Last Updated on December 29, 2021 at 6:03 pm

Pulkit has designed an investment dashboard for planning and tracking his investments in a goal-based manner. He had shared some screenshots in the goal-based investing Facebook group. Pulkit immediately agreed to share the thought process behind creating this dashboard. There is no better way to showcase the benefits of managing an investment portfolio as per our goals.

Hello all, A few days back, I posted a snapshot of my investment-tracking dashboard in the Goal-Based Investment Facebook group and received a warm response (thank you). Below is a deeper explanation on it, in an attempt to help/inspire others to do the same.

I can ramble on and on about the context which led me to do this, but this context is important, and I will keep it short. I have been meticulously tracking my expenses and networth using an app (MoneyWiz) for many years, (which I still do). Still, it did not answer fundamental questions for the future because expense tracking is post-facto.

Questions like how much I have to spend this month and how much I should invest always left me clueless. A couple of years back I learned about “Goal-Based Investing” and started doing it, but I panicked during covid-lockdowns, which is fine because it helped me realize that, for me, goal-based investing is the only way forward.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Hence, I needed to know what are my goals; what are my plans? For that, I needed to learn how to calculate goals, make plans, and track those. This is the context, now that we have established it, let us keep it aside and jump right into the dashboard. I have decided to write this post by answering possible questions, which people might have after looking at it. So here we go.

Can you share the template? No, I wish I could, but it is not a “template”. It is a deeply customized XL file with at least 10 worksheets with many XL formulas, which evolved over four months and is still evolving. To make a shareable decent “template”, I will have to spend lots of time for months, which I do not have, but maybe in the future. I also want to say that real learning will be in making your own.

What is it in for me, then? Well, this attempt will be sufficient for you to glide towards making your own. Many readers of this awesome blog are already mature enough, but new entrants do not even know what questions to ask (like me)! I hope it helps the latter, formers do not even need such push actually, but to be little bullish on myself, I hope that this will help older readers as well, in some minor ways.

