Last Updated on December 29, 2021 at 6:08 pm

This is a review of ICICI Prudential Nifty Low Vol 30 ETF FOF, an open-ended fund of funds scheme investing in ICICI Prudential Nifty Low Vol 30 ETF. We try to answer two main questions that investors should ask before considering an investment in this FOF.

They are: 1: Does low volatility investing work? If yes, what should investors expect from this strategy? 2: Does it make sense to invest in ICICI Prudential Nifty Low Vol 30 ETF FOF?

About the index: The NIFTY100 Low Volatility 30 Index chooses 30 stocks with the lowest price volatility among the “large cap universe” (as defined by SEBI) – Nifty 100. The index approximately mimics an “equal weight index” (at the time of writing). This is because any stock with a turnover lower than the lowest stock in the NIfty 50 cannot have a weight of more than 3%. Stock turnover is a measure of liquidity and is defined by traded volume divided by shares available.

Volatility is defined as the standard deviation of daily price returns for the last year. The stock weights are defined as

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

𝑤 =(1/𝑉𝑜𝑙𝑎𝑡𝑖𝑙𝑖𝑡𝑦)/∑(1/𝑉𝑜𝑙𝑎𝑡𝑖𝑙𝑖𝑡𝑦) –> ∑ refers to a sum over the 30 stocks

According to the Feb 2021 factsheet of ICICI Prudential Nifty Low Vol 30 ETF, the stocks in the index are:

- Bajaj Auto Ltd. 3.79%

- Hero Motocorp Ltd. 3.02%

- Bosch Ltd. 3.14%

- HDFC Bank Ltd. 3.39%

- Kotak Mahindra Bank Ltd. 2.50%

- Ultratech Cement Ltd. 3.95%

- ACC Ltd. 3.67%

- Pidilite Industries Ltd. 3.61%

- Larsen & Toubro Ltd. 3.51%

- Dabur India Ltd. 3.97%

- Hindustan Unilever Ltd. 3.37%

- Nestle India Ltd. 3.31%

- Britannia Industries Ltd. 3.22%

- ITC Ltd. 3.18%

- Asian Paints Ltd. 3.10%

- Colgate – Palmolive (India) Ltd. 2.97%

- Marico Ltd. 2.92%

- HDFC Ltd. 2.70%

- Coal India Ltd. 3.46%

- Indian Oil Corporation Ltd. 3.91%

- Reliance Industries Ltd. 2.82%

- Dr Reddy’s Laboratories Ltd. 3.10%

- Cipla Ltd. 3.08%

- Power Grid Corporation Of India Ltd. 4.13%

- NTPC Ltd. 3.68%

- Wipro Ltd. 3.53%

- Tata Consultancy Services Ltd. 3.51%

- Infosys Ltd. 3.24%

- HCL Technologies Ltd. 3.19%

- Tech Mahindra Ltd. 2.90%

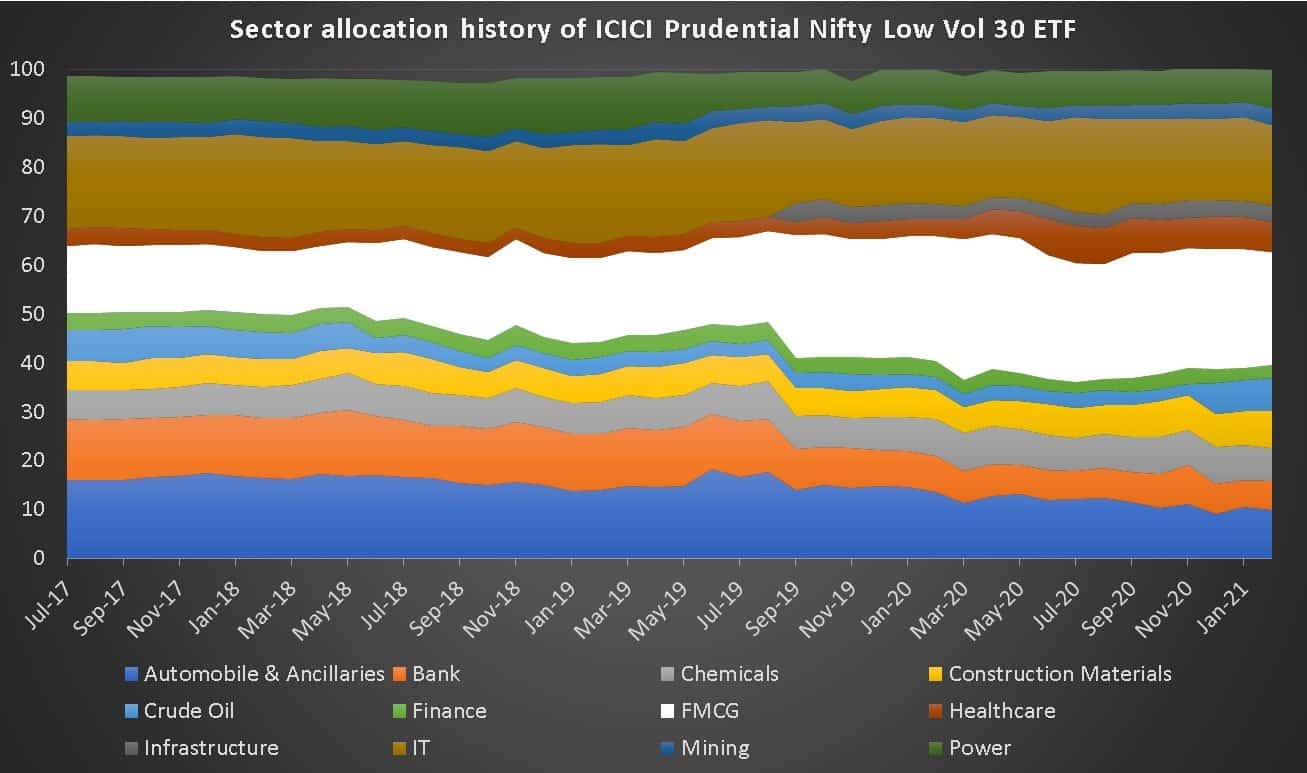

The index is generally heavy on FMCG and IT, as can be seen from ICICI Prudential Nifty Low Vol 30 ETF’s sector allocation history.

About the underlying fund ICICI Prudential Nifty Low Vol 30 ETF:

- Launch date: July 2017

- AUM (Feb 2021): 272 crores

- TER: 0.42% –> One can expect the direct plan of ICICI Prudential Nifty Low Vol 30 ETF FOF to have about 0.1% to 0.5% extra TER on top of this. We will know for sure only after the fund opens, and daily TER data is available. Please note that ICICI Prudential Nifty Low Vol 30 ETF FOF will have to work at least five times harder to keep pace with a Nifty or Sensex index fund. Then comes the issue of beating them on an absolute basis!

1. Does low volatility investing work?

Let us now proceed to discuss the first of the three questions mentioned above. We must understand the big difference between comparing a low volatility index vs a market-cap weighted index and comparing a low volatility ETF vs a market-cap-weighted index.

The difference lies in the TER as noted above and also the demand for the ETF. Retail ETF investors buy and sell units at market price, not NAV. And the price is set by the demand and supply in the pool of ETF investors. Ideally, an authorized participant (AP) appointed by the AMC should remove deviations from price and NAV. Ideally, the price should fluctuate equally above and below the NAV. This rarely happens: Indian ETF Liquidity: Here is how you can select ETFs.

Ideally, Price-Nav deviations only depend on how active the AMC or APC is in arbitrating out the difference and not the AUM. However AUM is typically an incentive!

