Last Updated on April 27, 2025 at 10:18 am

In this stock analysis episode, we consider Dr Lal PathLabs Limited, an international diagnostic and healthcare test service provider. Its IPO opened in Dec 2015. In Oct 2020, the company was in the news for the wrong reasons: a data breach

About the author: Ashish Tekwani has done his Masters in Finance from NMIMS, Mumbai. He is on the hunt to find great Indian companies to invest in, and his interests lie in pop culture, trekking & technology. You can follow him on Twitter via @AshishTekwani1. Editor’s note: No part of this article should be construed as investment advice. Kindly do your research before investing. The facts and opinions mentioned in this article do not represent the views of freefincal.

Healthcare Industry

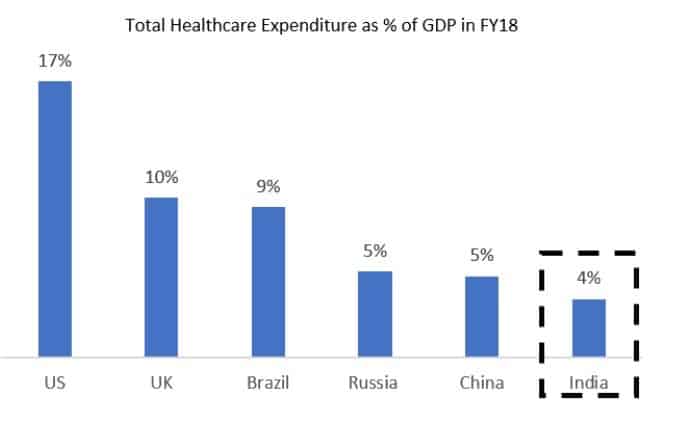

The Indian healthcare industry is expected to expand to US$ 372 billion by 2022 on the back of more significant health awareness among people, the prevalence of lifestyle diseases, better access to insurance, increasing incomes and greater investment by both public and private players. India has some of the lowest expenditure on healthcare in the world at around 3.6% of GDP. Public expenditure accounts for a meagre 1.28% which ranks India at 170 out of 188 countries in domestic general government health expenditure as a percentage of GDP, as per the Global Health Expenditure database 2016 of WHO.

Diagnostic Industry

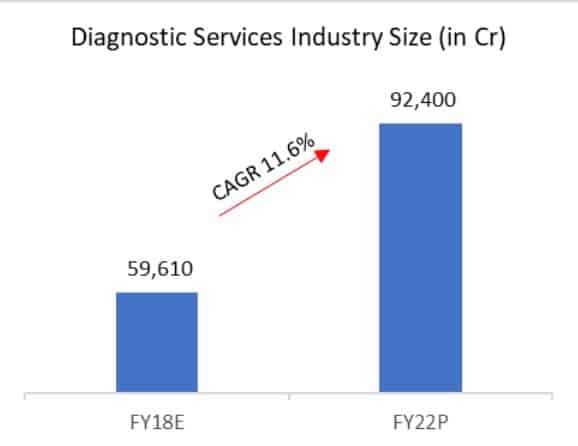

Operating at only 4–5% of the total healthcare expenditure, the medical diagnostics industry influences the remaining 95% of the cost. The Indian diagnostic market (including radiology), a subset of the healthcare industry is currently estimated to be ~₹80,000 crores. Private players are estimated to constitute around ` 45,000 crores of this market. The diagnostic industry is expected to reach ₹92,400 cr by 2022.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

There are multiple growth drivers for the diagnostic industry, which will help it grow faster than overall healthcare market growth. Some of these drivers include:

- Growth in non-communicable disease (NCDs) and chronic diseases

- Ageing population

- Increasing focus on preventive medicine

- Preference for evidence-based treatment

- Increasing per capita income

- Increasing insurance cover

- Increase in awareness levels

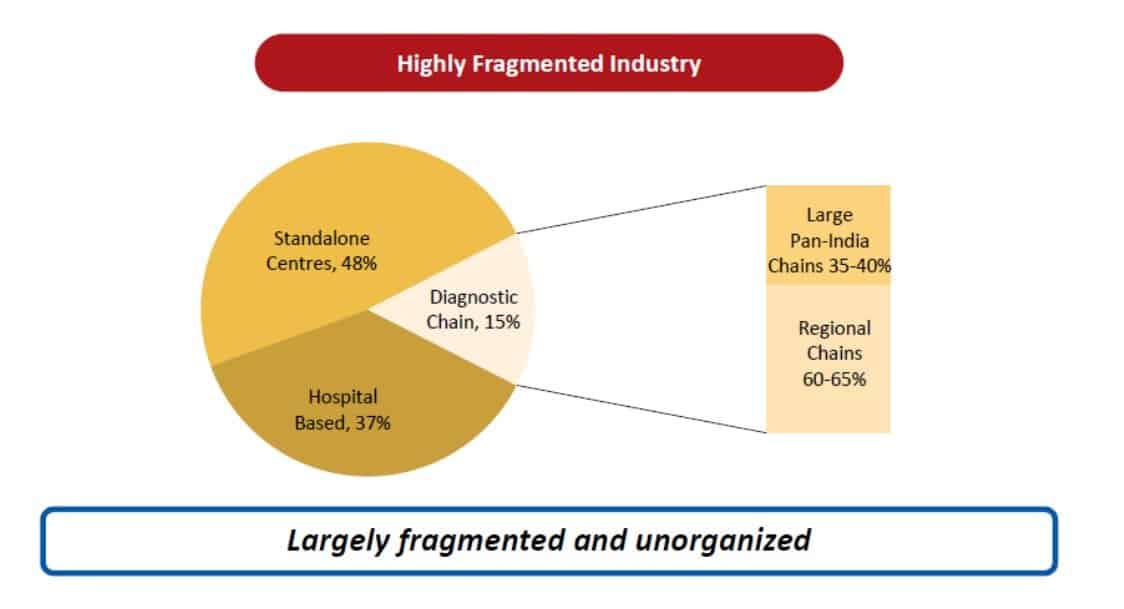

The industry is highly fragmented & unorganised with almost half of all labs being standalone centres and 37% being based out of hospitals. Large Pan-India franchisee players form a small part of the diagnostic chain where they also have to compete with the regional chains and standalone centres.

In the future, the industry will see consolidation led by large pan-India chains and formalisation of the industry through stricter regulation. There are currently three listed & one private company in the organised space, namely Dr Lal Pathlabs, SRL, Thyrocare and Metropolis. Every year we see acquisitions/JV’s/Partnerships by these franchises that continue to increase their market share in the organised space. We’ll talk about Dr Lal pathlabs since it is the biggest of the lot in market cap, geographical reach and revenue.

About the company

Dr Lal PathLabs Limited (DLPL) has an integrated nationwide network. Patients and healthcare providers are offered a broad range of diagnostic and related healthcare tests and services for use in core testing, patient diagnosis, prevention, monitoring and treatment of disease and other health conditions. The services of DLPL are aimed at individual patients, hospitals and other healthcare providers and corporates. The catalogue of services includes 455 test panels, 2,537 pathology tests and 1,961 radiology and cardiology tests.

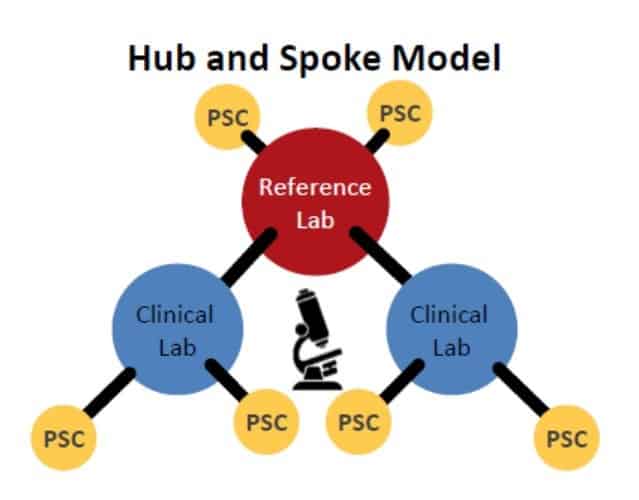

To achieve economies of scale and better efficiency, DLPL followed a hub and spoke model whereby the National Reference Laboratory (NRL) acts as a ‘hub’ for the rest of the network in India. In addition to walk-in patients, the National Reference Laboratory receives test requests and related specimens via courier from its clinical laboratories, patient service centres (PSC), pickup points (PUP) and through the home collection.

