Last Updated on October 8, 2023 at 1:46 pm

Many readers have asked me to explain how a financial plan is created with examples. I requested SEBI registered fee-only financial planner (meaning, no commissions and works only for you), Sukhvinder Sidhu to explain the financial plan creation process with an example. This is meant for those new to DIY investing and also those who wish to understand the role of a financial planner.

Sukhvinder is one of the most ethical and honorable people I have had the pleasure of interacting with. He spoke at the first Delhi DIY meet in March 2015. He is also in the freefincal list of fee-only financial planners

What you see below is sections of a typical financial plan prepared by Sukhvinder. All names and numbers are imaginary and only for illustration. The idea is to highlight how a proper financial plan requires the sharing of all relevant data.

The Family

Rajeev Goswami, aged 35, is working as a Senior Mechanical Engineer in BPCL for the last 7 years, and currently posted in Mumbai Refinery. He has some major health issues, but he is not much concerned about these as his employer takes care of all treatment and its costs.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

His wife, Minakshi, is a teacher in a private school, making some contribution to the family income. A very kind-hearted and helpful lady! Having seen the death of a near relative due to cancer, she always wants to help anyone who comes in her contact and needs money for some treatment. Recently she came to know about a serious medical problem being faced, and the paucity of funds for its treatment, by one of her Facebook friends; she readily provided Rs 80000 after getting her bank FD canceled.

The couple has a 1-year-old daughter, Kriti, and they have planned to have another child in two years time. Rajeev’s parents, who reside in Assam, his native place, are financially dependent on him partially, and he contributes a monthly average sum of Rs 4000 for their welfare.

Rajeev is very enthusiastic about planning his financials for future and informs/ discusses his family’s complete financial details with his financial planner.

Family’s Financial Goals

Rajeev wants to create wealth, and informs his ultimate aim in achieving this. He says, “I don’t like to work for money. Money should work for me to make more money so that I can become financially independent.”

Retirement Planning

He wants to retire early, but he is not sure when he can do so. He wants it at 50 but can take it up to 55 to adjust with his financials. He wants to know and be sure of its possibility.

(Goal Priority: High)

Children’s Future

The parents have set the target amounts of Rs 30 lakh each for Kriti’s graduation, post-graduation and marriage. They also want to plan for the future of the planned second child; they want to arrange the sums of Rs 15 lakh, 30 lakh and 10 lakh for the above goals respectively. Having decided to plan investments for their future quite early, these are now their long term goals, which they can hope to achieve more easily now than if they had postponed the planning for the next few years.

(Goal Priority: High)

House Purchase

Rajeev wants to purchase a house in a city in his home state for investment purpose, the total present value of which is estimated to be around Rs 45 lakh. Though he wants this in 5 years time but has decided to be guided by his financial planner, both on the usability and the no. of years to goal, after studying the House Building Loan scheme provided by his company. His entitlement in the scheme is Rs 20 lakh, and he wants to utilize this benefit.

(Goal Priority: High)

Car Purchase

The family dreams of buying a new car in 3 years time. They have also thought of the model with the current on-road price of Rs 13 lakh. They are willing to sell their existing car at the time of the new car purchase.

(Goal Priority: Medium)

International Vacation

The couple also desires to go on a vacation to Europe in 10 years. With 4 members, the total cost of vacation as on today, including tour package and additional costs like visa, shopping, etc. works out to Rs 4.30 lakh.

(Goal Priority: Medium)

Starting New Business

Rajeev has interest in tea plantation business that is common in his home state of Assam, and has already invested Rs 4 lakh in it. It is an ongoing project, and its expansion depends on the availability of new land. So, he wants to remain ready for any opportunity and immediately needs another Rs 8 lakh for it.

(Goal Priority: High)

Luxury/ World Tour

After his retirement, the couple desires to go on a world tour, which will cost Rs 60 lakh in today’s value.

(Goal Priority: Low)

Farmhouse

In 20 years time, Rajeev wants to own a farmhouse with present cost of Rs 30 lakh.

(Goal Priority: High)

Charitable Trust

Minakshi has a dream of floating a charitable trust so that she is able to help the people who need medical treatment but do not have sufficient money for it. And Rajeev really wants to fulfill his wife’s dream by immediately starting with even a small amount. For this he adds Rs 5 lakh as immediate requirement, for his financial plan to take care of.

Family’s Current Financials

Annual Income

Rajeev’s annual salary after tax is Rs 12.7 lakh, with performance bonus averaging Rs 50,000. The salary figure of Minakshi is Rs 3.43 lakh, with income from investment as Rs 20,000. The expected increase in income in both the cases is 3% p.a.

