Last Updated on December 29, 2021 at 6:01 pm

In the seventh edition of personal finance audits by readers, we meet 30-year old Rohit whose early struggles led him, to start investing early in a goal-based manner.

As regular readers may be aware, we publish a personal financial audit each December – this is the 2020 edition: How my retirement portfolio performed in 2020. This time, we asked regular readers to share how they review their investments and track financial goals.

- First audit: How Suhas tracks his MF investments and reviews financial goals.

- Second audit: How Avadhoot Joshi evaluates his investment portfolio.

- Third audit: How a single mom is on track to financial freedom

- Fourth audit: How Gowtham started goal-based investing & took control of his money

- Fifth audit: Why my financial independence & early retirement plans were postponed by four years

- Sixth Audit: How Abhisek funded his marriage & is on track to financial freedom.

- Seventh audit: The present one.

- These published audits have had a compounding effect on readers. If you would like to contribute to the DIY community in this manner, send your audits to freefincal AT Gmail.

Over to Rohit: Excited to write my portfolio audit. Thanks to Pattu sir for the opportunity. I am a software engineer by profession, and my hobbies are programming, reading (fiction to learn life better, non-fiction to understand the business better), watching movies (and TV series, still favour movies over TV series), sports (play cricket, football and watch the two + tennis), and personal finance and investing.

I was lucky to start a little early with my investment journey. In hindsight, I feel that this was driven mostly by the following reasons:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Lower middle-class childhood, where we struggled a lot with cash flow and all emergencies were handled by borrowing money.

Learnings from repayment of education loan for my B. Tech first, followed by contributing to sisters marriage and brothers education

Handling a medical emergency for my father early in my career, with an expense of 1.5 lakhs

In Pattu sir’s words, my rear end has almost always been on fire. And I think the only fire extinguisher that would have worked was and is, above-average income and money management skills.

Thanks to a lot of luck, hard work, and God’s grace, I started with a decent income and almost immediately started with repayment towards my education loan. A couple of years later (January 2016), when the loan neared its close, started my investing journey.

Few things I did right since the beginning:

Started with direct plans of mutual funds, never had any regular plans.

Avoided ULIPs and LIC policies

Even though I started in late 2015-early 2016, mid/small caps were never a big part of the portfolio, even though they were all the rage at the time. I remember learning from office colleagues when DSP Micro Cap (now DSP Small Cap) was there favourite.

I think these little things, along with stumbling upon Freefincal and then AIFW, helped me avoid a lot of trouble as I went ahead in my journey. Looking back, it’s almost unbelievable that I did these right.

Insurance

Health Insurance: I have HDFC Ergo Optima Restore (previously Apollo Munich Optima Restore) with a base cover of 10 lakhs (5 years old, thankfully no claims so far). And an HDFC Medisure Super Top policy with a cover of 25 lakhs.

I also have an employer-provided cover of 5 lakhs. Since parents are added in this policy with pre-existing diseases covered, I plan to use it for them. This came in handy a couple of months back when father caught an infection (non-covid) and 7-day treatment cost nearly 2 lakhs. Insurance paid 1.7 lakhs, and I paid 30k.

Term Insurance: I have a 1 crore Term Insurance from HDFC which was bought 5 years ago when I used to think ‘Oh, 1 crore is such a big amount’. This needs a revisit.

Emergency Fund: I have 6 months worth of emergency expenses in Savings Account + Liquid funds. Since I have decent amounts in debt funds available for access, I don’t overthink this.

My Portfolio

Equity: Equity exposure is via active mutual funds. I have recently started building a stock portfolio for myself after getting inspired by Pattu and Subra’s efforts (I find Subra’s YouTube videos on direct equity to be genuine and practical. Please take a look if you have not already. I assume that since you are reading this on Freefincal, you already watch Pattu sir’s videos 🙂 )

Debt: Debt exposure is with debt funds (liquid, money market and low duration categories as of now) and PPF. Debt funds have the largest proportion in my debt portfolio, so I have a decently sized liquid debt allocation as of now. EPF allocation is minimal as I skipped EPF contributions for the first 3 years when provided the choice, and for the past 3.5 years, have been contributing Rs 1800 per month (EPF min contribution) towards it.

Goals

- Decided asset allocation for Long term goals – 50:50 (equity:debt)

- Decided asset allocation for short term goals – 0:100 (equity:debt)

- For short term goals, I follow 100% debt allocation.

Marriage

Yes, I am unmarried, reaching 30 now and think it’s time to pay heed to MacKenzie MacHale’s advice to Jim Harper (“Gather ye rosebuds while ye may”, The Newsroom)

Most of the money is in place for this goal and will supplement the rest of it over the next 3 months from salary.

Car

I don’t own a car. Will buy a car for my parents in next 1 year. Have reached 50% of the target amount. Since this is a flexible goal, I will increasingly build a corpus over the next few months. Will be able to supplement with debt fund holdings if required.

Long Term Goals

Retirement

For this long term goal, I have decided to use 50:50 (equity: debt) asset allocation.