- Clinical labs, including the NRL act as a mini-hub for surrounding PSC’s and PUP’s.

- Patient Service Centers — which is internally referred to as “collection centres” — are to collect specimens for shipment to its clinical laboratories or NRL, depending on the nature of the test sought.

- Pickup Points are a cost-effective way for healthcare providers with specimen and sample collection capabilities. Still, they may lack the resources, expertise, scale or the requisite licenses possessed by larger clinical laboratories, like ours, to provide testing services for their patients.

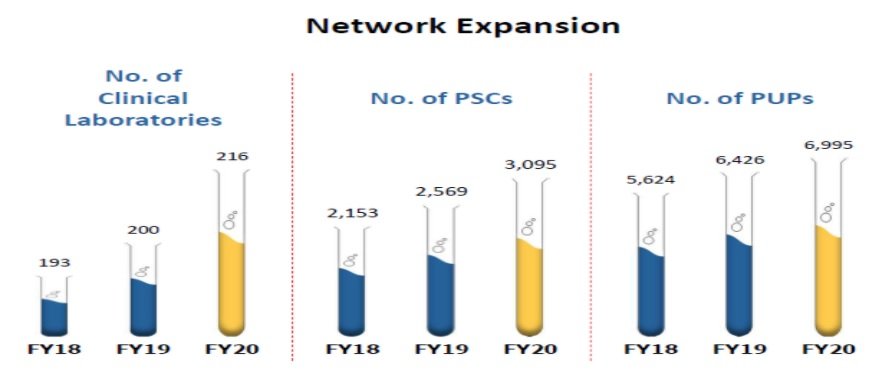

When the collected specimens require more complex, specialized testing than those are sent to the NRL. DLPL has about 216 clinical labs, 3095 PSC’s and 6995 PUP’s.

Complementing the hub & spoke model, DLPL follows a cluster city approach whereby it targets a potential market to develop important pockets that drive volumes.

Offerings

DLPL can perform substantially all of the diagnostic healthcare tests and services currently prescribed by physicians in the country with a catalogue of 455 test panels, 2,537 pathology tests and 1,961 radiology & cardiology tests. These are categorised into 3 types:

- “Routine” clinical laboratory tests — such as blood chemistry analyses and blood cell count

- “Specialized” testing services — such as histopathology analyses, genetic marker-based tests, viral and bacterial cultures and infectious disease tests

- Preventive testing services — such as screenings for hypertension, heart disease and diabetes

Fundamental & Operational metrics:

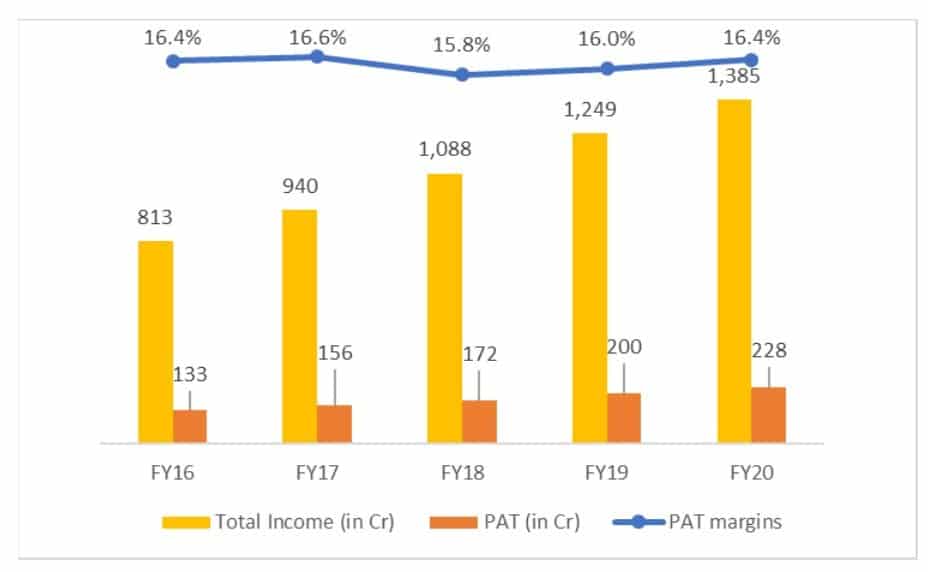

Being one of India’s top diagnostic chains, DLPL has been financially performing well in the past 5 years with a CAGR of 14% in total income and has consistently delivered ~16% PAT margins.

