’t care about were the EMI’s, resale value and gas prices. When you look back and see how our tastes have changed over the years and will continue to evolve, the problem seems to beguile us.

When people say, “I can’t believe I dressed like that back when I was 7” they don’t realize we are probably going to say the same a decade later about what we are wearing now. Oscar Wilde famously quipped on fashion: “a field of ugliness so absolutely unbearable, that we have to change it every six months.” And yet, we adore familiarity. We like familiar routes to office. We like buying from the same company for years and years. Yet, when Steve Jobs said “A lot of times, people don’t know what they want until you show it to them” he was right as well. No one anticipated the revolutionary technology Apple would put in our hands. If people liked familiarity, Apple would never have existed as the giant it is today. When you had the first sip of beer, no one has ever exclaimed “Where has this been all my life!” It probably runs along “Yuck, you guys drink so much of this??” We started having it because, well, we just did. When the Sydney Opera was built, people couldn’t fathom if they ‘disliked’ it or it was just plain ‘ugly’. Fast forward now, architects pronounce ‘why can’t we build like this anymore?’

Our perceptions and priorities over art, life, philosophy, philanthropy, work, money, rich, poor, relationships, social status, men-toys change and evolve as we undergo life. In a fascinating turn of events, you might want to change industries at work, pick up your childhood talents, travel the world, take a sabbatical, volunteer in Africa, teach high school, inspire the next generation, have a mid-life crisis, and retire early.

To do anything that might be cheesy or make a wonderful story-tell to your grandkids, you’d have to be prudent on the money front. Because what-ever you do, the end result is one currency and being savvy about it bodes well.

I was interning at Austin, Texas when an American’s debit card read ‘insufficient funds’ as I swiped it in my system. He nonchalantly lent me his Amex while giddily saying, “I hope to pay the balance on the card at least this month”. With no experience of working in the industry, a top-grade University granted me admit for my MBA. With no interest in learning about what people did with their money, I was soon paid to extract that information. On the flip-side, I got really good at it because people were really bad at it.

The world around me was running amok with credit card debt while I tried to comprehend what I was seeing. In turn, when I tried to inject some sense into their brains, my futile attempts were lost as ‘goodwill tax’ on the listener’s ears and they continued to spend like Arab princes, minus the dress. After working with and understanding customer’s money habits across 3 continents and 4 countries, the folklore that youngsters are mad with their money, seemed justified.

Most Personal Finance books and blogs, document wide-ranging ideas that cater to a greater swath of people from the diseased to the self-employed. A lot of this generic advice renders little scope for action. In a nation clamoring for solved examples, wouldn’t it be great, if someone could show the exact steps to follow?

The book Gamechanger will be functional when analysing personal-finance. It illustrates how to do everything with a step by step process like how Google Maps takes you to your destination. Instead of saying ‘choose the best bank to park your money for short term’, Gamechanger identifies which option is the best and points to the specific URL for the reader. With an emphasis on why you need to be smart with money, closely followed by how to set-up the cash-flow and automate the process, you’ll have a ball reading the conversational tone throughout. Pattu over-delivers on simplifying the investment process and gives you simple action steps that is sure to bound you to guilt if you don’t take action.

The fun portions that will make you loyal fans will include insider knowledge on:

- The cheapest ways to travel

- How to find Cheap Flights

- How to find cheap accommodations during vacations

- How to fund your vacations even if you can’t save a single penny right now

- How to properly utilize credit cards

- When Credit cards can be a secret sauce to paying less on your home loans

- How to get the most out of them in-terms of cashbacks, rewards and miles

Functional. Fun. Customer Centric. To the point. Insider Knowledge. 80-20. Compound Interest. Cheap Flights. Cool accommodations. Cashflow. Early retirement. Automation. Big wins. Equity. Real Estate. Mutual Funds. Narrative. Racy. Action steps. God-damn truth.

Now, that’s one hell of a promise to keep and a roller-coaster of a book to write!

After reading the book, I’m not sure if my mate will still buy the iPhone but he’s definitely going to make a decision and forgo the guilt. KUDOS!

For those already looking forward to reading the book, use the link below to be updated with the release.

Fun-tastic: The first few beta readers who sign-up and give their feedback will be mentioned in the book.

Click to Sign up for Updates on the Gamechanger

=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=-=

New Delhi DIY Investor Workshop April 23rd 2017

Register for the New Delhi DIY Investor Workshop April 23rd 2017

You Can Be Rich Too With Goal-Based Investing

is a book that I have co-authored with PV Subramanyam. if you have not yet got the book, check out the reviews below and use the links to buy.

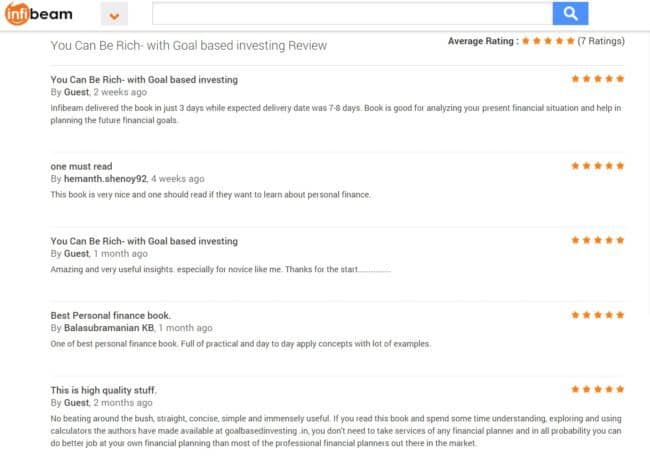

Reader Quotes:

Gift it to your Friends and Relatives whom you care more. Already follower of Pattu and Subra’s forum. Ordered 4 more copies to give gift to my friends and eagerly waiting to read

The best book ever on Financial Freedom Planning. Go get it now!

Your first investment should be buying this book

The (nine online) calculators are really awesome and will give you all possible insights

Thank you, readers, for your generous support and patronage.

Amazon Hardcover Rs. 317. 21% OFF

Kindle at Amazon.in (Rs. 307)

Google Play Store (Rs. 307)

Infibeam Now just Rs. 307 24% OFF.

If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Bookadda Rs. 344. Flipkart Rs. 359

Amazon.com ($ 3.70 or Rs. 267)

Google Play Store (Rs. 244.30)

- Ask the right questions about money

- get simple solutions

- Define your goals clearly with worksheets

- Calculate the correct asset allocation for each goal.

- Find out how much insurance cover you need, and how much you need to invest with nine online calculator modules

- Learn to choose mutual funds qualitatively and quantitatively.

More information is available here: A Beginner’s Guide To Make Your Money Dreams Come True!

What Readers Say

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)