Last Updated on December 29, 2021 at 12:17 pm

Here is a FAQ on Small Finance Banks: Are they safe? Can I invest in their fixed deposits? How are they protected? What are the safeguards? What are these banks for? Let us find out.

A FAQ on Small Finance Banks

- What are they? Small Finance Banks are Banks licensed by RBI under section 22 of the Banking Regulation Act, 1949.

- Why? Certain sections of the society were not fully catered to by the existing banks. These sections of the society were neglected and kept out of the financial system due to lack of availability of basic identity documents, literacy etc. Hence, differentiated banks were intended to be set up which can be primarily responsive to the local needs.

Hence, the objective of these banks is to:

- Promote Financial Inclusion.

- Be the last mile lender by giving loans to Small Businesses/Industries, Small Farmers, Un-organised sector/migrant workforce & the underprivileged.

- Where can you find them? On Google, of course! 🙂 However, 25% of branches of these banks have to be in unbanked rural areas (population up to 9,999 as per the latest census).

These banks pre-dominantly open branches in the states where they hold some existing customer base as many of these banks were Micro Finance Institutions earlier.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

- When? 2015:- RBI granted a license to 10 applicants out of 72. Click here to view: – Applicant List, Selected List.

- What can they do & what they have to do? They can:

- Conduct Basic Banking activities – such as accepting deposits & lending.

- Sell mutual funds, insurance products, pension products, etc. with the prior approval of the RBI and after complying with the requirements of the regulator for such products. They are allowed to do this as these are non-risk, simple financial activities, not requiring any commitment of own fund.

- Conduct foreign exchange business for its customers.

- Convert to a full-fledged bank.

They have to necessarily:

- Cater to-Small Businesses/Farmers, Unorganized and migrant Labourers.

- Give 50% loans to MSME (Micro, Small & Medium Enterprises)

- Ensure at least 75% of their total loans is given to the Priority Sector.

- What they cannot do?

- They cannot deal with sophisticated financial products.

- They cannot set up subsidiaries to undertake non-banking financial services activities.

- How should they work?

High use of technology & Low cost:-

Existing banks had to migrate to new technology as they may be as old as 100 years.

However, since these banks are being setup after 2015, RBI specifically wanted these banks to make high use of technology right from the beginning and keep the operating costs low. Hence, you would these banks to have good Digital Services and their banking outlets/branches may be small.

Should you invest in these small finance banks?

Well, there’s always more than what meets to the eye. There may be additional conditions attached. If you are in Mumbai, there are high chances that you may have seen huge hoardings of the following ad:

The bank in question offering 9.6% to Senior Citizen had:

- a lock-in of 3 years (ie non-callable deposits). Premature withdrawal is not allowed under any circumstances. One of the reasons they give such high-interest rates is because of the “lock-in” for a fixed time.

- The rate is applicable for deposits above Rs. 15 lakhs.

Ask yourself the following questions:

- Am I ok with giving my money to a new player? They are yet to show their strengths in testing times.

- If there’s a Lock-in, am I am ok with it?

You may not be able to withdraw the deposit under any circumstances except in case of death or in-case of order from statutory/regulatory body subject to approvals.

- Do I like to have Customer service which is Digital or which is offline?

- Can I get an overdraft against such deposits?

- Am I ok with giving money to someone who will give my money to other people (by way of loans) & knowing the fact the loan expertise in these banks is still evolving.

- Am I okay with a bank that has a mandate to lend to small businesses, many of them can fail at an alarming rate?

- If the bank fails, do you have the time to wait for the money to be returned back through the DICGC Insurance? Read more about this: What happens if my bank fails? All about Deposit insurance (DICGC)

Official Liquidator of the Bank makes application for the claim within 3 months after being appointed and DICGC makes the payment within 2 months). In reality, the timelines can be very different (years even, see above post for examples)

DO NOT INVEST YOUR: Emergency fund in ANY “non-callable/lock-in” FDs.

It is possibly an option that Cooperative Societies, Trusts, Partnerships, NGO and Private Limited Organisations can consider.

How safe are these small finance banks?

The regulators keep a close watch on them. There are multiple checks to ensure that they are run in a professional manner.

- At least 50 per cent of its total loans should be less than Rs. 25 lakh.

- Further, the maximum loan size to a single and group borrower would be restricted to 10 per cent and 15 per cent of its capital funds, respectively. Hence, you will not have a single borrower who can take loans of 9000 crore or 11000 crore.

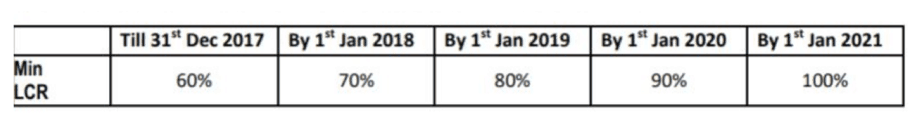

- For the investor with a number bug, you can look at the banks Liquidity Coverage Ratio.

Liquidity Coverage Ratio (LCR) ensures that the bank maintains sufficient High Quality Liquid Assets to survive acute stress scenario lasting 30 days. The RBI requires SFB (Small Finance Banks) to increase the Liquidity Coverage ratio in the following phased manner:

The LCR maintained by the bank can be found in the Disclosure section of the banks’ website.

The LCR maintained by the bank can be found in the Disclosure section of the banks’ website.

- All prudential norms and regulations of RBI as applicable to existing commercial banks including the requirement of maintenance of Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- The banks are run by Promoter/Promoter groups who are found to be ‘fit and proper’ with a sound track record of professional experience or of running their businesses for at least a period of five years.

- RBI mandates these banks to be listed within 3 years of operation. Listing of Banks ensures that additional system checks kick in.

- Minimum paid up equity capital of such banks should be Rs.100 crore.

- contribution by the promoters should be 40% which can be brought down gradually.

What happens if I invest Rs.15 lakh in their FD and they go bust?

Despite all of the above regulations, it can/may happen!! If it does, since these banks have deposit insurance up to Rs. 1 lakh can be claimed back. However, this can take months to years and therefore cold comfort. See: What happens if my bank fails? All about Deposit insurance (DICGC)

I want to invest, but I have fears & doubts. Koi rasta/jugaad?

The above-linked post on deposit insurance has examples of how the money can be divided among family members to ensure most of the invested amount is eligible for deposit insurance. However is it worth the risk? The headache and the wait? Definitely no.

RBI deputy governor KC Chakrabarty rightly said:

“Finance always exploits. I laugh when people say finance helps. Small finance banks need to be sympathetic to their customers if they want to remain relevant.”

Summary

I go for a walk each evening (after uploading the day’s youtube video) and love walking around busy streets filled with small shops and roadside hawkers. In the last four years, more than ~ 20-25 small businesses shut shop or replaced by other businesses. Almost all of them would have borrowed money (form local loan sharks). Since a small finance bank cannot do what a loan shark would do upon default, their business model does not appear to be strong enough to trust them with my money. I think they will be under severe pressure if many of their borrowers fail to pay. Therefore personally, I will not lend to small finance banks for a small benefit. How about you?

This post was written in collaboration with a commissioned content writer from the banking industry.

The latest from freefincal on Youtube

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)