Last Updated on September 27, 2023 at 5:26 pm

Readers may be aware that in September 2017 I had introduced a handpicked list of mutual funds and called it PlumbLine to accompany the freefincal robo advisory template. While we are still waiting for AMCs to fall in line after SEBI announced its mutual fund classification rules, this month, I present the funds in table form for easy understanding, consider the performance of each fund and some questions on mf investing. In the last month’s edition, I had discussed simple ways to review a mutual fund.

What is plumbline and how should I use it?

A plumb line is used to fix the vertical and therefore the horizontal. This list hopes to help new investors do the same. Pic credit: Mr. atm

A plumb line is used to fix the vertical and therefore the horizontal. This list hopes to help new investors do the same. Pic credit: Mr. atm

1: PlumbLine is a boring list of mutual funds. It will NOT change from month to month unless there is a significant change in the fund’s strategy or dip in performance or some other special situation. So please do not look forward to it. Also, there are plenty of good mutual funds that are not part of PlumbLine. If your funds are different, you are probably better off. Do not worry about it.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

2: Do not use PlumbLine for confirmation of your choices! PlumbLine is meant for young earners and first time investors after they have used the robo advisory template.

3: If tomorrow the funds in the list change, you will have to take a call on what you need to do, based on the fund performance from the date in which you invested. I cannot help you here, other than talk about how to review.

Disclaimer

On its own, this list has no meaning and unless you are able to look at it in the right perspective and context, it will not help you. The hope is that the robo template will try and provide such perspective which still has to be processed and interpreted by you.

Finally, I am only human and more than capable of making mistakes. Also, I am a below average investor and fund picker or analyzer. I am not a fan of looking into the fund portfolio. I prefer funds with a narrow investment mandate. I am sure you will agree that most of the picks are lame and obvious.and that this list is a no-brainer and nothing special.

If the funds here stop performing in future or have credit defaults issues, all I can do is to modify the list (if required). I WILL NOT BE IN ANY WAY RESPONSIBLE FOR YOUR INVESTMENT CHOICES, CAPITAL GAINS OR LOSSES.

If a PlumbLIne fund is present in your portfolio, it means nothing.

If none of your funds is present in the PlumbLine list, it means nothing.

MUTUAL FUNDS ARE SUBJECT TO IGNORANCE RISKS AND MARKET RISKS. PLEASE READ AND UNDERSTAND ALL SCHEME RELATED DOCUMENTS BEFORE INVESTING.

FAQ on Plumbline

1. Why are X, Y or Z funds not part of plumbline —> Plumbline is my list. Don’t expect me to make a list that matches your expectations.

2. The funds you have listed are not even 4-star funds —> I don’t care. Star ratings are injurious to your mental and fiscal health. Comparisons are injurious to peace of mind and plumbline is just plain bad.

3 Plumbline does not feature the top funds from your monthly screener —> Yeah because I did not consult it. Plumbline is a qualitative assessment of a funds investment strategy, mandate and performance.

Q & A on mutual fund investing

Sanjay Srivastava: Your posts are different and with a new perspective; thank you ! I have Mirae Asset Emerging (MC) and India Opp (LC), besides Franklin Prima (MC) and SBI Bluechip (LC). Any comments on these via-a-vis your suggested funds ?

Pattu: Thank you. Comparing funds like that will not help in any way. Will say this much: Both the Mirae fund and Franklin fund are good performers in their own right.

Jig: While analyzing the MF as year end to do list, observed funds performance on morning star as below. i felt worried but when i check my PF on value research and see the performance, it differs than it. I hope VR is giving XIRR and showing correctly.

Pattu: Returns depend on when you calculate it! See: The Blind Men and the Mutual Fund! I have checked the XIRR calculation of VR on excel and it matches. So nothing to worry.

sunny Hi sir Can you advise on how to select a good fund house. I have selected Franklin Templeton, ICICI and SBI in that order. I am old fashioned and would like to maintain a direct relationship with the AMC for a long period by investing in their various schemes. Thanks

Pattu: This is not an easy question to answer. Not only will it be a qualitative answer, but also a subjective one. From my experience and that of my friends, I would have not a problem in putting my money with Franklin, HDFC, ICICI, Quantum, Mirae, DSP BR, Canara Robeco, SBI, PPFAS. There could be other good ones too. But I will avoid fund houses which have the lowest AUM despite having been around for decades.

Dr Shivaji singh: I planned to invest in icici pru balanced advantage fund for 15 years. Only one fund. It does the tactical asset allocation and portfolio balancing for us.. I am not planning sip but buying on dips and buying more on good correction. Please suggest if the plan looks good.

Pattu: I cannot comment because I do not know your plan – what is your expected return, corresponding asset allocation and how it will change over years. Be prepared if ICICI changes its fund strategy or if the performance dips.

Somanathan B: Sir, First of all thanks to you efforts and articles, which prompted me and enabled me to go in & try to understand the mutual fund game. Sir you recommended Franklin India Bluechip Fund Direct Plan Growth Option in large cap. When analyzing I see that, it trailing return in lower than S&P and much lower than the market leader in this category. (From Value research) Comparing to peers it is doing bad and expense ration is high. Alphas is 4.3 where leaders are much better there. Sharpe is 0.61 where as funds like Mirae Asset India Opportunities Fund sharpe is much higher. Not sure I am making some analysis mistake. Please help and suggest. I was contemplating on buying Mirae Asset India Opportunities Fund – Regular Plan , which I felt is a good buy considering all parameters. rgds Somanathan

Kalai: I have made an lumpsum investment to one mutlicap fund and assigned to Son education goal. Now the current asset allocation shown as EQ:DEBT ( 98% : 2%). But my desired asset allocation would be 70:30. Should i stop investing Equity part and fully invest in Debt part for couple of years to bring the Desired asset allocation level. Once the level attained, then continue the same level(70:30) in both asset class for future SIP. Kindly advise.

Pattu: That is pretty risky. Suggest you redeem some money from equity and shift to debt.

Atul Goes I was analysing your mutual fund rolling screener for Nov. According to data there I accessed that Aditya Birla Sun Life Frontline Equity Fund outperformed benchmark and franklin India Bluechip Fund. However Money Control ranking, VR ranking also do not give it a good rating. What am I missing here?? Would it be possible for you to compare franklin India Bluechip Fund vs Aditya Birla Sun Life Frontline Equity Fund so that I can better do DIY activity.

Pattu If you want to do better DIY activity, you will have to DIY! Besides that, what are you missing? You are looking at two differently obtained sets of analytics data and assuming that they will make sense. They will not.

Allow me to insert a couple of other questions:

Satish: Hi Pattu Sir, I have a concern I have been pondering on for a long time. I am financially savvy and have taken all steps to protect my family and secure their financial future. My wife is not well versed with any financial investments at all. I am concerned about her in case of my untimely demise. What if someone cheats her of her money? What if she can’t use the funds wisely and protect my family? Is there a solution to this? I have tried involving her in financial management starting from asking her to manage monthly finances and invest, but alas it is not working… please advise

Pattu: Tell her to contact one of the fee-only planners from here: Fee-only India: launch of a movement to serve investors and advisors.

Better still both of start consulting one from today itself. She can continue getting advice from the if for some reason you become too busy, become bed-ridden etc. (death is not the only consideration!)

Anki: Thanks for starting this. If u can also put light on the below dilemma : 1) For any employee getting covered by company policy ‘A’ ( Lets say cover of ‘x’ with company specific terms and conditions) If he goes and buys a super top up from company ‘B’ Question : Whose terms and conditions prevail? Inclusions and exclusions might be different for each company right? then how do these work?

Pattu: Each policies conditions will prevail up to their sum insured limits including the deductible. So 0 to 5L in policy ‘A’ and 5L to 10L in ‘B” where 5L is the deductible for B.

