Last Updated on October 13, 2025 at 5:25 pm

A DIY investor invariably ends up reading a lot of stuff (and fluff). One typically starts with basic finance and business books, one thing leads to another and next thing you know, you end up reading stuff on history, psychology, personal and career development, management, leadership, philosophy and whatnot.

This is a guest post by regular freefincal contributor Srivatsan. His most famous pieces are: Forget the next Infy; Can you identify the next Satyam? And the more recent viral hit: Forget Buffettisms/Mungerisms: try these 2000-year-old personal finance tips! and Ten Amazing Similarities between Poker, Stock Markets and Life

Would you like to guest blog for freefincal? (follow this link to learn more). I look forward to contributions from DIY investors (please discuss topics before writing!). Also please check out this webinar on How to select a health insurance policy in 2019.

As I mentioned in my thirukkural post, கற்கக் கசடற (391) and எப்பொருள் யார்யார்வாய் (423) (learning flawlessly and gaining understanding) are the two cornerstones in our learning endeavours. How do you know whether you are reading stuff or fluff?

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

On a whim, I took a look at the list of non-fiction books I checked out from my local library over the last few years. What struck me was that these books were invariably written by Americans and the genre my librarian catalogued as “self-help”. I dug a little deeper on some of the famous books and this post is my personal take on what I found. Read on…

1 Security Analysis / Intelligent Investor – Benjamin Graham

This is where pretty much everyone starts right? It’s amazing to note the first editions were published in 1937 and 1949. You learn the holy grail of value investing – fundamental analysis plus the buy and hold till infinity; from these books.

One of my friends sent me a pdf of Benjamin Graham’s interview in 1976 (A Conversation with Benjamin Graham, Benjamin Graham, Financial Analysts Journal, Vol. 32, No. 5 (Sep. – Oct. 1976), pp. 20-23).

This is what Graham said in that interview on security analysis:

“…I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham and Dodd” was first published; but the situation has changed a great deal since then.

In the old days, any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost.

To that very limited extent, I’m on the side of the “efficient market” school of thought now generally accepted by the professors…”

— He said WHAT?? I will give you a couple of minutes to digest that one. Did Graham give up security analysis 40 years ago? He is abandoning his very own brain child?

In the same interview, this is what he said regarding buying and hold strategy:

“…The investor should have a definite selling policy for all his common stock commitments, corresponding to his buying techniques. Typically, he should set a reasonable profit objective on each purchase–say 50 to 100 per cent–and a maximum holding period for this objective to be realized–say, two to three years. Purchases not realizing the gain objective at the end of the holding period should be sold out at the market…”

— WHAT??? What about buying businesses for 20 years his famed student learned from Graham? What about thinking of never selling? How will one then write about “if you had bought Wipro for 10,000 in 1980 you will be sitting on 1 followed by gazillion zeros”?

— Guru believed in efficient market hypothesis and the student pooh-poohs it? What’s cooking? Did they have a fight?

Well, the fact is Graham wrote those books in the post-depression, post-WWII boom era in the US and what he wrote was very valid then. When he gave the interview in 1976, things were vastly different in the US. Benjamin Graham, being a brilliant man, simply changed his mind when the facts changed. Mere mortals don’t. Again, will these apply in India, now or during our retirement is anybody’s guess.

2 Warren Buffett doesn’t do derivatives as they “…are financial weapons of mass destruction…”

That oft paraded quote is from 2002 BH annual letter to the shareholders lived and breathed by Buffet bhakths. Go back, download and read it. Go to page 12, where he dwells on derivatives for 2 pages.

“…And, on a micro level, what they say is often true. Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions in order to facilitate certain investment strategies…”

“…But closing down a derivatives business is easier said than done. It will be a great many years before we are totally out of this operation (though we reduce our exposure daily). In fact, the reinsurance and derivatives businesses are similar: Like Hell, both are easy to enter and almost impossible to exit…”

For a detailed list of his derivatives transactions over the years refer this.

I know Buffet bhakths would be up in arms by now. Buffet’s message to those cult followers who are dying to and die trying to reach Omaha is simply this:

“Do as I say; Not as I do”. (Which violates thirukkural #667)

Simply because he is Warrant Buffet; you and I are not and will never be. He has an army of CPAs, Ivy-League MBAs slogging 100 hours a week to come up with butterfly options, CMO, CDO, MBS, ABS and many such BSes. We do not;

3 Rich Dad Poor Dad – Robert Kiyosaki

It is not a good sign when a financial guru’s own company goes bankrupt, when no one can find that rich dad, when there is no indication of wealth earned before that book and when his get rich quick schemes get promulgated as illegal in several states in the US. One can argue that he personally didn’t go bankrupt but only his company (which is routine in US); but what’s true financially at personal level is true for a business or a nation too.

