Last Updated on October 1, 2023 at 5:43 pm

We buy health insurance in the hope that it would come to aid in the time of need. Many people do not have a personal health insurance policy because they rely on their corporate health insurance or a group cover. The assumption is that corporate health insurance claims are unlikely to be rejected as the insurer would lose business (the firm will not renew next year). Well, guess what? Not all corporate covers are the same. Not all policies settle claims – genuine claims – without hassle. Here is the story of how Rahu’s corporate health insurance claim was rejected for a trivial sum and how he fought back.

Rahul is not his real name, but the one he chose to tell his story with upon my request. Rahul wrote to me about his claim rejection and I suggested that he support his application with a clear letter from his doctor about the severity of his condition and need for hospitalisation (explained below) and if they do not accept, threaten them about going to the Ombudsman. Later, when his claim was processed, he readily agreed to share his experience so that we can be more alert to such a possibility. Over to Rahul.

=============

Hi, I’m Rahul (the first fake name that came to my mind, changed to protect identities of everyone involved), 26, single, and your average IT worker in Bangalore. Not some big corp, just a mid-sized start-up, with about 50 employees. Instead of narrating these events like some DC comics origin story, I’ll do it Q & A style:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

1: What were you hospitalized with?

Dengue. About four months ago, I came down with high fever, and it just won’t go away. Went to a clinic for blood and urine test – initial diagnosis was Salmonella infection.

The meds didn’t do much, except to make me weaker. On the third day, my parents had to come from my hometown – it’s not every day you are under three blankets with a hot water bag, and you’re still shivering.

My fever was at 104, and on the fourth day evening, I was taken to the nearest hospital for consultation.

2: What transpired at the hospital?

The doctor put me on paracetamol IV drips, to bring down the fever. After 2 hours, it was still 1 degree above normal – doctor admitted me to observe me further. Blood report came back with Dengue, and symptoms were consistent with Dengue.

The hospital put me in a shared room (if you think crying babies should be put on a no-fly list, try sharing a hospital room with a baby who also has dengue!). For two days, I was on various types of salines and IV drips.

Because my parents were present, and I was getting bored and/or irritated; doctor finally agreed to release me after just 48 hours.

My fever was gone by then, but platelet counts were low.

3: What was your post-hospitalization period like?

Basically, a lot of papayas, carrots, and other fruits, vegetables etc. to bring the platelet counts to normal*. In addition to all the medicines. Daily blood reports were a thing – to check the platelet counts. Dengue leaves you really weak – you’ll have trouble walking around comfortably for a few days. Mostly bed rest and work-from-home. Took me about a month to fully recover.

* Pattu’s note: I am on daily immunosuppression medication that tends to decrease platelets gradually. When I did some digging around about the benefits of fruits and vegetables, I could not find convincing evidence that they work. Platelets tend to increase on their own when the infection dies down. However, there is no harm in a Dengue patient trying and I would try it too after such an episode. Sorry, Rahul, hope you don’t mind my saying this.

4: What about the claim?

As per our policy, we have to make a claim within 1 month of the first date of hospitalization. I submitted the claim just in time after being back at the office – had to run back to the hospital a few times to collect few missing bills and other documents. There were a lot of documents – bills, prescriptions, discharge summary, reports etc.

I won’t name the insurance company, but let’s just say smellycare won’t be a bad rhyme for its name.

