Last Updated on April 27, 2025 at 8:45 am

Last week I had compared Apollo Munich Optima Restore Benefit vs Max Bupa Re-fill Benefit. This week we shall continue our policy wordings walk-through with a discussion on some lesser-known features of Star Health Comprehensive Insurance policy and Religare Care Comprehensive Insurance policy. The main aim of these posts is to emphasise the importance of policy wordings or terms and conditions before buying the policy. Typically investors read these documents only when their claim is denied and wish to make a complaint to IRDA often after being emotionally spurred on by social media.

I neither have the time nor the inclination to publish a feature-by-feature comparison and will only talk about sentences that catch my eye. After publishing ₹e-Assemble step 4: How to choose a suitable health insurance policy, I have received several requests from readers asking for my help in choosing a health policy for them. Kindly note that I am not a health insurance professional and again do not have the time or inclination to help with such personal queries I am sorry but I do not enjoy offering personalised advice. I am open to answering generic questions on policy features. If you want help in choosing policies please consult a professional. It is quite easy for me tie up with insurance portal in the name of “helping” readers (get offers each week). I will not because it even if I do it without profit, it will diminish my ability to think straight and talk freely. As it is, I have enough trouble thinking, let alone straight.

Religare Health Insurance vs Star Health Insurance

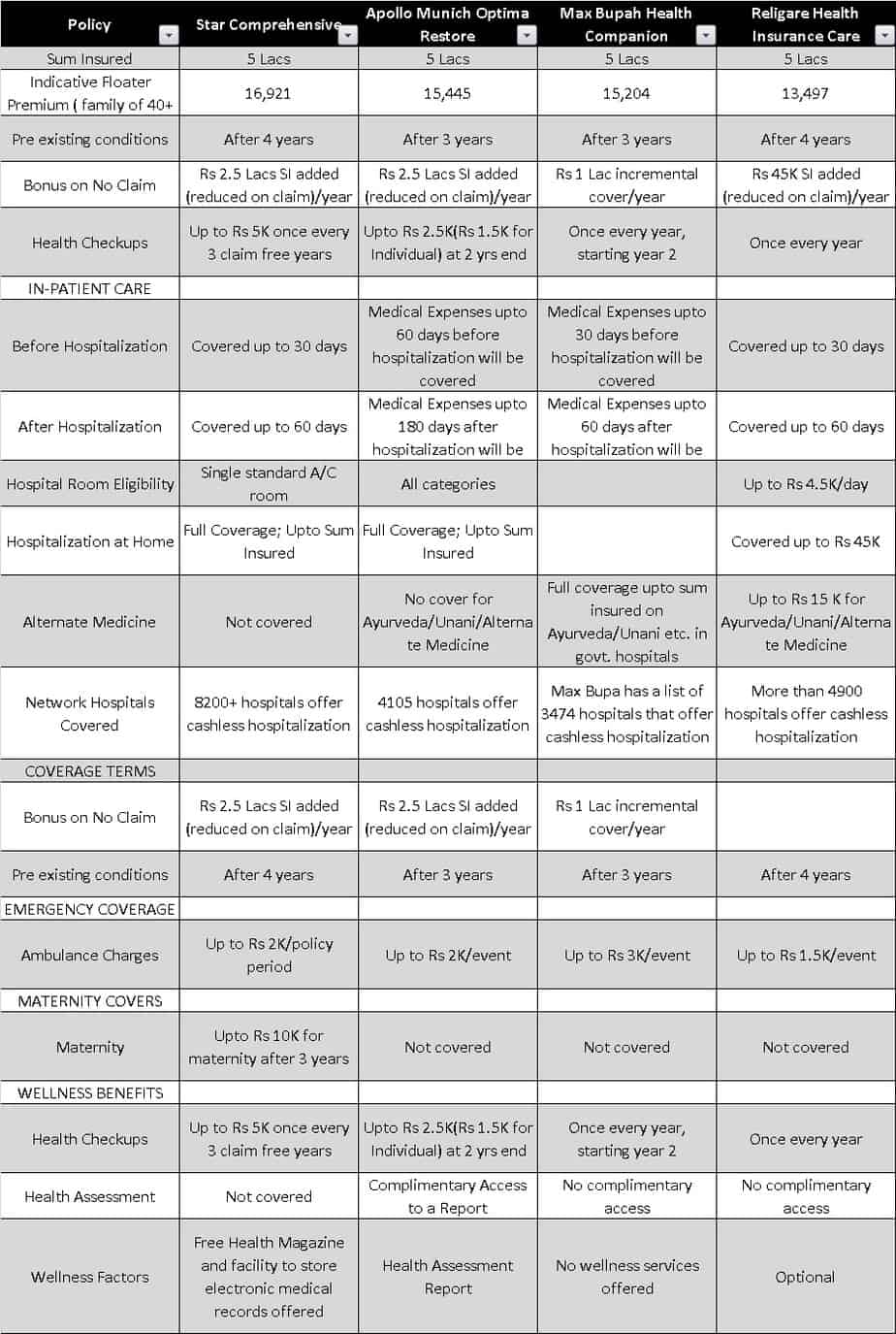

First, let us consider the perks of Star Health and Religare Health and compare them Apollo Munich and Max Bupa.

1 No claims bonus

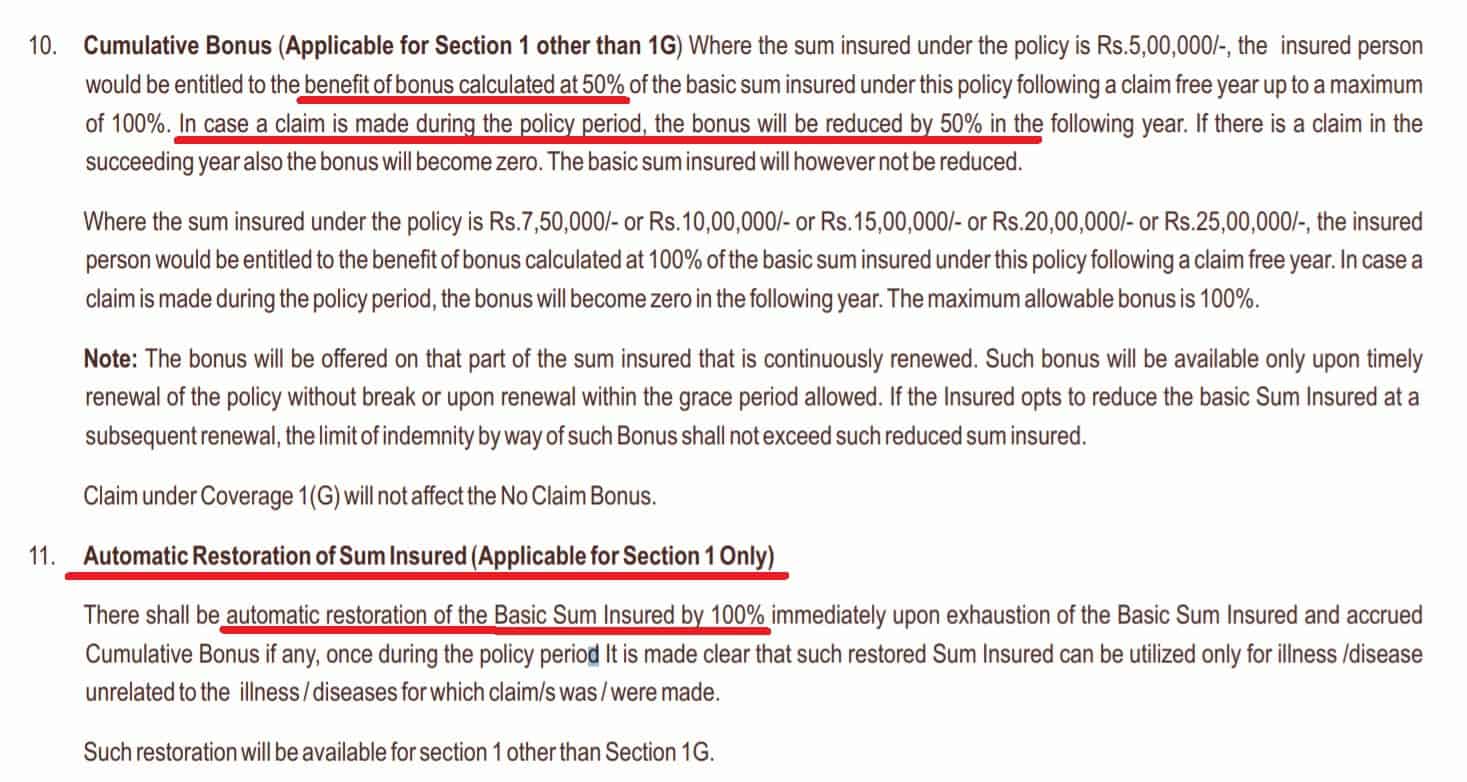

Apollo Munich has a multiplier option where the bonus increases by 50% of the sum insured (SI) the year after there is no claim but decreases by the same amount the year after a claim. The maximum allowed increase is 100% of the SI. Star Health Comprehensive Insurance has an identical feature but it is called a cumulative bonus. That is an amusing name for something can decrease!!

