Last Updated on December 28, 2021 at 6:25 pm

Every time a young investor reads John Bogle or Warren Buffett’s statements on low-cost index funds, they want to know if index investing will work in India? if in the long run index funds will outperform actively managed mutual funds, should I not switch to an index fund? I recently showed how the Nifty Next 50 is a hard benchmark to beat and therefore no one uses it! Since then, many have asked if they should switch to the Nifty next 50 and become an index investor. In this post, I discuss the advantages and disadvantages of index investing from hopefully a neutral standpoint.

Let us begin with some definitions.

What is index investing?

Investing in a set of stocks or bonds or other securities that part of a benchmark index and in the same proportion is known as index investing. The index investor does not invest in any other stock or security that is not part of the index.

What is passive investing?

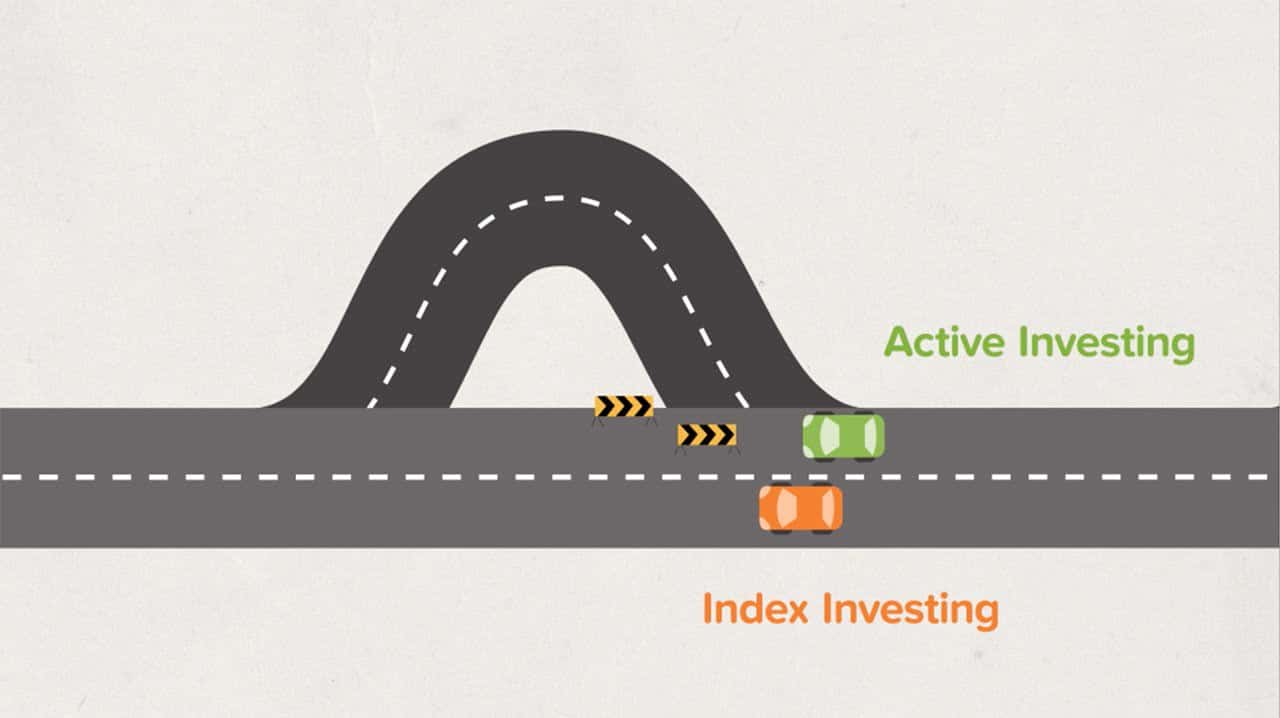

Passive investing implies that the investor will follow the composition of an index at all times. Therefore passive investing is the same as index investing. Passive here refers to following the index for a particular asset class (say equity) and has nothing to do with the management of the individuals overall portfolio. The opposite of passive investing is active investing where at least one security is personally evaluated prior to investing.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

What are the options for index investing?