Dipak Jamburasia: Dear Mr. Pattu I have Rs 14 lacs of funds to invest. As per asset allocation I have to invest in debt. I am in 20% Tax bracket and do not need this capital or interest on it for next 10 years for any need. RBI taxable bonds gives interest @8% every six months and tenure is of 6 years. I.e. No risk and interest rate assured for 6 yrs. Post tax return will be 6.4%. FD rates are less than 8% and max tenure is mostly 3 to 5 years and hence I am not considering FD.FMP have become less attractive on a/c of low inflation and max duration is 5yrs only. I can also invest in debt funds. How do I evaluate RBI bond vs debt fund vs FMP?? I would like to consider a debt fund where there a good likelihood of earning post tax interest of greater than 6.4% for at least 6 yrs. Is 5 year FMP likely to give more than this post tax return? I do understand that in bonds and fmp there cannot be any certainty of return. Regards

Pattu: If you buy RBI 8% bonds and hold it to completion there is no uncertainty in returns. In the case of FMP, you will have to read the investment document and choose carefully: How to Select Mutual Fund Fixed Maturity Plans (FMP)

Abbas: Hi Sir, My current monthly expense is x which includes my rent also.Curently i am staying in rented house forwhich i am paying nearly x/3 as rent. We are planning to buy an apartment in another 3 ~ 4 years and I will be in service for another 23 years . As we know flat’s life span in chennai is about 15 to 20 years so my then flat won’t be in position to live during my early/post retirement time.I may be wrong but assuming i will be forced to stay in rented house. My question is do we need to take account of rental expenses while calculating retirement corpus?

Pattu: If your apartment becomes old, you can re-build or sell. So there is not need to take into account rent now since you are planning to buy a flat.

Rahul Bhardwaj: I am planning to buy a health insurance policy for my parents(52 & 49). Should I go for individual policy for both or a family floater?

Pattu: A large enough cover that you afford. Floater or individual depends on what you can spend.

Mr Vijay Dighe: I am a Sr.Citizen aged 67 years.I am a holder of Mediclaim Policy2007 from New India Assurance Co. Ltd.with a insurance cover for Rs.4.00lakhs for myself and my spouse (aged 60years)of Rs.2.00lakhs each(not family floater).I have paid insurance premium of Rs.19580/-for insurance cover for the period 25.01.2017 to 24.01.2018. On 14.12.2017,I received a notice from New India assurance Co.Ltd.stating Quote”It has been decided by our Management to discontinue the Mediclaim Policy 2007.In view of this, we will not be able to renew the policy as per the terms and conditions of Mediclaim policy 2007.However,an option is given to you to migrate to any other product as may be suitable to you.In case you choose to migrate to any other product,you shall be governed by terms and conditions and premium of the policy chosen by you.You also need to fill the fresh proposal form.You will be allowed continuity benefits under the new policy as per IRDAI guidelines.”Unquote. I am holding this Mediclaim Policy 2007 from NIA Co.Ltd.since january 2002 continuously without any break/default.Under the circumstances I would like to know: i)Whether the Insurance Co. can unilaterally and abruptly discontinue any Mediclaim policy? ii)Are their any rules, guidelines by IRDAI which will protect the interest of insured especially under above circumstances i.e.policy is run for 16 years continuously and age limit has been crossed. iii)This has been done by NIA co.Ltd.ostensibly to increase the Insurance premuim(almost double) citing reasons of increase in Claim Ratio. iv)Under the circumstances I am ( and also all other such insured people)at the mercy of Insurance co.and have to renew the policy by paying exorbitant premium as no other insurance co.is likely to accept our proposal due to age factor. v)Is their any recourse available to unilateral decision of the insurance co.to discontinue mediclaim policy 2007? Please guide. with regards, Vijay Dighe

Pattu: The insurer can close down the policy at any time. They have offered a fair deal as per law. Nothing can be done. Either you shift to their new product or ask them time to shift to another product. I would suggest that you stick with them.

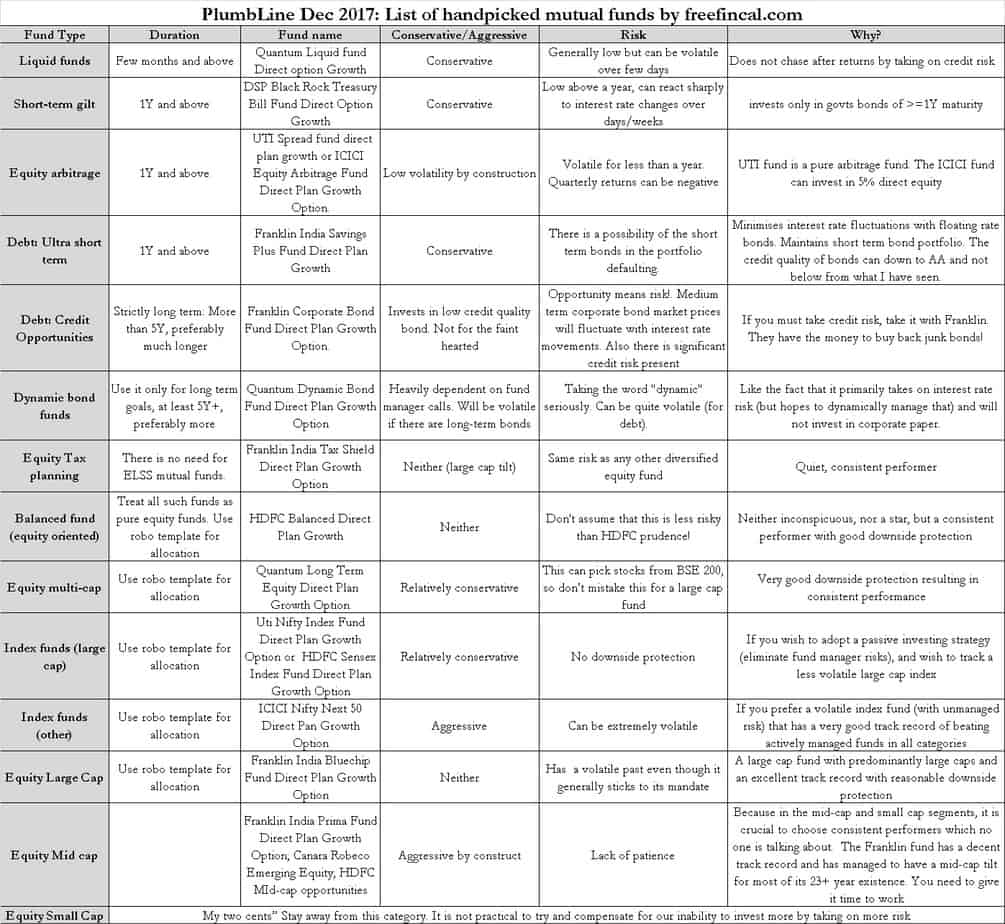

The PLUMBLINE for December 2017

This is the full list. If you want it in text form, check last months listing..

