Last Updated on October 1, 2023 at 4:53 pm

An exchange-traded fund (ETF) is one in which each unit of the fund (a basket of stocks or bonds) is traded among other unitholders via a demat account. How easily one is able to buy and sell these ETF units is referred to as liquidity. A common complaint is that Indian ETFs are not liquid enough. Is this really true? Do all aum ETFs suffer from poor liquidity? Are there any exceptions? In this, post let us compare the historical price and NAV of many ETFs and see what we can learn. Acknowledgement: With useful inputs from sanjaydixit @sanjayd30690453 on twitter.

These observations will help us decide how to select an ETF. First, if you wish to understand the basics of ETFs, you can start here: How ETFs are different from Mutual Funds: A Beginner’s Guide and here: List of Index Mutual Funds and ETFs in India: What to choose and what to avoid and here(!) Watch my talk on index investing: Can we get higher returns with lower risk?

Since the ETF trades at the exchange, the price of each unit need not equal its NAV and is decided by supply and demand. A large and consistent discrepancy bet the price and NAV is unhealthy and indicates that it is hard to trade those ETF units. Large AUM ETFs will heavy daily trading volumes almost always exhibit a low difference between price and NAV, suggesting that it is quite liquid. However, this does not mean, that low AUM etfs are always ill-liquid.

ETFs provide an arbitrage opportunity and this can ensure even a low AUM ETF maintains a low price-nav difference via authorized participants (AP). They are large banks or brokers capable of high volume tradings. APs can trade with etf unitholders at the exchange (secondary market) at the current price of the ETF and directly with AMC (primary market) at the NAV.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Suppose an ETF trades at a price higher than its NAV. This means the stocks that are part of the ETF are more expensive when purchased as part of the ETF compared to when purchased separately. So an AP can borrow units from the AMC and sell this to unitholders. At the same time, they will also but a corresponding amount of stocks (that make up those units). At the end of the trading day, they will give the AMC the underlying stocks corresponding to the borrowed units The profit is the difference between the cost of the ETF units and cost of the stocks directly purchased after expenses.

If the ETF trades at a price lower than the NAV, the AP will buy ETF units and sell the underlying stocks after borrowing it from the AMC. At the end of the day, they will return the ETF units in exchange for the borrowed securities. Again the profit is the difference in price of the units and the underlying stocks.

In other words, when the ETF trades above NAV, the APs inject units until the difference is small. When the ETF trades below NAV, the APs remove units until the price increases sufficiently. Thus the presence of an AP ensures that the price-nav difference is low, making the ETF easier to trade. Hence liquidity depends on how active the APs are and not on the AUM of the ETF. The mere presence of an AP (which all ETFs have) is not enough. They must actively maintain liquidity in the ETF. This can be seen from the number of daily units traded. Read more: Debunking ETF liquidity myths

In what follows, let us consider the price-nav difference of several ETFs and see if we can learn how liquid they are.

