Last Updated on September 27, 2023 at 5:26 pm

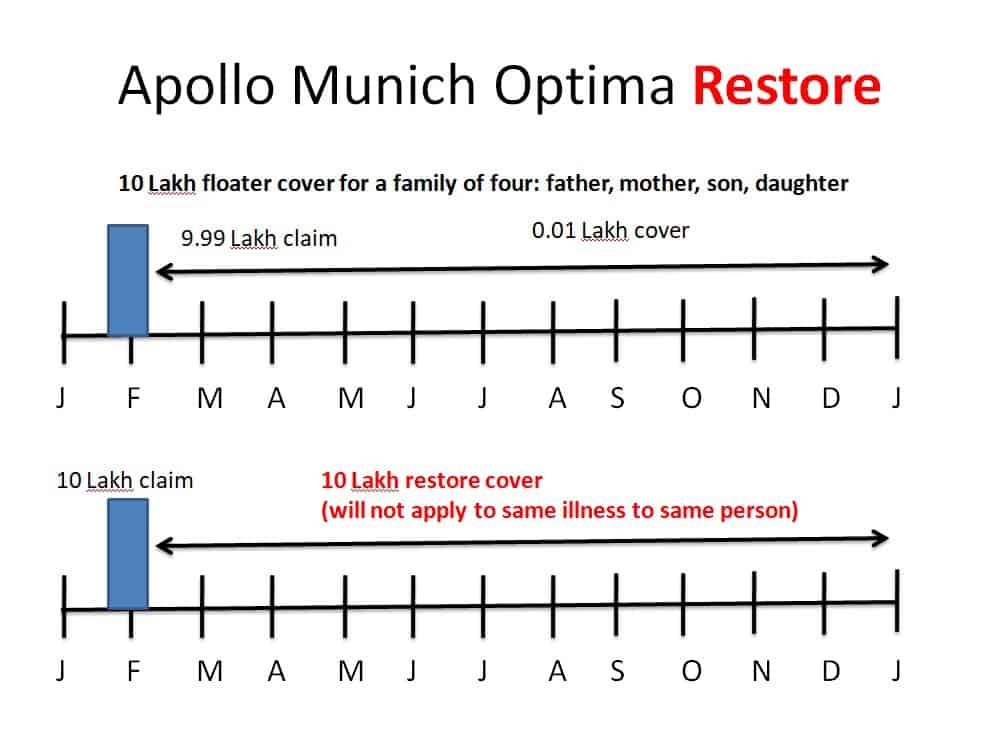

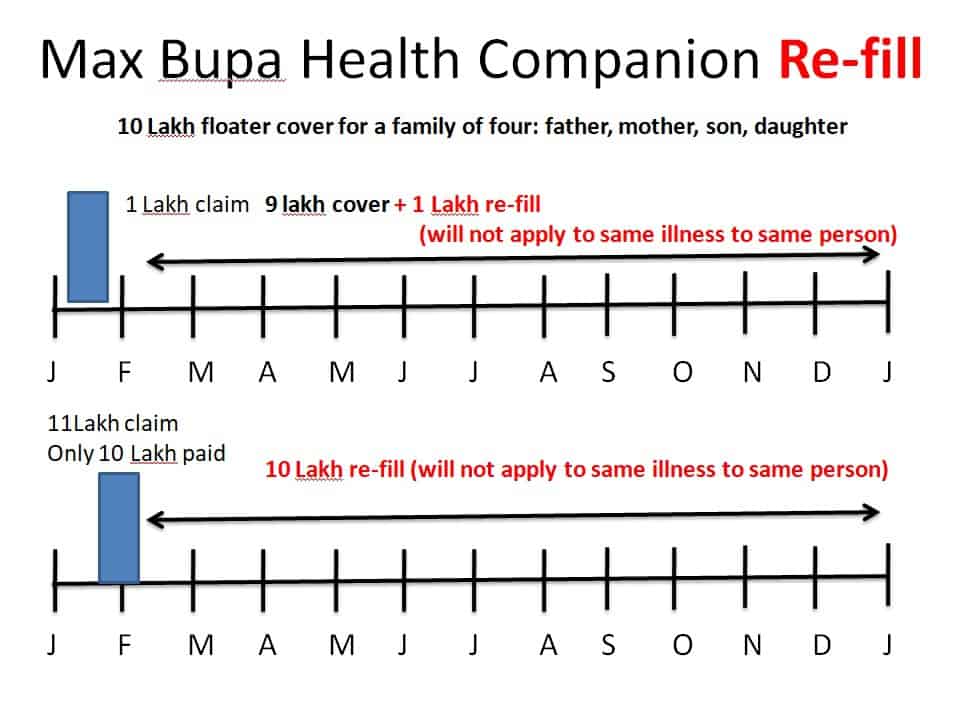

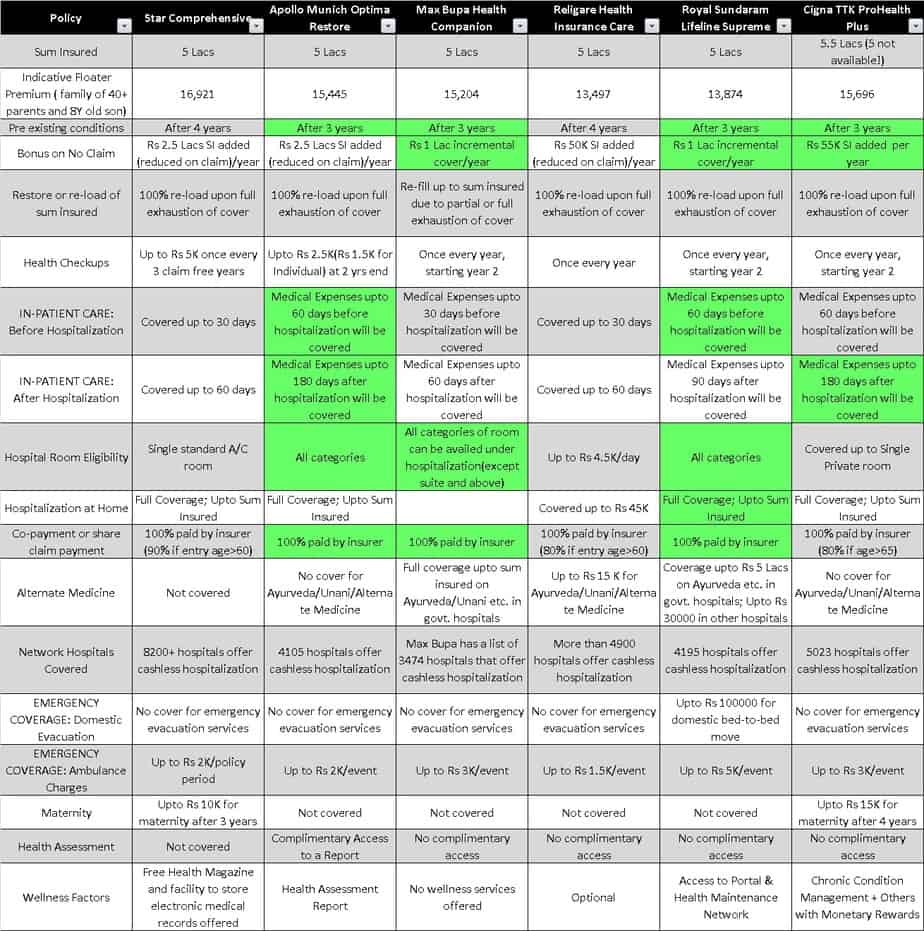

Wouldn’t it be great to have a DIY health insurance comparison chart that will immediately help you shortlist policies with most relevant and beneficial features? You could then read the policy wordings of these and choose one easily. Using the comparison feature at policybazaar, here is a health insurance policy comparison template with six policies filled in. You can easily add more. Plus we continue our policy wordings walk-through with Cigna TTK ProHealth Plus and Royal Sundaram Lifeline Supreme. We shall discuss their salient features and then compare them with the policies considered in previous wordings walk-throughs: Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit and Star Health Comprehensive Insurance vs Religare Care Comprehensive Insurance. Let us first discuss three aspects that insurance buyers must be aware of.

1 Beware of insurance comparison portals

First things first. Last week and this week I used policy bazaar to compare the main features of these policies. I noticed that when I refresh the window without changing the products the featured items in the comparison vary. Also, the information provided is not accurate. So please do not use only these portals for buying your policy. Always, always read terms and conditions before buying. Lazy people will get what they deserve.

This is from the cover page of TTK Cigna Prohealth plus T&C document. How true is that! What is more, true to policy terms and conditions document, the font contrast is poor!!