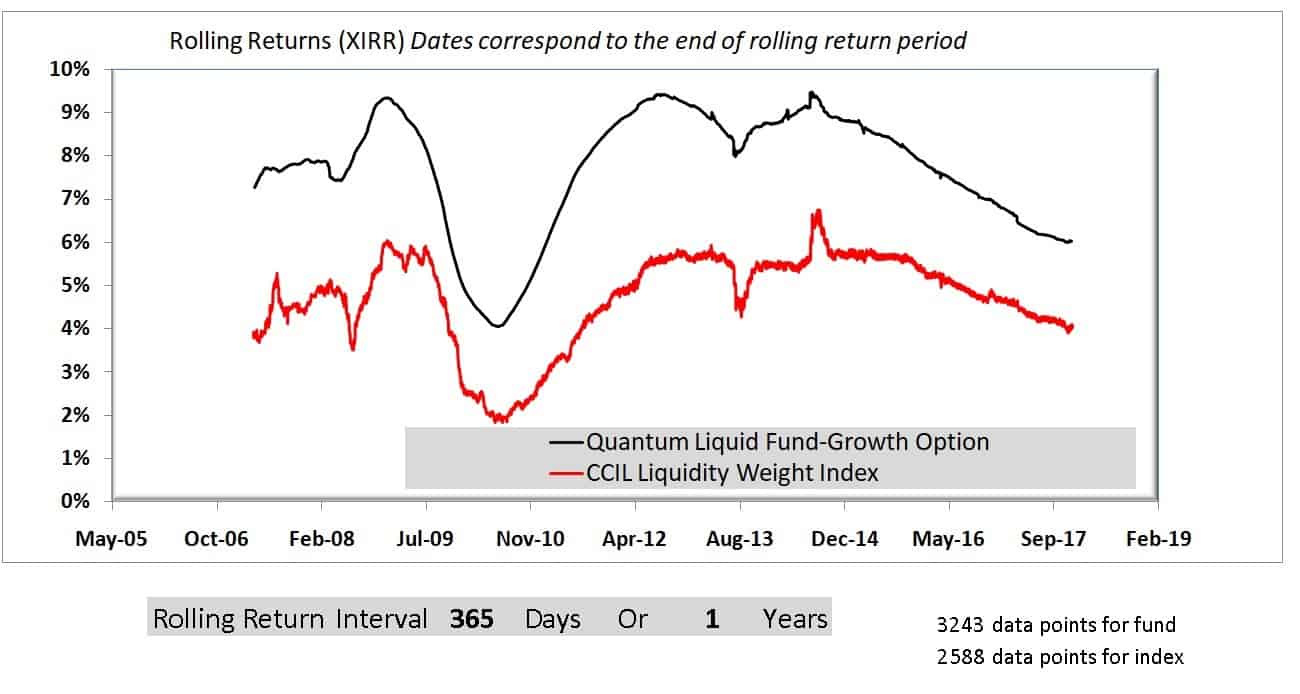

Quantum Liquid fund

This month I post rolling returns of each fund. This is Quantum liquid against CCIl money market (gilt) indext (not a right choice though). The no of data points in each curve can be seen at the bottom right of the picture. So for Quantum liquid, 3243 1Y returns were considered. The reason I am plotting rolling returns is for you to understand risk.

Remember: If a debt fund underperforms an index, it generally means it is taking a lower risk – a good thing!

