Last Updated on October 1, 2023 at 5:39 pm

This is a step by step guide to e-file AY 2020-2120 (FY 2019-20) income tax returns using forms ITR2, ITR3 and ITR5. This is an updated version of the second part of a guest post by Aparna C K. She describes LTCG, STCG, carry forward and income from other sources sections of ITR-2 and ITR-3 and ITR-5 utilities. Please do share this post with people who are yet to file their returns.

Know which ITR you are supposed to file.

| ITR | Description |

| ITR 1 | For individuals being a resident other than not ordinarily resident having Income from Salaries, one house property, other sources (Interest etc.) Agricultural Income up to Rs 5000 and having total income upto Rs.50 lakh Salaried with no capital gains use this |

| ITR 2 | For Individuals and HUFs not having income from profits and gains of business or profession If are salaried with capital gains, this is the one for you |

| ITR 3 | For individuals and HUFs having income from profits and gains of business or profession |

| ITR 4 | For presumptive income from Business & Profession |

| ITR 5 | For persons other than:- (i) Individual, (ii) HUF, (iii) Company and (iv) Person filing Form ITR-7 |

| ITR 6 | For Companies other than companies claiming exemption under section 11 |

| ITR 7 | For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or |

For full details and explanation refer to Which ITR Form Should I use for A.Y. 2020-21?

a)If you have an income from just salary, house property and bank deposits (Savings, FD, RD, Flexi RD), it is ITR1 (total income up to 50 L)

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

b)If you have income specified in a) and income from selling Real Estate, Stocks, Mutual fund units, derivatives, gold etc, or you have withdrawn EPF/PPF, it is ITR2 (individual or HUF with no business income)

If in addition to the above, you (or HUF) have income from a business or proprietorship, ITR3

e) For people having a presumptive business, it is ITR4 (no capital gains allowed)

For all others, it is ITR5 (other than an individual)

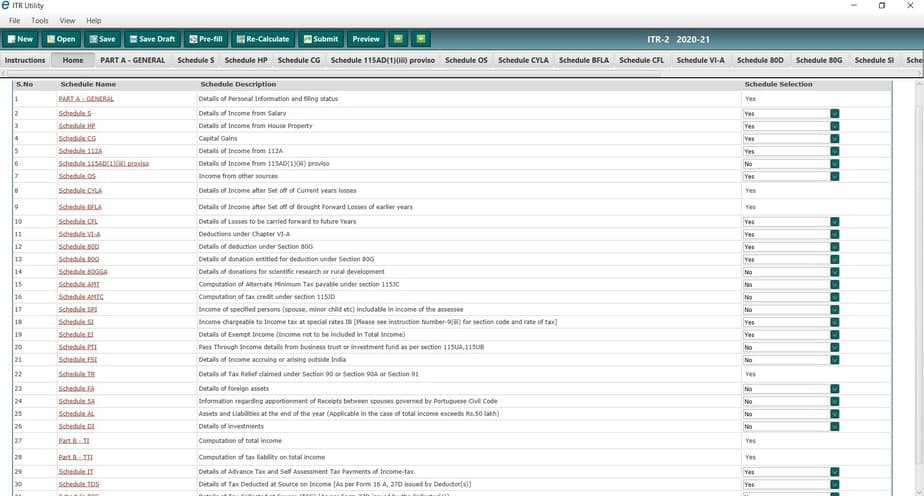

Which schedules to use

ITR2 comes with multiple schedules (forms). For a resident Indian, the typical forms needed are:

==================

The most confusing part apparently is Schedule CG.