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

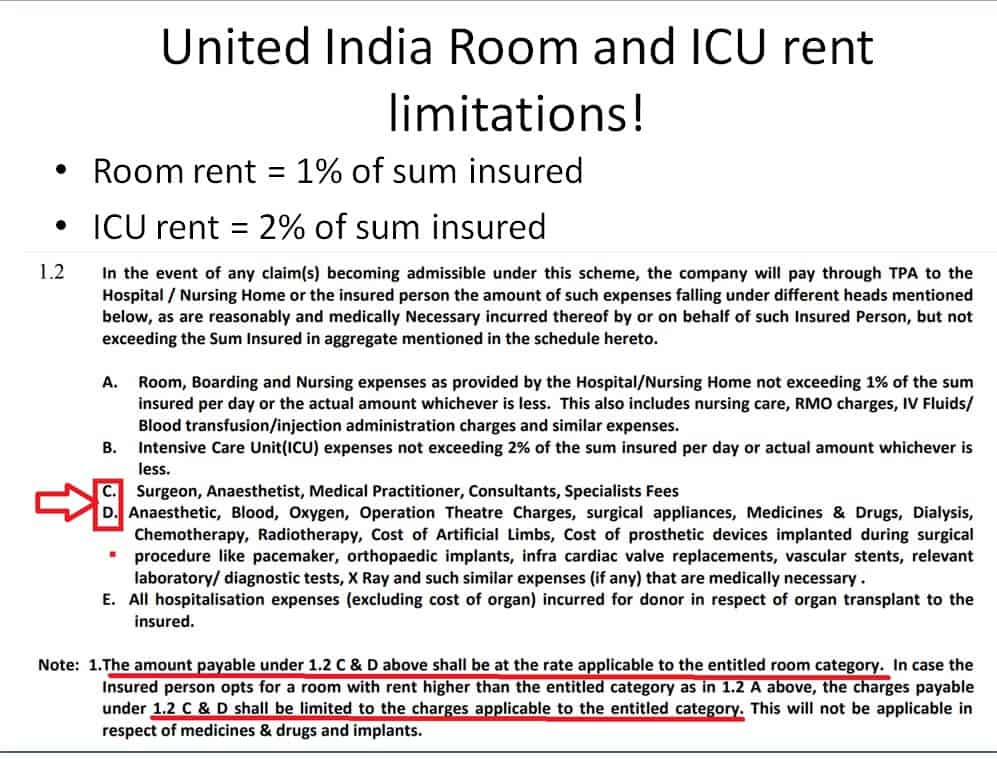

2 Beware of room-type based sub-limits

Many of us are aware of how the PSUs – United India, Oriental, New India – have room rent sub-limits. The typical wording is 1% of sum insured (SI) for daily room rent and 2% of SI for daily ICU charges. This is a clear wording. If my SI is Rs. 5 lakh, then I should not stay in a room that costs more than Rs. 5000. Else I will not be reimbursed in full of most medical costs. Here is a snapshot of my policy United India Platinum Cover:

Now, this may seem restrictive to you. Yes, compared to a policy compared to no sub-limits, this is restrictive. However, many privates insurers also have room rent sub-limits with a different type of wording that you should pay close attention to.

For example, this is Star Health Comprehensive Health Cover

Room (Single Standard A/C room), Boarding and Nursing Expenses as provided by the Hospital / Nursing Home. Single Standard A/C Room means an individual air-conditioned room with attached wash room. This room may have a television, telephone and a

couch. This does not include deluxe room / suite or room with additional facilities other than those stated herein.

And this is TTK Cigna ProHealth Plus

Covered up to Single Private room.Single Private Room means a single Hospital room of any rating with/without air-conditioning facility where a single patient is accommodated and which has an attached toilet (lavatory and bath). The room should have the provision for accommodating an attendant. This excludes a suite.

Royal Sundaram Lifeline Supreme does not have any room rent conditions.

So what is my problem with this kind of room-rent policy wordings? I was treated as an in-patient in a deluxe room with my United India policy during my thymectomy surgery because it imposes a limit only on the room rent and not room type. Rs. 5000 could be the daily rent for a standard room in one hospital, deluxe room in another, suite room in another or general ward in another.

I think these private players are playing with words when they say “cover for a standard room or private room”. It “sounds” as if there is no room rent limit, but it could hurt you bad. If I had Star Health my claim for staying in a deluxe room may not have been paid in full. At least TTK Cigna says single private room. This fits the description of a non-ac room, ac room and a deluxe room in most hospitals. A suite will have more than one room.