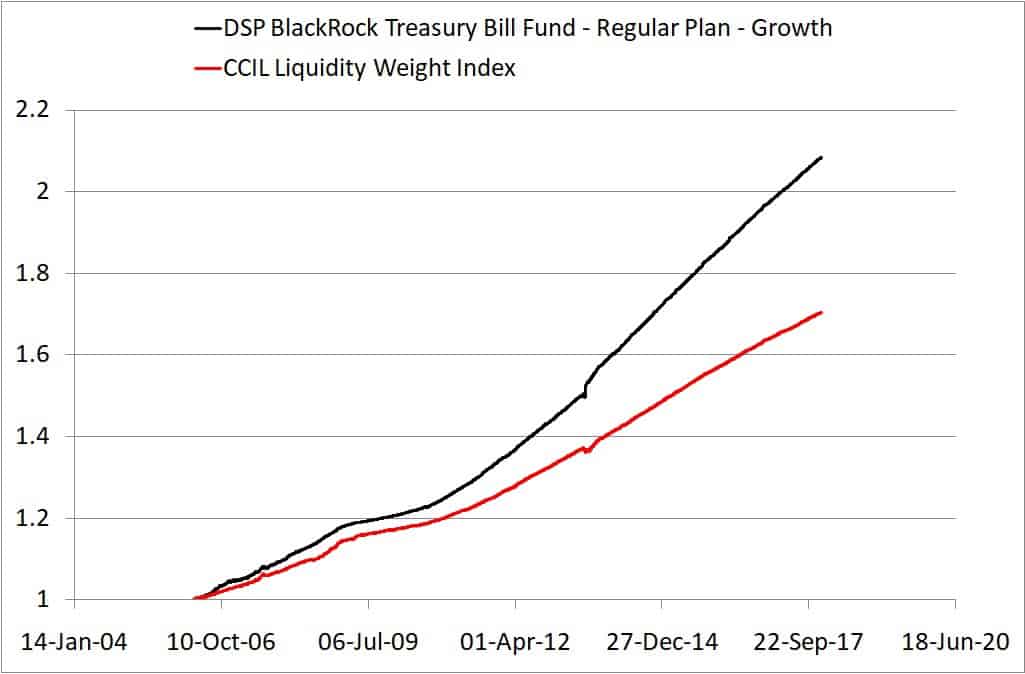

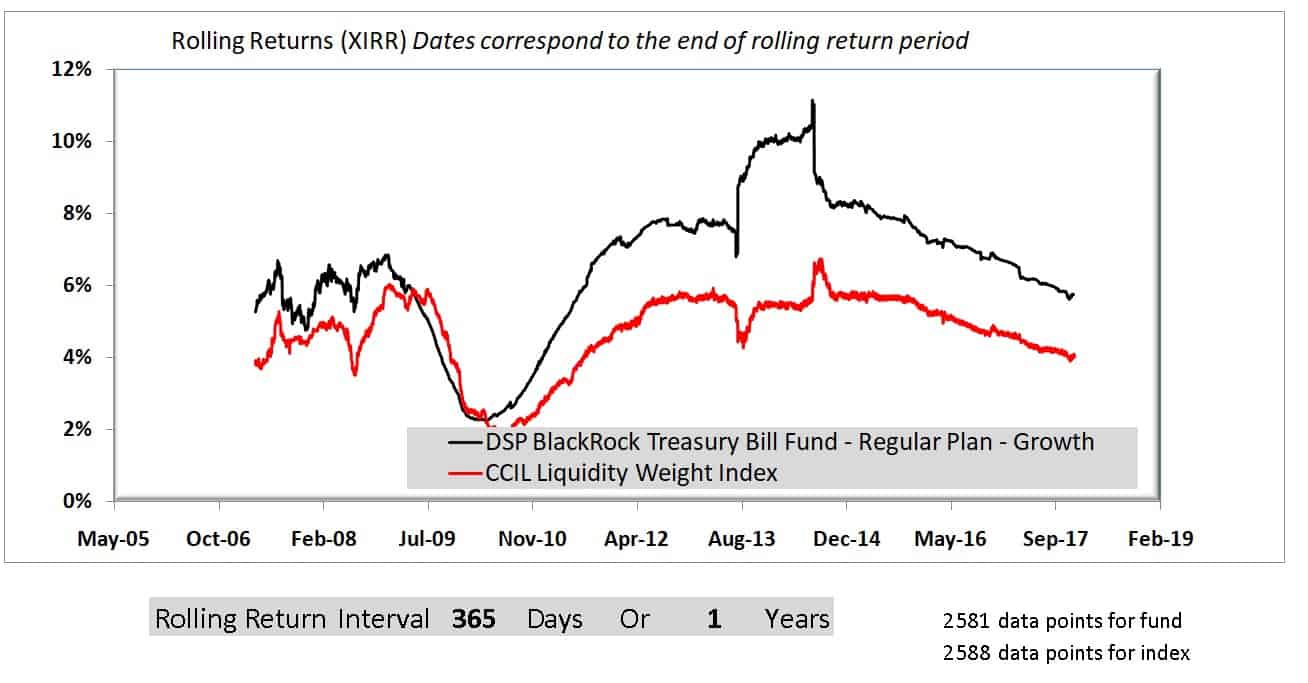

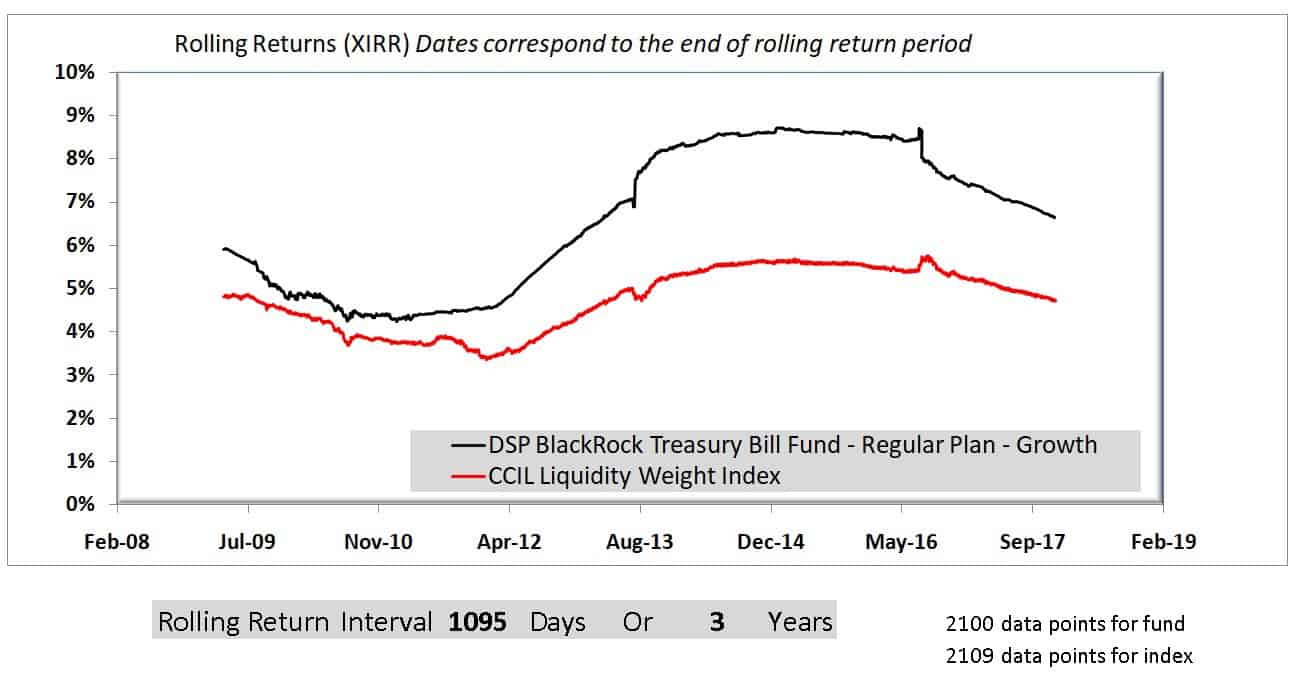

DSP Black Rock Treasury Bill Fund

Those sharp spikes are the fund’s reactions to the overnight increase of the overnight rate(!) by 2% to stem the fall of the Ruppe. This triggered a huge bond crash.

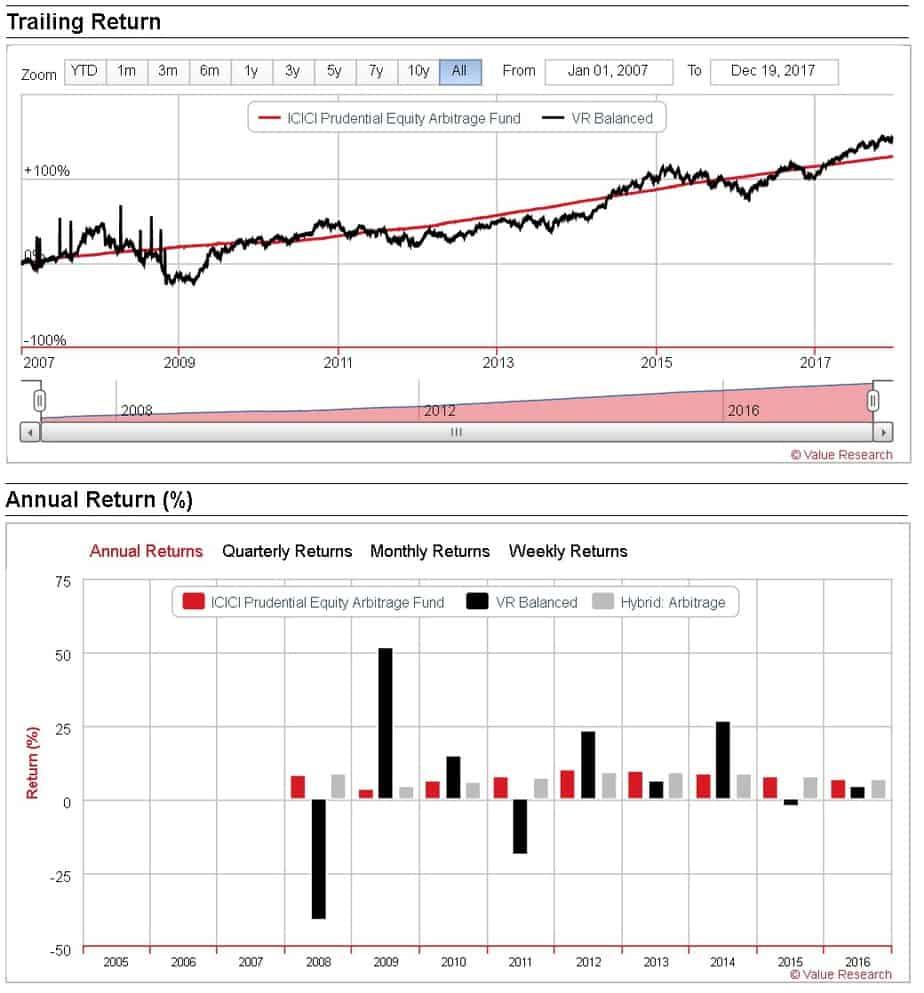

ICICI Equity Arbitrage Fund

I cannot but stop laughing at how an arbitrage fund has done when compared with VR-balanced (an aum weighted index of equity oriented (balanced) hybrid funds). Notice how bad returns (of VR balanced index) is the reason for this.

Notice rolling returns can be quite up and down even over 2Y.