Capital Gains are broadly categorised into

A. Short Term Capital Gains (STCG) and

B. Long Term Capital Gains (LTCG).

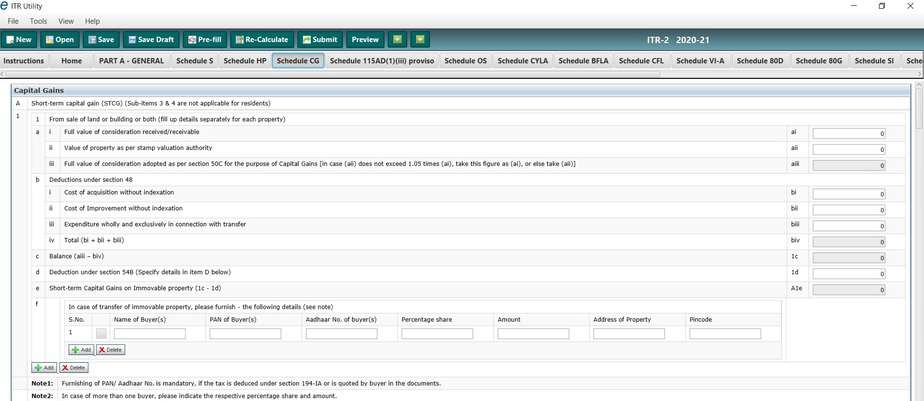

Their definition depends on asset classes. Hence we will take up one by one as in the points in the ITR tab. The picture shows how the Java utility looks like. As and when you fill it up, please click on “Save Draft” on top.

A. STCG

A1. From the sale of land/building: If a real estate asset is sold within 2 years of acquisition, there are two things. Firstly, you do not get indexation benefit (cost adjusted to account for inflation) and absolute numbers will be considered. Secondly, you will be taxed as per your tax slab.

- Enter the amount you received in ai.

- Enter the “government guideline value” (as it is commonly termed as) in aii.

- If aii is greater than ai, aii should be entered in aiii, else ai to be entered. For a full understanding of this, read this

Coming to deductions under section 48,

- Enter the purchase value in bi, as per the sale deed, including all the legal expenses and interest paid on loan etc.

- Cost of improvement, if it can be shown with documents in bii.

- The cost involved exclusively (like a broker or legal fee), while selling, again, only if you have supporting documents, in biii

- Deduction under 54B can be claimed in case of Agricultural land only.

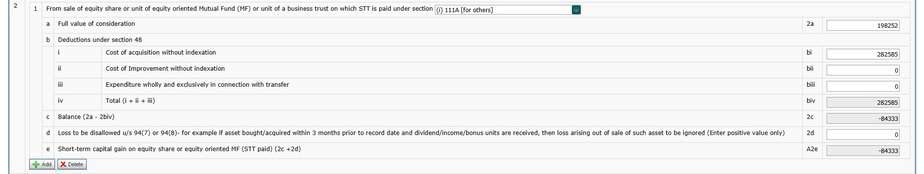

A2. Equity shares or Equity Mutual fund units on which STT is paid (normally this is the case): If sold within a year of purchase, it is considered STCG. For equity, it is a special rate of 15%, it will be taken care of by the tool.

- Enter the entire sale value in a.

- Enter the cost of purchase, including brokerage if any, in bi

- I don’t think the cost of the improvement is applicable in this case.

- Enter brokerage value if applicable in biii.

- Please ponder over d. If you sell and buy back units for the purpose of setting off the gain and within 3 months you receive additional units, then some portion of the loss is not considered for set off.

- Section 3 is skipped, as it is not applicable to Resident Individuals.

- Section 4 is skipped for the same reason as 3.

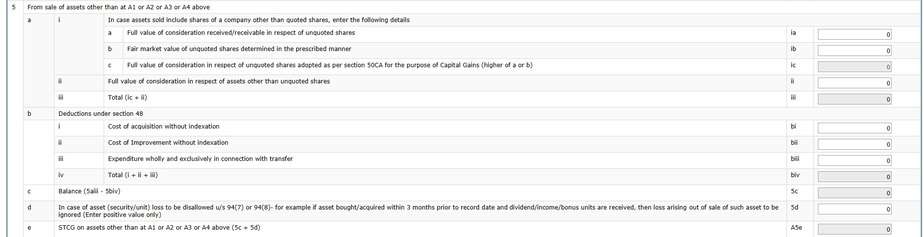

A5. Assets other than 1,2,3,4: Other asset classes like Debt Mutual funds, Gold ETFs, NCDs or tax-free bonds, if sold within 3 years of purchase and Physical gold/e-Gold, if sold within 3 years of purchase. Follow the same steps as above.

B. LTCG

Before looking at the various asset classes, let us understand what is indexation. Every year the govt of India publishes various inflation-related numbers. List of inflation numbers published for computing LTCG, which is called Cost Inflation Index (CII) can be found here. This is how the numbers with indexations are computed.

Cost of purchase with indexation = Actual purchase value * CII of the year of transfer / CII of the year of purchase. – B(1)

Cost of improvement with indexation = Actual cost of improvement * CII of the year of transfer / CII of year of improvement – B(2)

Any other cost should be computed similarly.