This is an unnecessary play on words. If an insurer wants to impost sub-limits, they should simply do it on the daily room rent.

3 Beware of future co-payment clauses

Co-payment means for every Rs. 100 expense, the insurer will only pay Rs. 70 or Rs. 80 or Rs. 90 and you pay the rest for each hospitalization.

For Star Health comprehensive insurance:

This policy is subject to co-payment of 10% of each and every claim amount for fresh as well as renewal policies for insured persons

whose age at the time of proposing this insurance policy is above 60 years.

This means that 10% co-payment will apply if I buy the policy above 60 and not before (I earlier interpreted this for all ages, which is incorrect). However, if you have 5 lakh cover before 60 and buy an addition 1 Lakh cover after 60, the 10% co-payment will apply to the extra sum.

For TTK Cigna:

A mandatory co-payment will be applicable for insured’s aged 65 years and above

This is applicable whether you buy before 65 or above 65.

Royal Sundaram has no such clause and 100% will be paid at all ages. This is an important point while choosing policies (see full table below).

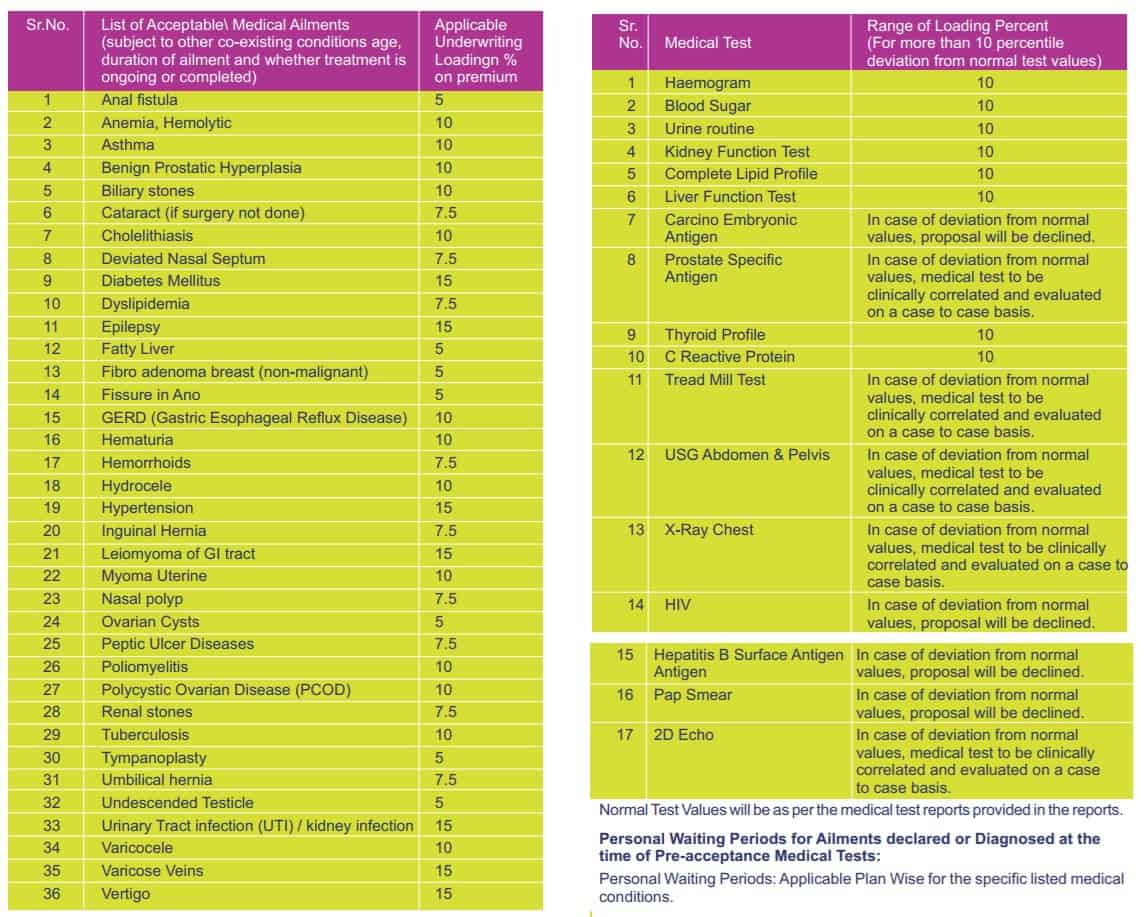

4 What is risk loading?

IRDA has mandated that insurers should not increase the premium after a claim. However, when they receive a proposal and find that covering a persona is a potential claim risk, they can increase the premium from day one whether you claim or not! So it is important to be aware of this. Many insurers do this and the premium could increase by anywhere from 100% to 200% depending on the insurer. This will be mentioned in the policy document. So watch out for it. Sometimes going through a broker could reduce this loading (because brokers provide insurers with business), but never hide anything from the proposal to reduce costs. That would be stupidity.