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Religare has a 10% no claims bonus that decreases by the same amount in the year following a claim. The ceiling is also 50% of the SI. There are other bonus options that can be purchased for extra premium. I do not cover them here.

( Max Bupa no decreasing bonus) vs (Apollo Munich & Start Health & Star Health: decreasing bonus)

Key difference: Max Bupa is better on this count because it offers 20% no claim bonus for each claim free year subject to a maximum of 100% of the SI. This is better than a bonus that decreases upon a claim as fast as it is given.

2 Restoration of sum insured in a policy year upon a claim

Remember: This is not as important as no claims bonus.

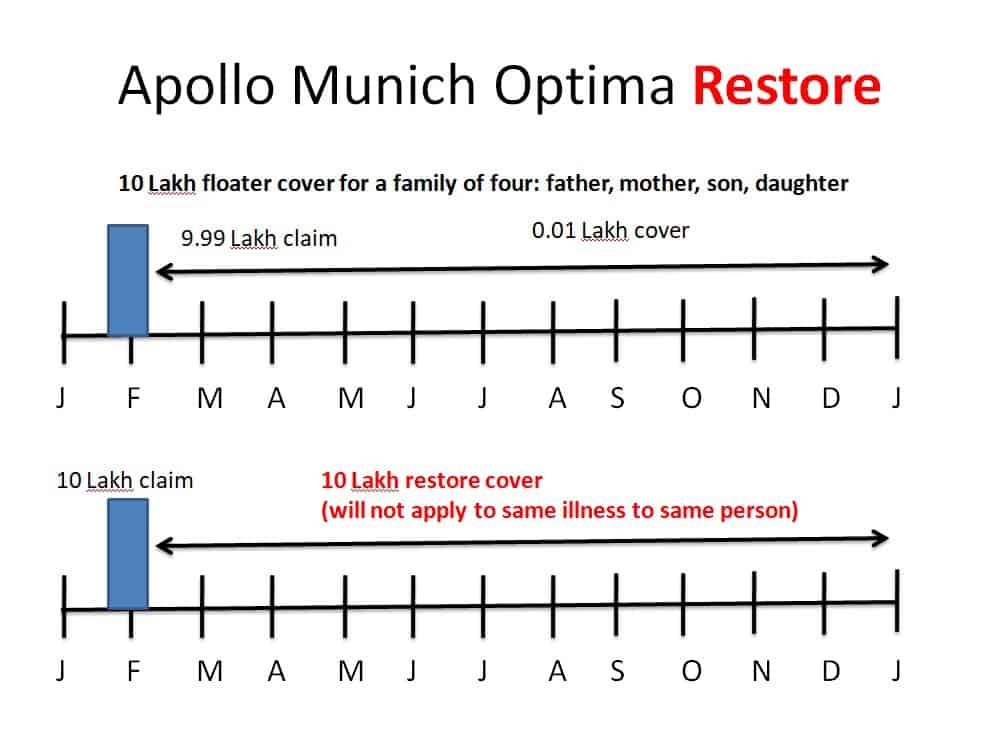