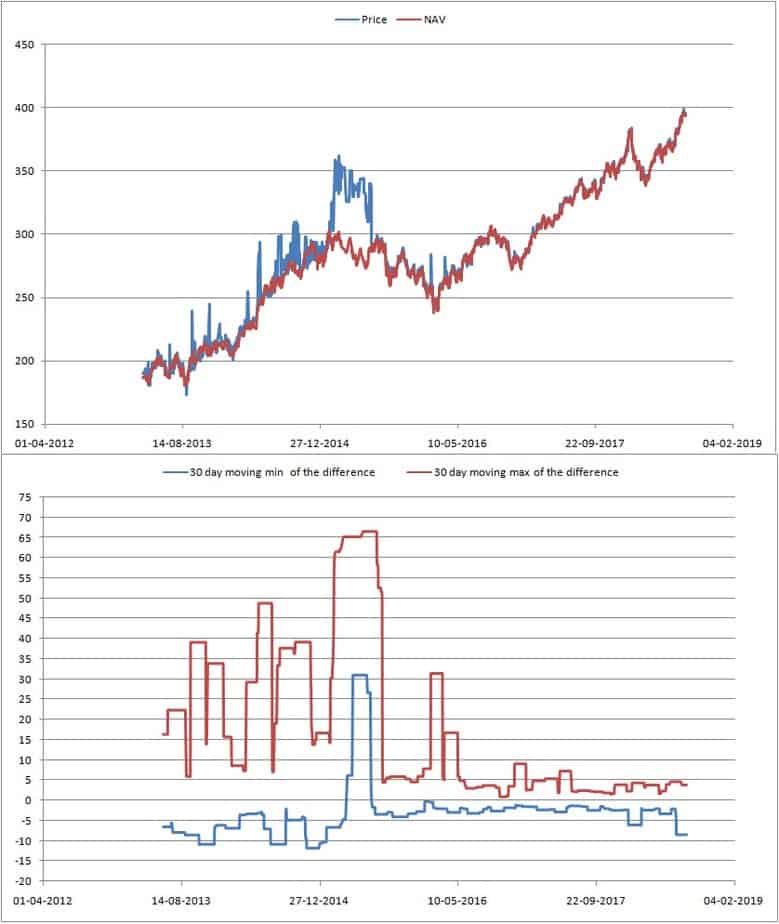

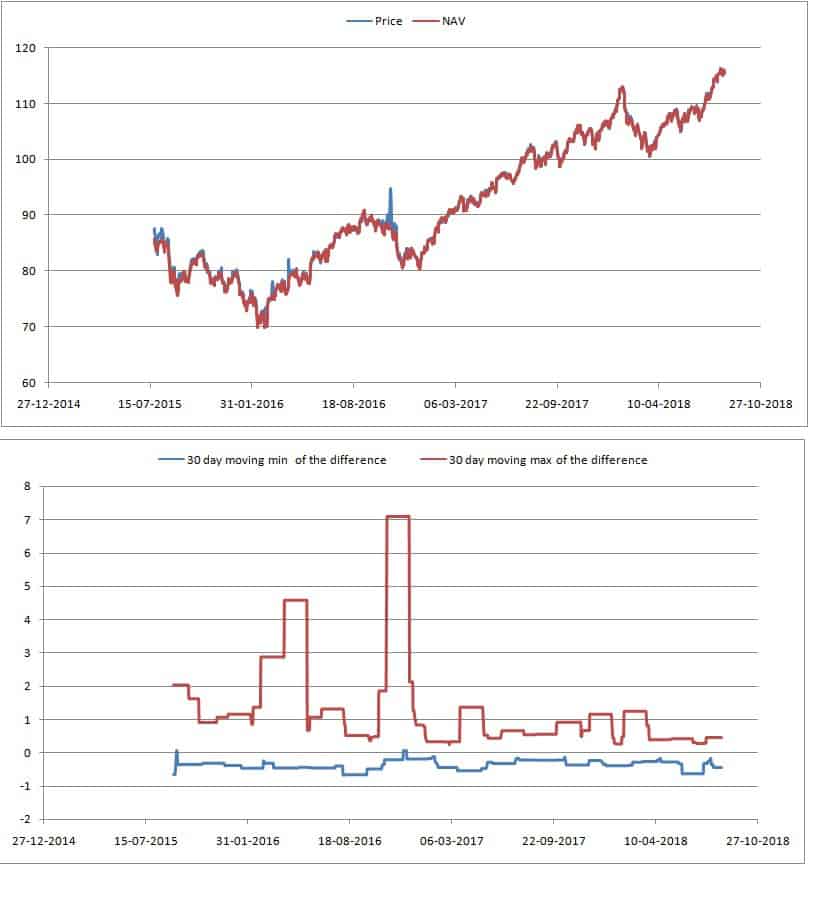

SBI NIfty ETF (AUM: ~ 38,883Cr)

This is the largest Indian ETF as the EPFO invests in it. The top graph is the price and nav. The bottom graph shows the min and max of the price-nav difference taken every 30 days. So this gives you a range over which the difference can move. This is a better measure of what to expect than the average. The difference is quite low and in the last few months, consistently low. This is a sign of heavy trading.