4 How to win friends and influence people – Dale Carnegie

I am yet to see a person who has not read this book in the corporate world. It always brings me a smile when you see consultants, sales guys, vendors, HR folks and new managers blatantly abuse the “tricks” with genuinely fake sincerity. Quick tip: Next time you meet a consultant, note down how many times they say your name within five minutes of the conversation. It helps when you have a longish or a slightly unusual Indian name!

Here is the deal: First of all, Dale Carnegie’s real name was Dale Carnagey. He changed it to Carnegie so that people would think he is related to the more famous Andrew Carnegie (US Steel, Richest American in 19th century, Carnegie Hall, Carnegie Mellon University – ring a bell?).

Second of all, his first wife divorced and left him. How is that for winning friends and influencing people? This is a big kicker for me.

Third of all, here is an interesting anecdote. Dale Carnegie’s golden rule is to never argue or criticize another person. In one of his lectures, he asked the audience whether they are happy. One guy said yes. Dale Carnegie was flabbergasted and went on to argue the entire day with that guy trying to convince him that he could not be happy. Reason: If you are contented, there is no need for Dale Carnegie or his tricks.

5 Think and Grow Rich – Napoleon Hill

If only getting rich was that easy. There are millions that swear by this book. Napoleon Hill was a con man par excellence. His life is littered with frauds, scams and fake claims. Did you know that he died destitute and was forced to sell the typewriter with which he wrote the bestseller on? I surely did not when I read that book. I am sure thinking didn’t make him rich in his twilight years!

The fact is this: Hill wrote that book post the great depression when all people wanted to hear was that there was a way out of poverty and despair. There were no jobs, no pay – simply hopes and dreams during that time. (a la Ache din now J ) Being a great con man that preyed on people’s vulnerabilities, he packaged his book that promised salvation to those downtrodden masses.

6 Search for Excellence – Tom Peters

This book was a trendsetter in that it set down to actually explore what makes a business great. As Buffet bhakts, we all want to own great businesses with crocodile-infested moats right? What better book to read that extolls what makes a great business? This is the ticket to our FIRE right?

Well, there is one very minor problem – Tom Peters faked the data. Some of the companies that were mentioned as excellent in the book became bankrupt or started making multiyear losses soon after.

For what it is worth, from this saga, you at least get an in-depth understanding of how consulting companies work: P

“…This is pretty small beer, but for what it’s worth, okay, I confess: We faked the data. A lot of people suggested it at the time…”

“…Search started out as a study of 62 companies. How did we come up with them? We went around to McKinsey’s partners…and asked, Who’s cool? Who’s doing cool work? …

…Then, because McKinsey is McKinsey, we felt that we had to come up with some quantitative measures of performance. Those measures dropped the list from 62 to 43 companies. General Electric, for example, was on the list of 62 companies but didn’t make the cut to 43 — which shows you how “stupid” raw insight is and how “smart” tough-minded metrics can be…”

7 Money: Master the Game – Tony Robbins

This was a bestseller that climbed up to NYT #1 rapidly in the 2014-2015 period during US recession times. Tony Robbins had his pictures and videos everywhere. This book was launched at the right place at the right time.

The problem – His book got hit with copyright infringement lawsuits, he got hit with lawsuits claiming he defrauded investors with a fake website and the inevitable sexual harassment cases followed.

8 Norman Vincent Peale – Power of positive thinking

Norman Vincent Peale was a pastor leading one of the protestant sects. He was politically well connected and had tremendous influence with/over Republican US presidents like Richard Nixon and even Donald Trump.

This book has by default adorned many a library shelves, reader’s hands and minds. However, this book has been vigorously denounced by psychologists both for its therapeutic effectiveness as well as for the religious intent and overtones.

Peale was an unapologetic bigot- He feverishly campaigned against John. F. Kennedy stating that electing a Roman Catholic like Kennedy would doom America (Why this sounds familiar?)

This witty retort by Adlai Stevenson sums it all – “I find Saint Paul appealing and Saint Peale appalling.”

9 Robert Schuller – Tough Times Never Last but Tough People Do + Several books

Robert Schuller is another famous TV preacher, pastor and author. If you ignore the repetitive Christian missionary interludes, his books are quite readable. Throughout his TV preaching and via his books he campaigned and got $ for building what is called the famous “Crystal Cathedral” – a glass monstrosity near LA, California.

Once again, it is not a good sign when you file for bankruptcy of the very church you built and your entire family gets kicked out of the church Board.