Rajeev is contributing Rs 1.17 lakh to his provident fund annually and Rs 1.42 lakh to VPF, whereas for Minakshi , it is Rs 37,000 p.a.

Assets (Rs Lakhs)

Liquid Assets (0.42): Saving Account (0.42)

Debt Assets (43.58): FDs (5.89), PPF (1.97), EPF + Gratuity + Superannuation balances (32.26), Policies SV (3.46)

Equity Assets (7.77): Stocks (7.65), Mutual Funds (0.12)

Real Estate (4.00): Agri. Land (4.00)

Total Investment Assets (55.78)

The personal assets are Rs 9.86 lakh and personal liabilities Rs 4.64 lakh.

Monthly Expenses (Rs Thousands)

Household (31.9), Lifestyle (6.7), Dependent (5), Loan Servicing (9)

Total Monthly Expenses (52.6)

Due to the availability of accommodation from Rajeev’s employer company, there is no house rent expense.

Other Financials

- Both Rajeev and Minakshi have taken car loans. The interest rate in case of Rajeev is 7% p.a., but it is higher at 9.7% on the other loan. The total of the two car loans outstanding is Rs 4.46 lakh and the EMIs total is Rs 9,000. He is in a dilemma whether to pre pay his wife’s car loan or not.

- Rajeev has not purchased any health insurance policy for himself or his family members, as he is of the strong opinion that he doesn’t need any. “There is no requirement of medical covers, including for parents, except accident insurance for both. My employer company provides all covers for all members, even after retirement”, informs Rajeev confidently. His wife’s risk of an accident is more as she travels more, but her income is lesser.

This is a great employment benefit for him, especially because his own current health situation is not satisfactory due to poor lifestyle. - The couple is investing about Rs 90,000 yearly in 4 traditional insurance policies. Rajeev had started four years back with three policies (total life cover 11 lakh), and later took one for his wife (life cover 5 lakh). Minakshi, on the other hand, has been more interested in simply depositing in bank, and had accumulated Rs 6.70 lakh in an FD from her savings over her working years.

- Rajeev has a great interest in direct equity investments and is already taking the services of an expert for this. He wants his financial planner to reserve a part of his future surplus for investments in stocks.

Financial Plan Creation for the Family

Assumptions

The assumptions made for preparing financial plan of Rajeev’s family are:

- Inflation – General (7.5% p.a.), Education costs (7.5% p.a.)

- Income Growth – Rajeev (3% p.a.), Minakshi (3% p.a.)

- Retirement Age – Rajeev (55), Minakshi (60)

- Life Expectancy – Rajeev (80), Minakshi (80)

- Income Tax Bracket – Rajeev (20%), Minakshi (0%)

- Loan Rates – Home (11%), Vehicle (13%)

- Asset Returns – Liquid (5%), Debt (8%), Gold (10%), Real Estate (10%), Equity (14%)

Investment Risk Profile

The Goswami couple is found to have the Investment Risk Profile category of ‘Growth’. This is based on their replies to the Risk Profiling Questionnaire and the relevant discussions. A Growth profile means that they will be comfortable with accepting a small measure of risk in the arrangements for their finances where justified. In particular, they will be prepared to accept some volatility in investment returns in order to achieve good long term returns.

Asset Allocation

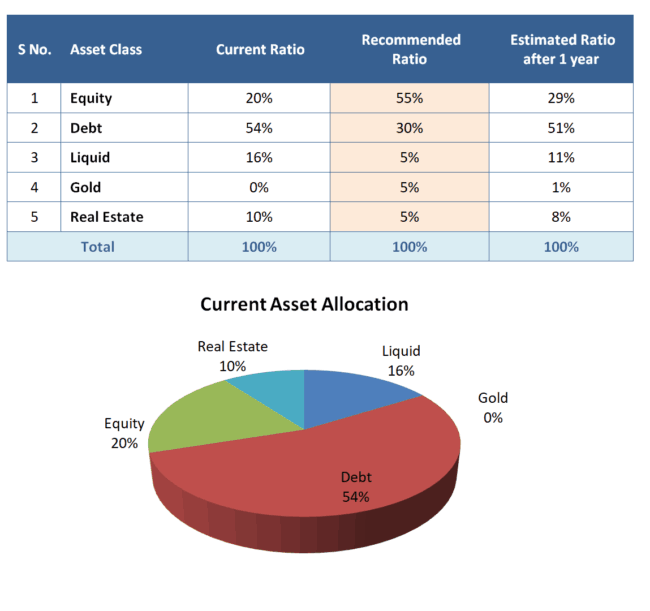

Based on the Risk Profile, Life Stage, Current Assets and Goals’ Achievement, the following Asset Allocation is set for the couple’s Investment Portfolio, which has to be achieved over time and maintained till a change is necessary. The table below also includes their Investment Portfolio’s Current Asset Allocation, and that estimated after a year on the implementation of the financial plan, neglecting changes in the investments’ market values.