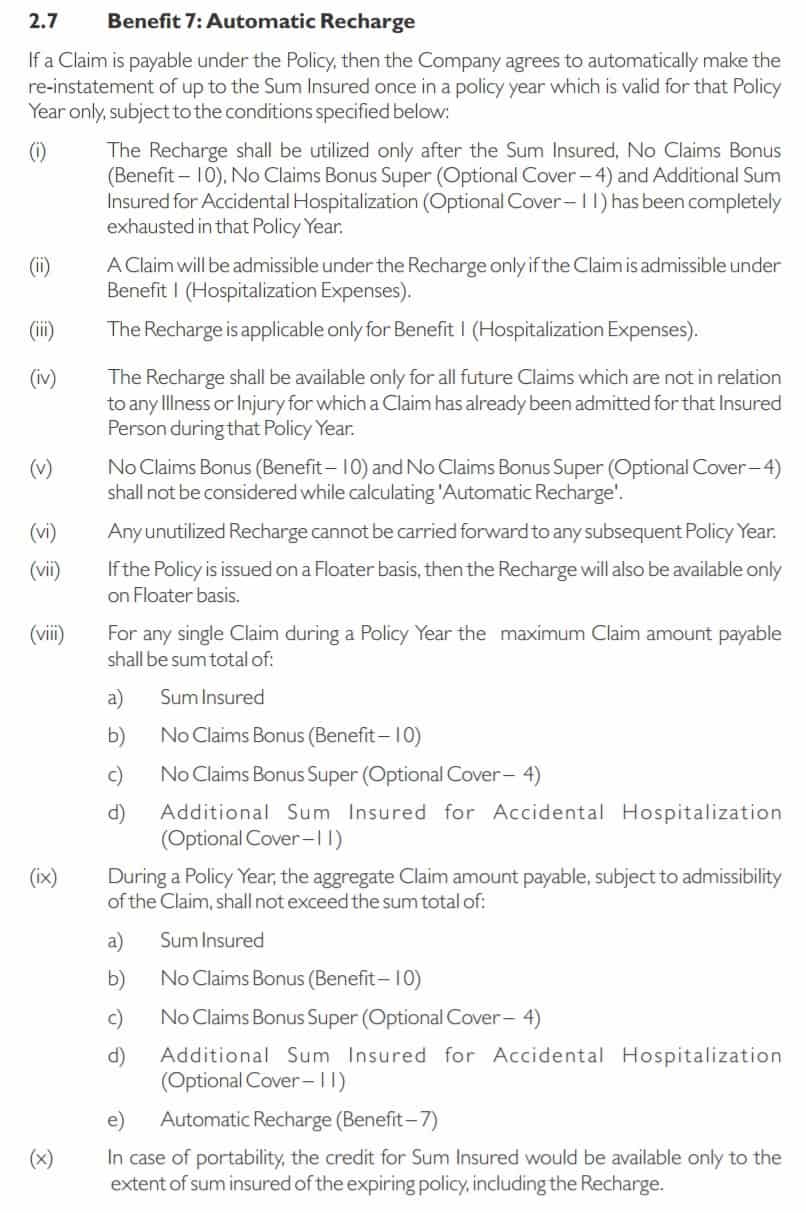

The “Automatic Restoration of Sum Insured” of Star Insurance is identical to the Apollo Munich Restore benefit. This is the Star Health Comprehensive cover policy wordings

Religare Insurance has an automatic recharge option which is essentially identical to both Apollo Munich restore benefit and Star Health “Automatic Restoration of Sum Insured. This is the Religare Insurance Comprehensive cover policy wordings

Note: I am deliberately not cutting and pasting text from the policy wordings and inserting snapshots. There is no fun in filling a post verbatim with information that you can read elsewhere.

Don’t spend too much time worrying about this feature it is not important. For the record:

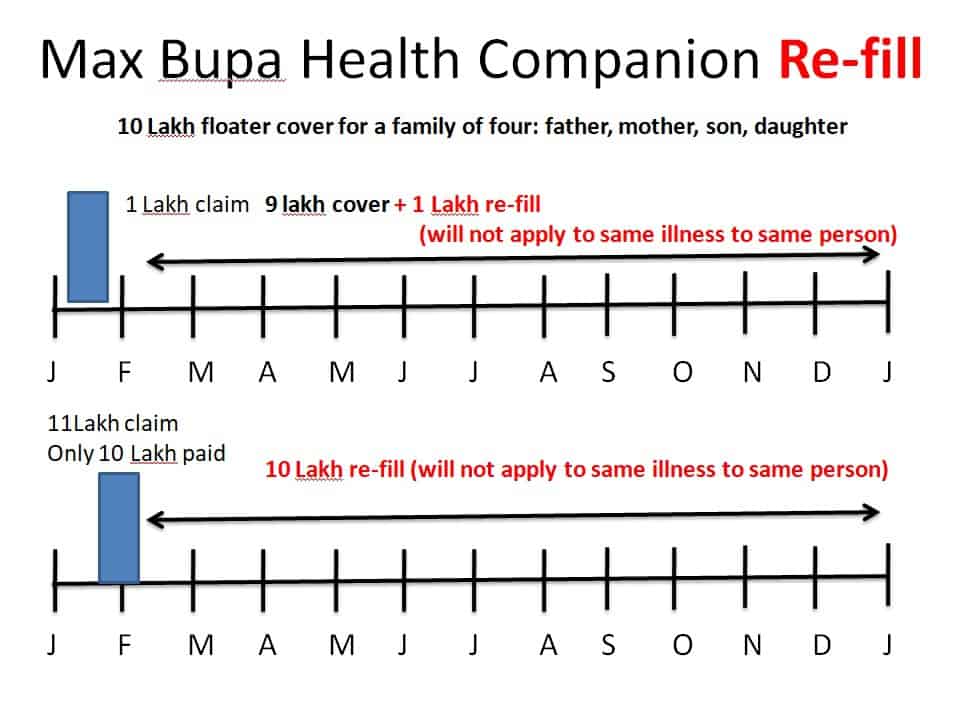

Max Bupa refill is different from the restore options of Apollo Munich, Religare Health and Star Health.

Max Bupa has a bit of an edge here as well because the re-fill works for partial exhaustion of claims. In addition, its no claims bonuses do not decrease as mentioned above. So just on these two features alone, I would say it is better.

3 The difference between outpatient coverage and Daycare coverage

It is important to consider the difference between these two features of an insurance policy. Many people seem to think they both mean the same. In fact, they are exclusive to each other. If you are a doctor please excuse me for the following. I just made it up.

If you have abdominal discomfort plus indigestion and go to the doctor for treatment, you an outpatient. The doctor gives you a prescription and wants you to come back after two weeks. You go again, again as an outpatient. She then orders an ultrasound of your tummy. This is a diagnostic test done in a lab upon a doctors recommendation.

You go see the doctor again and she gives you the bad news: fluid collection in your abdomen which has to be drained out. In the old days, this would have required an overnight hospital stay, but you could now go home the same day.

So you sign up for a “Pancreatic pseudocyst EUS & drainage”. This is a daycare procedure and it is done on a doctors recommendation.

Now, no insurer will cover you for the ultrasound as it is a diagnostic procedure (and you are not admitted in a hosptital). Even if you get admitted only for the ultrasound, they will not cover you.

The “Pancreatic pseudocyst EUS & drainage” is an allowed daycare procedure. That is, you will be admitted as an in-patient who will be dischared the same day. So that will be covered by most insurers even PSUs who do not make a song and dance about daycare treatment as much as the privates do.

