Last Updated on October 8, 2023 at 1:45 pm

On August 1st, 2017, Bitcoin is expected to fork (split into two). In this post, I discuss my learning about cryptocurrencies with an emphasis on Bitcoin and Bitcoin fork and why they may be a reasonable choice of currency for those who have a set of specific requirements but does not (dare I say, should not) represent an instrument for investment.

I started reading about cryptocurrencies (at last count 900 of them exist!) rather late and as I sit down to write this, the cryptocurrency with the largest market share – Bitcoin – is on the verge of significant change. In this post, I shall often use the Bitcoin as a synonym for cryptocurrency (depending on the context)

The question that popped into my mind as I started reading was:

What is the difference between a bitcoin and a computer virus?

The bitcoin is a few lines of encrypted code. The virus is a few lines of encrypted code. Of course, I am not being serious and the similarities end there (do they?), but the point is, at least those born before 1990 should chuckle with amusement that we now call computer code as currency!

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

However, if you come to think of it, cryptocurrencies did not just pop up. If you see it as an example of distributed computing, search for extraterrestrial life (remember the SETI@home screensavers?), computing large prime numbers and other math problems over the internet are more than 20 years old. It is intriguing to learn that the core principles behind Bitcoin have its origins in the cypherpunk community which has been active since the 1980s.

So the Bitcoin (or should we call it gitcoin due to its open-source nature) is in some sense a natural evolution. However as we shall see below, recent progress has been a little too fast and the Bitcoin is struggling to keep pace.

What is a Bitcoin and how does it work?

Here is a simple definition by a layman, for the layman. It is a currency without borders and regulators. As mentioned above, it is a piece of encrypted code exchanged between two parties. A network of validators or accountants verify each transaction and add it to a ledger known as the blockchain. Verifying a transaction is equivalent to solving a math problem.

This ledger is open to the public and to all accountants. Unless all the accountants agree, it is impossible to defraud the system (you will see how hard that is below). The accountants get paid in two ways: a transaction fee to be paid by one or both the parties involved and some amount of bitcoin. Since new cryptocurrency is created each time a transaction is verified, the accountants are also called miners.

The transaction need not be money. It can be anything mutually agreed upon like a sack of wheat. Each bitcoin has 100 million units (1 followed by 8 zeros) just like one Rupee has(had?) 100 paisa.

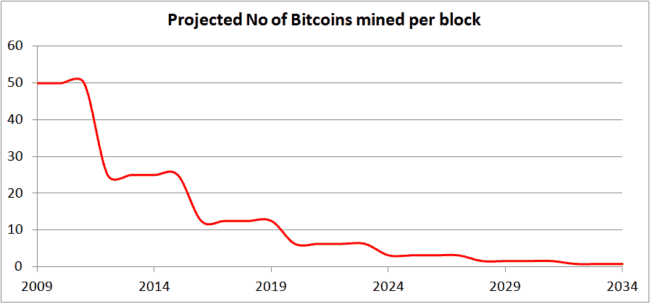

A system has been designed to create more bitcoins via transaction verification initially and then gradually (logarithmically) decrease production over time with an initial cap of 21 million bitcoins. As on date, about 78% of allowed bitcoins have already been mined and in circulation.

The transactions are bundled into something known as a block. All the blocks are linked to the other (called a blockchain) making it extremely hard (if not impossible) for someone to alter past transactions. The transaction in each block and the linking of one block to the other is done via code known as a hash. Each time such a hash is created, a reward of 25 bitcoins are created. Creating such hashes become progressively difficult.

About every four years or upon the creation of 210,000 blocks, the number of bitcoins created (mined) per block will decrease.

This is only a projection ignoring events to be discussed below. The point is that that reward for accountants will decrease over time and they will have to be compensated via transaction fees considering the enormous hardware and electricity required to verify transactions (see video below).

This is only a projection ignoring events to be discussed below. The point is that that reward for accountants will decrease over time and they will have to be compensated via transaction fees considering the enormous hardware and electricity required to verify transactions (see video below).