LTCG (computed by the tool) = Full value of consideration – Cost of purchase with indexation – Cost of improvement with indexation – Cost involved in the transfer

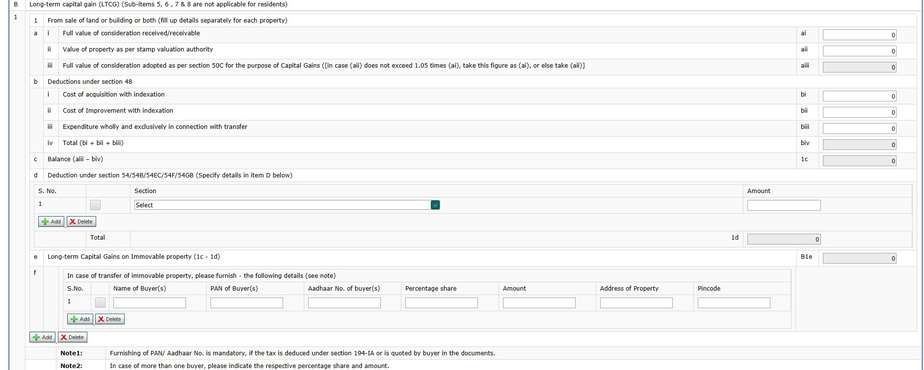

B1. Sale of Real Estate after 3 years:

- Enter the values from ai to aiii as described in the point 1 of A STCG.

- bi to biii is different from that of A, because here indexation benefits are available. Hence compute bi and bii according to B(1) and B(2).

- Exemptions are available under many variants of section 54. On a simple note, if it is agricultural land, it comes under section 54B. Otherwise, if you reinvest the gains in another house(54)/property(54F) or recognized bonds(54EC), the amount re-invested is subtracted from the net effective gains (not the absolute gains, indexed gains). Some FAQs answered here, and it is tabulated in the end of that page.

- Enter the amount invested under the options available under variants of 54.

- Remaining gains are taxed at 20%.

B2. For bonds/debentures (not listed) etc sold after a year: Indexation benefits are not available and they are taxed at a flat rate of 20%. The deduction is available if the gains are re-invested under 54EC/54F.

B3. For listed securities, like tax-free bonds, NCDs etc sold after a year: Same as 2 above except that they are taxed at a flat rate of 10%.

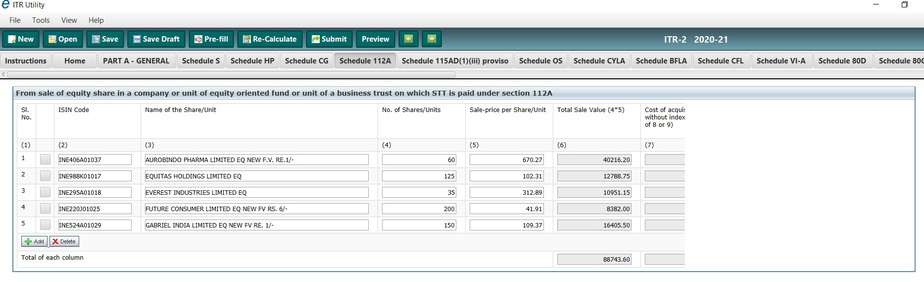

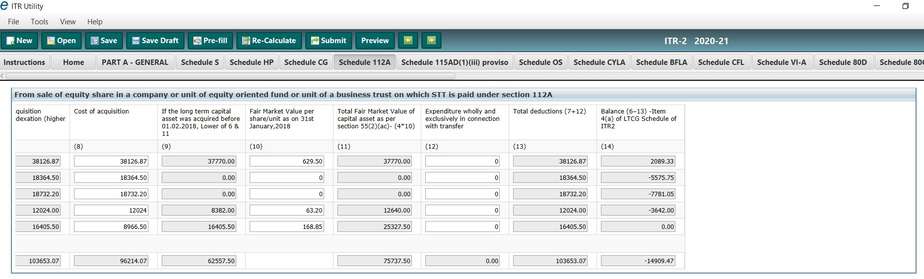

B4. For the sale of stocks and equity-oriented mutual funds.