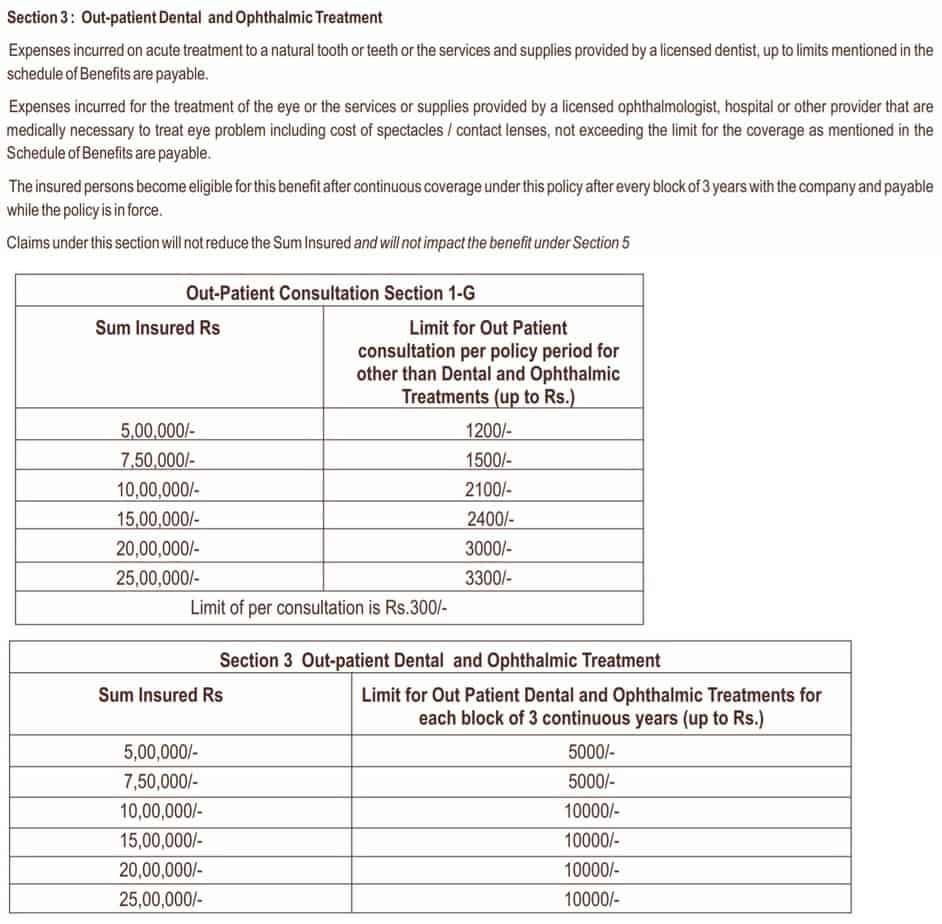

The visits you made to the doctor count as out-patient consultation. Some policies cover this. Apollo Munich does not, Max Bupa does not. Religare offers this as an add-on. Star Health provides this.

Star Health offers this:

Outpatient consultation (other than Dental and Ophthalmic treatment) Minimum Rs. 1,200/- Maximum Rs.3,300/- based on the sum insured. Outpatient Dental and Ophthalmic treatment Minimum Rs. 5,000/- Maximum Rs.10,000/- based on the sum insured

But

Claims of Out Patient Consultations / treatments will be settled on a reimbursement basis on production of cash receipts.

But

Expenses of Medical Consultations as an Out Patient incurred in a Network Hospital for other than Dental and Ophthalmic treatments, up to the limits mentioned in the schedule of benefits with a limit of Rs.300/- per consultation. Payment under this benefit G does not form part of Sum Insured, and payable while the policy is in force.

With:

You will probably not agree with me, but in my opinion, this feature is a waste of time and money. Excuse me, I would prefer my nice little doctor in a nice little clinic and will not go to a network hospital to see an unknown doctor to save some money. Outpatient coverage is not the core feature of a health insurance policy and should be disregarded while buying a policy.

Daycare treatment, on the other hand, is crucial and the exclusions in this section should be carefully understood. Many insurers clearly list the daycare procedures allowed. Some simply state some example and say they will support daycare coverage provided

The treatment is undertaken under General or Local Anesthesia in a hospital/day care centrein less than 24 hours because of technological advancement and which would have otherwise required a hospitalisation of more than 24 hours

As far as my understanding goes, this is good enough as long as there are not any important daycare exclusions. I could not find any serious issues with the daycare wordings of all four policies.

4 Co-payment

This is a cost-sharing arrangement in which you pay 10% or 20% of the hospital costs and the insurer pays the rest (up to the sum insured which is independent).This co-pay will apply to each claim made.

Apollo Munich Optima Restore —> no co-pay

Religare Care Heath Insurance —> 20% co-pay if age of entry is 61 or above. Option to take 20% co-pay (lower premium) if person reason 61 during coverage.

Max Bupa Companion —-> Optional 20%

Star Health Comprehensive Insurance —–> 10% co-pay for persons aged above 60 (fresh or renewal)

Considering its cover is already pricey (see below) Star Health is not attractive on this count. It is good to have optional co-pay after 60 for people who buy young. After 60, we can reduce the premium if we wish to. A choice is always good compared to a strict copay or no-copay feature.

5 Feature Differences

This is a snapshot of a comparison made with policybaazaar (this is a direct comparison link). This only shows some features. So do not base your decision only on these. For example, co-ayment differences and the inpatient consultation coverage of Star Health is not considered below.

Notice the difference in costs vs features. Star health offer inpatient consultation (not shown above), and maternity benefits. This could lead to an increase in costs. I would discard these features.

Although Max Bupa has a lower coverage network, as long as it is valid near hospitals and home and work, I think has some good features – no reducing bonus, lower pe-existing disease waiting period (among these), better ambulance coverage.

Although Religare has lower costs, its bonus comes with a reduction on the claim. My idea has been to offer a way to compare and not make an exact comparison. I hope this series of posts will aid selection from at least these insurers. Will take up Sundaram and one more company next week.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)