This is how the difficulty in finding new blocks has increased over time. The message is that each periodic increase could render the equipment the accountant (miner) used to maintain the ledger obsolete! So profits will drop sharply and costs will increase. So miners now pool their resources together and now mining is possible on “cloud”.

There are fears that network security will decrease once bitcoins cannot be created. However, it is too early to say anything. What is clear is that the fee structure is bound to change sooner than later.

Pros and cons of Bitcoin

The USP of all cryptocurrency is the lack of a central leadership and regulator. Sadly, this could also turn out to be its biggest flaw.

Everything about the Bitcoin process is out in the open – the code and all the transactions ever logged. You can get all the relevant data from blockchain.

As is well aware, the ransomware hackers demanded payment in Bitcoin. Would you believe that people are still paying those hackers in bitcoins! This twitter account: @actual_ransom tracks these. So listing all transactions means little in terms of transparency because the receiver will work with a false name (glad to see Bitcoin wallets in India demand a Pan card and this implies Aadhaar is also known if the governments want to track the individual).

A transaction made under duress should be identified by a miner via a token sent by the sender/receiver and this should be cancelled at an appropriate time with the receiver account frozen. Such a facility does not exist now. As far as I can tell, the ransomware hackers are still at large. Transparency should not be confused with accountability, credibility, traceability and security

That said, the notion of a currency without borders is fantastic. Under certain circumstances, such a transaction could prove cheaper than conventional currency transactions.

The Bitcoin Scaling Problem

However, Bitcoin suffers from a scaling problem. That is, as it gets popular transactions seem to take longer and longer (hours to days!) or sometimes get rejected. The fee seems to be on the rise too as a juicy fee is necessary for a miner to validate a transaction. This makes it like an auction house.

The problem is traced back to the size limit of a block (which contains a list of transactions). This was set at 1 Mb by the creators to prevent hacking. However, they probably did not predict a sudden increase in popularity.

Due to an increase in transactions, the block size of 1 Mb seems too small. Notice that the ceiling was reached in 2017. Every few minutes such a block is created and often some transactions take too much time or even get left out.

So the community has suggested several modifications to the Bitcoin operation code (protocol). Since there is no one in charge, a change will be set into motion only if there is a majority agreement. the bitcoin community has been unable to find a single solution.

The cryptocurrency community resembles a bunch of communists with no one in charge. It is important to keep in mind that communism worked (for a few decades in many places) only when it was thrust down the throats of its citizens by a leadership.

The Bitcoin Fork

That might seem like a strong comment, but the reason I make it is, come August 1st, 2017, the bitcoin community will split into two – bitcoin and bitcoin cash.

The reason for this split is due to a clash between the code developers vs miners ( coders/developers/miners – sounds like a young adult science fiction like the divergent series! It is!).

The developers want a gradual increase in block size from 1 Mb to 2 Mb (this year end) and 4 Mb later this year with a code change in which the block is freed up by changing the way transactions are logged. This is known as Segwit + 2Mb increase. The Segwit was implemented on July 21st, 2017 as seen below. The 2X block size increase is expected in November.

The miners oppose Segwit and want an immediate increase in block size to 8 Mb. This means more coins (to mine) and lower transaction fees. This will bring back the retail investor (for whom Bitcoin is just too expensive now)

But why? This is what the Bitcoin Cash FAQ says:

The legacy Bitcoin code had a maximum limit of 1MB of data per block, or about 3 transactions per second. Although technically simple to raise this limit, the community could not reach a consensus, even after years of debate.

Not only is this Bitcoin split (a fork as they call it) confusing, it is also unnecessary. If there was a central leadership, this could have been avoided (or the Bitcoin could have collapsed with no change).

Now everyone is warning Bitcoin users to preserve their private key and get all their coins back in the wallets as many exchanges have refused to support this fork. It is a mess. A mess created by decentralization. On August 1st, users who have kept their private keys (coins in wallets) will see them split into two – bitcoin and bitcoin cash.

A couple of years later there is nothing to stop Bitcoin Cash to split further. With the news of every such split or even every major disagreement, the exchange rate of the Bitcoin will fluctuate.

Already Bitcoin volatility is anywhere between 3-5 times higher than that of US stocks (S&P 500) and Gold. Any stock investor would tell you that a strong management is crucial for stability.

