Last Updated on June 3, 2022 at 11:11 pm

This is a performance review of Franklin India Feeder – Franklin U.S. Opportunities Fund. This is an open-ended fund of fund scheme that invests a minimum 95% of its assets in the Franklin U.S. Opportunities Fund – I (acc) USD based in Luxemburg!

Before we consider the fund’s performance, we must understand the nature of the underlying fund – Franklin U.S. Opportunities Fund. The amount we invest in Rupees is converted into USD and invested in the US stock market via the underlying fund. The NAV of the fund of fund (feeder) is reported in INR.

What is the nature of Franklin U.S. Opportunities Fund? It is an actively managed fund investing in US growth stocks across market capitalization and sectors. MorningStar categorises this fund as “US Flex-Cap Equity”. Launched in Aug 2004 the fund has an AUM of $5.78 Billion as on July 31st 2020. Source: fund homepage

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Please note that this fund has several variants and the Franklin Feeder fund invests in “Franklin U.S. Opportunities Fund – I (acc) USD”. This has a total expense ratio (TER) of 0.85%. In addition, the feeder has a TER of 0.63% for the direct plan and atrocious 1.61% for the regular plan.

Thus the direct plan investor in the feeder fund is currently subject to a total TER of approximately 1.47-1.48%. This is three times as expensive as Motilal Oswal S&P 500 Index Fund (What return can I expect from this?). Readers may recall from our review of ICICI Prudential US Bluechip Equity Fund that it had a TER of 1.68%. The ICICI fund had difficulty in beating the S&P 500 but managed to fall lower.

What is the benchmark of Franklin U.S. Opportunities Fund? The fund is benchmarked to the Russell 3000 Growth Index. This is a subset of the Russell 3000 Index. While the S& P 500 represents the large cap segment of the US stock market (a good 80%), the Russel 3000 represents large, mid and small cap segments with 3000 stocks (98% of the market). Source: Presentation by BlackRock

The Russell 3000 Growth Index “measures the performance of the broad

growth segment of the US equity universe” and includes stocks from the base index (Russel 300) with “higher price-to-book ratios and higher forecasted growth

values”. Source: Fund factsheet.

As per the latest factsheet, the growth index has 1513 stocks with a 5-year EPG growth rate of 19.77 as opposed to 12.62 for the base index. A dividend yield of 0.86 (17.74 base index). A PE of 36.18 (24.97 base index). Total returns from the fund factsheet are tabulated below.

| Period | Russell 3000 Growth | Russell 3000 |

| 1Y | 28.24 | 10.93 |

| 3Y | 20.08 | 11.39 |

| 5Y | 16.18 | 10.89 |

| 10Y | 16.96 | 13.59 |

| 2015 | 5.09 | 0.48 |

| 2016 | 7.39 | 12.74 |

| 2017 | 29.59 | 21.13 |

| 2018 | -2.12 | -5.24 |

| 2019 | 35.85 | 31.02 |

| 2020 | 17.1 | 2.01 |

These are NAV-based total returns of two iShare ETFs based on the S&P 500 and Russel 3000.

| Duration | iShares Core S&P 500 ETF | iShares Russell 3000 ETF |

| 1y | 11.93 | 10.72 |

| 3y | 11.97 | 11.2 |

| 5y | 11.45 | 10.71 |

| 10y | 13.78 | 13.39 |

A more detailed comparison is not possible since daily total returns data could not be sourced. It probably a fair assumption that there is not much of a difference between the RUSSEL 300 and S&P 500 as both of them are market-cap weighted. The growth index may not beat the based index every year (see table) but has the potential to be more rewarding but with a little more volatility (see factsheet for standard deviation).