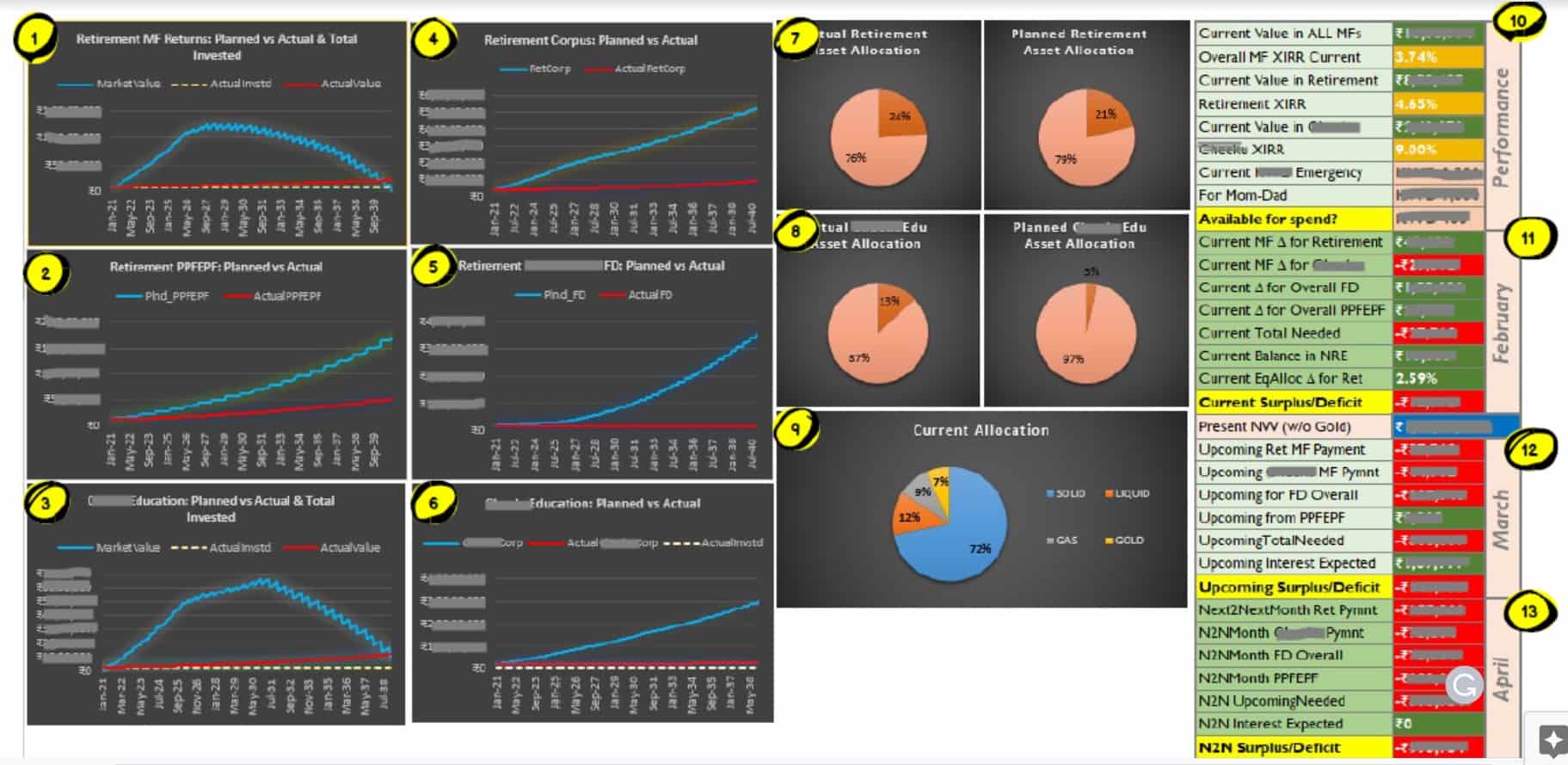

Just walk me through your dashboard already! So this is how it currently looks, and all its different parts have been explained below.

Another view:

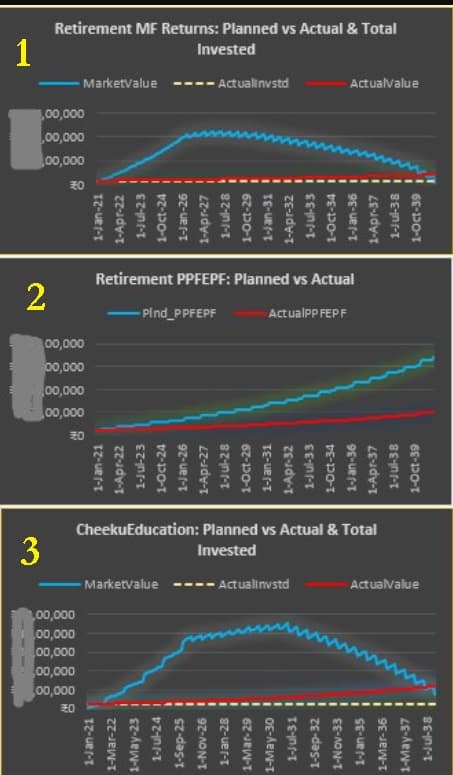

Part 1: This is the retirement investment plan for Equity MFs. As you can see, the blue lines are the “expected” ideal path. Assuming 9% returns, my total equity exposure reaches to 60% in 2025. Gradually, I withdraw funds from it and put it in FD, to eventually make the equity exposure as “0” in 2040, which is when I intend to retire. The yellow-dashed line is my net invested value, and the red line is the “actual” value (i.e. the current value in the market). Notice that both are at the bottom because I have re-started the investing only 3-4 months back, but both stretches till 2040 because whatever is Jan-2021 onwards is my forecast.

It answers me this fundamental question: At the current state and the current IRR, even if I don’t invest anything extra now, how exactly my net invested value and my actual value look? It shows me that I need to ramp-up my investments (yellow-dashed line) AND it shows that my returns are also not that great (red line). But its OK, I have just started now. These red and yellow-dashed lines will be of much use after 3-4 years.

Part 2: I am currently not working in India, but we have earlier opened PPFs and EPFs there. I am not allowed to invest in EPF, being an NRI, but I have not touched the amount there either, but I invest in PPF; hence this graph tracks my investments there. All of it goes towards my retirement fund.

Part 3: Similar to Retirement Equity MFs, I invest for my second kid’s education; end date is going to be around the same time as I retire. The allocation of equity will be ramped up first, and then gradually, it will get down to 0. Like my retirement plan, I will invest the proceeds from these MFs into FDs to bring down my equity exposure from 2025 onwards.