Also to facilitate the creation of wealth in the long term, Rajeev should follow a Core & Satellite Portfolio investment approach. The investments are to be as below.

Current Financials

The couple should surrender the three endowment policies with them, and make the Whole Life policy as paid up, as these are providing returns varying between just 4 to 6% over long periods. This will make free Rs 91000 of the annual premium amount, for investing in better avenues from now onwards and to be able to fulfill their financial goals effectively.

Over the long period involved, the return from investment for child should be able to beat inflation related to education/marriage expenses of their child. The Sukanya Samridhi scheme does not fit well in their investment portfoilo in this respect currently, and also in terms of liquidity and flexibility for periodic rebalancing in the next few years. So, they should deposit only small amounts in the initial years of these accounts.

Regarding direct equity investments, Rajeev will have to regularly analyse the individual equity shares that he holds. He should take care of the taxation and cost aspects, in case of short term buying/selling, if done anytime. Also, he should utilize these for the family’s long term goals, and take care to exit each invested individual stock at its right time/price well before the goal year.

Family Goals

Life Insurance Needs (Life of Husband)

Rajeev is under-insured for current family lifestyle, commitments, and liabilities. After excluding the current life insurance recommended to be surrendered, the additional life insurance cover required works out to Rs 19.8 lakh. He should buy Rs 25 lakh of Term Insurance cover for 25 years on an immediate basis. An equivalent amount for the premium payment (Rs 5300 approx.) can be earmarked in family’s cash flows for the year.

Life Insurance Needs (Life of Wife)

Minakshi does not require any life insurance cover for herself as the available resources are more than sufficient to cover current family lifestyle, commitments, and liabilities in case of her absence.

General Insurance Needs

Rajeev has comprehensive medical facilities provided as employment benefits, available to all members of his family including his parents, even after his retirement. But the couple requires personal accident insurance individually. An equivalent amount for the premium payment (Rs 3,000 approx.) can be earmarked in the family’s cash flows for the year.

Contingency Funding

Contingency fund to meet emergencies should be kept at 3 months’ expenses of Rs 1.55 lakh, maintaining Rs 50,000 in Saving account for regular expenses, Rs 50000 in a Flexi – FD scheme and the remaining Rs 55000 in a Liquid Mutual Fund for emergencies. This amount can be sourced partly from current Savings balance and existing Flexi-FD, and the remaining by saving Rs 3,700 monthly for 12 months. These should preferably be joint accounts of the couple, with ‘Either or Survivor’ mandate.

Fund for Charity

Minakshi can utilise existing Flexi-FD’s part amount of Rs 5 lakh for the charity purpose on an ongoing basis. By investing it in a Balanced Mutual Fund scheme, she can draw Rs 50-60K annually keeping the principal amount intact, assuming long term return of 10-12%p.a. from it.

Vehicle Loan Prepayment

Minakshi can pay-off her vehicle loan in 2 years (in place of 5 years with the current EMI) with new monthly installment of Rs 12,354. The increase in EMI of Rs 6,474 can be adjusted in the cash flows.

Expanding Business

Rajeev can collect the amount needed to purchase land for tea plantation business in a period of 3 years using the proceeds of LIC policies after surrendering these, and with new monthly investments of Rs 6,000 in liquid and short term mutual fund schemes, increasing the investment amount by 10% each year.

Car Purchase

Rajeev can buy his desired car by taking a car loan of Rs 6 lakh (employment scheme) after 2 years, and utilizing the resale value of old car for the down payment after repayment of the previous loan. He also requires fresh monthly investments of Rs 17,700 in debt mutual fund schemes.

International Vacation

He can collect the corpus required for his family vacation by making fixed monthly investments of Rs 3,700 in suitable mutual fund schemes.

Wealth Creation/ Corpus

In a period of 20 years till Rajeev’s retirement, he can collect a corpus of Rs 63 lakh, after allocating resources for all other goals. For this, he requires to make fixed monthly investments of Rs 5,500. The investment amount may be increased after few years, which will raise the corpus. Also, Minakshi’s income remains fully spare for the next 9 years till her retirement.