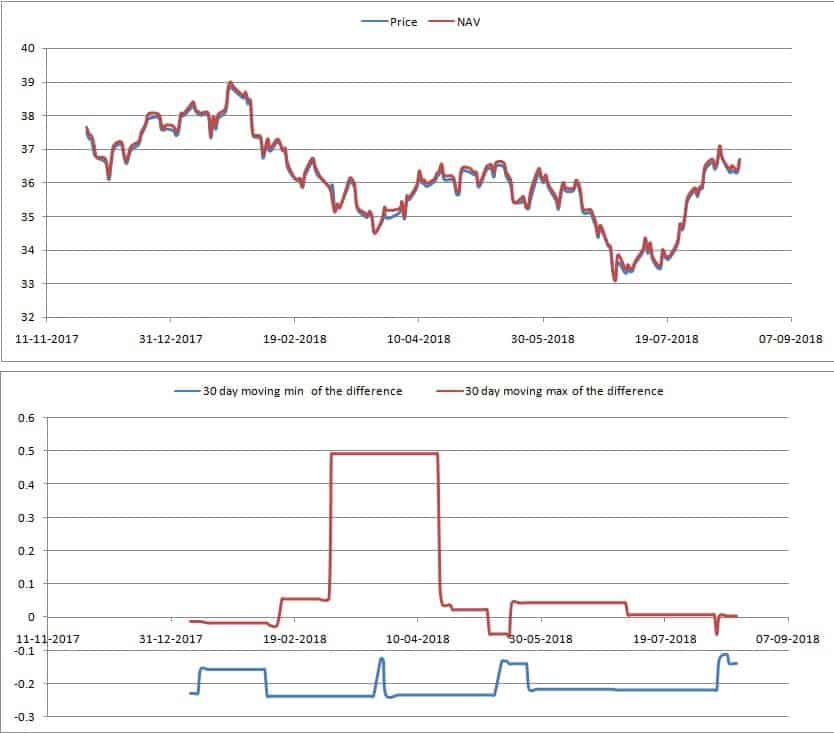

SBI Sensex ETF (AUM ~ 12,379 Cr)

This ETF has had dramatic price-nav deviations in the past. It is much better now, possibly due to the larger AUM and associated trading.

ICICI Bharat 22 ETF (AUM ~ 6980 Cr)

In 4th place (in terms of AUM) is the great Indian disinvestment story. The price-nav difference is fantastic here. Possibly the lowest in Indian ETF space.

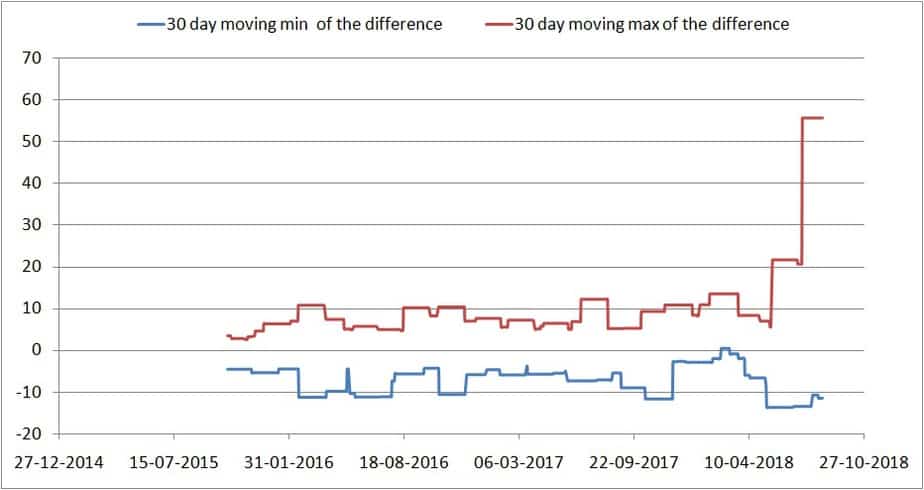

ICICI NIfty ETF (AUM ~ 1000 cr)

In 5th place is this. Notice the big drop in AUM and also the spike in price-nav difference. Notice that this ETF has both max and min difference positive. Meaning the price is consistently above. The price shot up on April 9th 2018 and never came down! A clear signal to avoid. A large but fluctuating price-nav difference (+ to -) is better than this!