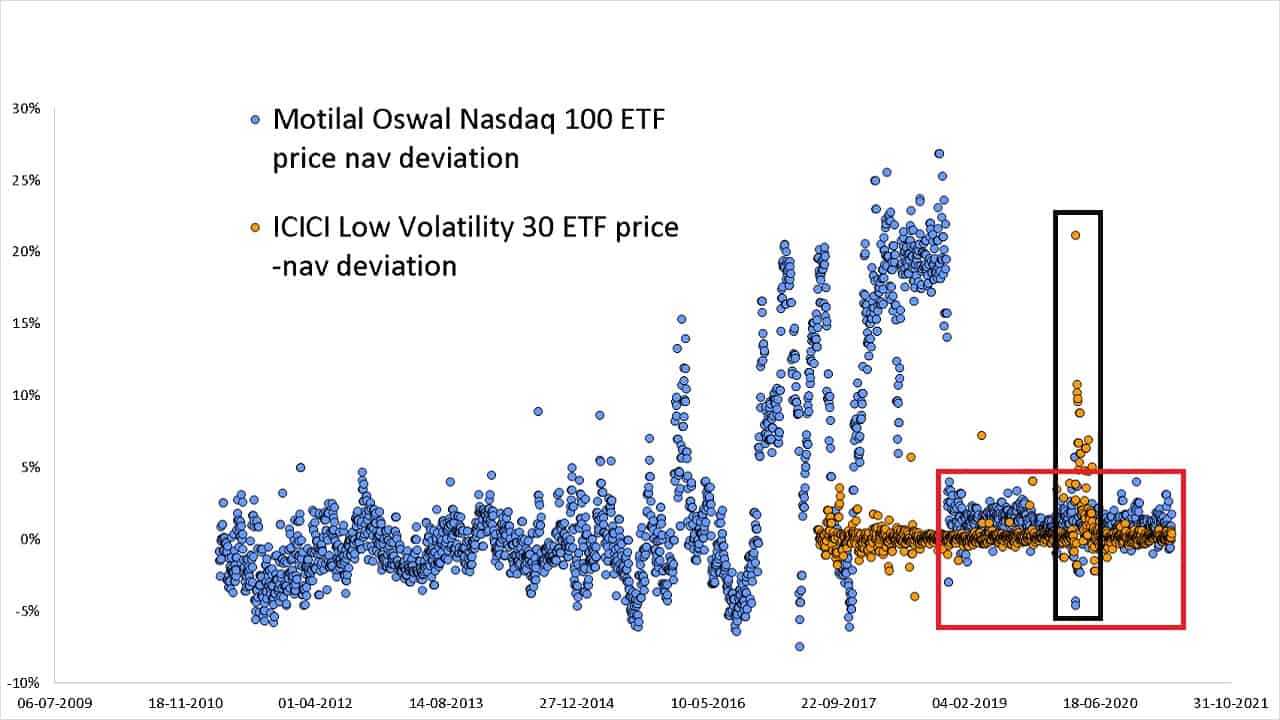

Fund of fund investors should note that the fund manager will buy the underlying ETF at its market price, except perhaps during the NFO period. The most dramatic example of how AUM inflow into an ETF via a fund of fund “motivated” the AMC or its AP to reduce price nav deviations is shown below.

The blue dots represent (price – nav)/nav of Motilal Oswal Nasdaq 100 ETF. One can immediately tell when MO N100 Fund of Fund was launched – the red rectangle. This was in the middle of a downturn in N100 and notice how the rush of funds into the FOF literally extinguished the huge price-nav deviations – so much that the March 2020 crash is barely visible (demand-supply mismatch shoots up during a crash/turbulence)

The orange dots show the same quantity for ICICI Pru Low Volatility 30 ETF. ICICI has done a much better job keeping deviations low (MO N100 ETF deviations will always be higher as it invests in a market open at a different time zone).

However, if you look inside the black rectangle, the deviation zoomed during the March 2020 crash. This is how the price and NAV differed during this period.

When we look at rolling return graphs below, we shall be comparing the total return indices without complications of TER and price-nav deviations. In reality, these factors play a big role.