The details here are auto-filled from the Schedule 112A. You will have to enter the scrip-wise details for all shares/mutual funds sold by you after holding for a year in Schedule 112A.

Most of the details to be entered in Schedule 112A is self-explanatory as can be seen in the screenshots. Cost of acquisition is to be entered at (8). You need to know the value as on 31-1-2018. This is the “fair market value” according to section 55(2)(ac) and is to be entered at (10). If you bought the share after 31-1-2018, you can enter zero at (10). Brokerage & other charges paid can be entered at (12).

The gain up to Jan 31st 2018 is tax-free. LTCG up to Rs 1 lakh is also exempt from tax. Other examples of LTCG calculation can be found here: Long Term Capital Gains Taxation from Equity: Examples (Budget 2018-2019) A video version is also available.

Schedule 115AD(1)(iii) is applicable to Non-Residents. For AY 2019-20, taxpayers had an option to either enter the Scrip wise details of long term capital gains in Schedule 112A and 115AD(1)(iii) so that the correct values are populated in the CG Schedule or enter the self-calculated aggregate value of long term capital gains directly under respective items in schedule CG in terms with Sec 112A or 115AD(1)(iii) without entering scrip wise details. However, this option is not available this year and Sec 112A or 115AD(1)(iii) is to be filled compulsorily.

B5,6,7,8. is skipped, as it is not applicable to Resident Individuals

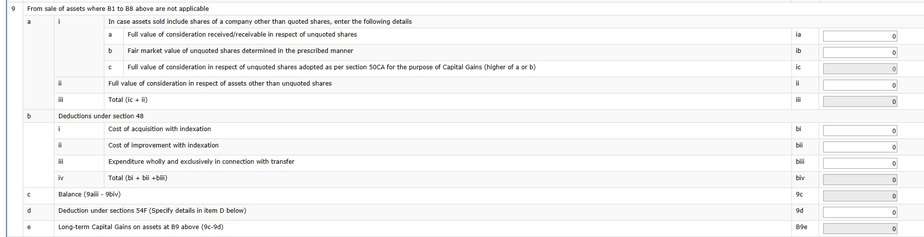

B9. For items not covered so far: For example, Debt funds, Gold ETFs sold after one year or physical gold/e-Gold sold after 3 years come under this category. You need to enter purchase value with indexation as per B(1). The system will take min (tax at 20% on gains with indexation benefit, tax at 10% on absolute gains) for the MFs/ETFs. For Physical gold/e-Gold, it will take 20% with indexation benefit.

B10,11,12 is skipped as it not relevant for a common taxpayer

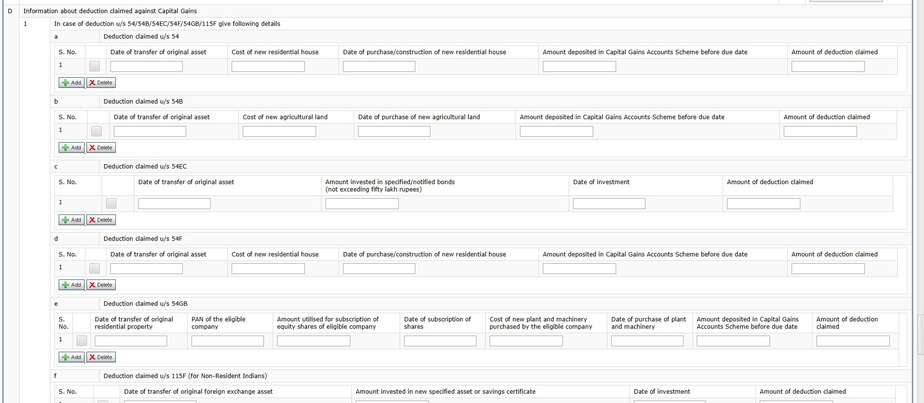

D. LTCG under 54/54b/54ec/54f/54GB/115F See more about this here

Please note that tax rates are mentioned above for understanding purposes, if all the numbers are entered correctly, the utility would correctly calculate the tax at applicable rates and set off against losses, wherever possible. It does not matter what is the source of gains/losses, as long as it is from a source whose gains are taxable.