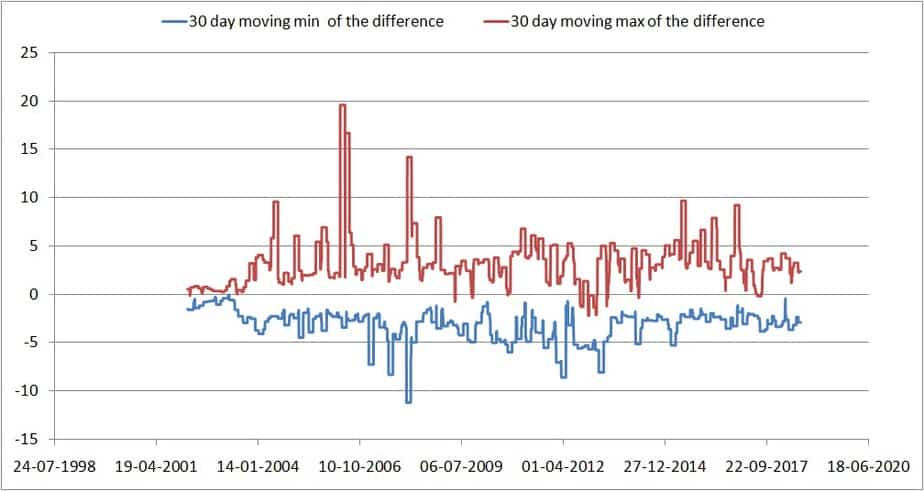

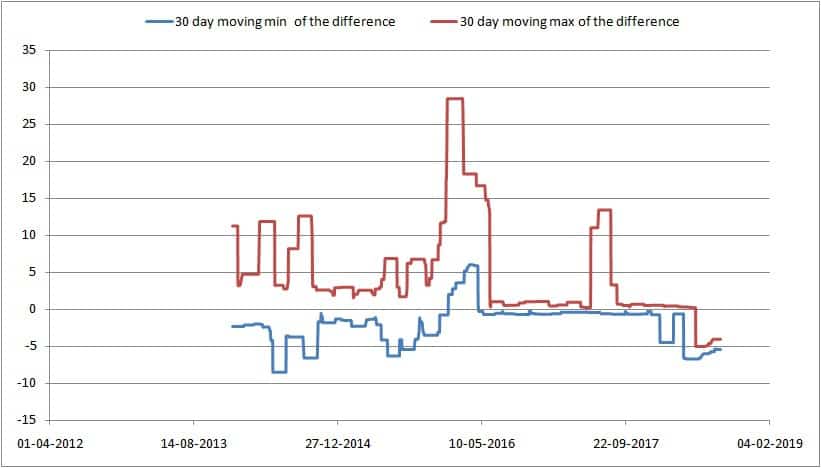

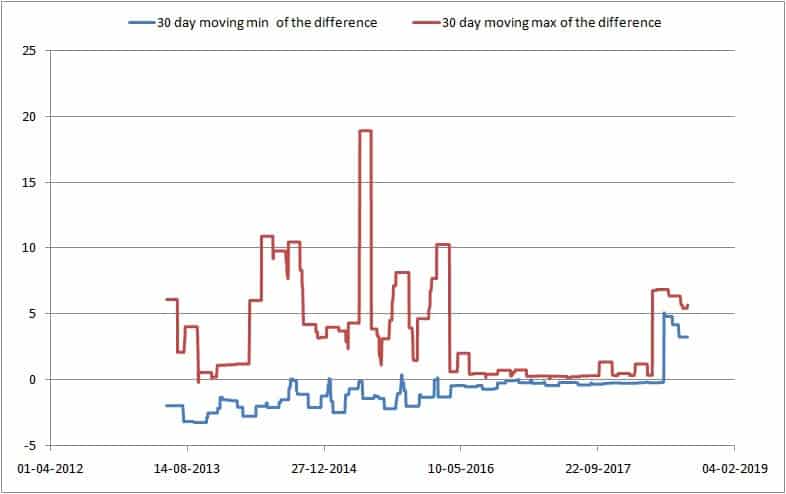

Reliance Nifty Bees(AUm ~ 920 Cr)

In 6th place is this old ETF previously owned by Goldman Sachs. Notice that although the difference is noticeably large, at least it swings both ways (+ and -). For an ETF this old, this should have had much more AUM! Over 10 years, although the big difference spikes have reduced, the range is more or less the same. Disappointing.

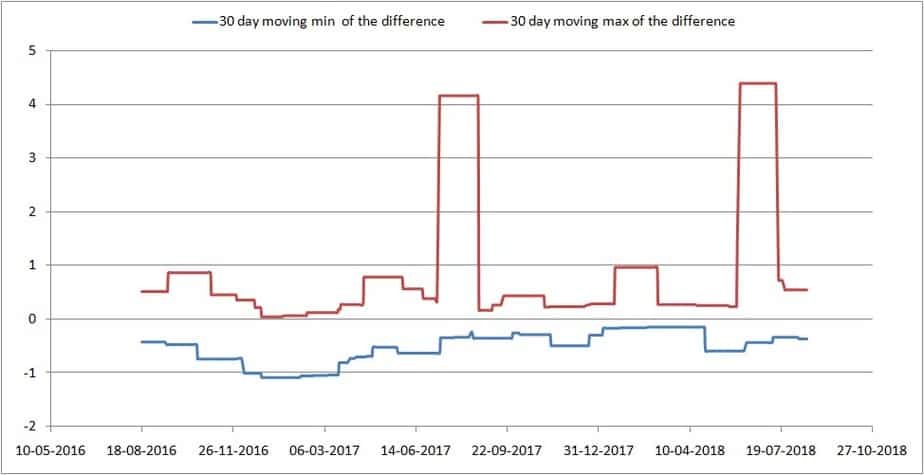

Reliance Junior Bees (AUM ~ 515 Cr)

In 7th place is Kotak Nifty ETF (545 cr) and 8th place the Junior bees (tracking Nifty next 50). That is reasonable, there are enough opportunities to sell high and buy low (although the volume will matter).

