Last Updated on July 17, 2025 at 2:23 pm

Many first-time visitors to our website ask, “Where is the freefincal retirement calculator?” Our signature retirement calculator is now part of the freefincal robo advisor, which allows you to create a complete financial plan for your family.

The retirement calculator was the first tool we created. Over the years, we have modified it by adding more and more features and factoring in user feedback. The final version, which many of our users call ‘perfect’, is now the flagship of the freefincal robo advisor used by more than 2500 investors and advisors to create complete financial plans for themselves and their clients. The tool was featured in the Economic Times: Meet Pattabiraman, the man who helps many plan a better retirement through his calculators.

Unique features

- Can handle up to three post-retirement income streams

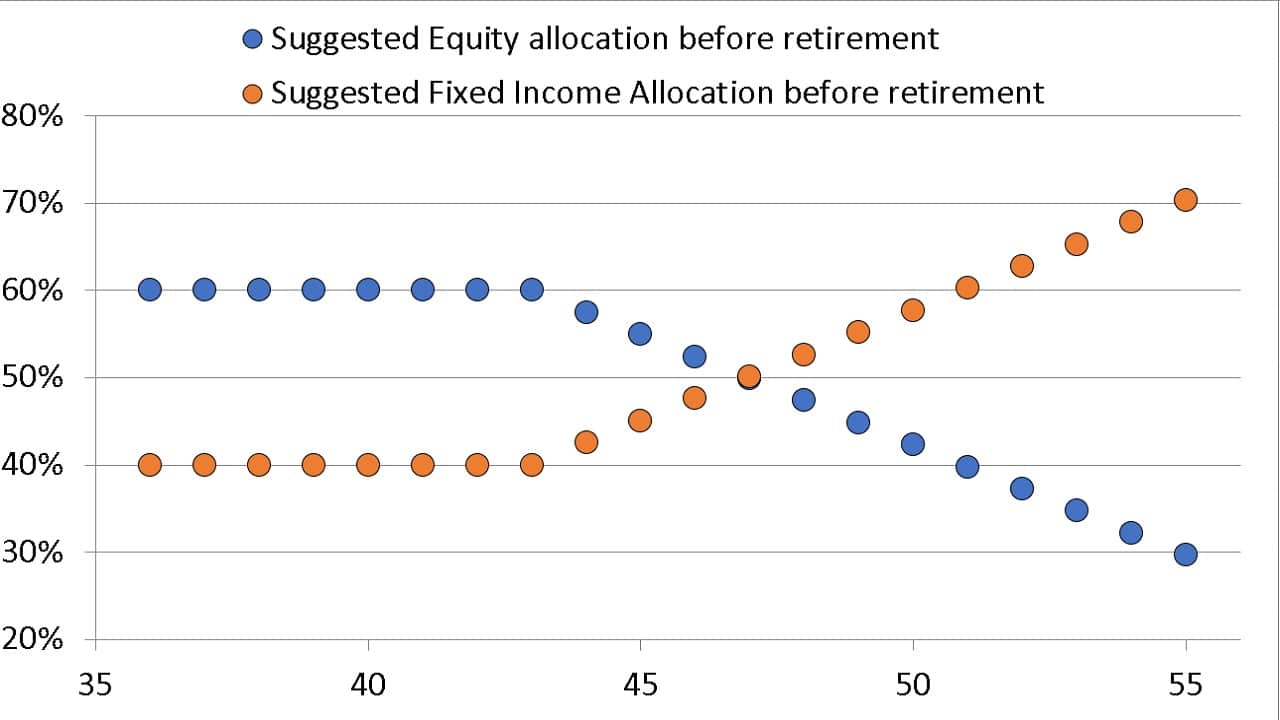

- Automated asset allocation schedule to reduce sequence of returns risk (poor returns that can derail our plans)

- Detailed bucket strategy calculation

- Options to include various levels of pension after retirement (income flooring)

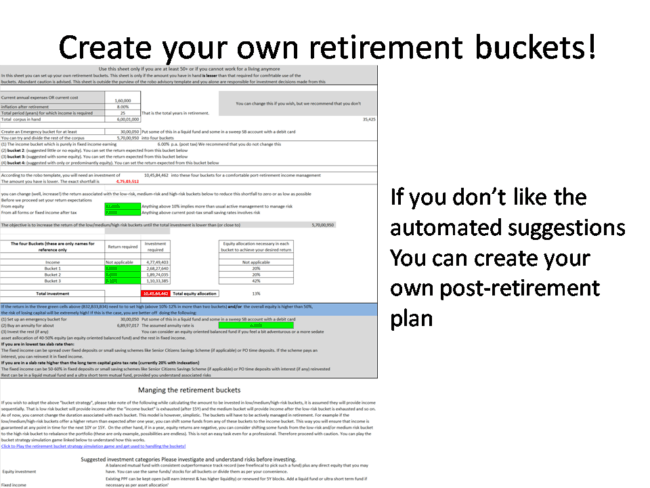

- Option to DIY bucket strategy and use an annuity ladder.