The Franklin U.S. Opportunities Fund is benchmarked to the growth index. This table of returns obtained from the AMC’s fund page shows that the fund has not been able to beat the benchmark over the last 5 and 10 years. The 2015-16 performance was particularly abysmal bringing to the fore the dangers of active management. These returns are as on 31st July 2020 in USD.

| Duration | I (acc) USD (%) | Russell 3000 Growth Index (%) |

| 1 YR | 30.68 | 28.24 |

| 3 YRS | 20.68 | 20.07 |

| 5 YRS | 14.3 | 16.17 |

| 10 YRS | 15.63 | 16.96 |

| 15 YRS | 11.51 | 11.32 |

| Since inception 31/08/2004 | 12.32 | 11.58 |

| JUL‑19 / JUL‑20 | 30.68 | 28.24 |

| JUL‑18 / JUL‑19 | 11.24 | 9.88 |

| JUL‑17 / JUL‑18 | 20.93 | 22.86 |

| JUL‑16 / JUL‑17 | 19.61 | 18.02 |

| JUL‑15 / JUL‑16 | -7.18 | 3.57 |

The top ten holdings of the fund contain many of the “usual suspects”. From FI Feeder factsheet.

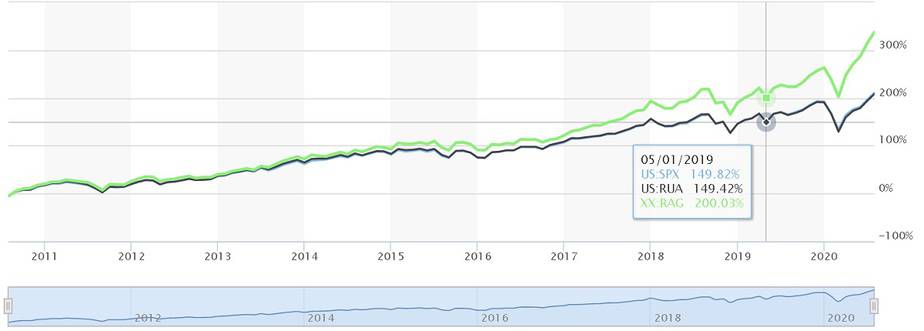

The NAV movement of Franklin India Feeder – Franklin U.S. Opportunities Fund along with ICICI Pru US Bluechip Equity Fund(G)-Direct Plan and S and P 500 in INR from Jan 2013 is shown below.

Notice how both the ICICI and FI Feeder funds are unable to move above the S&P 500 in INR. Do not get too swayed by the recent up movement in the red line. This is also seen in the five year rolling returns below.

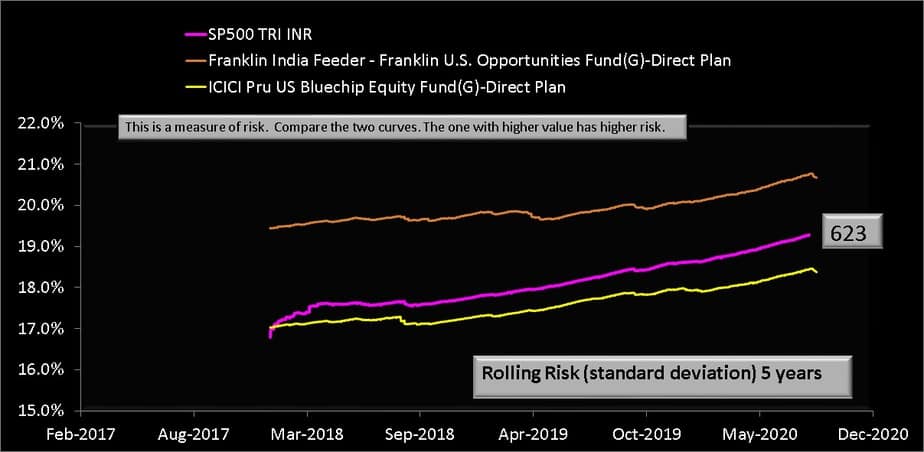

The FI feeder fund has a noticeably higher volatility than the S&P 500 INR index and the ICICI Bluechip funds as seen from the five-year rolling standard deviation plot below.

It is quite clear that the active funds struggle to beat the S&P 500. Therefore the S&P 500 index fund from Motilal Oswal appears to a better choice (for those who know how to manage a portfolio with US equity) than both ICICI US Bluechip Equity and Franklin India Feeder – Franklin U.S. Opportunities Fund. The only caveat is the tracking error of the index fund. We need some time to assess this.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)