Last Updated on January 31, 2026 at 10:13 am

In this article, Avinash Luthria explains how even DIY investors can benefit from a discussion with a fee-only SEBI registered investment advisor (RIA). Avinash is a RIA himself and is part of my list of advisors and fee-only India Avinash presents a quiz for investors to assess their knowledge of finance and investing and goes on to discuss an insightful hypothetical exchange between an DIY investor and a RIA using structured products as an example.I respect Avinash’s realistic views on investment risk and reward and I especially agree with his point here. Even if you are a DIY investors, you can always discuss with a fee-only RIA to check if your ideas and plans are along the right track. You can read his previous guest articles here:

- Don’t waste your energy fighting the law of no-free-lunch. Instead, use it as a tool for thinking, to avoid mistakes and also minimize costs through index funds.

- Real returns, after-tax, across one’s entire portfolio and across one’s lifetime, will be in the ballpark of zero per cent This dramatically changes how one should invest and save.

If you wish to work with Avinash use the contact info at his website: Fiduciaries Avinash previously was a Private Equity & Venture Capital investor; His articles have appeared at Business Standard, Mint and The Ken. See: publications Views expressed here are of the author and do not reflect the views of freefincal.

DIY investors are likely to benefit from a discussion with an RIA

Such a discussion may address issues, answer questions or at least, provide a second opinion. “Will a Do-It-Yourself (DIY) investor benefit from engaging with a ‘Fee-Only Financial Planner & SEBI registered Investment Adviser’ (for brevity ‘RIA’)?”. Several of my potential / eventual clients have asked me that question. One could list various pros and cons of a particular DIY investor engaging with a particular RIA. Instead, in this article, let’s look at an illustration of one possible discussion between a DIY investor and an RIA.

DIY Investor = Temperament + Knowledge

Let’s start with, what is a ‘DIY investor’? Since the term has a very wide range of meanings, let’s put together one workable description.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Competence in personal finance is roughly a combination of (a) temperament for being relatively frugal, being proactive about fixing issues and for being a patient investor and (b) knowledge of personal finance and investing. Both aspects are difficult to measure.

An earlier article I had written provides guidelines for how much one should save for retirement. Assuming that your life is broadly in steady state, those guidelines allow you to determine whether you are relatively frugal or not.

Quiz about knowledge of personal finance & investing

Since it is difficult to assess one’s own knowledge of personal finance and investing, as a starting point, this is a brief quiz. You could run through this list of questions without reading up about or Googling any of the points and write down your ‘initial answers’:

- “Over the long-term, mid-cap stocks have been shown to generate higher returns than large-cap stocks. So, a majority of one’s equity allocation should be invested in a diversified set of mid-cap stocks through a mutual fund”. Point out and explain at least one flaw in this statement.

- “The BSE Sensex started on 1st April 1979 with a value of 100 and on 11th February 2019, it was at a value of around 36,395. So, the BSE Sensex has delivered an average pre-tax return of 15.93% per annum from its inception till 11th February 2019”. Identify and explain at least two flaws in this statement.

- “The average life expectancy in India is 68. So, assuming that my spouse and I plan to retire at 60, we can plan for 8 years of retirement”. Point out and explain at least four flaws in this statement.

- “If one holds a broad stock index for at least 10 years, then it will definitely outperform inflation”. Identify and explain at least one flaw in this statement.

- The ‘Four-percent rule’ (rule-of-thumb) about a sustainable withdrawal rate during retirement roughly states that “if you invest half your net worth in stocks and half in bonds and you withdraw 4% of your net worth during the first year of retirement and subsequently keep increasing the amount that you withdraw at the rate of inflation, then your corpus will almost definitely last at least 30 years”. Identify and explain at least three flaws in the ‘Four-percent rule’.

- “Moody’s had estimated that there is a 0.18% probability of a AAA-rated bond defaulting within 5 years (Source: Credit Rating (wikipedia) ). So, if one holds a bond which has been rated AAA by ICRA / CRISIL / Brickwork, then the probability of default within 5 years is in the ballpark of 0.18%”. Point out and explain at least two flaws in this statement.