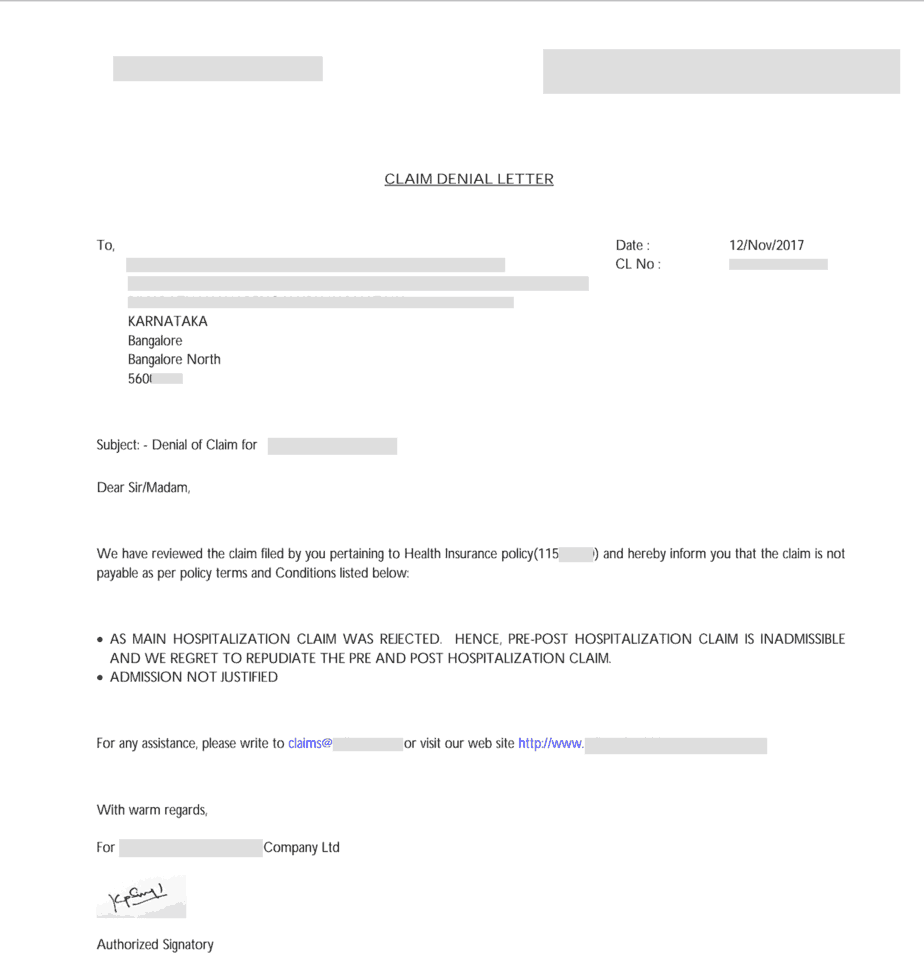

After about one month, I got an email from their claims department. It was a claim rejection letter.

It said that the claim is being rejected as the hospitalization was not justified.

Reason: – AS PER THE SUBMITTED DOCUMENTS NEED FOR THE HOSPITALIZATION WAS NOT JUSTIFIED AS THE TREATMENT COULD HAVE BEEN TAKEN ON OPD BASIS. HENCE, WE REGRET TO INFORM YOU THAT YOUR CLAIM IS REJECTED. – ADMISSION NOT JUSTIFIED.

I also got a physical version of it, via post. Health insurance companies! They will s**** you, but with manners. The pre- and post-hospitalization expenses were also rejected for the same reason as shown below.

Ours is a group cover of a 5L family cover – no room-rent limit, no co-pay option; and my claim was for about 20k – even that was rejected.

5: What did you do after that?

To be honest, I was sure this would be approved. I’ve never heard of group cover claim being rejected. Since I have an adequate emergency fund in place, 20k won’t set me back by much. If you go to a doctor with a high fever and great discomfort, and after a physical examination, they say you should be hospitalized – you’d listen to them!

I did too. Now some insurance company says hospitalization wasn’t justified!

The first reaction of my troubled mind was to immediately contact Pattu sir. He suggested that I go to the doctor and get a letter from him citing severity of the conditions at times of admission.

Also, I informed my manager and HR rep; who in turn contacted the TPA asking for an explanation.