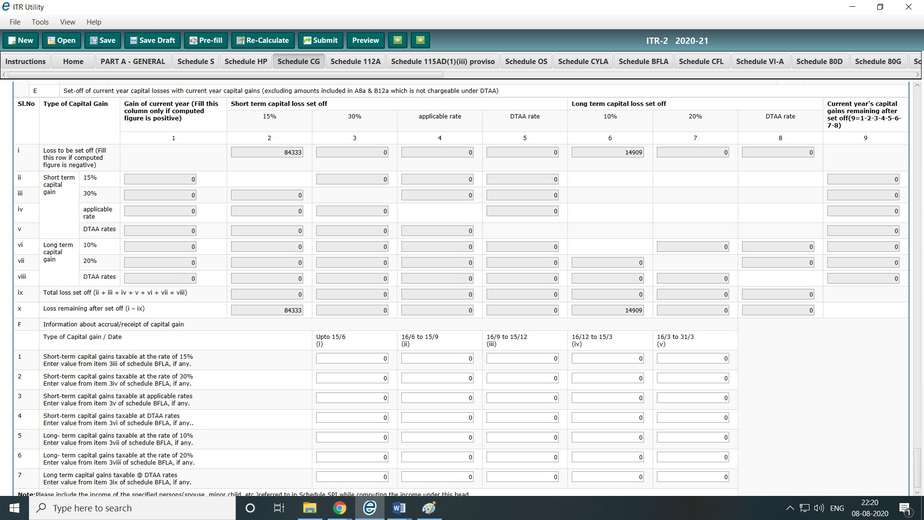

E. This section deals with setting short-term and long-term capital loss set off

Notes on capital gains set off:

1) STCL can be set off against STCG or LTCG.

2) LTCL can be set off against LTCG only.

3) In case LTCL is from equity and equity-oriented MF, the LTCL cannot be set off, because LTCG from equity is not taxable. It is only fair that when the entire gains are ignored by taxman, the loss is also ignored.

For a detailed account on this, please refer to this.

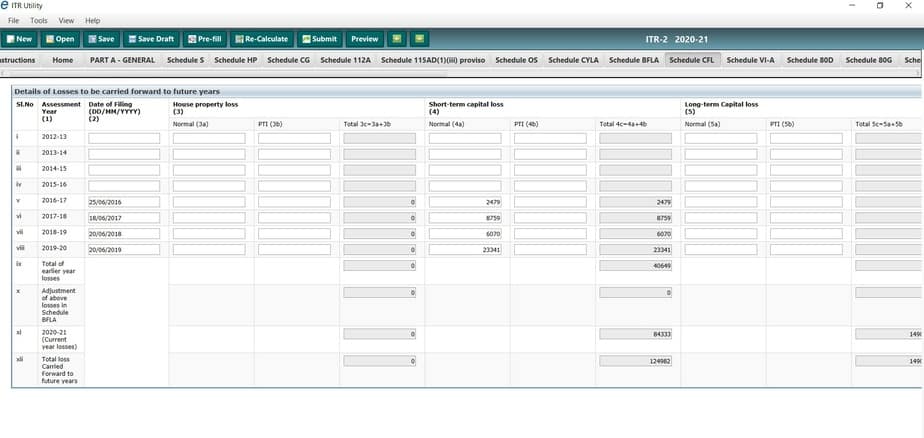

Now go to schedule CFL, and fill the losses from earlier years

Schedule CFL: Carry forward of losses

The AY shown start from 2012-13 for AY 2020-21. Some example entries are filled in the screenshot for reference.

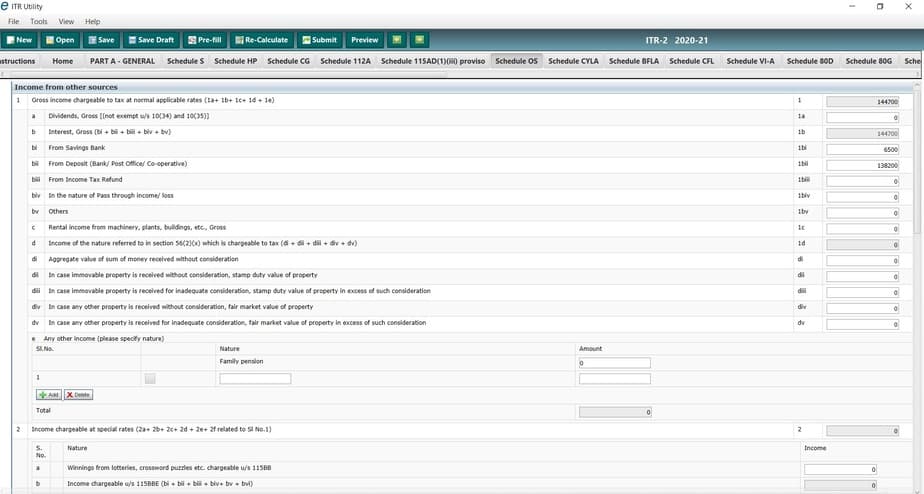

Schedule OS: Income from Other sources

Income:

- dividend: Taxable dividend from any entity other than domestic companies/MFs. Eg.: Dividend received from a Co-operative bank or a foreign company. (Thanks to Sundaram Anathakrishnan for pointing this out).

- Interest: This is gross of total Savings bank interest (to be shown as exempt under 80TTA of chapter VI A up to 10000), FD and RD accrued interest, interest on EPF member contribution (if withdrawn before 5 years), interest on money lent to non-close-relatives, interest on NCDs and bonds.

- Rental income from assets other than house property, because house property is covered in detail under Schedule HP.

- Others: Can be several sources as shown in the drop-down in the figure. One common thing is the member contribution component of EPF. Note here that you should not enter the full amount here, but just the taxable portion of the member contribution amount. The detailed note is presented under the section on Schedule SI below. Another common thing is if you opted to withdraw the EPS amount instead of getting a service certificate. This is possible if you were in service for less than 10 years. This amount should be entered as “Others” in the drop-down shown above. It will be taxed according to your tax slab.

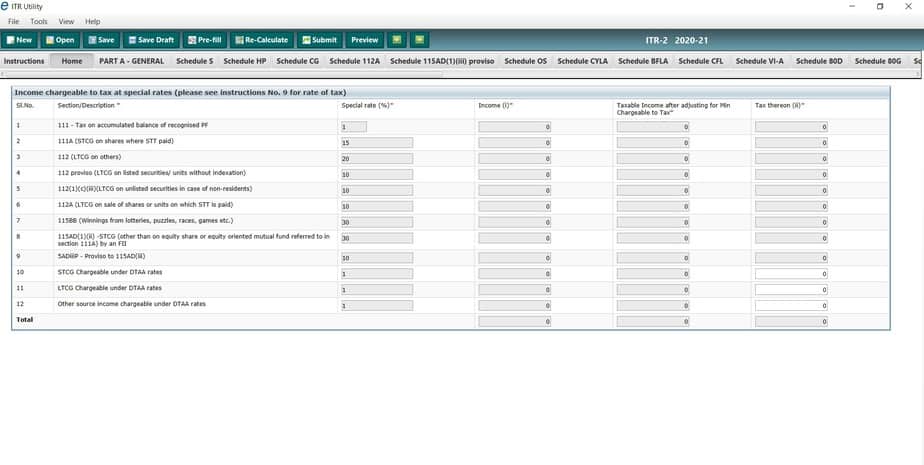

Schedule SI: Special rates

1. Tax on accumulated balance on recognised PF: When EPF is withdrawn before 5 years, it is taxed retrospectively. The company contribution and interest on that come under the head salaries of the year in which it is withdrawn, i.e. this year and to be entered in Schedule S tab. The member component (not the interest) comes under accumulated balance and it has to be taxed at the applicable tax rates of respective years. I think many options are provided (not just 10,20,30) so that the closest value can be chosen on the whole amount, in case the individual was on different slabs in the previous years. Also, in the last column here, one needs to enter the tax amount too, which is approximately equal to the tax rate * balance accumulated. Now the interest portion of the member contribution is added to the income under other sources in Schedule OS and taxed at the applicable tax rate of this year.

2 to 8: Please cross verify entries in the greyed portion.

