Last Updated on December 29, 2021 at 5:13 pm

In October, the Income Tax Department (ITD) launched an ambitious faceless e-assessment scheme for scrutiny of income tax returns (ITRs) from the Assessment Year (AY) 2018-19 onwards. In this article, Anjesh Bharatiya explains what is Faceless E-assessment and how it will change the compliance framework for taxpayers.

Author: Anjesh is a 30+ taxman by profession and a Chemical Engineer by education. He has been an investor in the stock market since age 15! He likes to write about personal finance, stock markets, government policies, taxation, philosophy and football.

The Faceless E-assessment Scheme had earlier been announced by the FM who vowed to commence it by Vijayadashmi. In the first instance, 58,322 ITRs have been selected for scrutiny in this mode. In official communications, the launch of the scheme has been stated to bring about “Ease of compliance for taxpayers, transparency and efficiency, functional specialisation, improvement in the quality of assessment, risk-based and focussed approach, better monitoring and expeditious disposal of cases.” So what is the fuss all about? Let’s see.

In the beginning, it must be emphasized that the ITD had already been doing all assessments online (barring a few exemptions) since the last few years. The taxpayer was not required to attend the Income Tax Office & could file all documents/information required of him through his e-filing account. Only in some rare cases was the taxpayer or his representative required to attend proceedings manually.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

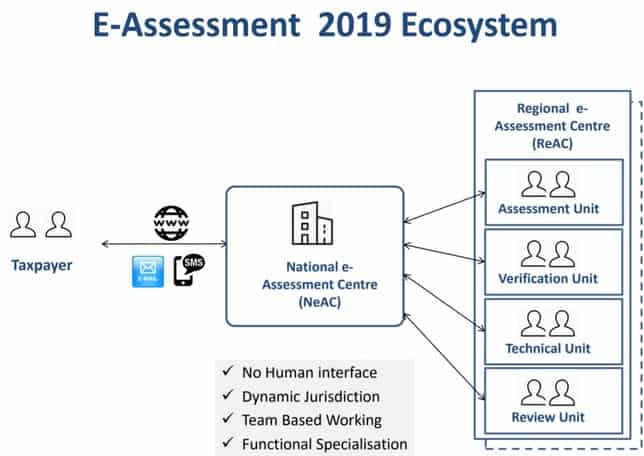

Some of these included instances were books of accounts were to be verified manually or the taxpayer was provided a final opportunity of explaining his side before an adverse assessment order was passed. What has changed now is that the taxpayer will no longer know the identity of his Assessing Officer (AO). To be fair, in the new scheme, the concept of AO has been replaced by Assessment Unit (AU) comprising of more than one officer.

Thus, there will be minimal chances of the AO harassing the taxpayer or the taxpayer yielding any undue influence on the AO. As a result, assessments are likelier to become more fair & reasonable leading to less acrimony between the ITD and taxpayers.

How will Faceless E-assessment Work?

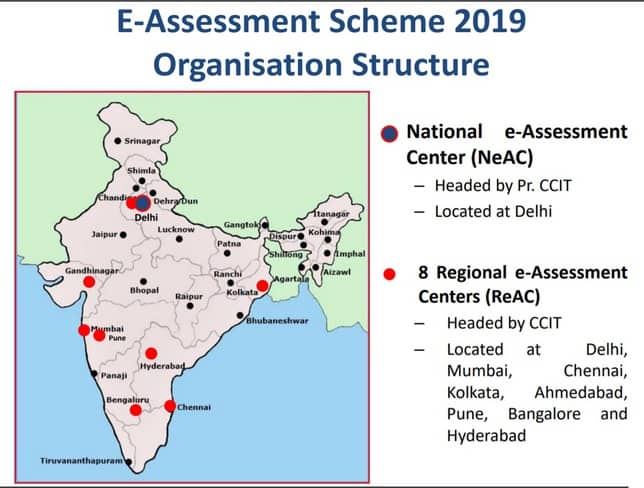

The scheme works through a National e-Assessment Centre (NeAC) which is a newly set up independent vertical that will look after the working of the scheme. Under the NeAC, there are 8 Regional e-Assessment Centres (ReAC) set up at Delhi, Mumbai, Chennai, Kolkata Ahmedabad, Pune, Bengaluru and Hyderabad that will conduct the actual proceedings under the scheme. Each ReAC will have 04 units comprising of Assessment unit (AU), Review unit (RU), Technical unit (TU) and Verification unit (VU).