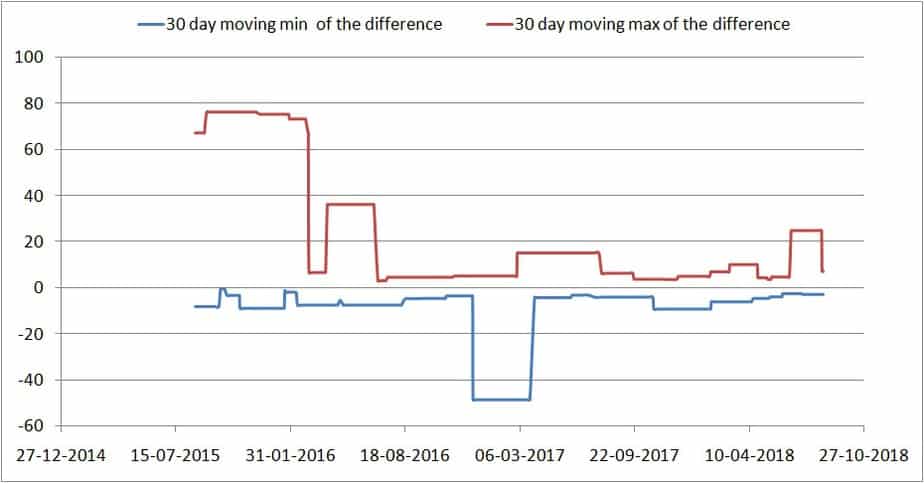

Motilal Oswal NASDAQ 100 ETF (AUm ~ 83 Cr)

At 10th place is the only Indian ETF that allows trading in US(international stocks). However, its liquidity is plain awful. Stay away from this one. Some price-nav difference is expected when the trading hours of the underlying stocks and the ETF units are different, but this is a bit too much. Is it not possible for APs to decrease the difference?

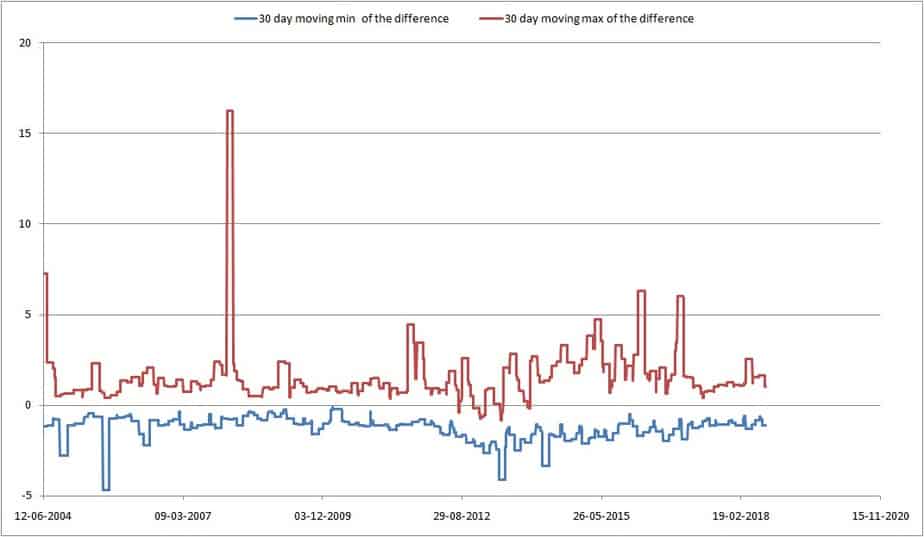

ICICI Nifty 100 ETF (AUM ~ 41 Cr)

In the 11th place is this fund. Notice the 10 times drop in AUM for only a 4-place shift. This has been trading below NAV since April 10th 2018. What happened on April 10th?! Not so great. Avoid.