- Track the index manually using a demat account. In an index that does not change much, the expenses can be lower. A small amount of active investing is possible – eg. get rid of a stock that is having issues on our own. One can change the composition of the portfolio the moment the change is announced and not wait for the index to change (about two weeks could elapse and this can trigger prices changes in both the incoming and outgoing stocks)

- Buy an exchange-traded fund using a demat account. Here one buys or sells designated units of the fund (= 1 index unit or 1/10 or 1/100th or 1/1000th index unit) with other members of the fund. The advantage here is to trade in real time, but one must have a willing party to trade – not all ETFs have high liquidity.

- Buy an index mutual fund. Here one buys a mutual fund that passively tracks a mutual fund. The units are directly purchased and sold to the AMC and hence no issues with liquidity. In terms of cost, a cost comparison with an ETF is hard, as one rarely opens a demat account only to trade in ETFs.

Next, it is not possible to list the advantages and disadvantages of index investing without understanding some basics.

Views on Index Investing: analyst vs investor

Some of the common misconceptions about index investing arise from not understanding the basics of portfolio management and not recognising the difference between an analyst and an investor.

Suppose you turn on the business channel, some guy will say that the Nifty will touch some X or Y number in the next few years. This is a statement made by an analyst and as an analyst.

If you as an investor, take this seriously and assume your returns will reflect the projected increase or decrease, the fault lies with you and only with you.

An analyst looks (assuming that they do) at a variety of factors such as corporate earnings, interest rate movements, policies that are expected to roll out etc. before making such statements. If you want to agree or disagree with that, you will have to do so as an analyst alone. Whatever the predicted movement of the index, the returns for individual investors can never be predicted.

What is the relevance here? When Warren Buffett says index funds will beat all actively managed funds in the next 10 years, he is speaking as an analyst. We as investors (or analysts) must first ask, What does beat an actively managed fund mean? If we do not stop and think about this, we would either be biased or be confused.

By the way, many assume that index funds are a popular choice in the US. They only account for about 29-30% of the market. Naturally much higher than India*, but not as much one assumes. In the US too, commission based selling is high and therefore active funds get sold more.

* The NPS is the largest mutual fund in India. The combined AUM of the state and central government employees is almost index like (it closely resembles NIfty 50). So in India, the NPS government AUM is about 14% of the total equity mutual fund AUM. So not as small as one would think! Sources: Value Research, AMFI trends, AMFI report

So let us say after 10 years some active fund of your choice has an annualized return of 15%. The benchmark index for the fund has returned 15% or a bit less. Does this mean index investing is the winner because if expenses are taken into account, the active fund has lost us money?

If you are thinking the answer is, Yes index investing is the winner because the active fund has failed to beat the index fund despite charging about twice for the active management, you need to think again. That is the central message of this post.

What is active investing?

The definition of passive investing was straightforward (unless we ask which index to follow, we shall consider that below). Active investing is easier to define but harder to understand. Any portfolio where the stock selection is not formulaic can be called active investing. Usually, the formula corresponds to the construction of a benchmark index.

Why does active investing need a benchmark?

All forms of active investing need benchmarks, not just active mutual funds. If you were a stock investor, you should ask, “if I had invested in an index or in an active mutual fund on the same dates, would I have got more returns? Would my risk be lower?” This obviously is why active mutual funds need a benchmark. They need to justify the extra fee that they charge.

How do active mutual funds beat their benchmarks?

The portfolio of an active mutual fund must deviate from that of the benchmark in order to beat it in terms of risk and/or return. This can be done in two distinct ways:

- Choose the same stocks as that of the benchmark, but in a different proportion. For eg. reduce financial stocks in the portfolio compared to the portfolio to reduce concentration risk.

- Choose stocks from outside the benchmark. This is controversial as there are no set rules on how much deviation is allowed.

- A combination of the two.

See for example Large Cap Mutual Funds: What is their source of outperformance?

The main problem with active investing is the lack of clear-cut investing rules. If the going is good, no one will question the fund manager or the AMC for a high expense ratio. When the fund underperforms its chosen benchmark for a year, then all sorts of questions about investment choices, expenses will do the rounds.

What is the purpose of active investing?

- Get better returns than the chosen benchmark index (commonly called beating the index)

- Provide better risk-adjusted returns. That is, provide reasonable returns at a risk lower than the benchmark. What is reasonable, is subject to debate.