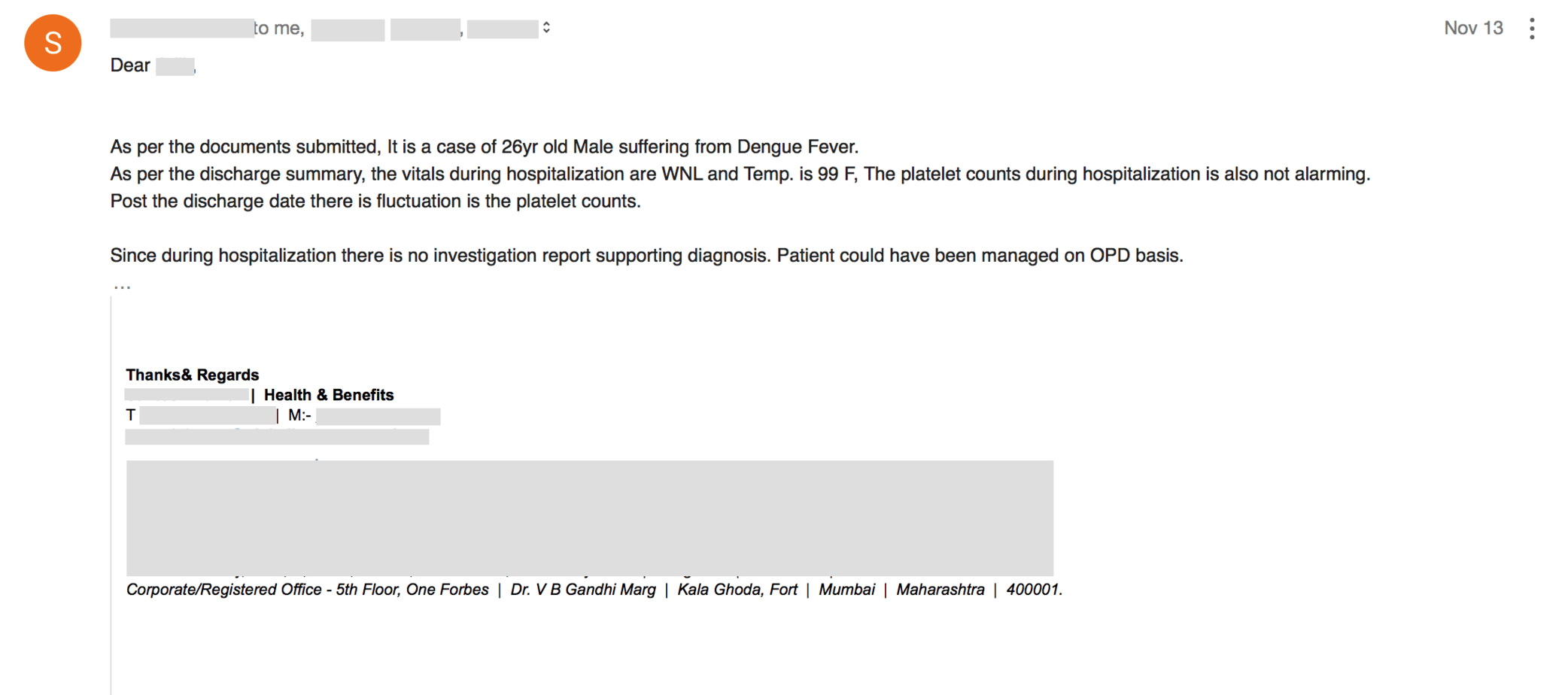

This is what the TPA got back to us with.

For those who are unable to view the image, let me quote from the mail:

As per the documents submitted, It is a case of 26yr old Male suffering from Dengue Fever.

As per the discharge summary, the vitals during hospitalization are WNL and Temp. is 99 F, The platelet counts during hospitalization is also not alarming.

Post the discharge date there is fluctuation is the platelet counts.

Since during hospitalization, there is no investigation report supporting the diagnosis. The patient could have been managed on OPD basis.

There are a lot of issues with this text, not the least of which is – definition of “alarming”.

My platelet count was 1.15L when I was admitted, and the lowest normal limit is 1.5L. They also agree that it was below normal – just not abnormal enough!

Also, note how the discharge summary mentions my temperature after 2hr of paracetamol IV drip – but not when I went to the doctor.