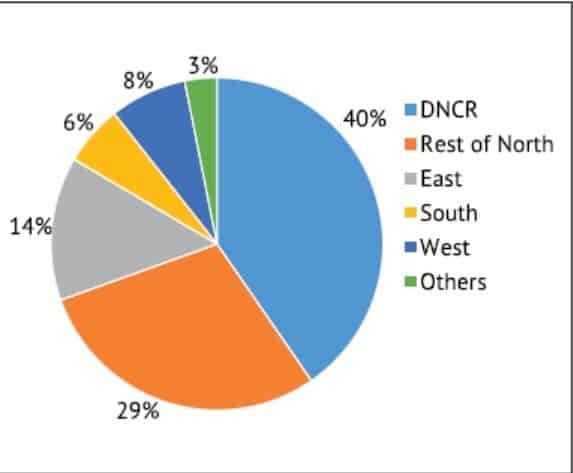

DLPL has been working judiciously on enhancing its product mix, geographic mix and channel mix, which has resulted in reduced dependence from the dominant Delhi-NCR market. Revenue contribution from outside its home market has increased to about 60% and has grown 15% in FY20 compared to the previous year.

As explained earlier, DLPL follows a Hub & Spoke model and has expanded aggressively on that front. It is important to note that DLPL is a zero-debt company, so all its expansions are self-funded on account of strong cash flow generation. This is because it has a negative cash conversion cycle meaning it receives cash immediately and has to pay to its debtors on a later date.

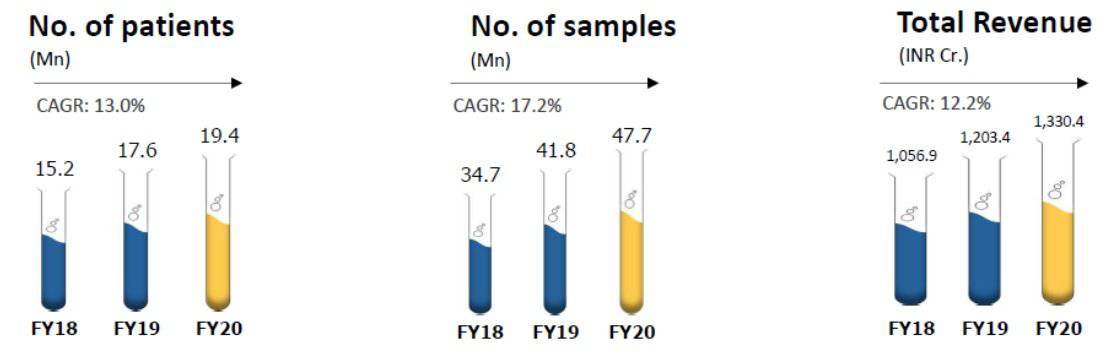

PSC’s manage the bulk of all sample collections, and hence the growth witnessed in the network is largely asset-light. The network expansion has naturally led to an increase in No of patients (CAGR of 13%), No of samples (CAGR of 17%) and Revenue from operations (CAGR of 12%)