In order to make a choice between active funds and index funds, you need to convince yourself about what you value:

- Index returns at lowest expense

- Active management of risk and reward to lower risk, enhance returns or both.

We will get back to this.

Index Investing: advantages

- Expenses matter. No question about that. When you pay more, you expect more. Since more returns or less risk is not guaranteed in an active fund, it makes sense to pay less and settle for guaranteed index funds (almost aside from expenses and tracking errors),

- No dependence on AMC on investment strategy or fund manager. The index constitution is independent of the fund management company. So there is no need to review fund performance. You always know what you are going to get. Most people neither know how to choose an active mutual fund, let alone review it.

- Passive investment = passive investing in a particular asset class. Whether investments in that asset class or actively managed or passively managed, the entire portfolio must be actively managed by us. So might as well passively invest in asset classes and actively manage the portfolio

Index Investing: disadvantages

- Returns are always measured in hindsight, whereas the risk is in real-time. Most actively managed funds manage to reduce risk compared to an index (most of them). Therefore using an index fund can result in a higher sequence of returns risk. That is a series of poor returns which may take years to set right. Thus, the higher expenses are not exactly unjustified. Beating the index does not mean higher returns. It also means reasonable returns at lower risk.

- Most investors spend a lot of time comparing the performance of one fund to another, eg. star ratings. So if some active funds outperform their index, they are likely to be filled with a sense of regret. Justified or not, this indisputable behavioural trait is will derail (both active and) index investing.

- Most funds do manage to beat their designated benchmarks in terms of risk and reward. So it is not hard to be an active mutual fund investor.

The index investing debate

It is indisputable that the Nifty Next 50 has a fantastic short-term and long-record. However, that is based on hindsight does not make it the index of choice for the future (assuming one wishes to index invest). Non-capitalization based indices or smart-beta indices can offer better risk protection. Take for example the Nifty Low Volatility 50: A Benchmark Index to watch out for. (ICICI has an ETF based on this index, but hardly any AUM).

Active vs passive fund results entirely depend on which index we choose to represent the category. Take a look at some of the results published before:

April-2017 Active vs Passive Investing: Large Cap Equity Mutual Funds

Active vs Passive Investing: Mid Cap Equity Mutual Funds

One can always argue that the job of an active fund is only to beat its designated benchmark and be satisfied with that. So whether or not to take the outperformance of Nifty Next 50 boils down to opinion.

If more returns is the only concern then if you look at the Equity Mutual Fund Performance Screener Dec 2017,

- only 30 of the 167 funds compared with NN50 have managed to get a higher 3Y/5Y/7Y return with 60% or higher consistency.

- However, 110 out of 122 funds fall lesser than NN50 with 60% or higher regularity over 7Y periods. Similarly, 131 out of 141 funds have a similar distinction over 5Y. Similarly, 129 out of 167 over 3Y also have similar downside protection.

There is a big difference between how returns are compared and how downside protection is compared. When it comes to returns only the starting NAV and ending NAV matters – the journey does not.

Downside protection is computed using monthly returns. Suppose you have 60 monthly returns (over 5y). Out of this, there are about 25 negative monthly returns of the benchmark. If the fund fell less than the benchmark every single time, is that not active management? It is quite easy to pick such a fund! The downside protection takes into account the journey and is more indicative of active management than just a returns comparison. Read more: What is mutual fund downside protection and why is it important?

I would argue that most active funds actively prevent losses for their investors. This is beating the index too. To assume that only the final returns matter and the journey does not, is childish. A simple annual rebalancing will lock-in the benefit of active management (on good years or bad) in my portfolio. So even if active funds start underperforming in future, my portfolio would have beat the index. That is all that matters!!

Also, the Nifty Next 50 is an arbitrary choice that we made. You can compare both the returns and downside protection of individual funds with their respective benchmarks with this tool: Mutual Fund Downside Protection Calculator or visually with this: Mutual Fund Downside Protection Consistency Analysis. You would find that most funds offer good downside protection and better returns than their benchmarks.

So, Yes to Index Investing or no?

Yes to index investing, If you do not care about the volatile journey and have the confidence to counter it with your portfolio management skill. Else, you need help from active fund management. Costs or higher returns are secondary factors. Ultimately it boils down to a question of faith.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)