- Fully customisable. No hidden formulae.

Illustrations:

- Retirement plan review: Am I on track to retire by 50?

- I am 30 and wish to retire by 50 how should I plan my investments?

- Can I retire by age 55? Retirement Planning Case Study

- Case Study: Achieving Financial Freedom for Early Retirement

- How should I plan if I want to retire in 20 years?

- Is it possible to combine a bucket strategy with income laddering after retirement?

It is available in Excel for Windows and Mac (Excel) users and on Google Sheets. For a full list of features, see Robo Advisory Software Tool: Build a complete financial plan!

Sample financial plan calculation using the freefincal robo advisor

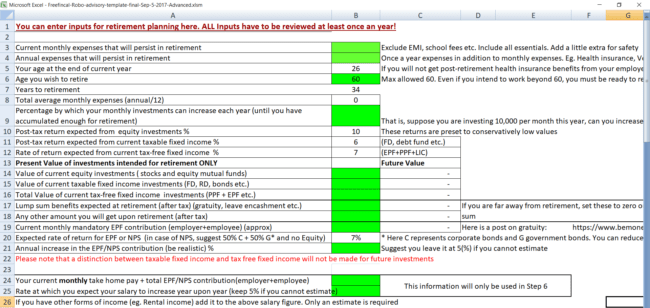

A 35-year-old reader wishes to retire by age 50. He is married to a homemaker aged 30. We shall plan for retirement income from when he reaches 50 to when his wife (or, generally, the younger spouse) reaches 90. Therefore, he has 15 years to invest and needs to plan for inflation-protected retirement income for 45 years.

What is inflation-protected income? This retirement income increases each year as per the family’s needs. It considers inflation in expenses as well as lifestyle modifications. Young earners should not think about constant income or pensions in retirement today. They should consider consistently beating inflation with an inflation-protected income (or inflation-indexed income). Read more: Generating an inflation-protected income with a lump sum.

What is financial freedom? The ability to generate inflation-protected income for a given number of years, preferably until the death of the youngest dependent. In this case, the reader’s family requires financial freedom for 45 years.

We shall use the freefincal robo advisory tool to create the retirement income plan. We shall consider 6% inflation before and after retirement. It is better to determine how much your expenses are increasing yearly and use that rate. You can use our Personal Inflation Calculator.

Inputs and assumptions

- Monthly expenses of Rs. 50,000

- Another Rs. 50,000 annual expenses.

- Existing assets: Rs. 65 lakhs in stocks, mutual funds, and Rs. 50 lakhs in EPF

- The expected return from equity is about 10% (post-tax), and the return from EPF is 7% (this is after 15Y, so it is better to err on the side of caution).

Output:

- Average monthly expenses at the time of retirement will be about Rs. 1.3 lakhs.

- The total corpus required (excluding existing investments) is about Rs. 5 Crores!

- Factoring in existing investments, the net target corpus to be achieved is only Rs. 1 Crore. That is the power of starting early and accumulating a sizeable corpus by age 35.

- The monthly investment (including mandatory EPF or NPS deductions) is Rs. 27,000! If he can increase the investments by 10% a year, the initial investment will come down to Rs. 15,000!