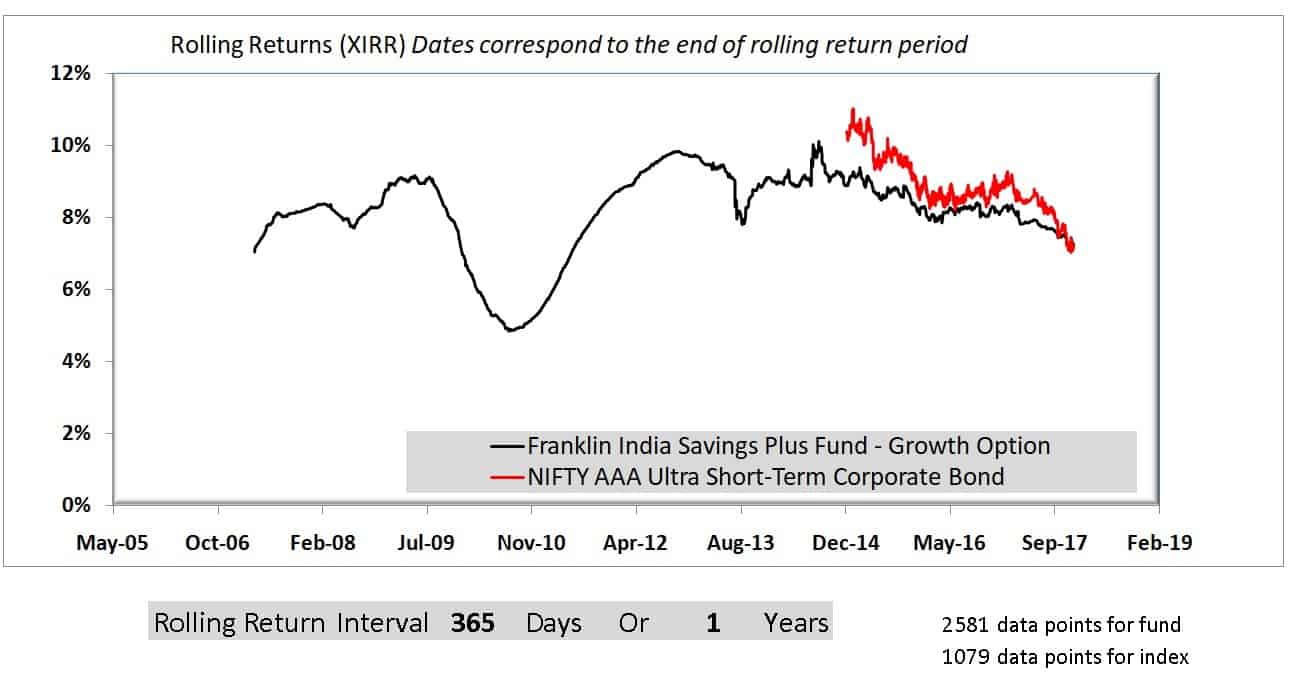

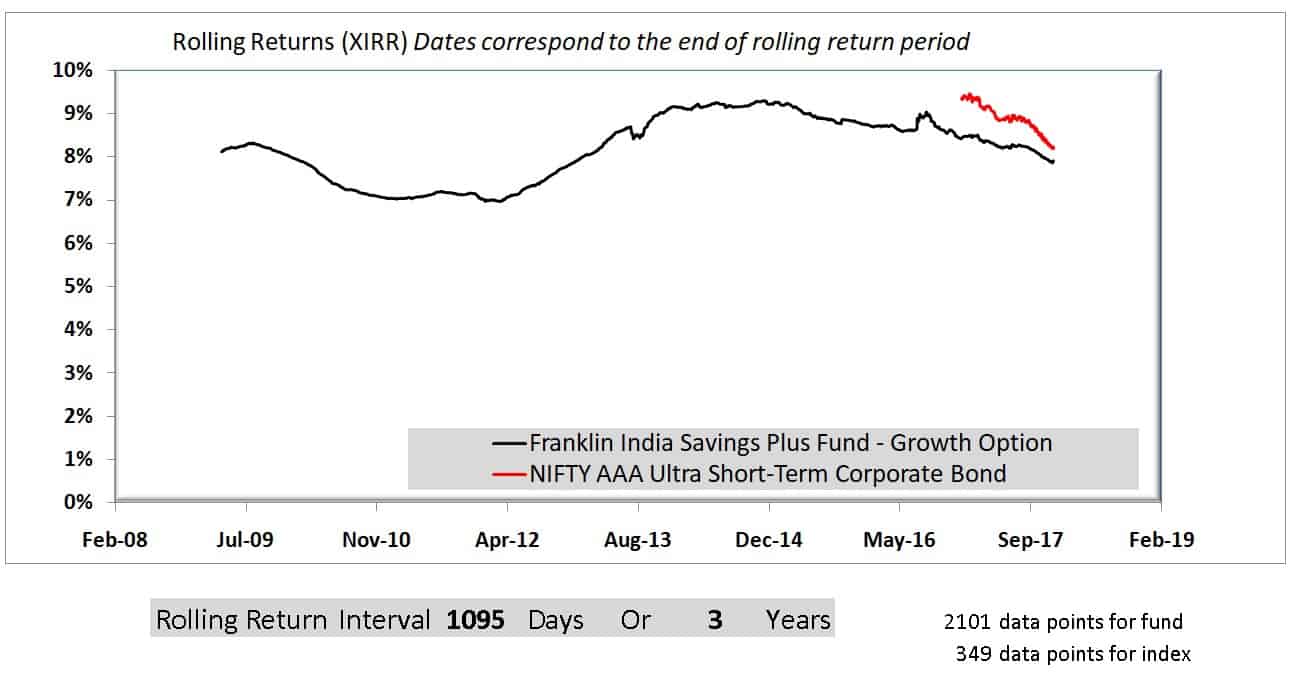

Franklin India Savings Plus Fund

“NIFTY AAA Ultra Short-Term Corporate Bond Index measures the performance of AAA rated corporate bonds with residual maturity from 0.5 years to 2 years.”

Never thought I would see a Franklin index undperform (perhaps) a (inappropriate) corporate benchmark. This is good as it means lower risk. The fund has floating rate bonds. So the choice of benchmark is poor, but then again, I don’t have much choice in this space. Also, the benchmark itself does not have much history.

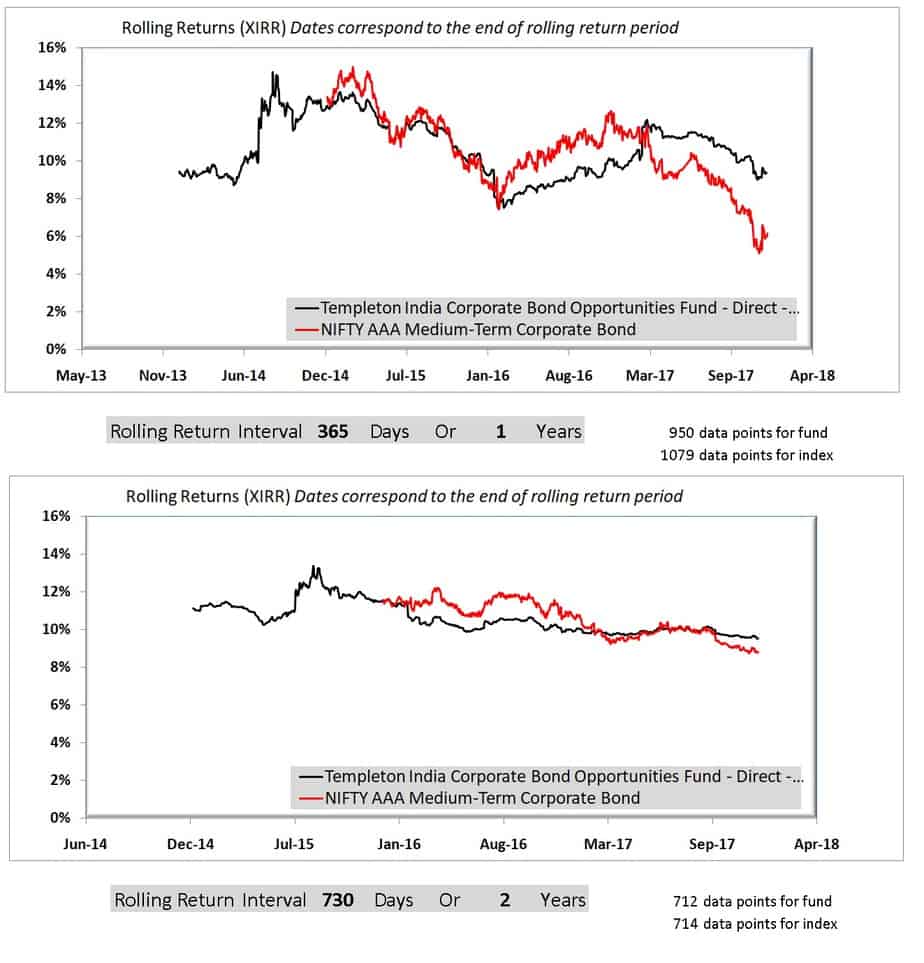

Franklin Corporate Bond Fund

I have made an exception with this one. It is probably the most volatile fund in plumbline, but hey if you choose your duration right, you can afford to take some risk.

“NIFTY AAA Medium-Term Corporate Bond Index measures the performance of AAA rated corporate bonds with residual maturity from 3 years to 5 years.”

This fund has an average maturity of about 4 years, but invests in A and AA rated bonds predominantly. So higher risk and therefore higher returns than the index until there is a credit default.

Quantum Dynamic Bond Fund

This one I am watching with an Eagle eye. The prospect of a rate hike has been playing out in the debt markets and debt fund investors are recognising what a market-linked product really means! The rate does not have to increase to decrease for the NAV to fall or rise. Just the prospect of a rate change, or even status quo due to inflation can affect returns of long term gilts and their cousins the not really dynamic bond funds due to supply vs demand pull/push.

I have maintained that one should not invest in dynamic bond funds, but made an exception for the Quantum fund. I Like the fact that it primarily takes on interest rate risk (but hopes to dynamically manage that) and will not invest in corporate paper. Question is, has it been dynamic enough to minimise losses?