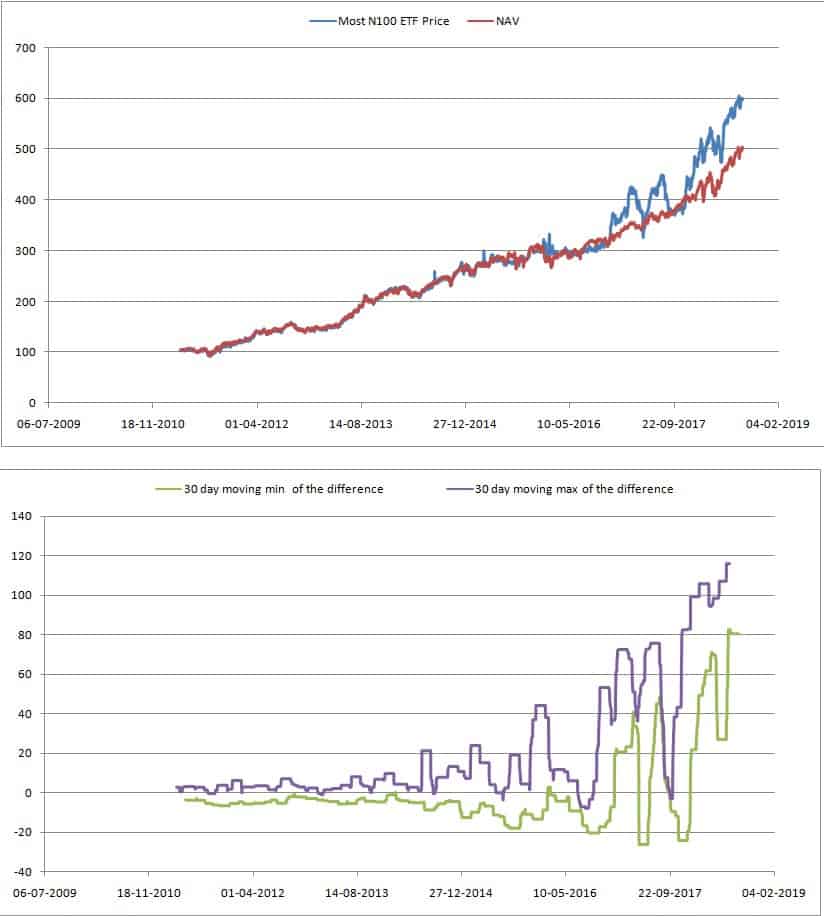

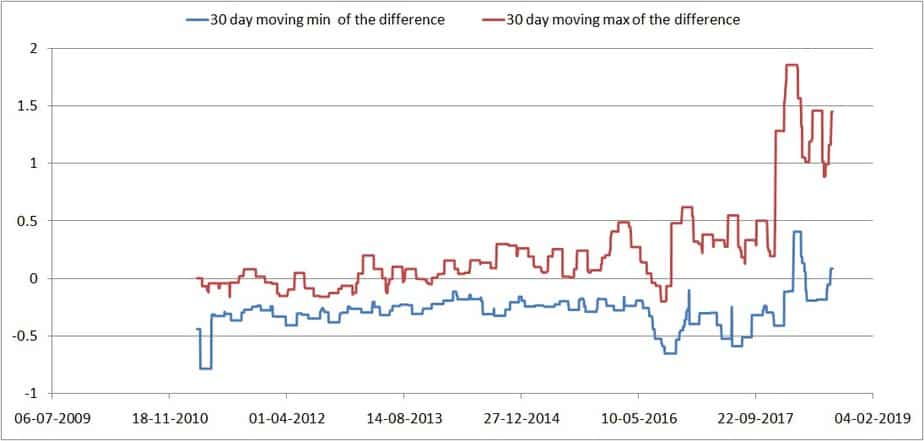

Most Midcap 100 ETF (AUM ~ 23 Cr)

Now let us get to the second part of the title. This is fund is in the 14/15th place in terms of AUM. I would say for these AUM levels, that is pretty fantastic! The price-nav difference though recently higher (probably due to the fall in midcaps?) has been pretty low when compared to other higher AUM ETFs. This is striking. What is special about this? Surely this cannot be the only ETF where the APs are active. Or is that the supply/demand is low and the APs can easily negate much of the price-nav difference?

ICICI Midcap ETF (AUM ~ 14 Cr)

The other midcap fund has much lower AUM but still has a good price-nav difference history. Although a short one.

