Last Updated on December 29, 2021 at 5:36 pm

This is a review of Edelweiss Mid Cap Fund that hopefully serves to illustrate why investors should not ignore past changes to a fund and need to study past fund factsheets and not go by current star ratings.

According to Value Research (VR), Edelweiss Mid Cap Fund Direct Plan has a four-star rating (June 2020). Those who have read the star rating methodology would recognise that a rating is given to a fund only if it has a history of at least three years. However, that alone is not enough. The fund portfolio must have been homogenous over this period or longer.

That is, there is little point in rating a large cap fund that suddenly became a midcap fund after a year. The SEBI categorization rules (early 2018) changed the fundamental attribute of most mutual funds. VR claimed they have retained the star ratings only for those funds that did not change type. However, that is not the case as shown here several times before. See for example SBI Focused Equity Fund Review

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Fund History: Like most funds, Edelweiss Mid Cap Fund has a colourful past. It is always important to consider the changes in the nature of a fund in the past before crunching NAV data. An easy way to do this would be to search for “fund name change in a fundamental attribute” and follow the results.

Another would be to randomly download AMC factsheets and look for changes in fund names and attributes. Funds typically mention such dates in the factsheet. As on June 2013, the oldest factsheet available online the AMC has a fund called Edelweiss Select Midcap Fund.

Investment objective: “The primary investment objective of the Scheme is to generate long term capital appreciation from a portfolio predominantly comprising of equity and equity-related securities of MidCap Companies”. Benchmark: S&P BSE Midcap Index.

From Aug 2015, the fund was renamed as Edelweiss Emerging Leaders Fund and the objective modified to, “The primary investment objective of the scheme is to generate capital appreciation from a diversified equity portfolio predominantly comprising of equity and equity-related securities of mid and small cap companies.” Benchmark: CNX Midcap Index.

Then JP Morgan sold out to Edelweiss. From Nov 2016, Edelweiss Emerging Leaders Fund was merged with JPMorgan India Mid and Small Cap Fund and renamed as Edelweiss Mid and Small Cap Fund! Benchmark: Meanwhile NSE went through changes of its own and the benchmark became Nifty Free Float Midcap 100!

The investment objective became: to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity-related securities focused on smaller companies. Generally, the universe will be the companies constituting the bottom fourth by way of the market capitalization of stocks listed on the NSE or the BSE. The fund manager may from time to time include other equity and equity-related securities outside the universe to achieve optimal portfolio construction.

Then came the SEBI regulations and surprise, surprise! Another name change, another change in objective. From March 28th 2018, the fund became Edelweiss Mid Cap Fund and will have to hold 65% of mid cap stocks.

Edelweiss started this fund in August 2011, but because of the scheme merger with an older fund, today the inception date is listed as Dec 2007! Please take some time to study the history of a fund before calculating returns and other metrics.

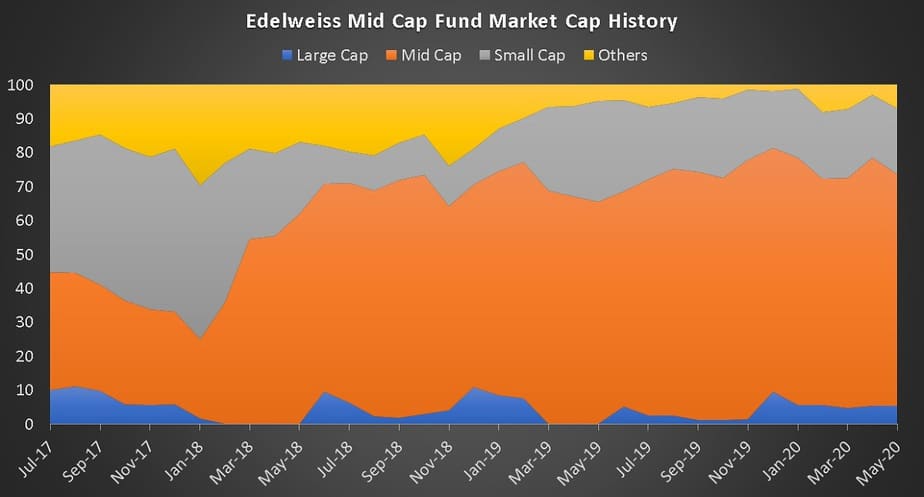

Once you get into the history of a fund, the last 3Y, 5Y, etc returns make no sense. The fund has been a mid cap fund for only the last two years as is evident from the market cap history.

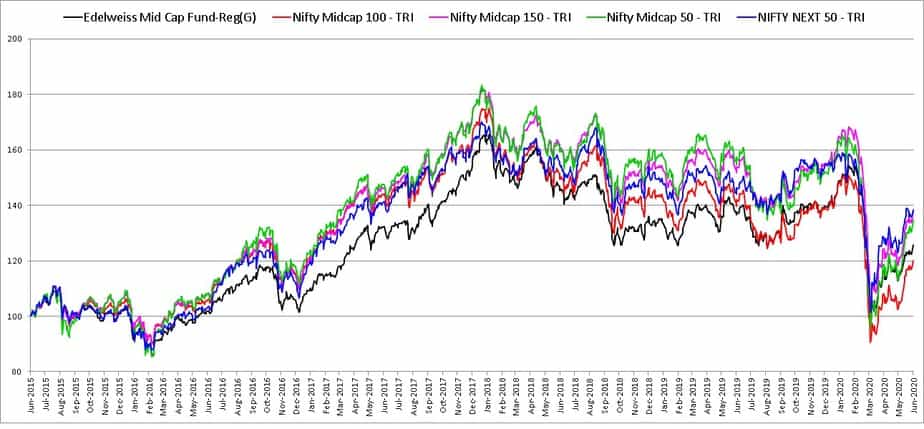

For what it is worth, the fund has not done well over the past five years even though the small cap allocation was reduced just as small cap indices began their slide. The fund is the black line at the bottom of the pack.

This the performance over the last two years when the fund has operated as a mid cap fund.

| Name Duration | 1 Y | 2Y |

| Edelweiss Mid Cap Fund(G)-Direct Plan | -6.6 | -5.4 |

| Nifty Midcap 100 – TRI | -14.0 | -9.8 |

This is quite good. Let us consider the pros and cons of investing in Edelweiss Mid Cap Fund. Cons: lack of history, the expense ratio (0.68%) is high for AUM of 780 Crores. There are less expensive more popular alternatives like Axis Midcap fund (review link) 0.56% or Kotak Emerging Equity (review link), 0.63% or the new kid on the block, Mirae Asset Midcap Fund, 0.48% (all nos as of June 2020 and subject to upward revision when the AUM increases or decreases!!).

Pros: AUM growth unlikely to be as high as the above-mentioned funds when the market starts to move up (yes most investors get in at the wrong time and repent later). So this might one of those “quiet funds”. If your expectations are not too high and if you do not mind a “new fund” then you consider Edelweiss Mid Cap Fund.

Please take some time to dig through old factsheets of your funds. There could be a few surprises buried in the closet!

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)