Last Updated on September 27, 2023 at 3:53 pm

In this guest post, Anish Mohan presents a step-by-step guide to applying online for an MF Utility account. MF Utility is the transaction aggregation portal run jointly by a consortium of 26 mutual fund houses. It offers investors way to invest in direct mutual fund plans (and switch from regular) via a single portal. It has now been in operation for just over a year now and has continuously evolved for the better, thanks to fantastic management/support team led by MD and CEO, Ve Ramesh.

=-=-=-=-=-=-=-=-=

Dear Readers,

I am back with another topic on MFU. Regular readers of freefincal and Facebook group Asan Ideas for Wealth would by this time know, I had written a post back in Feb 2016 which was a lite user manual on how to transact online in MF Utility. At the end of 2016, in last week of December I wrote another post to update the new changes on the transaction handling pages of MFUOnline: MF Utility Portal User Guide: Updated Second Edition

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Today I write to discuss on a new aspect of MFU. This is known as electronic Common Account Number, abbreviated as eCAN.

This process allows an individual to open CAN in a completely online mode without any paper signatures and courier or submission at any office. Obviously, this comes with certain pre-requisites as below:

- eCAN can be created by fresh investors who do not have any investments in the industry (at least in MFU participating AMCs)

- For existing investors who are creating eCAN, they should compulsorily register only those bank accounts which are registered in the existing folios that get mapped to the CAN. Bank Accounts which are not registered in the mapped folios will be ignored.

- In both instances, they should be KRA KYC Compliant.

- eCAN is of two types i.e. Completely Electronic & Partially Electronic. If investors do not satisfy 1-3 points above, the eCAN mode will be changed to Partially Electronic and they will be provided with a prefilled form to be submitted physically.

- For details on eCAN qualification criteria – Please refer to the eCAN FAQs in MFU Website.

Now, please see below the list of steps that are required to open an eCAN.

The process starts below

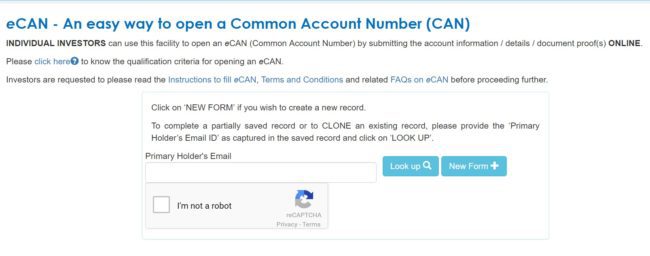

1: On the MFU website, click on eCAN and the following screen appears. Input your email ID in the following text box.

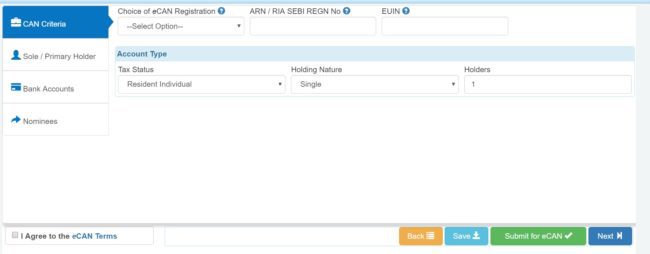

2: On the click of “New Form” button, the following screen appears. Make your choice of the CAN (read the pre-requisite section to assess if you are eligible for Completely Electronic CAN). The rest of the fields are self-explanatory.

2: On the click of “New Form” button, the following screen appears. Make your choice of the CAN (read the pre-requisite section to assess if you are eligible for Completely Electronic CAN). The rest of the fields are self-explanatory.

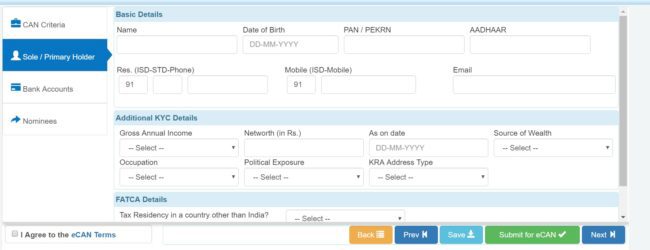

3: On the click of “Next” button, the following screen appears. These fields are related to your personal details as PAN and AADHAAR and contact numbers and FATCA declaration. On FATCA, the electronic fill up is more than enough and no need to fill any paper forms. The relevance of this statement will be clear in a later section of this post. Fill it and press the Next Button.

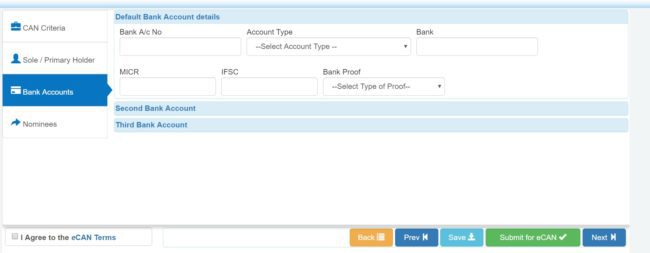

4: On the click of “Next” button, the following screen appears. These fields are related to Bank Accounts of the Primary Holder. Please note a very important thing at this point. Please add the Bank Account Number which is ALREADY recorded in your Folios. If you mention any other bank account that does not feature in your existing Folios, then the eCAN request will get rejected.

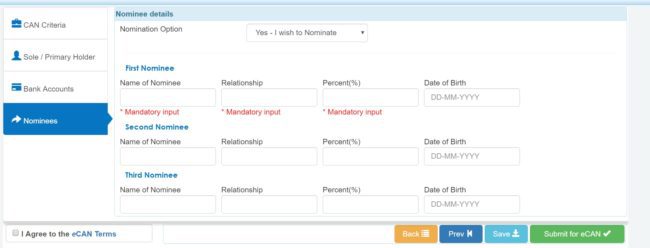

5: On the click of “Next” button, the following screen appears. These fields are related to Nominees of the CAN. Here you may wish NOT to provide any nomination at all. In which case, the Nomination Option should be selected as “No – I do not want to Nominate”.