10 John C Maxwell – The 21 Irrefutable Laws of Leadership + Several books on leadership

John C Maxwell is a pastor who went to Bible College specializing on writing and speaking on leadership. He is a default leadership speaker at the US Military and many fortune 500 companies. His books are routinely touted as the “go to” manuals for C-suites. Hold on for one more!

11 Stephen Covey – 7 habits of highly effective people + others

Stephen Covey was a Harvard MBA. Many people don’t know that he has a Doctorate in Religious Education from BYU (A well-known private Mormon university in godforsaken Utah in US with very “selective” admissions). Covey was also actively involved in preaching and missionary work during his student days at Harvard.

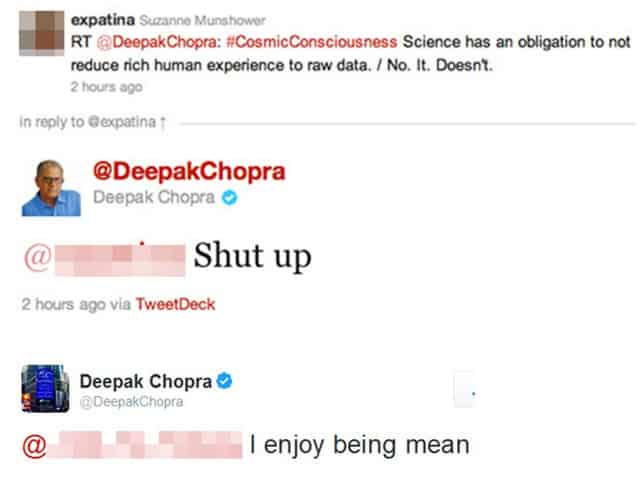

12 Deepak Chopra M.D – Ageless body, Timeless mind

Why leave a desi guy in US out of the list? A best-seller by a doctor of Indian Origin? YAY!

Take a guess – his book got hit with copyright violations. Journal of the American Medical Association disqualified his paper stating that the author had a conflict of interest and financial stakes.

As a person who routinely preaches calmness of mind, spirituality and anger management, he went and did this on twitter. Read kural #667 again please.

13 Coup de grace (the final blow)

Self-Help Gurus Commit Joint Suicide Not only in the US; In India too!

What am I trying to say?

DO NOT TAKE THESE BOOKS BLINDLY AT THEIR FACE VALUE!

If you notice #8 to #11, you will find a remarkable pattern that the authors of those best sellers are Christian missionaries, men of religion who had little or no practical experience with the corporate world or finances. Covey is a remarkable exception because he didn’t blatantly mix his religious beliefs into his books plus he was actually a successful businessman and a professor in his own right.

These books are clearly a distillation of the authors’ own agenda as well as a reflection of their times and what their parishioners wanted to hear.

This quote by a Stanford B-school professor (Pfeffer, Leadership B.S.: Fixing Workplaces and Careers One Truth at a Time, Harper Business, September 2015) highlights the anguish that most Corporate HR leadership programs are BS: (Yours truly has attended several of those and can readily concur!)

“…Companies must also have people teaching these programs who have at least some expertise in leadership, he adds. He recalled reading an article about the top 50 leadership experts. He researched the top 20 people in that list and found that only four had a degree “in anything remotely related to leadership.” The top leadership expert on the list, he noted, was John C. Maxwell, who has a degree in theology…”

Addendum

A simple letter change from ‘n’ to ‘x’ makes hell a lot of difference.

Remember – Reading self-help books is never mentioned as one of the 7

or 8 habits of highly effective people!

Watch this video:

(courtesy: BS Prasanth)

EndNote

There is a reason self-help and leadership is a billion $ industry in the US and most of these self-help gurus are American church preachers.

In my view, the reason is the key difference between western and eastern philosophy. Oriental philosophy believes the self is already complete and it is the individual’s responsibility to look inward and seek it. Oriental philosophy’s locus is internal while Occidental philosophy’s focus is external.

(Don’t believe me? Take any novel – from a Sherlock Holmes, Agatha Christie all the way to a Grisham. See how they do a hair to toe-nail description when introducing a character that will reinforce external appearance to that character’s “character”. In India, even a 1st std kid gets drummed into its head about Ishwar Chandra Vidyasagar)

The very term self-improvement or self-help assumes the sense of self is incomplete and malformed. The reason pastors make best sellers in America is simply because their target audience already have myriad inadequacy issues including psychological ones. You simply exploit their weaknesses and promise them salvation in both religious and financial sense – Lo and behold – you have a bestseller!

PS:

I am sure almost all of you would have read all these books. The intention is not to belittle or denounce these works or authors (well, except Carnegie, Hill and PealeJ). Rather it is to bring forth and understand the context more than the content. A simple letter change from ‘n’ to ‘x’ makes hell a lot of difference.

Happy reading!

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)