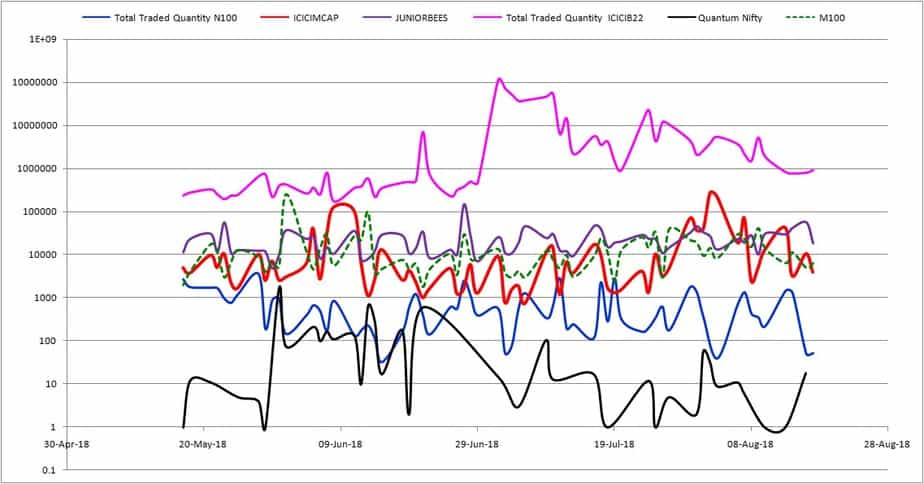

Total Daily Traded Quantity (last 3 months)

If you look at the daily traded quantities of a few ETFs, notice that the Bharat 22 ETF is understandably the clear topper. Which is why its price-nav difference is low. Notice however that Junior Bees (515 Cr), Most Midcap (M100) (23 Cr), ICICI Midcap (14 Cr) all have similar trading volume range. So the AUM does not matter. As long as there is robust trading, the price-nav difference will be small. Clearly, at least for these two ETFs, the APs are quite active. Why not for other ETFs (eg. ICICI Nifty 100 etc). Is there something more profitable in these midcap ETFs for the APs?

Notice the low traded quantities of the Most Nasdaq 100 and Quantum Nifty ETF. You can look at this data from Nifty and decide whether to invest in an ETF or not. So let me round out this post with a few more ETFs. The price-nav data for this post has been sourced from Value Research.