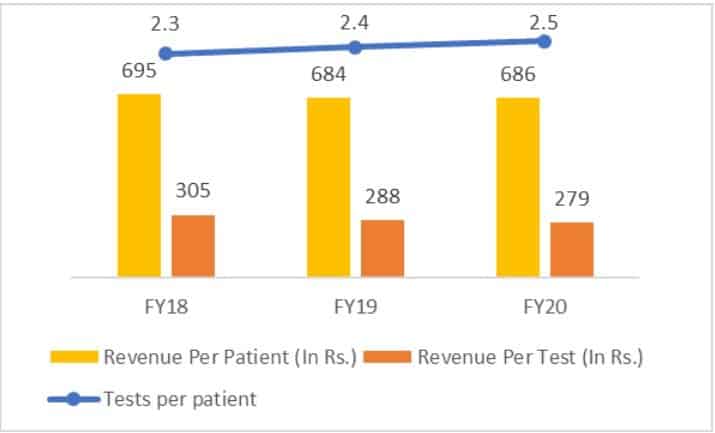

An aggressive expansion has led to a slight decrease in revenue per patient and per-test basis, but a slight increase in patient tests covers that. One possible reason for the same might be because DLPL has been pushing bundled test packages under ‘SwasthFit’ and targeted offerings like ‘Sugar and Me’. Such offerings are witnessing growing popularity because they provide greater value for patients, thereby contributing to higher sampling. DLPL has mentioned that it has a clear focus on patient volumes over test prices.

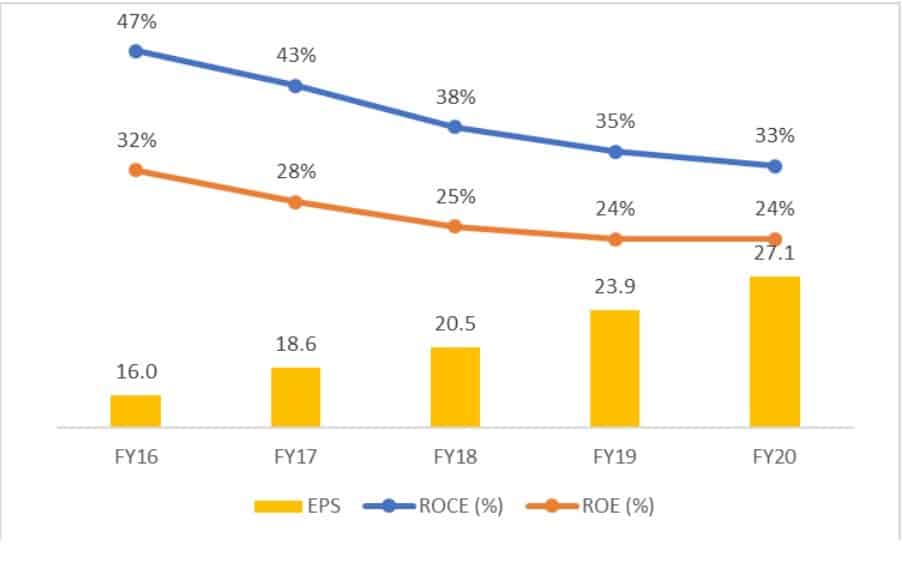

An asset-light approach and strong cash flow generation coupled with aggressive expansion have led DLPL to consistently maintain good profitability ratios with 30%+ Return on Capital Employed, ~24%+ Return on Equity and a CAGR of 14% on EPS in the last five years.

Covid update

FY20 will be well remembered by all of us due to covid, and one of the primary beneficiaries is the pharma industry. Strong companies with efficient management can navigate tough times better than their counterparts on the back of strong risk management practices and operational efficiencies. The first step in CoVID-19 is identifying the virus and testing it, thereby giving the diagnostic industry a centre stage. DLPL swiftly responded to the covid-19 outbreak by forming a task force to handle all covid related operational issues.

- It was one of India’s first private laboratories to have got approval to begin testing for CoVID-19.

- Initially, three of its labs got the approval to begin testing with accreditation granted to 7 additional Labs by Q2 of FY21.

- In the first half of FY21, it had already performed 5.05 lakh CoVID RT-PCR.

- In Q2 FY21, non-CoVID business is back to 98% of last year levels.

Where does the company stand in terms of competition?

