Last Updated on December 29, 2021 at 5:14 pm

The Government recently cut corporate tax rates in September to 22 per cent from 30 per cent in a bid to boost investments and revive flagging market sentiments. The Finance Minister (FM) also announced that more taxation reforms are in the offing leading many to believe that personal income tax rates along with other taxes like Long Term Capital Gains (LTCG) tax on equities and Dividend Distribution Tax (DDT) could be next on the chopping block. These speculations also had a part to play in the recent market rally. But recent developments have almost put paid to these hopes. Let’s look into what happened to understand if personal income tax would be cut next.

About the author: Anjesh Bharatiya is a 30+ taxman by profession and a Chemical Engineer by education. He has been an investor in the stock market since age 15! He likes to write about personal finance, stock markets, government policies, taxation, philosophy and football.

Bad Economic Data:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Recent data points coming out in the past few weeks do not paint a rosy picture of the Indian economy. In fact, they point to a deteriorating fiscal situation which may put to halt any freebies the FM may want to give to the small taxpayer. We will look into some of these data points now.

- GDP growth slumped to a 6-year low of 4.5% in the July-September 2019 quarter. For perspective, it was 7% during the same period last year. The nominal GDP growth (pace of growth without considering inflation) also fell sharply to 6.1%. GDP growth is linked to the government’s fiscal estimates as well as its tax collection as we will see below.

- During the April-October period, the net collections from direct taxes and the Goods and Services Tax (GST) were 38% and 49.21%, respectively, of the Budget Estimates (BE) for the full FY 2019-20. Between April 1 and October 31 of this year, the net collection of direct taxes was Rs 5.18 lakh crore. This is a little over 38 per cent of the BE while during the corresponding period of the last financial year, it was 44 per cent. This also means that the direct tax collection rate needs to increase at 30% between November 2019 to March 2019. With nominal GDP growing at a mere 6.1%, this is nearly impossible as business earnings are stagnating and salary increases have been nearly absent because of the financial stress on companies. The corporate tax rate cut will also ensure that there is almost no chance of any increase in corporate tax collection. Even in the case of GST, the collection needs to be more than the Rs1.10 lakh crore a month for the remainder of the financial year to meet the BE. For perspective, GST collection has only ever crossed the Rs1.10 lakh crore mark once since the new tax was rolled out. That was in April 2019 when the collection hit Rs1.13 lakh crore. As a result, the fiscal space for personal income tax rate cuts simply doesn’t exist.

- Fiscal deficit (FD) also hit 102.4 % of 2019-20 BE at Rs 7.2 lakh crore at the end of October as per recent Government data. FD is the gap between the Government’s expenditure and revenue. Thus, there is no headroom for the Government to absorb any further cut in revenues. Consequently, there is little to no chance of personal income tax cuts any time soon.

- The output of eight core infrastructure industries decreased by 5.8% in October, indicating continued pressure on the economy, as per Government data released recently. This means that GDP growth for the third quarter of the year (October to December) may be even lower than the second quarter, notwithstanding a better-than-expected festive season, especially for online retailers and the auto sector.

Disinvestment and corporate investments:

Disinvestment in Government-run companies (known as Public Sector Undertakings or PSUs) and corporate investments are potential tailwinds that may help the Government rake in more money from existing routes and may lead to personal income tax rates being slashed down the line. However, even in these two areas, expectations are unlikely to come to fruition. India Inc. is grappling with excess capacity in many sectors and with consumption flagging, there is little reason for these companies to go for investment and therefore, the corporate tax cuts are unlikely to give much fillip to growth.

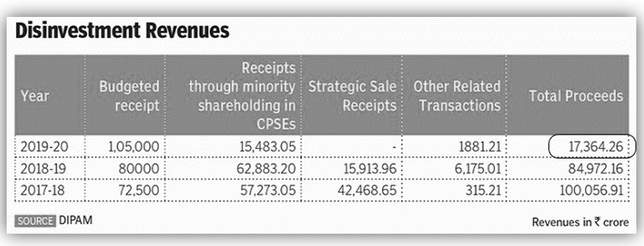

On the disinvestment front, the Government recently laid out its plans to disinvestment varying stakes in five PSUs, including majority stakes in oil company Bharat Petroleum Corp Ltd (BPCL) and Shipping Corporation of India. However, there are many hurdles before the planned disinvestment proceeds of Rs 78,400 crore (at current market prices) reach the Government coffers. The opposition is up in arms over the sale of the country’s family heirlooms. BPCL workers went on a strike on 28th November against the sale of one of the country’s profit-making PSUs. “The Modi government is inviting crony capitalists to grab resources that belong to the nation. The workers will welcome them with strikes, dharnas, and opposition,” said the protesting workers. The current collections from disinvestment for the year are also pretty disappointing as seen below:

The failed attempts to sell or shut down loss-making PSUs like Air India and BSNL also don’t inspire much confidence in any money coming in through these companies. In fact. The Government had to come up with a costly Voluntary Retirement Scheme (VRS) for BSNL & MTNL workers which will be a further blow to Government’s bid to control expenditure. On the whole, the purported disinvestment proceeds are unlikely to come in as early as expected by the Government.

The failed attempts to sell or shut down loss-making PSUs like Air India and BSNL also don’t inspire much confidence in any money coming in through these companies. In fact. The Government had to come up with a costly Voluntary Retirement Scheme (VRS) for BSNL & MTNL workers which will be a further blow to Government’s bid to control expenditure. On the whole, the purported disinvestment proceeds are unlikely to come in as early as expected by the Government.

Income tax rate cut may not be a cure-all:

Even at the microeconomic level, there is cause for worry. Consumer confidence is down in the dumps at the moment. People are fearful for their jobs as the economic slowdown shows no sign of abating. In such a situation, there is no certainty that a personal income tax rate cut would translate into spending. It is quite probable that conservative individuals may decide to channel the tax cuts into savings. It all depends on the popular mindset on the course of the economy. Currently, the mindset is more pessimistic than a few months back.

Final Word:

Based on the balance of current economic data, there is very little scope for the Government to bring cheer to the small taxpayer through any tax sops. The economy will have to get back on the high-growth path and corporate tax cuts will have to translate into investments on the ground before any such move is contemplated by the powers that be. The Akhilesh Ranjan taskforce on a proposed new Direct Tax Code recommended an upward revision in the tax slabs according to the grapevine. The report, which was submitted in August to the Government, has not been made public. The earliest that the report may be implemented is Budget 2020. However, there have been no commitments by the FM on its implementation and so, for the time being, seeing our tax bill go down remains a pipedream.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)