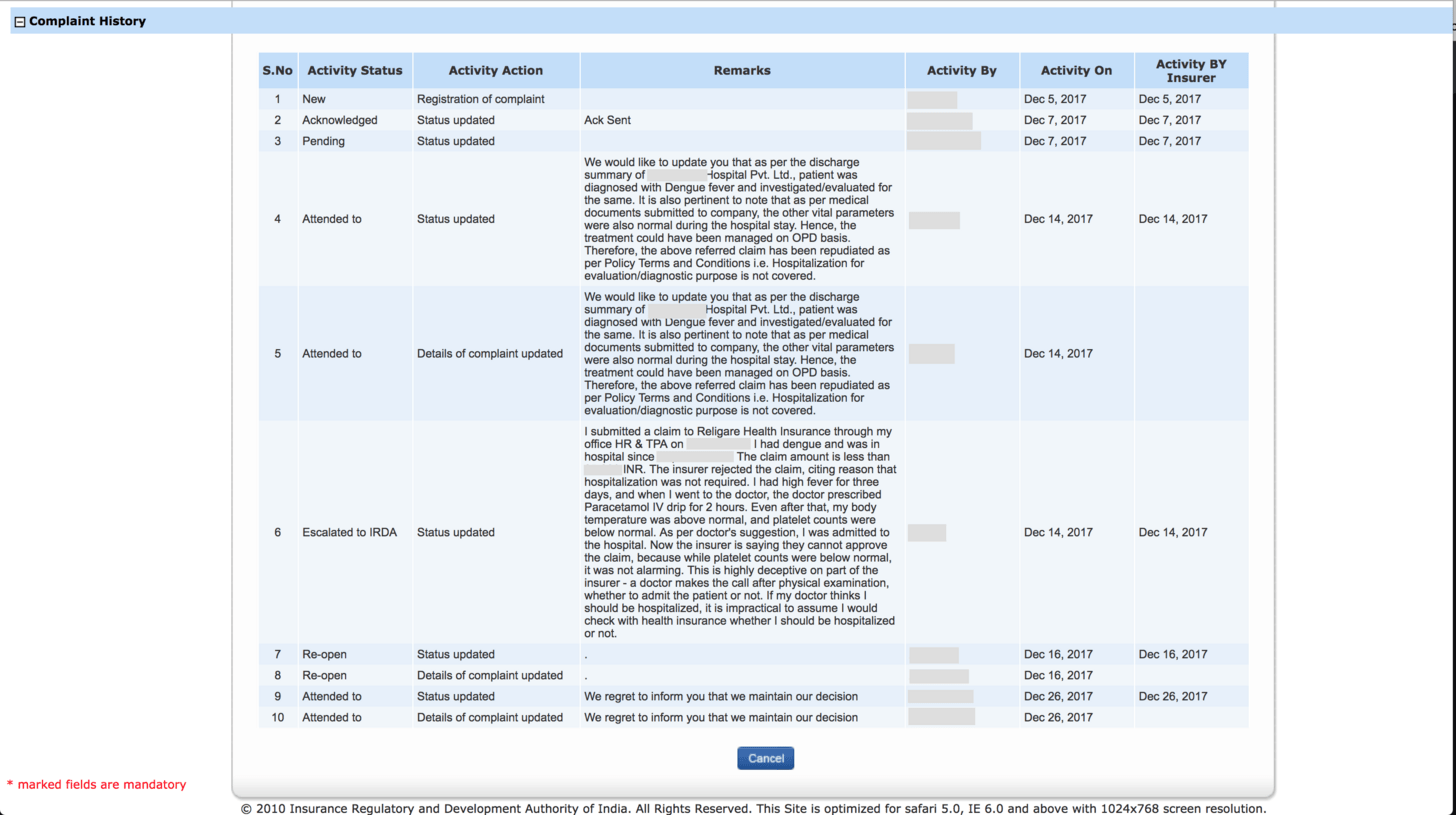

I was furious with this bovine explanation. So, I reached out to IRDA, through the IGMS portal.

Only to discover that this portal doesn’t do anything other than forwarding the complaints to the company itself against which you are filing a complaint.

You can escalate the grievance, but it would still be handled within the company itself. IRDA won’t lift a finger no matter what*. Guess what a futile exercise this was!