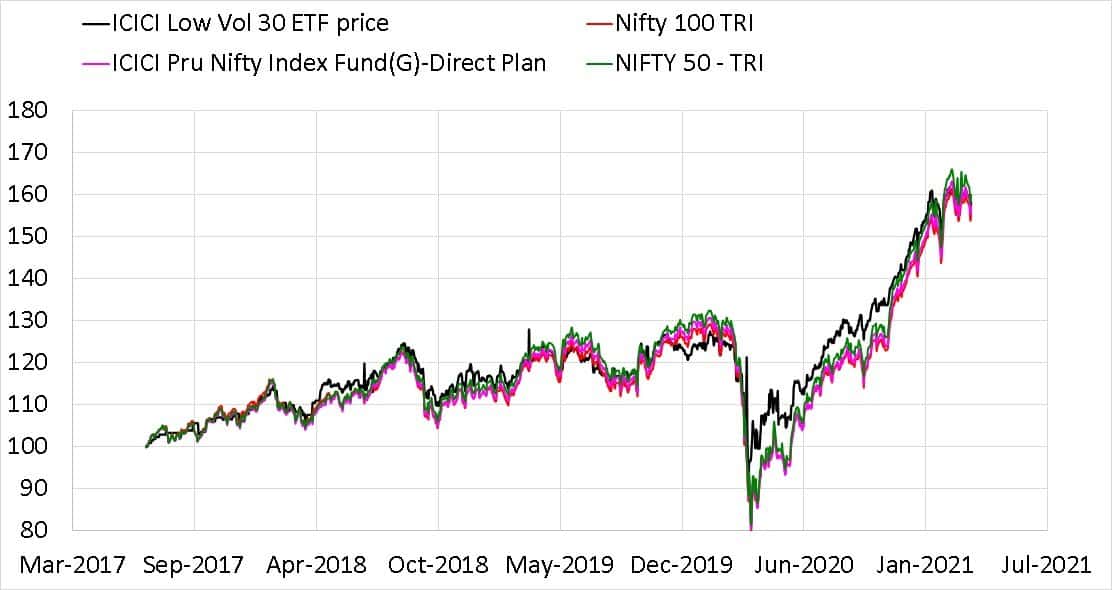

Since July 2017:

- Nifty 100 TRI has moved by 55.75% (absolute change).

- The NIfty 100 low volatility 30 Index TRI by 60.32%.

- Nifty 50 TRI by 60.08%.

- UTI Nifty 50 index fund direct plan by 58.22%

- ICICI Low Volatility 30 ETF price has changed by 58.18%

The ETF is priced more than four times more. The fund of the fund will at least have an extra TER of 0.1% (the direct plan, that is). Even if low volatility works as a concept (we shall see this below), the ETF implementation and a fund of fund buying the ETF will mess it up.

We also have to consider the higher concentration of the top few stocks in the Nifty/Sensex and how this can drive returns for years. An almost “equal weight” index like the Nifty 100 low volatility 30 may find the going harder during this period (e.g. Late 2017 to March 2020)

The inflow of AUM into ICICI Prudential Nifty Low Vol 30 ETF FOF will help reduce the price nav deviations. However, “low volatility” investing has a much lower charm than the Nasdaq 100 with the benefits of “international diworsification”. Even if the price = nav, the likely five times higher TER (of the FOF) will make beating a Nifty 50 index fund tough. Here is the ICICI Nifty index fund’s performance, the low volatility ETF price since inception compared with Nifty 100 and Nifty 50.