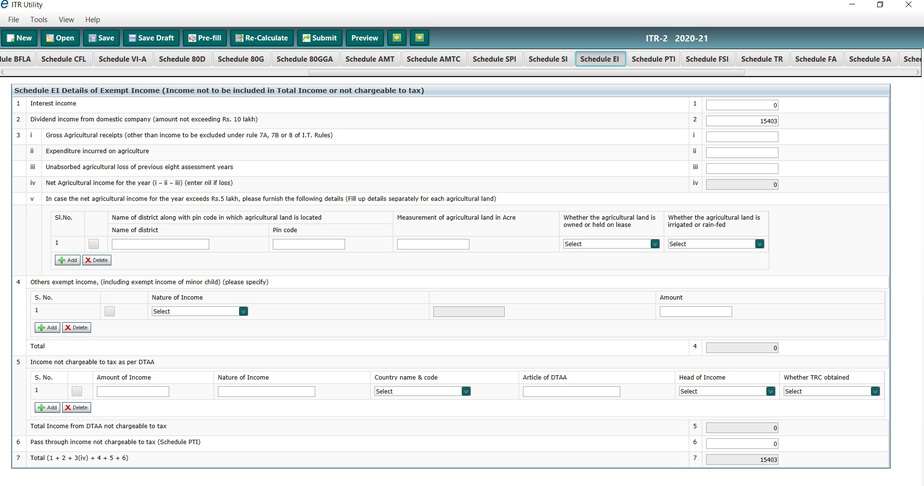

Schedule EI: Exempted income

- Interest: For example, interest from tax-free bonds, or interest portion of PPF/EPF if matured and withdrawn. EPF is not taxable only if withdrawn after 5 years of continuous service, and it is illegal to withdraw during a job change. Please do not enter Savings bank account’s interest here. It should be entered in 80TTA.

- Dividend: Dividend from equity shares or MF units held (Debt/Equity)

- Income from Agricultural land

- There can be several sources under this, and the total of all of it needs to be entered.

- Interest income up to 1500 on the deposit in the name of the minor child.

- If entire EPF corpus is withdrawn before the completion of 5 years, member contribution of EPF to the extent of other investments contributing to 80C. For example, say this year, you made about 1.25L investments which come under eligible options of 80C, of which 30L was to EPF, then only 5L out of your contribution is taxable, and 25L can be entered in point 5 of schedule EI. This is true for all the previous years’ member contribution. In summary, the taxable portion of member contribution of all the years should be added together and entered in 1d of Schedule OS and the non-taxable amount of all the years should be added and entered in point 5 of Schedule EI.

Schedule IT and Schedule TDS: Schedule TDS is similar to that of ITR-1. But unlike in ITR-1, there is a separate Schedule IT to enter Advance tax paid and Self-assessment tax.

Tabs Part – B TI and Part B TTI: Since ITR-2 onwards, there are a number of components to consider, these two tabs are exclusively kept for total income and tax on total income respectively. Bank details and refund, if any will appear in TTI. TTI tab is similar to “Taxes Paid and Verification” tab of ITR-1. One has to verify details here and submit.

My apologies for not covering Schedule HP, because I don’t have own house/home loan and hence I do not want to copy-paste from somewhere.

A note on ITR-5: It is a superset containing ITR-2, ITR-3 (Schedule IF for example) tabs and a few more tabs, Nature of Business, Balance Sheet, P & L, OI, QD and many more, but only a few are covered in this blog for brevity and due to lack of time. I am an engineer who started working on contract after I quit my company job. Hence I come under the self-employed professional category. Mine was relatively easier compared to how complicated it would get if most tabs in ITR-5 are applicable. Hence I think I am not qualified enough to write on entire ITR-5. I will summarise what I learnt in the following paragraphs.

Self-employed people are not eligible for many benefits, especially the absence of HRA component increases tax liability. There is a section 80GG, under which one can avail maximum 2000 rupees per month. If you are having a business other than profession where you provide employment, you can claim many items as in P & L sheet as expenses (if you have receipts), and tax is computed after deducting these. An individual can only claim a few things like telephone connection, petrol, the internet if they are in an individual’s name and ideally, paid by own account and not from a spouse’s account.

Taxation: For professionals, the company which took them on contract cuts TDS at 10% and issues Form 16A instead of Form 16. Hence if the total taxable income crosses 10%, the individual has to pay advance tax every quarter of the financial year. Defaults can be paid as Self-assessment tax along with the interest. For self-employed businessmen, no TDS portion, they need to estimate the income and pay advance tax every quarter. Finally, during the ITR filing, they will claim the refund in case of excess tax paid.

This pretty much covers what I know and I will be happy to answer the questions on topics covered here.

==================

I would like to thank Aparna for her extraordinary effort in preparing this guide and Anjesh Bharathiya for updating it

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)