* Pattu’s note: frustrating as it is, that is the system.

Why didn’t you use cashless?

Another one of those quirks of a group cover. Earlier, our company was with a different insurer, and we have switched to this insurer recently. HR issued the cards to all employees, but that happened to be the day I got sick, so couldn’t be in office. Basically, when I went to the hospital 4 days later, I couldn’t avail the cardless feature – even though our policy allows it.

Unfortunately, your sickness won’t wait for you to have a proper health insurance in place with all the paperwork. It can come unannounced whenever it pleases.

What happened after all this?

Buried within all the reports, prescriptions, bills etc. were the ammunition I needed. Basically, I went to the doctor for consultation with 104 deg F fever, and he put me on a paracetamol saline drip for 2 hours. The discharge summary recorded the body temperature during admission – which was after application of 2 hours of paracetamol IV drip!

Pattu’s note: Technically this is the hospital’s fault and not the insurers, but this being a simple case, it was easy for the patient to spot it. Also see my impressions below.

After much bickering and strongly worded emails pointing the above from our side, the TPA got the insurer to approve the claim, and the insurer transferred me ~85% of my claim amount, about 3 days ago.

Why are you sharing this with us?

I want to be clear – I’m not doing this as a knee-jerk rant against some insurance or TPA provider. I already got my money. This has been an educational experience for me, and I wish to share my learning with you.

Before that, another small story. About two years ago – my brother had to be taken to hospital with severe chronic pain in his tummy. After many tests, the diagnosis turned out to be idiopathic – as in, not caused by any known cause. The pain went away on its own, but all that cost 3 nights of stay in the hospital, with 85k in bills. Happens when you’re in a hospital that’s expensive ‘cause it’s named after a certain Sun God.

My dad has a personal cover for my brother from a PSU insurer. The PSU insurer paid the full amount without asking any questions.

So, without any further ado, here are the things I’ve learned:

- Just because it’s a group cover, doesn’t mean it’d be “always approved”. Be prepared for a fight.

- Different people have different anecdotal experiences with different insurers. Don’t go by anecdotal evidence when choosing a policy.

- Know that the time will come when you’ll have to demand what’s yours.

- When submitting documents to insurance, always keep a clear scanned copy of all this with you. Get a letter from the doctor stating severity of your conditions, in addition to the discharge summary.

- Be on top of your paperwork, and have patience.

- It should be immediately apparent from your docs & paperwork, about how severe your condition was.

- Insurance is a profit-making entity – it’s not a court of law, which would reach out to you and give you a chance to make your case.

- Once you submit your paperwork, only that can speak on your behalf. And know full well that if the insurer senses the slightest chink in your armour, they’d reject the claim just to see how far you are willing to take this.

- When you fall sick, your first priority would be to get better and to get cured. Put paperwork as a priority as well.

- Good record keeping would surely help towards you getting the claim approved.

- Even if you cannot get the claim approved (in full or at all), don’t forget to claim medical tax benefits at end-of-year investment proof submission.

- Most of our salaries come with a medical component, and depending on your employer, you can claim up to a certain amount. This is not part of 80D.

- All the more reason to keep scanned copies of your medical bills and reports, before submitting the originals to insurance.

- Goes without saying, having your own insurance is always better. If you are a freefincal reader, you must know the reasons behind it.

- Here’s another reason to do it: if something goes wrong with a claim, you’d be able to approach the ombudsman directly without the need for your HR and senior management

- Last, but not the least, no one hands you anything on a platter. The biggest issue with insurance today is that the entity gets to decide whether to pay or not.

=============

Please join me in thanking Rahul for sharing his experience. Let us also appreciate his fight back. Some impressions on this episode

Records are meant to be broken and claims are meant to be denied. This is the mindset with which we need to use health insurance!

Perhaps if Rahul had used cashless, this episode could have been averted, but it is, what it is. I say this because, in the case of cashless, the TPA or insurer would have ascertained the need for the hospitalization immediately. Maybe the hospital would have provided accurate reports then. Or maybe not! In that case, the insurer would have asked Rahul to reimburse anyway! The point is, Rahul is spot on above. We need to be ever alert and meticulous in our record keeping and be ready for a fight. Not emotionally, but professionally.