Although its 3-month absolute return of -0.52% is almost twice that of the category average ( -0.24%), it as done better than the category average in the last month and last week (unfortunately since benchmark indices are not available in the open, it is hard to make a comparison with a benchmark). Need to watch this fund carefully. If it continues to fall, it will be the first to be removed from plumbline.

Have a look at its portfolio

Dec 2016:

Money market (liquid/cash) ~ 28%

long-term bonds (>9Y) ~ 71%;

Sep 2017

Money market ~ 12%

very llong-term(>12Y) ~ 50%

Nov 2017

Money market ~ 18.5%

Still 83% exposure to >10Y bonds.

That is not dynamic enough for me. Let use see next month. Investors can hold without fear. New investors can perhaps sit back and keep an eye.

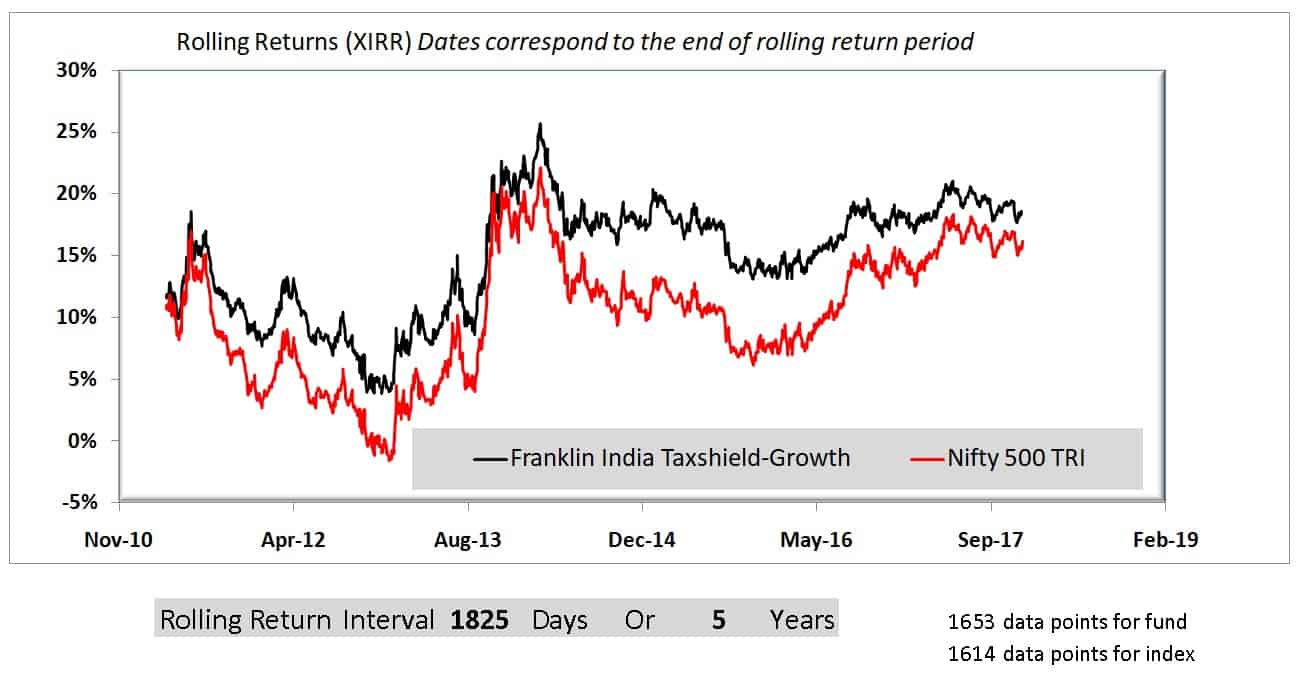

Franklin India Tax Shield

Quiet performer.

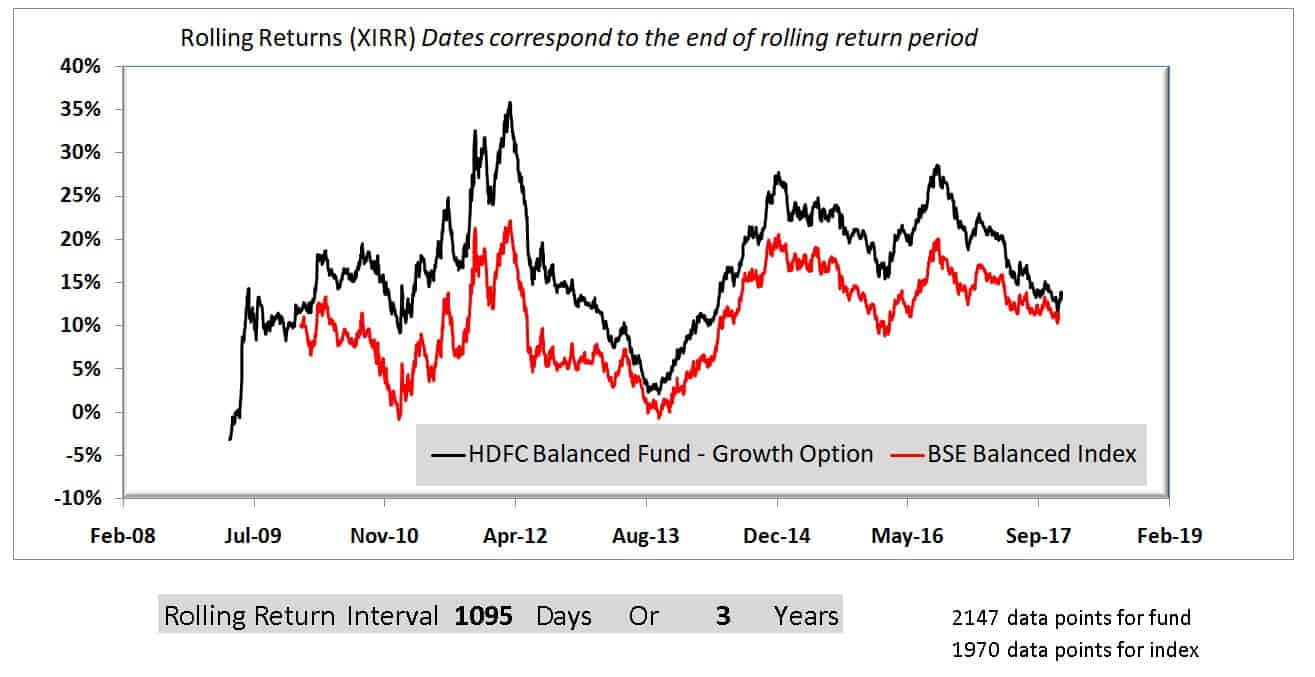

HDFC Balanced Fund

BSE Balanced index use to benchmark equity-oriented balanced fund is one of my own making: A new & accessible benchmark for balanced mutual funds