- Two large listed companies in India, X & Z are identical in every way and also both have the same return on equity as the NSE NIFTY 50 index. X is expected to keep growing at 0% p.a. and Z is expected to keep growing at 4% p.a. Then, what should be the ratio of the Price-to-Book of Z to that of X and why?

You could do this after reading this article. After you have completed noting down your ‘initial answers’:

- In case you are unable to answer some question, please score it as 0

- Use Google to figure out your ‘revised answers’ which may or may not be the same as your ‘initial answers’. This research could require several days but let’s say that after a total of one hour of research, you do a time-out on it.

- Then let’s temporarily assume that your revised answers are correct (even though this may not be true). Let’s use these revised answers to score your initial answers. If required, you could give yourself half-marks or partial-marks.

- Your score of between 0 and 7 provides you an indicative sense of where you fit on the DIY investor spectrum

- If you scored 7, then go back and double check the ‘revised answers’. The questions have been selected to be a mix of easy and less-easy questions so that less than 1% of readers are likely to score a 7 on 7.

- I have not provided answers since each of those questions is a starting point for further study / research. And that is more useful than just being able to score yourself on such a short quiz where the results will not be robust.

Illustration of a discussion with an RIA

One of the objectives of the discussion between a client and an RIA is to identify one or two critical issue and identify feasible solutions to them e.g. are you taking too much risk. Or it might help to identify one or two important questions and to figure out workable answers to them e.g. should I voluntarily retire early. These issues or questions could be in the domain of saving or investing. Uncovering such critical issues or questions requires extensive discussions.

To provide a sense of the nature of discussions between a client who is somewhere on the spectrum of being a DIY investor and an RIA such as myself, I provide a hypothetical conversation below. This is one of a thousand different conversations which could take place. Also, for the sake of brevity, a lot of explanations and several important nuances have been skipped. So, this hypothetical conversation is only indicative:

RIA: By the end of our previous discussion last week, we came around to the view that the secondary reason that your net worth and annual savings is materially less than ideal is because various relatives keep facing problems and asking you for assistance. We also concluded that if things continue as-is, you would be materially short of savings seven years from now i.e. at the age of 60, when you are likely to retire. Also, neither of us were able to come up with any solutions other than saying no to almost all of those requests for assistance. Shall we move on from that point?

Client: Saying no to almost all of those requests will make me feel terrible but not doing so may result in a big problem in the future. So, I will discuss it with my spouse and will try to implement it. We can move on.

RIA: Around Rs 1.25 cr, which is around 25% of your net worth is in various complex products, particularly Structured Products which you had prior to starting this engagement. So, it may be useful to discuss Structured Products. Shall we do that?