Kriti’s Future

All the goals related to Kriti can be achieved with the existing investment assets of Equity Stocks, Mutual Funds, SSY a/c and an LIC policy. The couple also needs to save Rs 24,400 per month for investment in an equity mutual fund scheme and stocks (under expert advice).

Child-2’s Future

All the goals related to the second child can be achieved with fixed monthly investments of Rs 21,800 starting after 2 years from now.

Farmhouse

Rajeev can accumulate the corpus required to purchase a farmhouse by investing Rs 15,000 per month, starting after 2 years from now, in the remaining 18 years.

Retirement Corpus

The couple will be requiring a corpus of Rs 4.33 Crore after 20 years for funding their retirement life expenses. This objective can be achieved by earmarking the existing PPF investment and employment benefits of the EPF, Gratuity and Superannuation benefit. They further need to save Rs 7,300 per month and invest in equity stocks (under expert advice) and a new PPF a/c to be opened in the name of Minakshi.

Luxury/World Tour

Presently the family’s cashflows do not allow complete fulfillment of this goal. It may become achievable in future if the investment portfolio works better than the plan expectations. Rajeev can leave it for now and accumulate the surpluses as under ‘Wealth Creation’ goal.

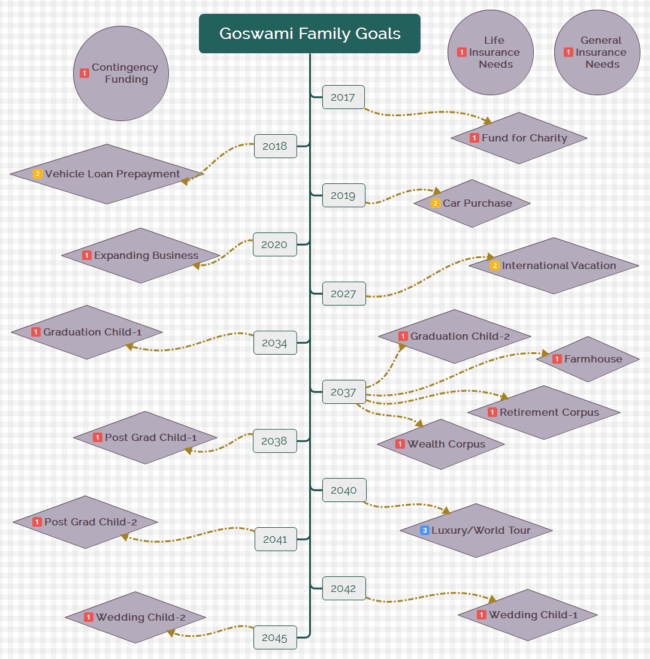

This is a pictorial summary.

Interested readers can contact Mr. Sukhvinder Sidhu for consultation

Website: finlifecare.com

Email: sukhvinder [AT] finlifecare.com

Office: FinlifeCare Solutions SCO-76, 2nd Floor, Mugal Canal Karnal, Haryana, India – 132001

Phone : 092-5353-5051

Please note: Freefincal.com is committed to promoting conflict free, fee-only investment advisory as much as DIY investing. I do not receive any kind of compensation (other than satisfaction) for such promotion. This post is by invitation. I requested Sukhvinder to write this for the benefit of readers.

Financial advisory is not like medical advisory. For an physical ailment, the range of treatment is rather limited. In financial advisory, there are thousands of ways to create a financial plan and no two planners are likely to full agree (with each other or with me).

You can also create your own financial plan with this financial planning template (robo version coming soon)

Ask Questions with this form

And I will respond to them in the next few days. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS WITH THIS FORM it is for questions only.

Error: Contact form not found.

GameChanger– Forget Startups, Join Corporate & Live The Rich Life You want

My second book, Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want, co-authored with Pranav Surya is now available at Amazon as paperback (₹ 199) and Kindle (free in unlimited or ₹ 99 – you could read with their free app on PC/tablet/mobile, no kindle necessary).

It is a book that tells you how to travel anywhere on a budget (eg. to Europe at 50% lower costs) and specific investment advice for young earners.

The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download)

You can Be Rich Too with Goal-Based Investing

My first book with PV Subramanyam helps you ask the risk questions about money, seek simple solutions and find your own personalised answers with nine online calculator modules.

The book is available at:

Amazon Hardcover Rs. 271. 32% OFF

Infibeam Now just Rs. 270 32% OFF. If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Flipkart Rs. 279. 30% off

Kindle at Amazon.in (Rs.271) Read with free app

Google PlayRs. 271 Read on your PC/Tablet/Mobile

Now in Hindi!

Order the Hindi version via this link

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)