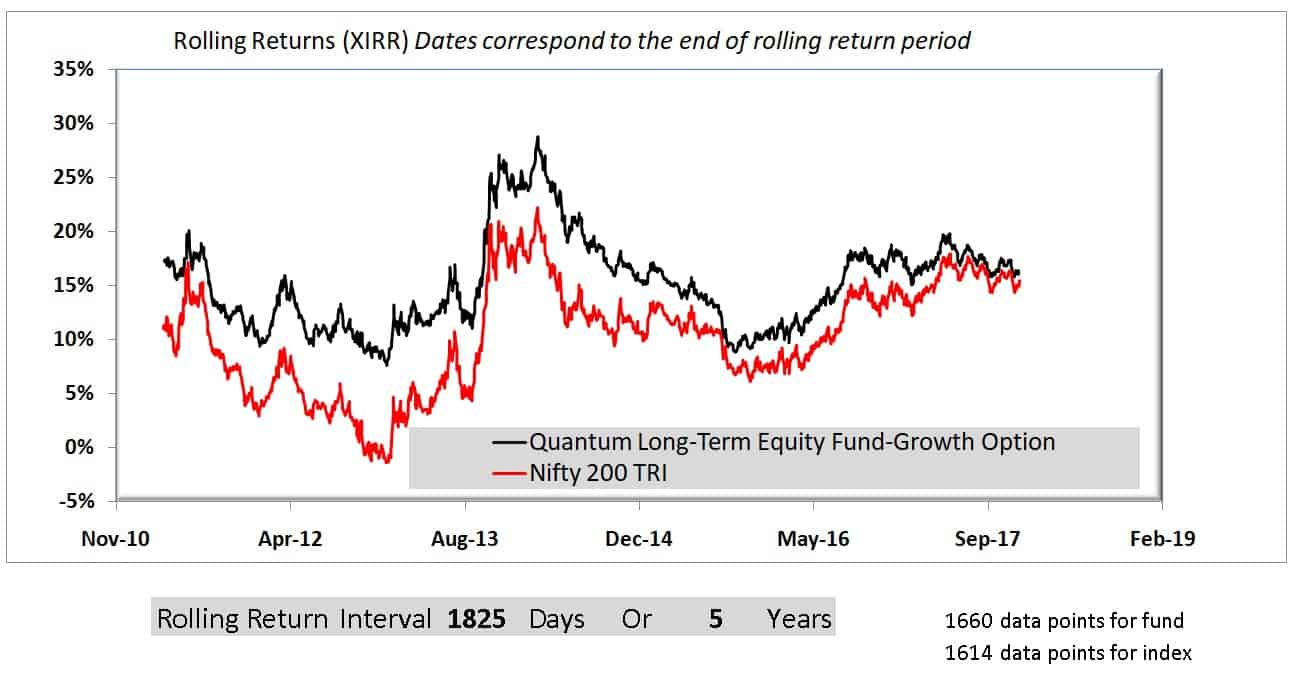

Quantum Long Term Equity

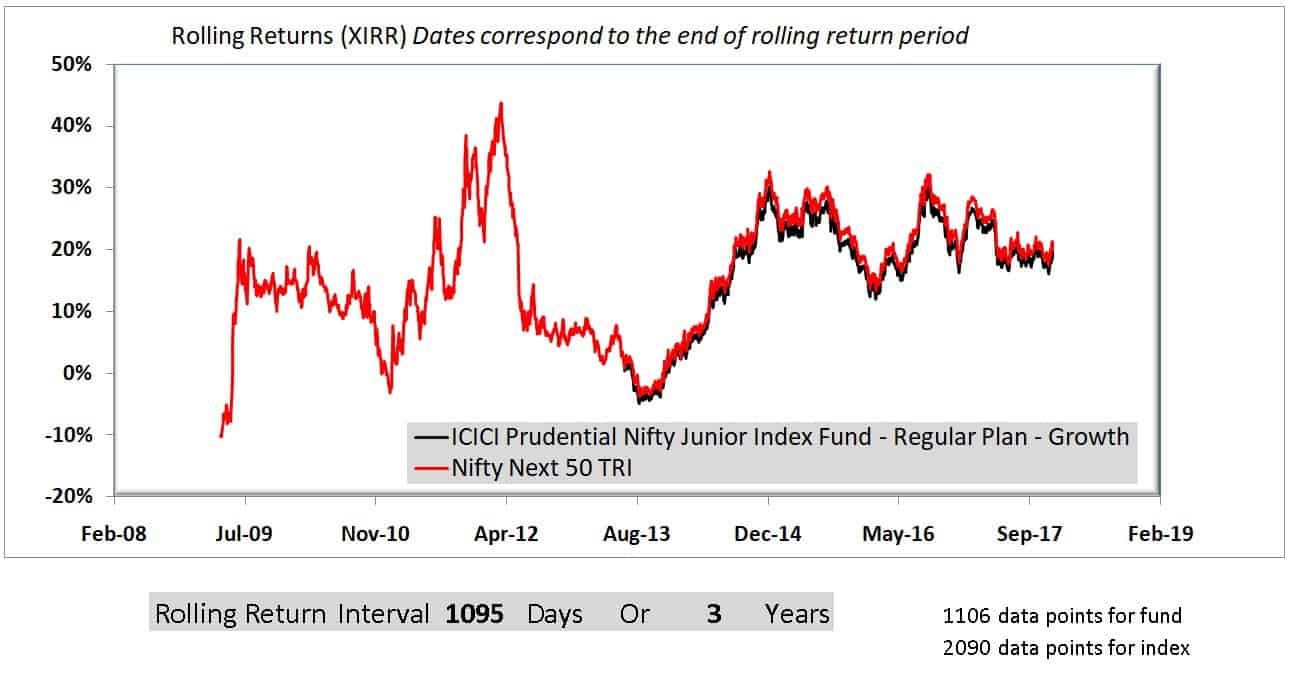

ICICI Nifty Next 50 Fund

Notice how volatile returns can be!! Hey, why is the index fund underperforming its own benchmark?! 🙂

Read more:Nifty Next 50: The Benchmark Index That No Mutual Fund Would Touch?!

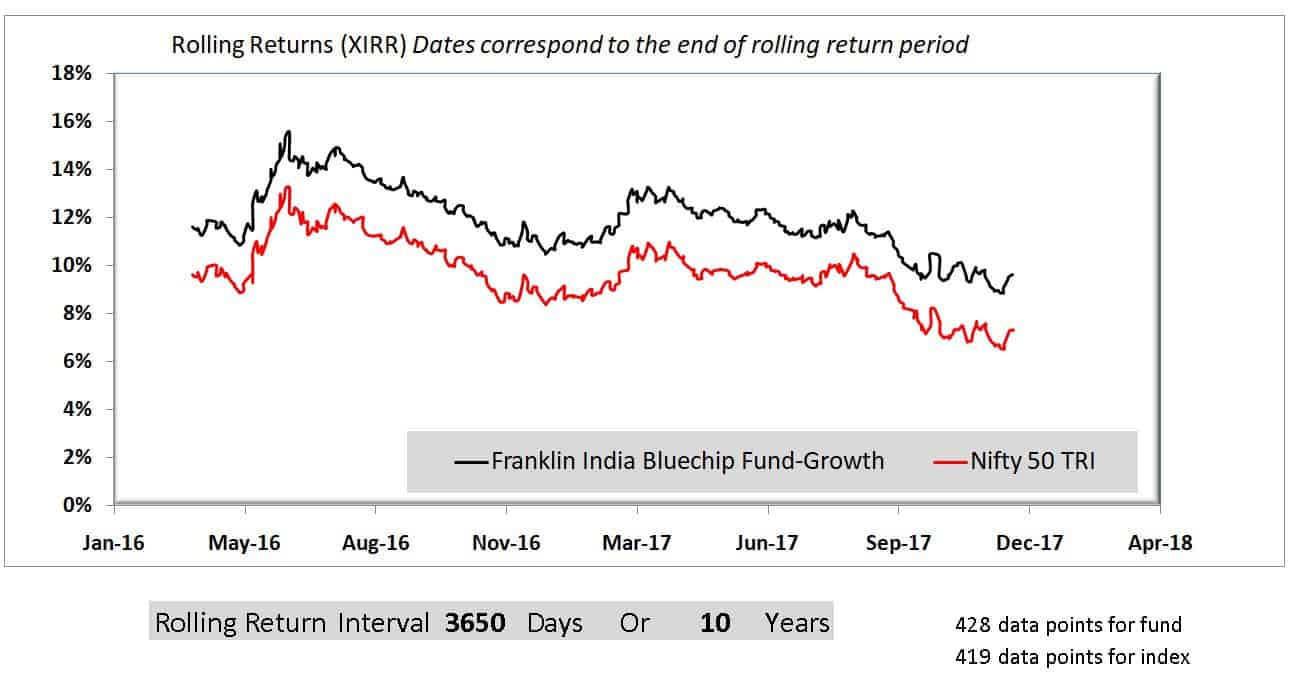

Franklin India Bluechip Fund

You need to give this fund time to beat the market!