Client: Ok

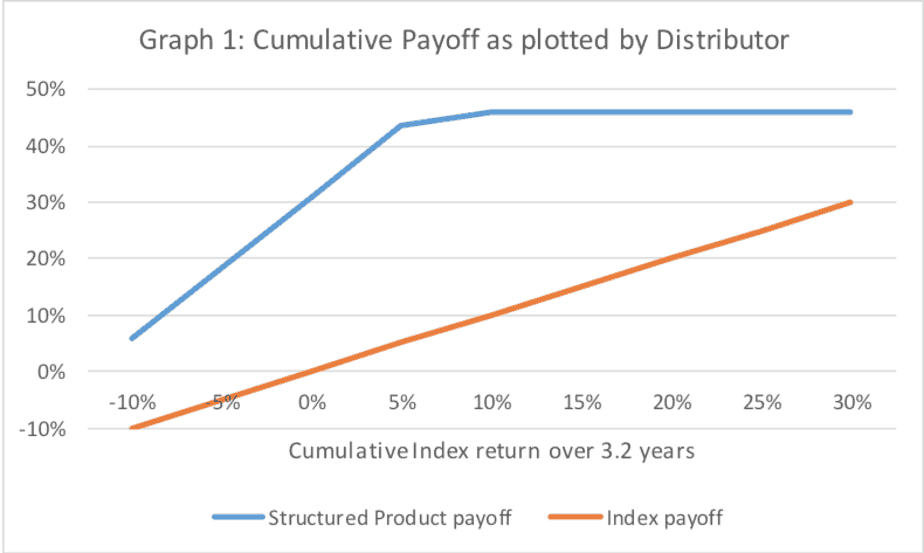

RIA: To make the discussion more tangible, let’s look at one of the products that your earlier distributor of financial products had classified as a ‘Debt Structure’ (i.e. Debt Investment), the product ‘[Name of NBFC] Protected Call – Number xxx’. (Note for readers: The illustration is of an actual Structured Product but the name of the product has been redacted. Since this product is just like many other structured products, there is no reason to single out this particular product or NBFC). The product was sold as a way to do better than the index in good times and bad. Let’s get into some of the details. The description of this product that matures 3.2 years from the date of purchase refers to the cumulative payoff and says that “1. For Final NIFTY levels at or above 106% of Initial NIFTY, the product offers a flat coupon of 46%. 2. For NIFTY levels below 106% of Initial NIFTY level, starting from the coupon of 46%, first the coupon erodes by 2.5 times the NIFTY performance, after which the Principal starts eroding by 2.5 times the NIFTY performance”. Graph 1 is the Cumulative Payoff i.e. the cumulative return over 3.2 years that has been provided to you by your earlier distributor:

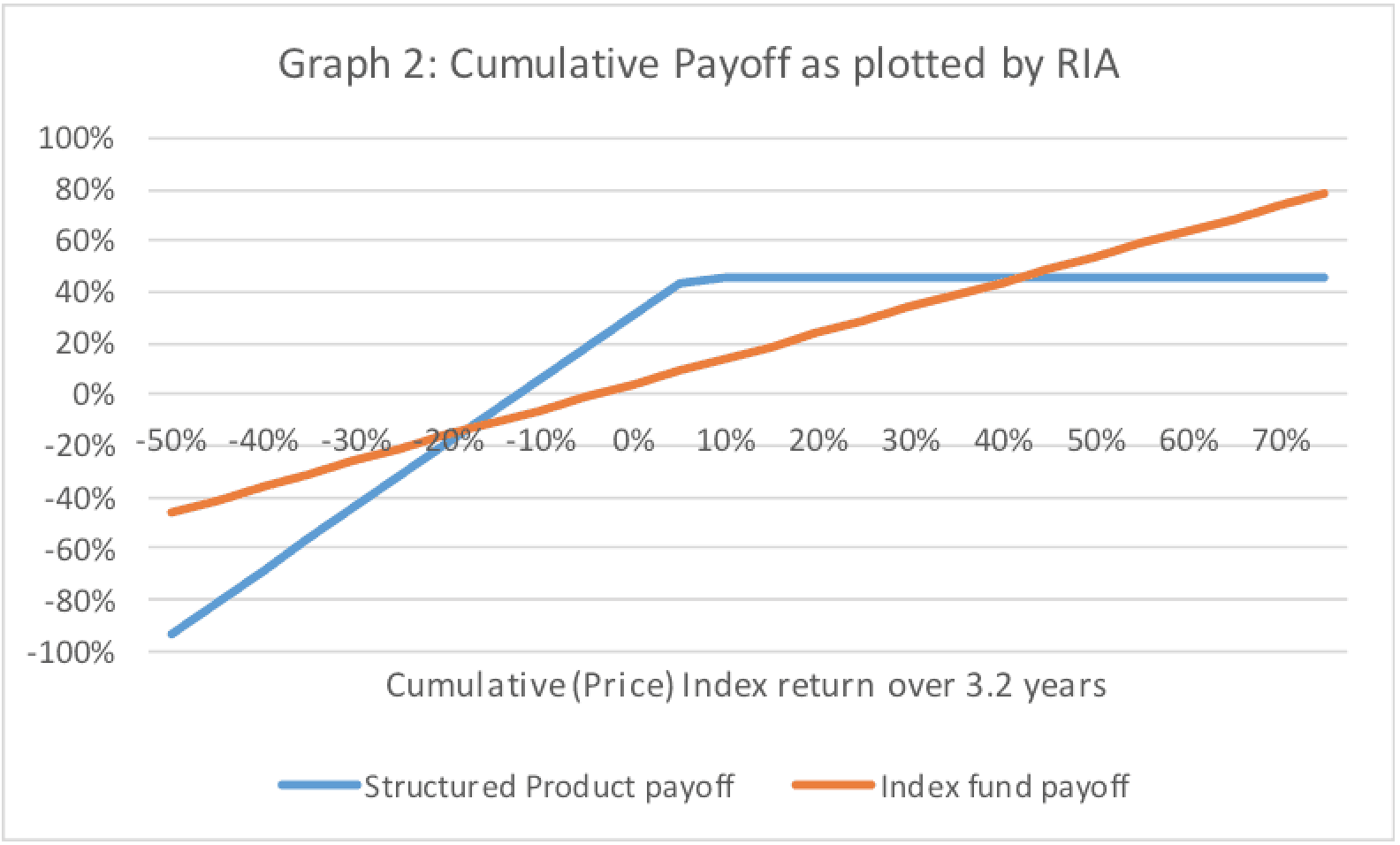

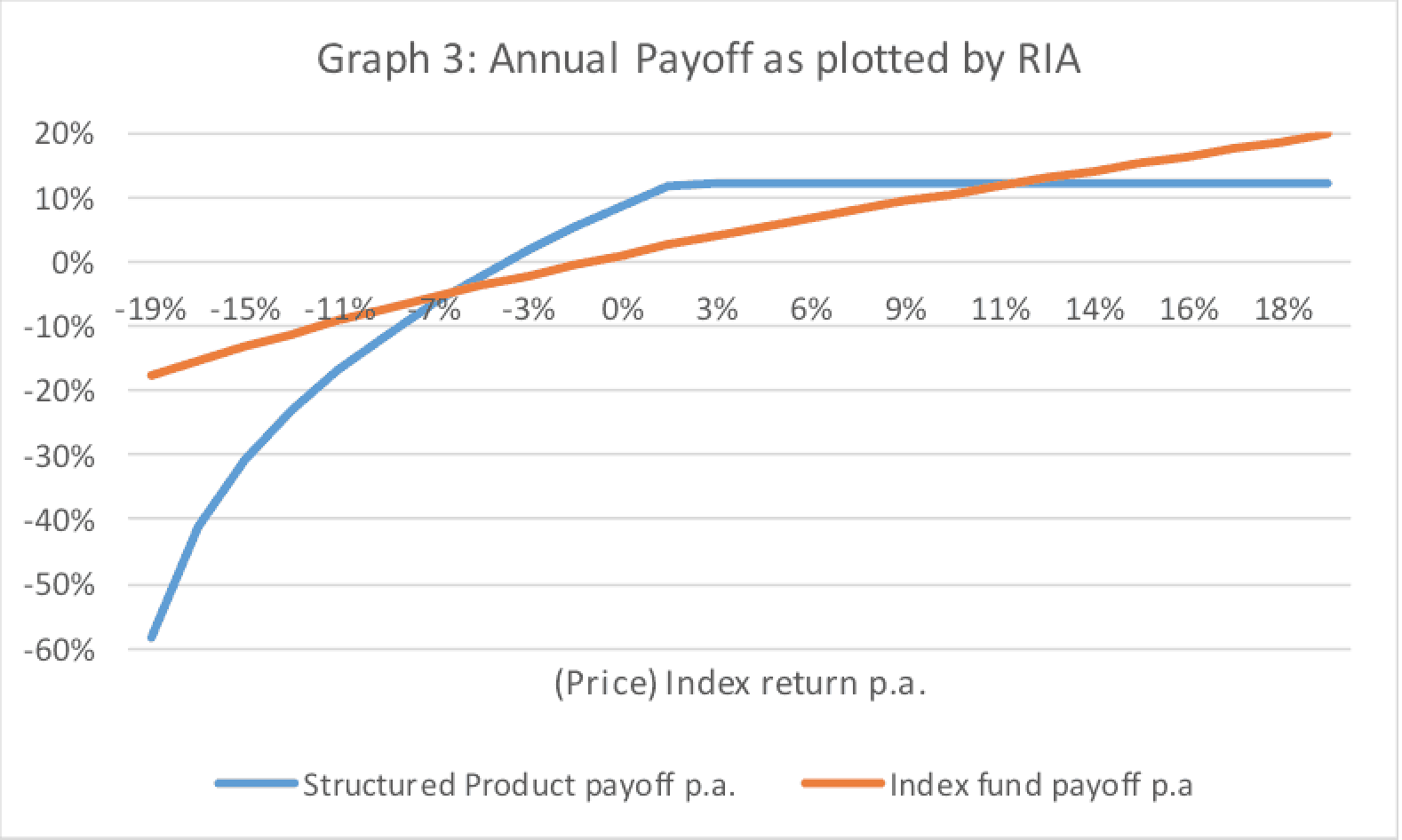

RIA: I have plotted Graphs 2 & 3. The primary difference in them is that I have extended the range on the X-axis in both positive and negatives directions. Secondarily, I have also plotted the performance of an index fund (where the performance is linked to the Total Return Index, not the Price Index). For convenience, I have plotted the cumulative payoff over 3.2 years (Graph 2) and also the annual payoff (Graph 3).

RIA: Graphs 2 & 3 indicate that in the majority of cases, the Structured Product will do better than an index fund. But in a minority of cases, the index fund will do better. Also, in a small minority of cases, almost the entire investment in the Structured Product will be wiped out. The left-most point in Graphs 2 & 3 (but it is clearer in Graph 2) is a relatively extreme case when over the 3.2 years, the price index has cumulatively lost 50% and the structured product has cumulatively lost 94% of its value. Also, one has to take the risk of the issuer of the Structured Product i.e. the NBFC defaulting on its commitment to repay this Non-Convertible Debenture (NCD). Lastly, none of these Graphs factor in the commission of 3% that would have been deducted to be paid to the distributor which is a sister concern of the NBFC etc. So, in some ways, this product is more risky than the index fund. Another way to think of this product is that there would be a fair number of investors who would want to take the opposite side of this trade i.e. to underperform under normal circumstances but when all one’s other investments are doing badly, to have an investment that does well and partially compensates for the losses from other investments… (the rest of the discussion has been skipped for the sake of brevity)

Client: Ok, I get your point that for my future investments, it would be best to avoid all Structured Products.

RIA: Yes. Also, as we discussed in an earlier session, you don’t have much buffer in your net worth. So, in general, it would be good to minimize all new such complex and high-fee ‘experimental investments’ (including but not limited to Structured Products). Now let’s factor in your feedback that you would like to continue to experiment at least to a limited extent. Combining both constraints, as a first step, these experimental investments should ideally reduce to not more than 10% of your net worth. Subsequently, at that point in time, you could re-evaluate whether to further bring down the allocation. To clarify, since there is very little buffer in the net worth, I prefer a 0% allocation to such experimental investments, but you could take it one step at a time… (end of illustration of a discussion).

——

For a DIY investor, a discussion with an RIA may help to identify critical issues that can hurt the client’s net worth. Or it may help to identify and address important questions. In the unlikely event that no such important points can be identified, then at the very least it may help to provide the client with a second opinion.

As mentioned above, you can contact Avinash via his website: Fiduciaries

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)