I have no concerns about cryptocurrency security. In fact, my concern is that is too secure for its own good. That is the security seems to get tighter with time and this poses a problem for the miners. The system seems to have a grand vision but without the plans to handle a surge in usage. This makes it fundamentally unsuitable as an investment as the underlying product is premature.

Amidst all this debate and the proposed Bitcoin fork, the beneficiary may be the user, definitely not the investor. Perhaps the split and the surrounding uncertainty/volatility presents an opportunity for the trader.

The user as in a person who buys bitcoins in exchange for USD or INR and buys products or services with it for a lower fee (lower than conventional means) and in a reasonable time (say 30 minutes or less). For the user the exchange rate of the Bitcoin is incidental. The only caveat is that user must be prudent enough to secure the private keys to the currency. Else if the device they use for transacting is hacked or lost or misused, it is all gone. Of course, they will have to evaluate the cost of such lower fee and transactions without a regulator.

For the investor or even speculator, the risk is huge, because the uncertainty is huge. The product can change colour, it can split into two and the worst part is, just about anyone can initiate this change. Some people advise “small exposure”. What good is 5% of 10% exposure going to do? Might as well be 0%!

Will Bitcoin put actual food on an actual table?!

Will there be a day when a cryptocurrency can be used to buy a cup of coffee or a loaf of bread? In its current form, I don’t think so and I hope not.

Time for a totally different cryptocurrency?

Cryptocurrency is the future, but the present format does not seem to be future ready. Why can’t we have one in which there is validation & accounting for a fee and no currency creation (mining) involved? Each currency is regulated by a country and the exchange rate is always one: one unit of local currency = one unit of local cryptocurrency. So the exchange rate is the same as conventional currency. There are local regulators and security protocols associated with the validation can be simpler and uniform? The ledger of transactions is available to all regulators at all times. Like the UN, the strong players get to make the rules. It is not an ideal system but it has avoided a world war for seven decades.

Calm down, I was thinking aloud. I know, I know, most Bitcoiners would say, that would defeat the whole idea of decentralization, transparency, blah blah blah. Unfortunately, the decentralization seems to be enough to defeat decentralization!

I think a stable system with reasonable security (not requiring the mess that you see below) but at the same time accountability (via regulation) with lower transaction fee may work better.

Yeah, I am just an old guy yapping along with little understanding. At least I am not worried that my money is controlled by a bunch of uncooperative geeks and will vaporise due to the Bitcoin fork. So there.

Life Inside A Chinese Bitcoin Mine

Do have a look at what some big-time miners are up to. What a waste of power and resources. And look at the junk they are creating. Just what the World needs now in the name of security and transparency.

Ask Questions with this form

And I will respond to them coming Monday. I welcome tough questions. Please do not ask for investment advice. Before asking, please search the site if the issue has already been discussed. Thank you. PLEASE DO NOT POST COMMENTS/OPINIONS WITH THIS FORM it is for questions only.

GameChanger– Forget Startups, Join Corporate & Live The Rich Life You want

My second book, Gamechanger: Forget Start-ups, Join Corporate and Still Live the Rich Life you want, co-authored with Pranav Surya is now available at Amazon as paperback (₹ 199) and Kindle (free in unlimited or ₹ 99 – you could read with their free app on PC/tablet/mobile, no kindle necessary).

It is a book that tells you how to travel anywhere on a budget (eg. to Europe at 50% lower costs) and specific investment advice for young earners.

The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download)

You can Be Rich Too with Goal-Based Investing

My first book with PV Subramanyam helps you ask the risk questions about money, seek simple solutions and find your own personalised answers with nine online calculator modules.

The book is available at:

Amazon Hardcover Rs. 271. 32% OFF

Infibeam Now just Rs. 270 32% OFF. If you use a mobikwik wallet, and purchase via infibeam, you can get up to 100% cashback!!

Flipkart Rs. 279. 30% off

Kindle at Amazon.in (Rs.271) Read with free app

Google PlayRs. 271 Read on your PC/Tablet/Mobile

Now in Hindi!

Order the Hindi version via this link

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)