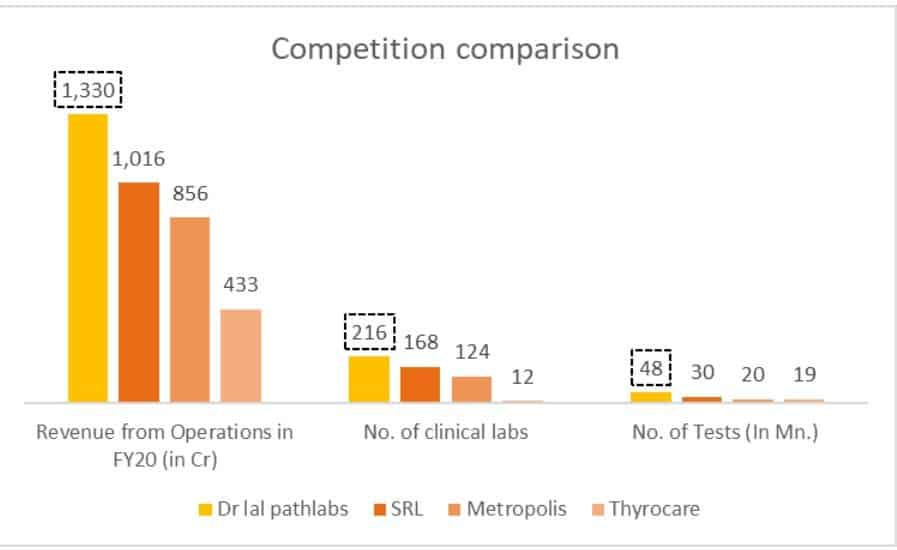

Popular pan-India franchises in the industry include SRL, Thyrocare and Metropolis. DLPL stacks way ahead of the competition in almost all the metrics in terms of market cap, revenue, geographical reach, better gross margins and the number of tests performed.

Over the past couple of years, DLPL has been able to significantly outperform its peers (Thyrocare & Metropolis), the midcap index, and the healthcare index.

For future growth prospects, DLPL has highlighted a couple of points to focus on:

- Tap into underserved niches within existing markets

- Drive expansion to the east in states like Uttar Pradesh, West Bengal, Bihar, Orissa, Northeast, etc. where other franchises have a low focus

- Acquire small but scalable laboratories that can enhance network presence in untapped geographies

- Further, widen the test menu.

- Develop an online presence together with a sharper focus on the home collection of samples to drive customer convenience

Some risks to look out for

- There is no barrier to entry, and any player can enter the market freely.

- The diagnostic industry has very little regulatory oversight, and anybody can open a diagnostic centre. There are some accreditations like NABL, but they are completely voluntary in nature.

- Highly competitive market with standalone centres having a 48% market share, 37% going to hospital-based labs and competition from other pan India franchises & regional chains.

- The brand name can get affected due to negligence by any of its franchisees or sub-par quality tests.

Steps to navigate the risks

- DLPL has Accreditations from CAP, NABL and ISO that establish trust among its customers. The National Reference Lab has a best in the Industry CAP Proficiency Testing Score of 98.3% with consistently high EQAS Performance Testing Score at 98.7% for Satellite Labs.

- To counter the highly competitive market, it has a nationwide network of coverage in metros, tier-1 & tier-2 cities that provide high quality & standardised testing services with a faster turnaround time which can leverage a high brand recall amongst its competitors.

- It has also invested heavily in various IT infrastructure services to enable ERP systems, Laboratory Information Management System and Data Collection & Analytics to maintain its edge & improve efficiency.

How will the company stock benefit in the future?

- Unorganised sector has struggled in the last few years to keep pace with their organised counterparts due to Long term macro developments like the implementation of GST, demonetisation, lockdown, etc. which has led to consolidation in the industry.

- Organised players’ ability to build scale & consistently provide quality services led to trust for a well-established national brand

- Public healthcare spending in India has historically remained significantly lower than in many other countries & to address this; GOI has allocated ₹ 69,000 crores to healthcare in the Union Budget FY2020-21.

- Given consolidation & inorganic growth, DLPL has already signed a term sheet to acquire 100% stake in Bindish Diagnostic Laboratory, Jamnagar & 70% stake in ChanRe Diagnostics Laboratory. We can continue to see such deals happening in the future.

What is the recipe for success then? An underserved market at the cusp of formalisation that is spearheaded by the pandemic. DLPL has got all the ingredients right to be a long-term compounder. It is leading in the industry by a substantial margin in operational & financial metrics compared to the competition; it has a strong management board with over 55% of all staff in laboratory functions. Zero debt, an asset-light model and strong free cash flow generation will considerably work in its favour for future growth expansion. Investors looking for quality companies in the small cap case should look at DLPL for wealth creation.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)