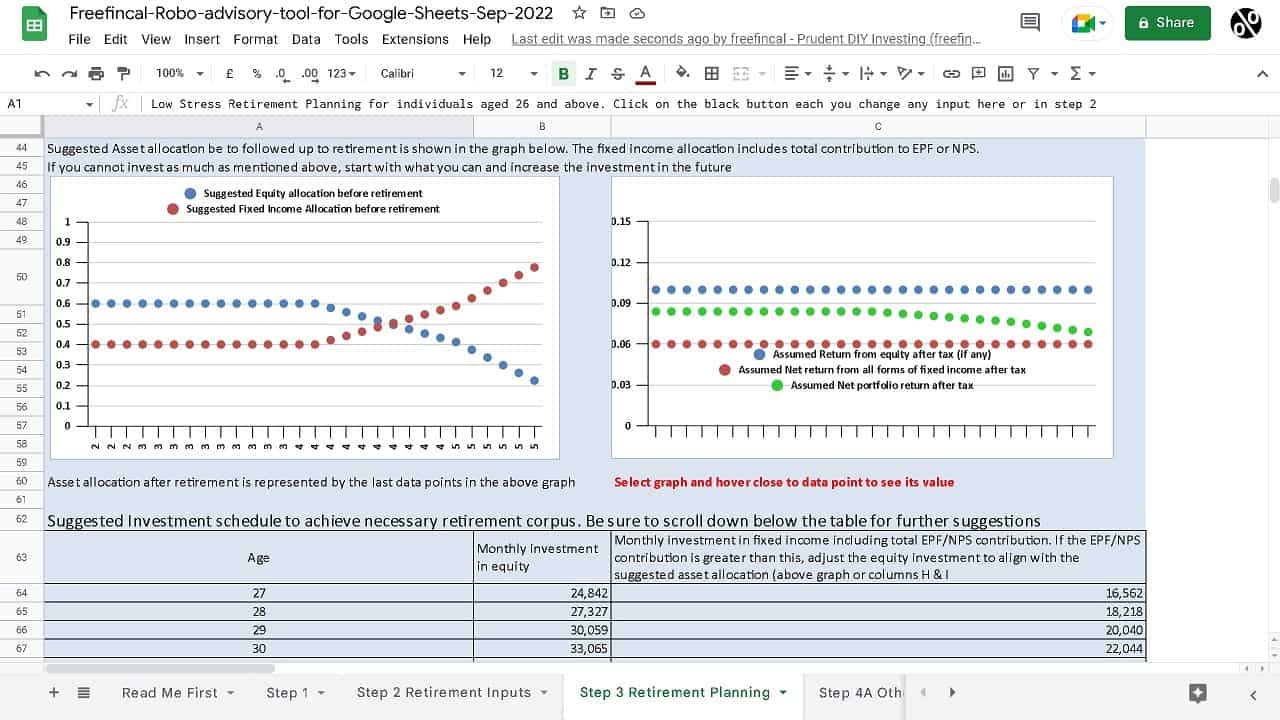

To ensure the portfolio is adequately de-risked and the actual retirement corpus is close to the expected corpus at any time, the robo tool recommends a variable asset allocation, as shown below.

As the portfolio’s equity exposure decreases, so too does the expected net return from the portfolio. This is factored in from day one in the above calculation.

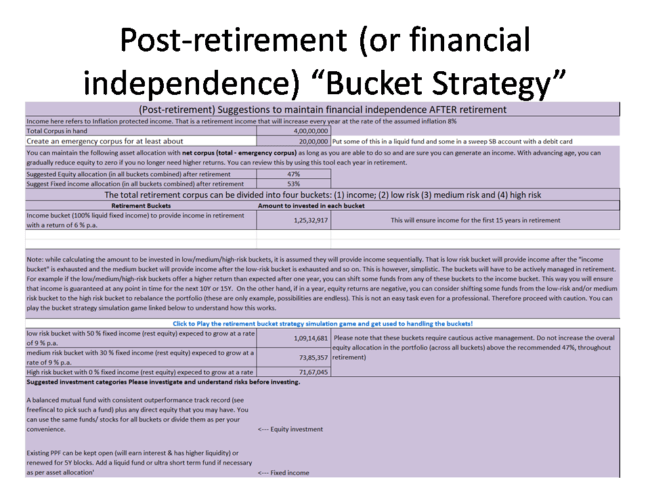

This is only one part of the retirement calculation. What about after retirement? The second part determines how the corpus will be divided into buckets. A retirement bucket strategy refers to how a retiree invests her corpus in different investments and tries to generate inflation-protected income.

The robo tool divides the retirement corpus into five buckets. That is, the retirement corpus will be divided into five parts. This is only one of many ways to construct a bucket strategy. This assumes 45 years in retirement.

- An emergency bucket to handle unexpected expenses. Example: 5%

- Note: The overall equity allocation from the entire corpus is only 35% after retirement.

- Income bucket that provides guaranteed income for the first 15 years of retirement. During this time, investments are made in the following three buckets.

- Corpus from a low-risk bucket that provides retirement income from year 16 to year 26. To provide this income, the low-risk bucket will have an asset allocation of 50% equity and 50% debt during the investment period (years 1 to 15 of retirement). This corpus weighs about 25%.

- Corpus from a medium-risk bucket will provide retirement income from years 27 to 35. To provide this income, this bucket shall have an asset allocation of 70% equity and 30% debt during the investment period (year 1 to year 27). This corpus weighs about 15%.