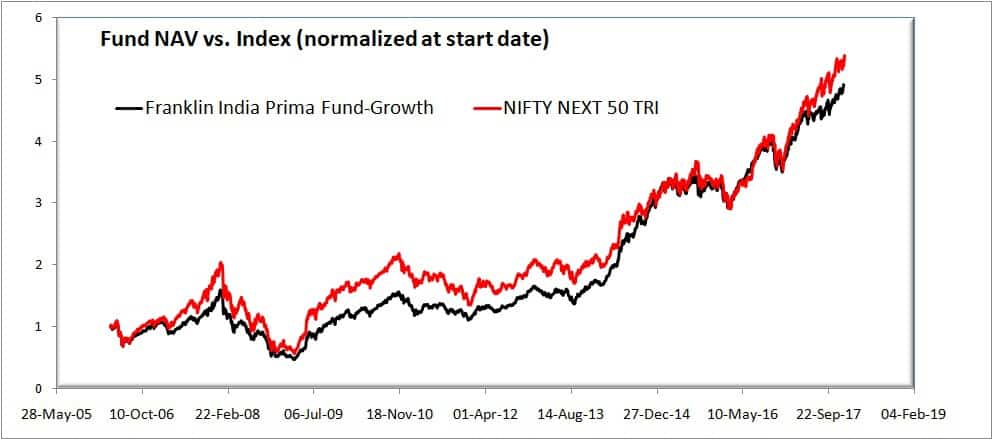

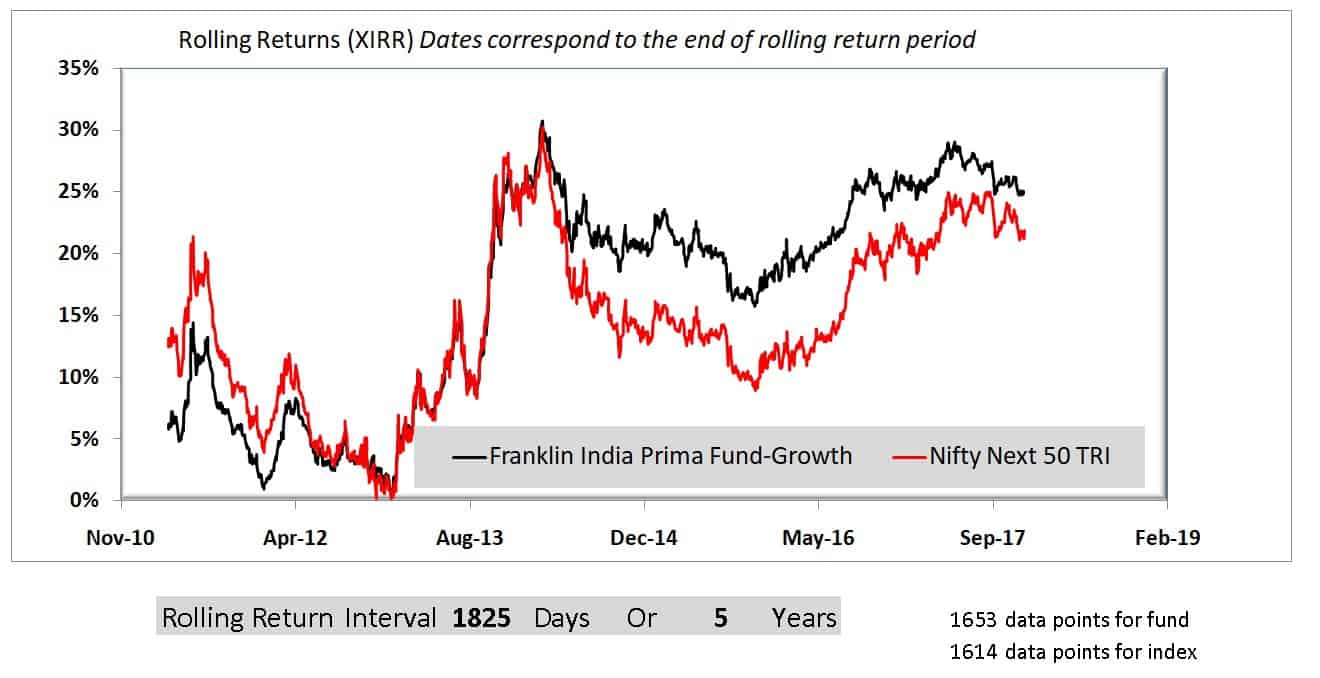

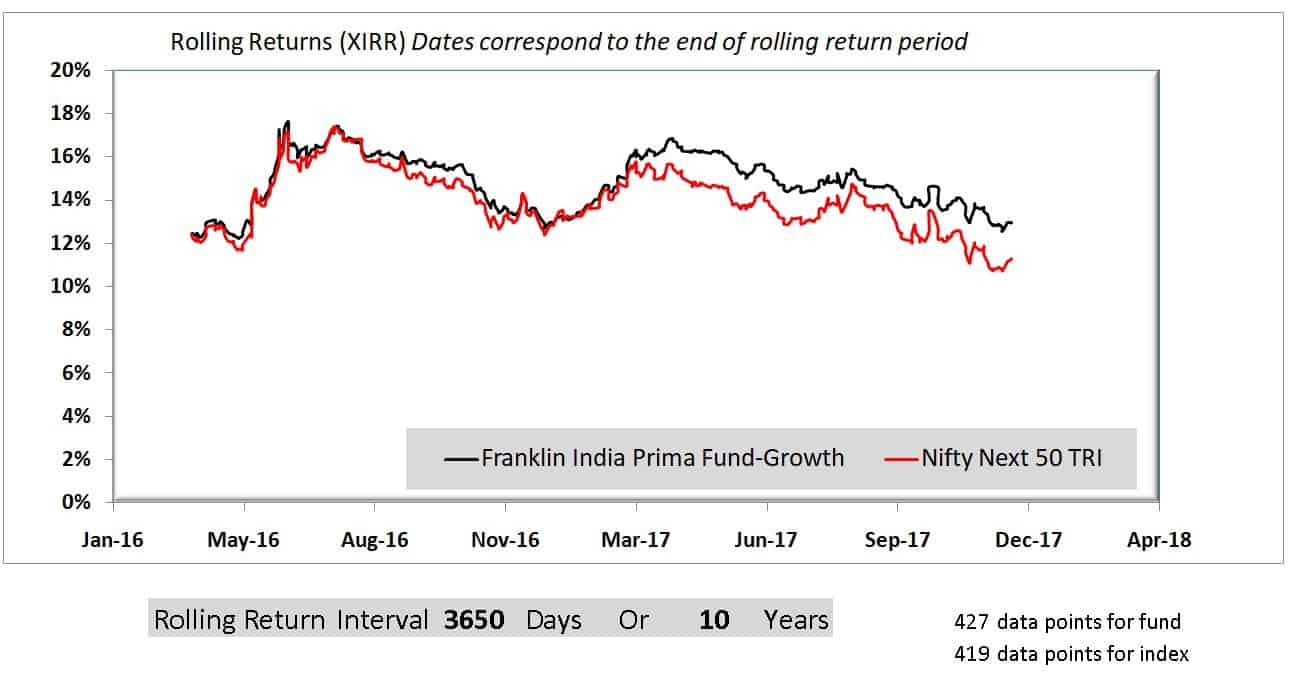

Franklin India Prima Fund

You can see the good benefit of active fund management below.

The long term returns are better than Nifty next 50 because of good downside protection.

phew! That was exhausting. Not sure how many will get to this point.

Do check out my books

| You Can Be Rich Too with Goal-Based Investing, my first book is now available at a 35% discount for Rs. 258. It comes with nine online calculators. Get it now. The kindle edition is only Rs. 199 |

| Gamechanger, my second book is now only Rs 199 (Kindle Rs. 99). Get it or gift it to a young earner |

| The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download) |

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)