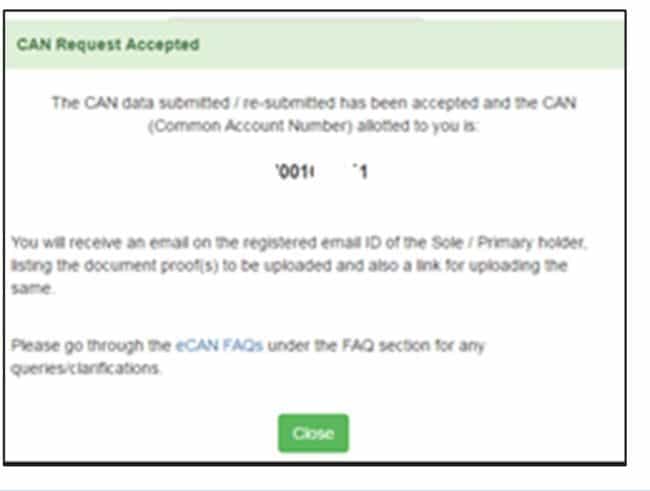

6: The above screen is the penultimate screen after which the “provisional” CAN will be allotted and displayed as follows.

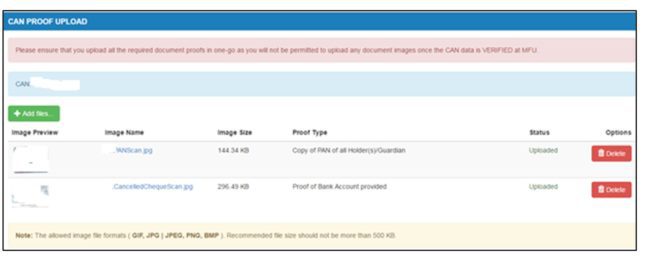

Post allotment of the Provisional CAN, a mail would be sent by MFU with a URL for uploading the documents. Please click on the hyperlink in the mail, wait for the OTP which will come in your mailbox and mobile, input the OTP and the following screen appears. Note: The allowable file formats are GIF, JPG or JPEG, PNG and BMP and PDF is NOT allowed. Therefore, make sure your scanned copies are in the proper formats as stipulated by MFU.

A common confusion on the document upload process: The automated mail from MFU advises you to upload three documents

- Scanned Copy of PAN card

- Scanned of Cancelled Cheque or Bank Passbook

- FATCA declaration

The 3rd point is where most applicants get baffled as to how to get the declaration form or make the declaration. Let me answer you, loud and clear, “IGNORE THIS 3rd BULLET”. No need to do anything on the 3rd bullet and my confabulations with MFU team tells me that this is a standard email response.

The electronic CAN is one of the unique things that MFU has come up with. It simplifies the process of opening a CAN manifold and is truly something that “Digital-India” should look like. I have always vouched for electronically executed processes since I am extremely abhorrent to signature and form-fill-up. Working 24 X 7 on laptops and smartphones, one thing which I regret is to lose my handwriting skills and ever-changing signatures. Therefore, any kind of handwritten paper or signature or paper-based process irritates me to the core.

I thank you, readers, for your patience and going through this post. At the end, let me take the opportunity to wish you all a very Happy New Year 2017.

=-=-=-=-=-=-=-=-=

Thank you, Anish. If you require some motivation to switch from regular to direct, have a look at: Direct Mutual Fund vs. Regular Mutual Fund: 2017 Performance Report.

You Can Be Rich Too

My new book with PV Subramanyam, published by CNBC TV 18

The book comes with 9 online calculator modules to create your own financial plan.

It also has detailed selection guides for equity and debt mutual funds.

Amazon Rs. 375

Kindle Rs 244.30

Infibeam Rs 307

Googe Play Books App Store (Rs 244.30)

What Readers Say

- Simple and powerful This book empowers the reader with the concepts in easy to understand & simple form. Those who have been reading blogs of both authors would know that they are not only good with finance domain but also have a knack of simplifying the methods of investing for their readers. This book by them is a gem of financial knowledge for people who are starting to invest or want to get better at it. The presentation and the thought process with calculators is extremely powerful.The book should be read & calculators used simultaneously to understand the concepts well. The calculators when used with real inputs will show you where you are & where you need to reach for each of your goals. Don’t ignore these numbers.Learnings from Chapters 7 to 11 will help you avoid going off path & saving your money from financially hazardous products. With discipline & right approach suggested here you wouldn’t need a financial advisor to build wealth.

- This is perfect book on personal finance. Very nicely explained about taxation about debt mutual fund. Topics like early investing and asset allocation are very well explained. – Mahesh Deshmukh

- Highly Recommended For anyone who wishes to take control of his/her finance this book is a must read. Very simply put, even an amateur in finance will be able to understand and implement. The author genuinely attempts to inculcate the habit of investing among the people who have the ability to invest but refrain from doing it, either due to lack of time , interest or understanding!. The message from the book is ” Investment done without setting a goal/ objective is like leaving for a trip without knowing the destination, not everytime the end result will be promising. Hence, it’s important to invest in a planned & disciplined manner.” A read is highly recommended ??

- A must book for everyone who wants to take control of personal finance. Nice explanation of how a debt mutual fund works. Bonds trading and indexation benefits in high inflation years were something new I learnt. After reading this book you will be able to easily choose any funds, because you will know what that fund does or how that fund works

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)