A hospital discharge summary makes it quite clear about the condition in which the patient arrived before admission and the necessary treatment given for that condition. I am surprised that in spite of that, the insurer felt hospitalization was not necessary. It is possible that the hospital goofed up – another thing to worry about!

I am annoyed that the corporate insurer insisted that the hospitalization was not necessary and did not pay a trivial sum. If this is the extent that they could go to in a group cover and for a reasonably simple hospitalization, imagine what could happen in case of more expensive procedures and individual policies. Whether we buy the policy ourselves or via an intermediary, we need to be alert. The competence of an intermediary can only be gauged when a claim is denied and they help us get it back.

Rahul was under the impression that the ombudsman cannot be approached for group policies. Unfortunately, this is because the IRDA’s consumer education website page on Ombudsman says:

The Insurance Ombudsman scheme was created by the Government of India for individual policyholders to have their complaints settled out of the courts system in a cost-effective, efficient and impartial way.

And then goes on to say:

You can approach the Ombudsman with a complaint if:

You have first approached your insurance company with the complaint and

- They have rejected it

- Not resolved it to your satisfaction or

- Not responded to it at all for 30 days

- Your complaint pertains to any policy you have taken in your capacity as an individual and

- The value of the claim including expenses claimed is not above Rs 30 lakhs.

This is most unfortunate because the Insurance Ombudsman, Rules – 2017 at the end of the above page says:

(1) These rules shall be called the Insurance Ombudsman Rules, 2017.

(2) They shall come into force from the date of their publication in the Official Gazette. 2. The objects of these Rules is to resolve all complaints of all personal lines of insurance, group insurance policies, policies issued to sole proprietorship and micro enterprises on the part of insurance companies and their agents and intermediaries in a cost-effective and impartial manner.

3. Application.—These rules shall apply to all insurers and their agents and intermediaries in respect of complaints of all personal lines of insurance, group insurance policies, policies issued to sole proprietorship and micro enterprises

Also, the FAQ on Insurance ombudsman says:

In case of Group Insurance policies, the complaint may be lodged with the Insurance Ombudsman under whose territorial jurisdiction the place of residence of the complainant falls.

The Executive council of insurers (ECI) says in its FAQ

4) Who can approach Ombudsman?

Any aggrieved individual who has taken an Insurance Policy on personal lines of insurance, group insurance policies, policies issued to sole proprietorship and micro enterprises may himself or through his legal heirs, nominee or assignee can approach Ombudsman.

While Rahul cannot be faulted, he had every right to complain to the insurance ombudsman. He would have needed some paperwork from his employer to support his claim. If he had done so, he might have got 100% claim settlement. In this case, the lost 15% was a small amount and he was prudent enough to have an emergency fund. In case, the claims run to Lakhs, the 15% would be significant.

What can I do to ensure my claim is approved?

- Read the policy wording before buying and understand what will not be covered. Most people are lazy and fail to do this.

- Understand how to claim via cashless and reimbursement (found only in policy wordings!). When to intimated the insurer or TPA and how. This is crucial. I almost failed to make a claim for my wife because I did not understand this.

- In the case of cashless, the onus on proving the need for hospitalization lies with the hospital. If they fail (and they can!), then the insurer will ask you to reimburse.

- In case of reimbursement, it is your responsibility to prove the need for hospitalization and every course of treatment. It is always a good idea to get a clearly worded certificate from your treating doctor(s) about the treatment. Doctors are busy people. So tell them clearly what you want. The above-mentioned claim for my wife was via reimbursement was only possible because of the clearly worded letters from two of her treating doctors in addition to discharge summary, test reports and bills.

- Getting a claim approved is common sense. You need to justify your case. Do so professionally, not emotionally. Know whom to ask when you get into trouble. Asking a personal finance forum like AIFW will only result in emotional nonsense like, “file a case”, “go to consumer court etc.”. This is not the time for complaining about the system. Methodically build your case, one step at a time.

Prepare for the worst and hope what you like.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)