This was 36:64 till Feb 2020, but 55:45 in Dec 2020, thanks to diverting money from debt funds and cash to equity over the months of Feb-September.

I have decided not to rebalance it, as I will likely be supplementing my short term goals over the next few months.

Will this allocation I am at ~10X (X being annual expenses for me + my parents). Target is 35X as early as possible. In this runup in equity markets, I have started to feel that the accumulated equity portfolio has become a contributor to corpus creation.

The equity portion of long term goal is almost equally invested in PPFAS, Axis, Mirae and Invesco AMC’s funds. I am happy with portfolio performance so far and don’t plan to move to index funds. But next time I would consider shuffling funds due to underperformance, I will likely move to index funds.

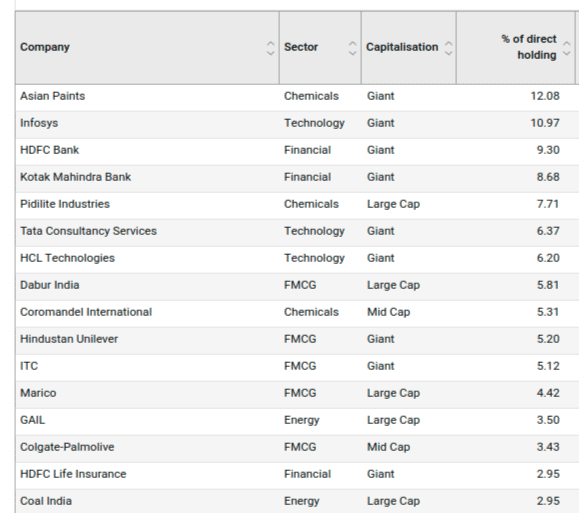

I have also started building a direct stock portfolio 4 months back, which is 1.5% of today’s total equity portfolio. Have decided a fixed amount for the direct portfolio and will continue to buy stocks in the portfolio, which can be accommodated in that amount, keeping the position sizing as close to decided as possible.

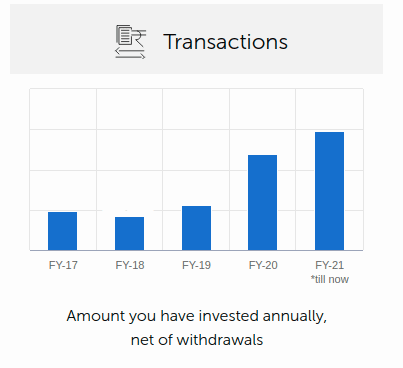

The annual (FY) investment made into mutual funds is schematically shown below, along with the direct equity portfolio.

The long-term debt portion is invested in Debt funds (money market and low duration) + PPF + Small amount in EPF.

Since debt funds form a big chunk of the portfolio, I follow a simple evaluation system (familiarity, brand, allocation % etc.) and regular monthly monitoring to take actions as and when needed. For example, I held Axis Treasury Advantage when the DHFL saga began.

The fund had ~7% exposure to Zero-Coupon Bonds of DHFL bonds. I laughed at myself and moved money from the fund (Nothing happened though, Axis Treasury sold the bond (or transferred within AMC), but some Axis funds took a hit in the NAV. I didn’t know about inter-scheme transfer at the time; otherwise, I would have researched a little bit). Same with Franklin Ultra Short Term – I only remained invested in the fund for 3 months, as I could not come up with a system to review it. In hindsight, this was a good decision.

Liabilities

I have no active loans. I use credit cards wherever possible, I have 3, and pay bills on time. With no EPF, NPS and home loan, taxes are my biggest liabilities 🙂

That said, I am aware that I am at a stage where a lot will likely change in very less time. As Morgan Housel would say, ‘ Reasonable optimist’ is how I would like to approach the changes to come.

Plans for 2021

Revisit Super Top Up policy: I am actually not comfortable with low cover (25 lakhs) of HDFC Super Top Up, but this is the max cover they provide. Since this is only 1 year old, I may move to a different insurer this year for Super Top Up.

Build up medical corpus: For parents (and myself), and do it fast. I have exhausted 1.7 lakhs out of 5 lakhs for parents, 3.3 lakhs is grossly insufficient. On the same line, I will try to complete buying health insurance for my parents. I have done my research, but will likely take professional help for this.

Reach target corpus: For short term goals.

For long term goal, continue to invest in equity and debt as per desired asset location. I will gradually build my stock portfolio, which I have found to be a great learning experience.

Revisit debt allocation: So far, I have taken a conservative approach to build my debt fund portfolio. I feel that for long term goals, and with growing debt fund corpus, Banking and PSU, Short Duration and Gilt debt funds can find a place in the portfolio. May also consider increased EPF contribution. Not convinced of the role of NPS yet, so will likely avoid it.

Be grateful

Keep re-reading ‘The Financial Arrow of Time’ on freefincal: “Every moment wasted, not being in control of your cash flow, not investing enough, not taking action, is lost forever. The magic of compounding diminishes slowly and relentlessly. The past is prologue!” This is my all-time favourite post on freefincal. I have read this post countless times, and it inspires me and springs me into action every time I read it.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)