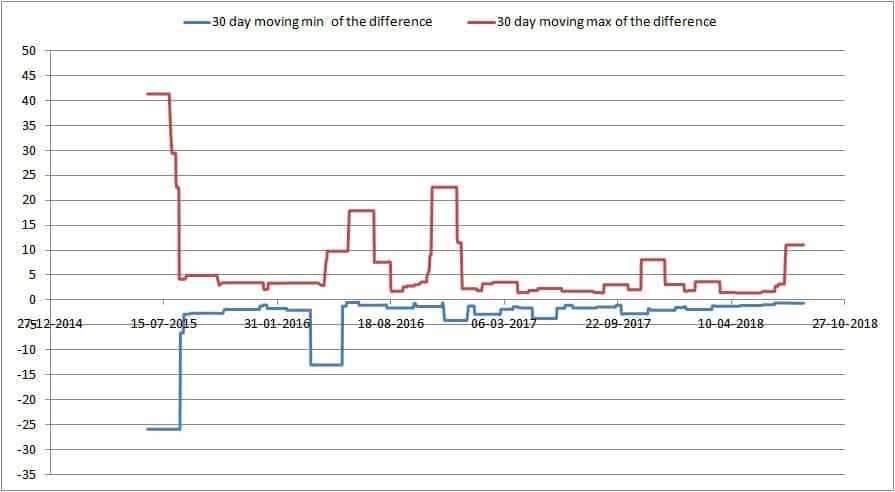

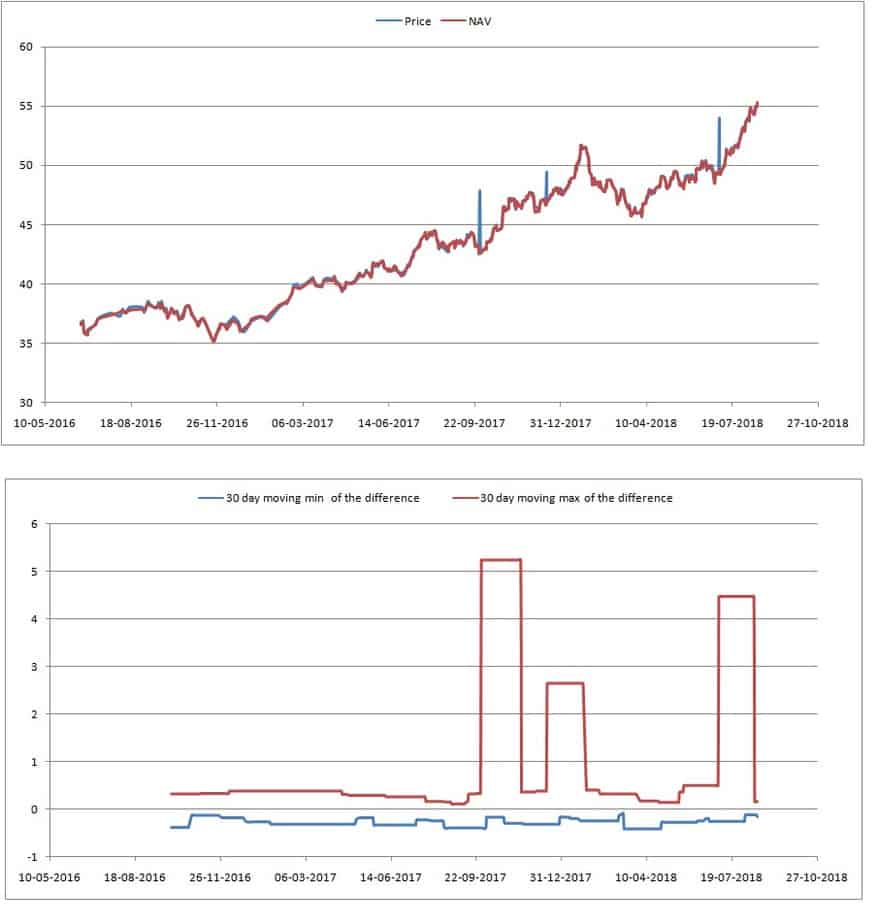

UTI Nifty ETF (AUM ~ 9000 Cr)

Notice that even at this high an AUM, sudden spikes in price-nav difference are possible. If the appointed AP is active enough (interested enough?) I think such spikes should not occur, at least should not last this long. Of course, this difference is small compared to the absolute value of the NAV, and in this post, I have only considered absolute differences. Perhaps this is wrong. The max of 55 that you see below is about 5% of the NAV. This 5% is the same as the peak difference of the ICICI Midcap ETF.

Spikes by themselves are okay, as long as they are brief. This is not the case of many Indian ETFs.

ICICI Nifty Value 20 ETF (AUM ~ 10 Cr)

This is prettty okay difference at just 10Cr Aum.

So let me go ahead and post a couple more, without commentary.

SBI NN50 ETF (AUM 19 Cr)

Reliance NV20 ETF (AUM ~ 11 Cr)

How to select an ETF

In hindsight, I should have presented (price-nav)/nav instead of just (price-nav). However, thankfully the central observations remain unchanged.

1: Look for an ETF that has a consistent trading volume (high or low does not matter). You can see this date on the NSE website. Go to live markets on the top menu and look for exchange-traded funds. This will give you the list of ETFs. click on anyone to analyze further and get last 3-month trading data. Consistent trading volume will result in low price-nav difference or at least quick corrections if there are deviations.

2: High or low AUM ETF does not matter as long as the price-nav differences do not stay high or low (deviation from “average”) for too long. If it takes too long for the price to correct then stay away. You can check this at Value Research. Set the graph window at one month and scroll it back. If the price takes that long to correct, stay away.

3: It is surprising that both the midcap ETFs exhibit reasonably low price-nav difference and spikes seem to correct fast compared to some large(r) cap ETFs. What is surprising (to me) is that they trade as often as ETFs with ten times their AUM.

4: However, recognise that midcaps themselves are not too liquid and therefore even if APs are active in these funds, they cannot help much when markets crash. Still early days. So DO NOT invest in a hurry. These midcap ETFs should go through a couple of market cycles.

5: A 5% deviation from NAV seems to be quite common for most ETFs. However, what matters is how fast they revert back. An ETF that swings from price > NAV to price < NAV regularly is better than an ETF that stays on one side for weeks or months.

6: Before we read a lot of US-based material and talk high and low about ETFs, it is important to recognize that ETFs were created only in the 1990s – after more than 100 years of stock trading!! I think the Indian stock market is too young for ETFs. I doubt whether it is liquid enough to quickly correct price-nav differences. Just because we live in a connected world, we cannot expect progress fast!

7: ETFs are significantly lower cost than index mutual funds (excluding the demat charges). However, they can be frustrating when you cannot buy or sell as you wish. Remember, today you are young and not too rich, so you think in terms of buying a few units. You will get rich soon and you cannot remain invested forever!

Endnote: I don’t claim to be an expert. These are merely observations and it is possible that my inferences are wrong. If you feel so, kindly correct me with technical details.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)