The scheme will work in the following manner:

- A notice under section 143(2) would be served by the NeAC specifying the issues for selection of taxpayer’s case for assessment. The notice will not have the name of any officer but instead will be issued & signed by the ‘Prescribed Income Tax Authority’.

- The taxpayer will have a period of fifteen days for filing a response with the NeAC.

- The NeAC will then assign the case to a specific AU in any one ReAC through an automated allocation system.

- The AU may then make a request to the National e-Assessment Centre for:

- Obtaining further information, documents or evidence from the taxpayer or any other person.

- Conducting of certain enquiry or verification by the VU

- Seeking technical assistance from the TU

- Upon a request being made by the AU for any documents or evidence, the NeAC will issue a notice to the taxpayer or any other person for obtaining the information, documents or evidence requisitioned by the AU.

- Upon a request being made for certain enquiry or verification required in the case, the request will be assigned by the NeAC to a VU in any ReAC through an automated allocation system.

- Upon a request being made seeking technical assistance in the case, the request will be assigned by the NeAC to a TU in any ReAC through an automated allocation system.

- Based on the information & feedback received from the VU & TU, a draft assessment order will be prepared by the AU which will then be sent to NeAC. The NeAC will examine the order including through the use of an automated tool and may finalize the order or may provide an opportunity to the taxpayer of being heard I case of some adverse findings. It can also send the draft order to an RU for review.

- Once the order is reviewed, it will be sent back to the AU for finalization. The order will then be issued and the record will be transferred to the local AO for collection of demand and imposition of penalty.

- The taxpayer or his authorized representative is also entitled to a personal hearing before any adverse order is passed. Such hearing would be conducted exclusively through video conferencing at the closest possible Income Tax Office to the taxpayers address.

What should taxpayers keep in mind?

Since the proceedings are entirely faceless and the case will travel among various units set up for the purpose, the taxpayer needs to provide answers to any queries raised in a to-the-point and timely manner. Vague replies or excessive requests for adjournment are likely to land him in hot water. Since no physical notices will be sent to the taxpayer, the taxpayer also needs to properly follow up with any SMS or e-mail he may receive from the ITD. For that to happen, the taxpayer must make sure that the phone number & e-mail ID linked to his e-filing account is up to date.

What doesn’t change?

The taxpayer may still receive notices from his local AO in certain cases. These include cases were a search/survey was conducted or the taxpayer’s returns are taken up for re-assessment under section 148 of the Income Tax Act on the basis of specific information on potential tax evasion. However, the AO will issue such notices only after taking approval from his senior authorities and therefore, the taxpayer need not worry too much if he has a clean record.

Once the assessment is completed in the faceless scheme, the records are transferred back to the local AO. Thus, the taxpayer may also receive notices for imposition of penalty or collection of outstanding demand form the local AO. However, all such notices will be issued through a computerized system with a Document Identification Number (DIN) and the taxpayer may file his replies online through his e-filing account without needing to appear personally before the AO.

The upshot

The Government hopes that the scheme will lead to better taxpayer service, reduction of taxpayer grievances and promotion of ease of doing business for taxpayers. It also hopes to rein in errant tax officials & reduce malpractices in the ITD. These are laudable objectives but how well the scheme works in a country where a large number of small businesses and taxpayers are not fully conversant with the digital world remains to be seen.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)