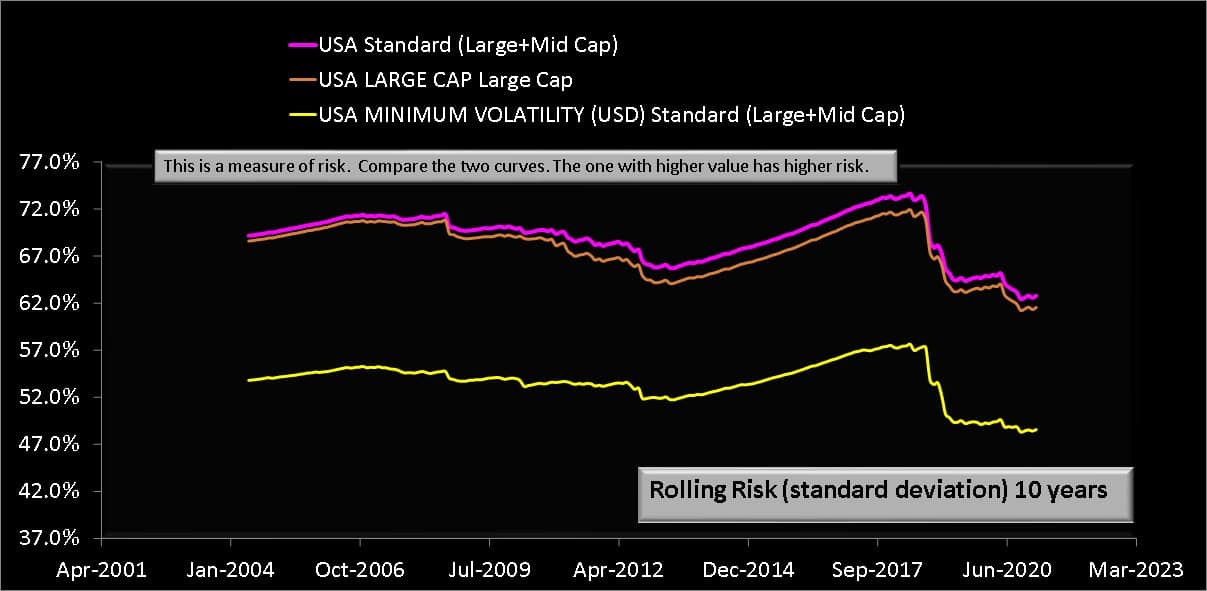

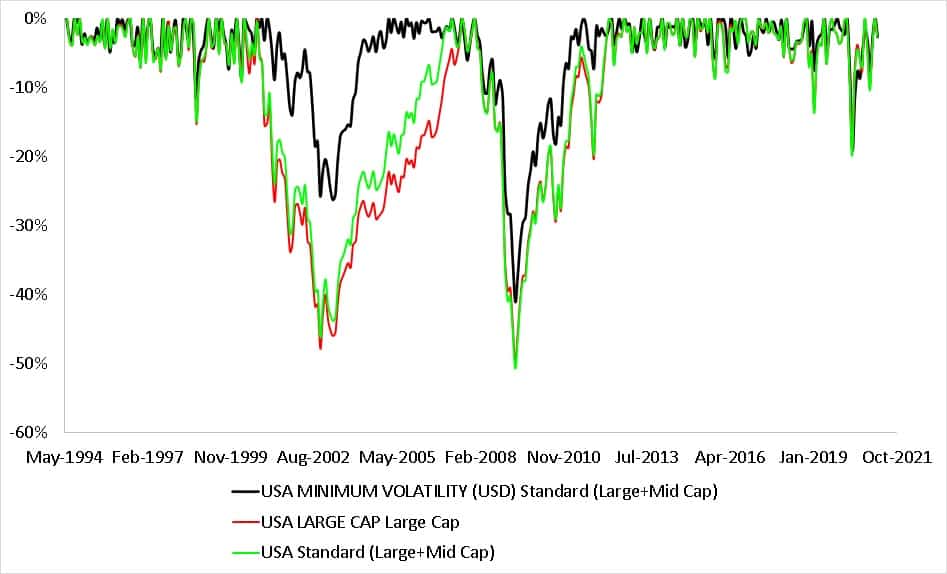

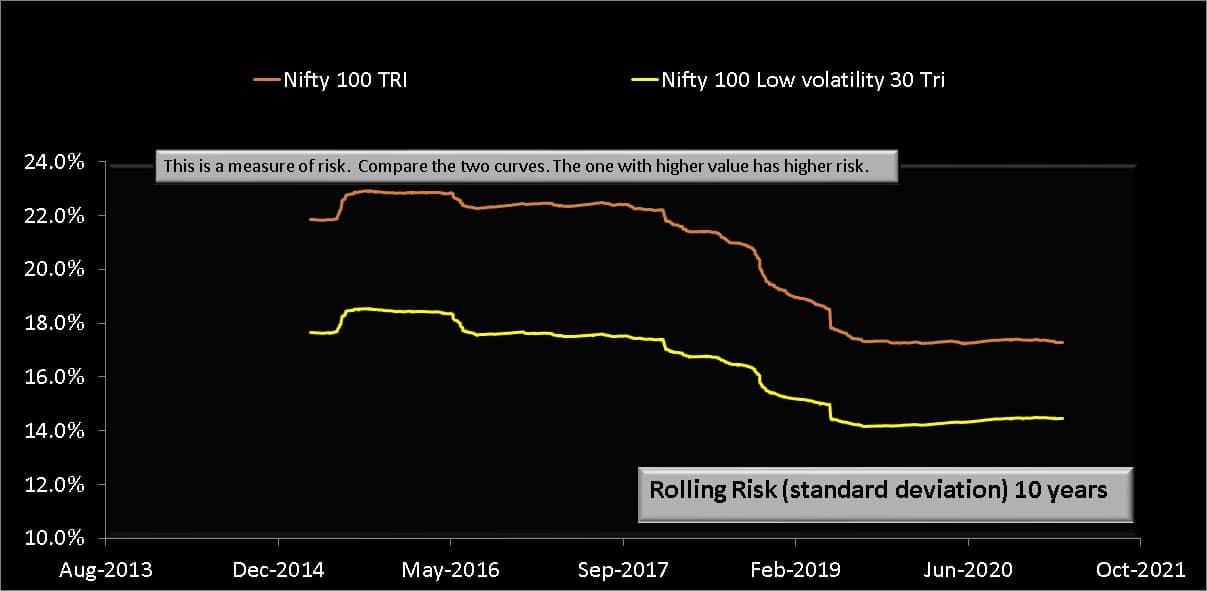

Now, does low volatility investing “work” as an “idea”? The short answer is “yes; not all the time and not in the way we want it to, but it does work”. Shown below are 202 10-year rolling return data points (based on monthly data) from May 1994 to Feb 2021 of the MSCI USA Min volatility (large + midcap) total return index with MSCI USA index (large + mid cap) and MSCI USA (large cap) index.

The minimum volatility index has done fairly well over a ten-year period. Even during periods when there is no outperformance, the lower standard deviation (volatility) or, the lower drawdown (fall from a peak) would result in a better risk-adjusted return (without expenses). So there is enough evidence to suggest that over a 10-year period, the idea “works”.

Similar arguments can be better for the Nifty 100 low volatility 30 index too.