- Corpus from a high-risk bucket will provide retirement income from years 36 to 45. To provide this income, this bucket shall have an asset allocation of 100% equity during the investment period (year 1 to year 36). This corpus weighs about 9-10%.

- During this investment period, the buckets will be actively managed to reduce risk: rebalancing and profit booking from one bucket to another. To understand how this works, try The Retirement Bucket Strategy Simulator.

- After 15 years, the low-risk bucket can be turned into 100% debt and provide income for about 11 years. After that, the other buckets can also be progressively used. One can always customize this usage after retirement.

- Please note that bucket allocations will change as per the user inputs and are auto-determined by the robo tool.

Video Guide

Screenshots

You can enter details relevant to creating your retirement plan here

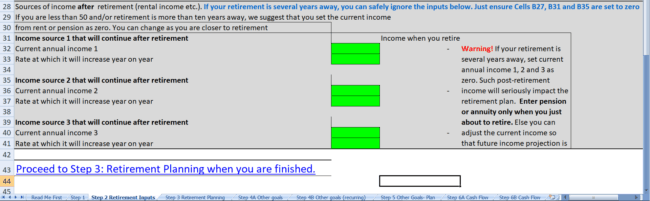

You can include up to three post-retirement income streams

Step 3 Retirement Planning

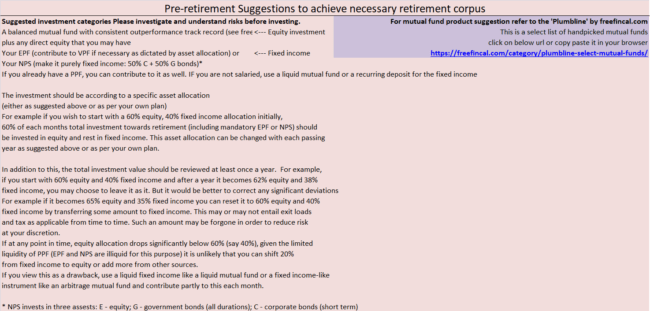

This sheet tells you the investment strategy to be adopted before retirement (and up to retirement) with clear asset allocation break up and investment portfolio management suggestions.

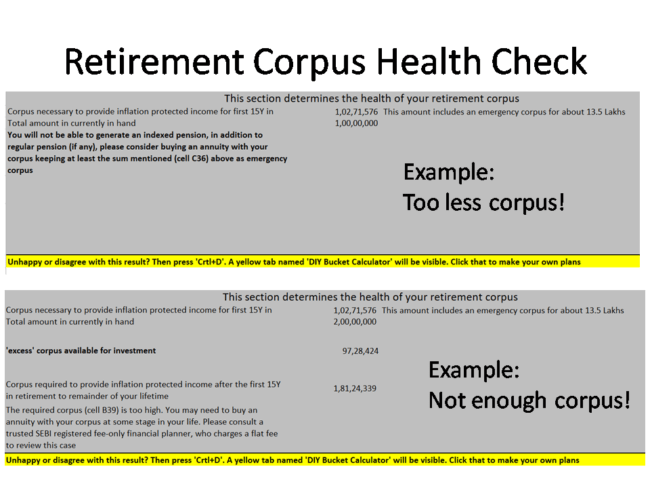

If you are retired, you can obtain an opinion about the health of your retirement corpus.

and a detailed retirement bucket investment strategy in case the corpus is good enough.

You can play this simulation game to understand how the bucket strategy works: The Retirement Bucket Strategy Simulator

For a full list of features, see Robo Advisory Software Tool: Build a complete financial plan!

Get the Robo Advisory Tool

Presentation: The tool is available in two formats

- As an Excel file with macros. It will work on Mac Excel and Windows Excel.

- Or on Google Sheets with scripts.

All inputs are fully customisable. It can be used for commercial purposes as well. More than 2500 investors and financial advisors are using the tool. Users will get all future updates as well.

One-time purchase; lifetime access. Price includes future updates to the sheet.

Get the robo tool by paying Rs. 5625 (Google Sheets edition; Instant Download. No refunds allowed). Use the discount code: robo25

Use this link to get the tool to get the Robo Advisory Template Excel Sheets Edition at a 20% discount for Rs. 4500 only (the regular price is Rs. 5625). Use the discount code: robo25 (this will work on Mac and Windows Excel)

Outside India? Then use this Paypal link to pay USD 80 (Kindly write to freefincal [AT] Gmail [DOT] com after you pay).