Not many insurers mention the exact amount of loading for each condition. I am happy to see Cigna TTK provide this list in their T &C. The following can be assumed to be close to what all insurers practice.

5 What is a personal permanent exclusion

In addition to the usual permanent exclusions that one sees, depending on our health condition, the insurer could permanently exclude certain conditions before issuing the policy. This means we cannot claim for any illness directly or indirectly related to that permanent exclusion! Tough luck!

6 No claim benefits for Cigna TTK ProHealth Plus and Royal Sundaram Lifeline Supreme

Cigna TTK Health Plus

Cumulative Bonus- We will provide a 10% (for Health Plus) increase in sum insured for every claim free year, subject to a maximum of 100% accumulation as per the Plan opted. The cumulative bonus will remain intact and not get reduced in case a claim is made during the policy.

Policy Bazaar mentions incorrectly that sum insured could reduce when there is a claim.

It is always good to have a policy that offers no claim benefits that will not be removed upon a claim. Usually, if the bonus is high (50%), it will be removed when there is a claim. Better to choose a smaller but permanent bonus.

Royal Sundaram Lifeline supreme

We will increase Your Sum Insured by 20% of Base Sum Insured per Policy Year up to a maximum of 100% of Base Sum Insured of renewed Policy for Supreme and Elite variant provided You understand and agree that the sub-limits applicable to various benefits will remain the same and shall not increase proportionately with the increase in total Sum Insured; Any earned No Claim Bonus will not be reduced for claims made in the future;

On this count, if there are no claims for a number of years, the no claim bonus for Royal Sundaram Elite will be twice as much as Cigna TTK Health Plus.

Both Cigna TTK and Royal Sundaram have a “re-load/restore”but thanks to Nitesh G Buddhadev in AIFW, I am not quite sure how they operate as the wording is confusing.

In Apollo Munich Restore option the restore will kick in after full exhaustion. In Max Bupa the re-fill up to sum insured for partial claims too

Now Royal Sundaram says

We will provide a 100% Re-load of Sum Insured once in a Policy Year, provided that: a) the Base Sum Insured and No Claim Bonus (if any) is insufficient as a result of previous claims in that Policy Year;

Cigna TTK Says

We will provide for a 100% restoration of Sum Insured once in a Policy Year, provided that: (a) The Sum Insured inclusive of earned Cumulative Bonus (if any) or Cumulative Bonus Booster (if opted & earned) is insufficient as a result of previous claims in that Policy Year

So this will work for partial exhaustion as well but consider this: I have 5L cover and make a claim for 2L. I get admitted again. The expense could be <= 3L (remaining cover) or it could be higher. If the second claim is <=3L then for a second claim the restore option in these policies will not kick in. If it is above 3L then I must be eligible for the restore. But how I will I know beforehand?! hmm…

7 Building a health insurance comparison chart

So as mentioned above, this is the chart based on policybazaar information (corrected where discrepancies were found). You can build one or add more entries to the file linked below.

I have marked desirable features in green. The more green boxes a policy has, the better it is. Build a shortlist of policies from this chart and read their policy wordings carefully before choosing.

Download the health insurance comparison chart in excel

Coming soon:

- How to build a medical corpus and why it is important?

- base policy + super top vs single large cover?

- How much policy should I have anyways?

Let me know what other issues you would like compared. Please do not ask me which policy to buy. I will not respond.

Do check out my books

| You Can Be Rich Too with Goal-Based Investing, my first book is now available at a 35% discount for Rs. 258. It comes with nine online calculators. Get it now. |

| Gamechanger, my second book is now only Rs 149 (25% off). Get it or gift it to a young earner |

| The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download) |

Use this form to ask Questions or reg. the robo template ONLY (For comments/opinions, use the form at the bottom)

And I will respond to them in the next few days. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)