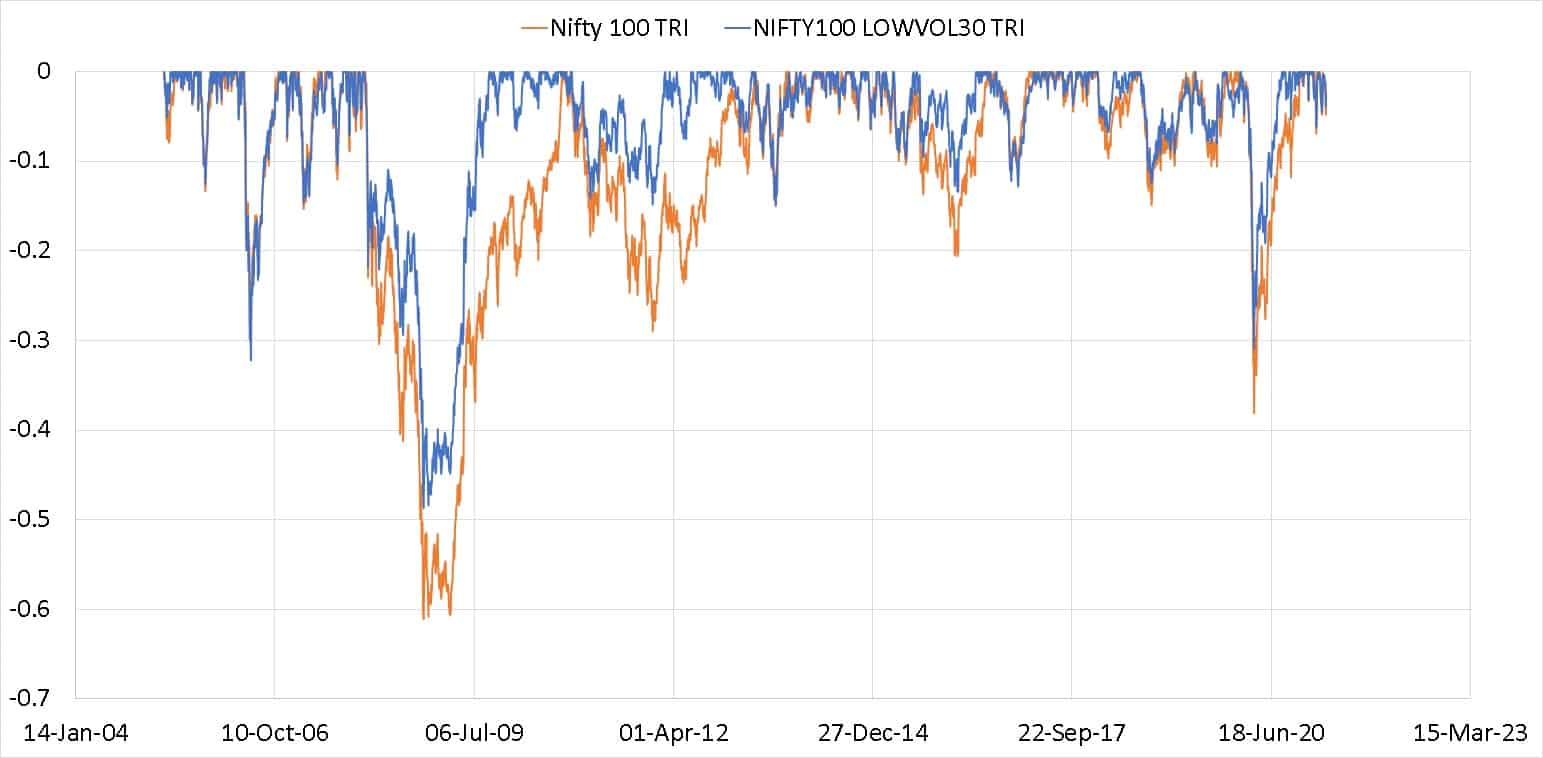

Max drawdown of Nifty 100 Low volatility 30 TRI compared with Nifty 100 TRI

Conclusion: Before expenses, a low volatility strategy ‘works’ in a sense, there is a reasonable chance of getting an absolute higher return “over the long term” and an even better chance of getting a better risk-adjusted return since the low volatility is relatively “guaranteed”. However, expenses and ETF buy/sell demand can change the equation dramatically.

Does it make sense to invest in ICICI Prudential Nifty Low Vol 30 ETF FOF?

We recommend that investors not buy the CICI Prudential Nifty Low Vol 30 ETF FOF at least for a year after launch. We can see how the AUM builds (NFOs are launched depending on uninformed regular plan purchases and not finicky direct plan purchases), how the price-nav fluctuations of the underlying ETF changes, how the expense ratio fluctuates (yeah, that is a thing!), how the FOF fares against the Nifty or Nifty 100 for a year and then take a call.

We are, however, not hopeful of a change even after a year. Although the idea itself is good (readers may recall I am using this strategy to build a direct equity portfolio; also see: How to buy your first stock without breaking your head!), the expenses would effectively stamp out the possibility of higher returns even if the lower volatility and lower drawdown remain.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)