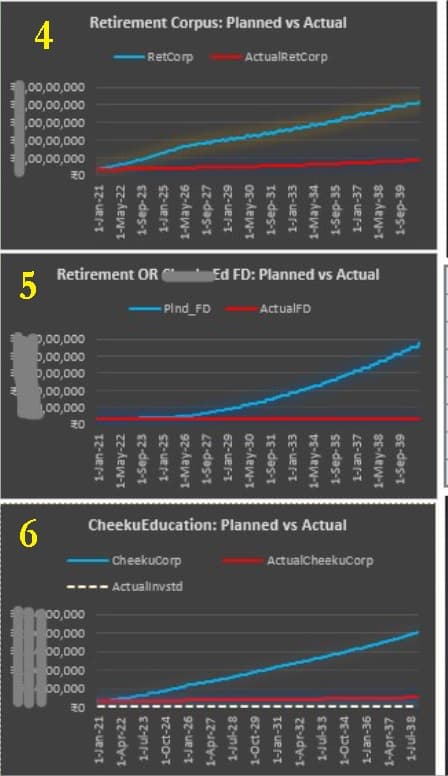

Part 4: Investments into some MFs, PPFs, EPFs and 1/5th of all my FDs booked go towards my retirement fund. This is the tracker for that total Retirement Corpus. The blue line, as always, is the expected one. Red-one is the actual one. Any portion of those lines beyond today’s date is a forecast even if I don’t invest anything.

Part 5: As mentioned earlier, 1/5th of all my FDs booked goes towards a retirement fund. Other 1/5th goes towards my second kid’s education (the remaining 3/5ths goes towards my first kid’s education, which is just 7-8 years away). So this is the tracker for those investments. The expected blue line constitutes the FDs, which I will freshly book; OR older FDs which will get reinvested; AND ALSO the FDs which will result from my withdrawals from Retirement Equity MFs and Son’s Education Equity MFs.

I am delighted with this specific tracker because it took a lot of my time to plan FDs in XL, which will take inputs from three different sources and track revolving FDs, over the period of next 20 years. This plan eventually impacts my equity allocation, so the retirement plan and second kid’s education plan and FD plans are tightly coupled.

Part 6: This is similar to Retirement Corpus tracker; this graph tracks my second kid’s education corpus. Some MFs and 1/5th of all my FDs booked go towards my second kid’s education.

Part 7: Couple of pie charts shows my equity allocation for retirement, actual v/s planned. As you can see, I am little ahead of what I have planned, in terms of investing in equity (I should slow down a bit, I tend to hurry up things).

Part 8: Couple of pie charts shows my equity allocation for the second kid’s education, actual v/s planned. As you can see, I am way ahead of what I have planned to invest in equity, but this is fine because I believe my initial plan for the second kid’s education was a little bearish. If you notice, I am not tracking investments for first kid’s education because 3/5th of all my FDs are going towards that, a safe instrument with no risk. After all, it is just 7 years away.

Part 9: This graph gives me the asset allocation picture of ALL my net-worth, including gold. “Solid” means FDs, PPFs and EPFs; “Liquid” means funds in Debt MFs and Saving Bank Accounts; “Gas” means equity MFs (I do not have stocks yet); and “Gold” is gold. This terminology helps me remind me that equity is “Gas”, it can vaporize quickly, and this graph will hopefully help me remain sane in market-falls, as I will see that my equity exposure is less in the grand scheme of things.

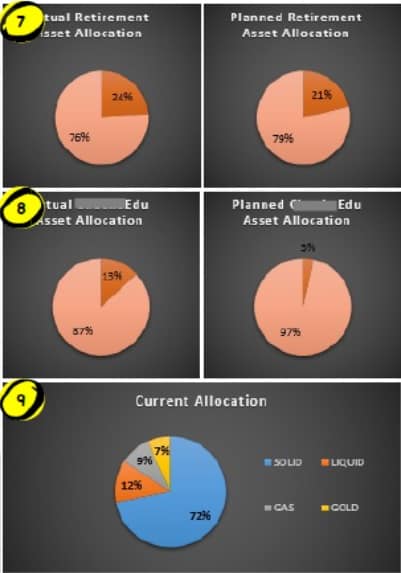

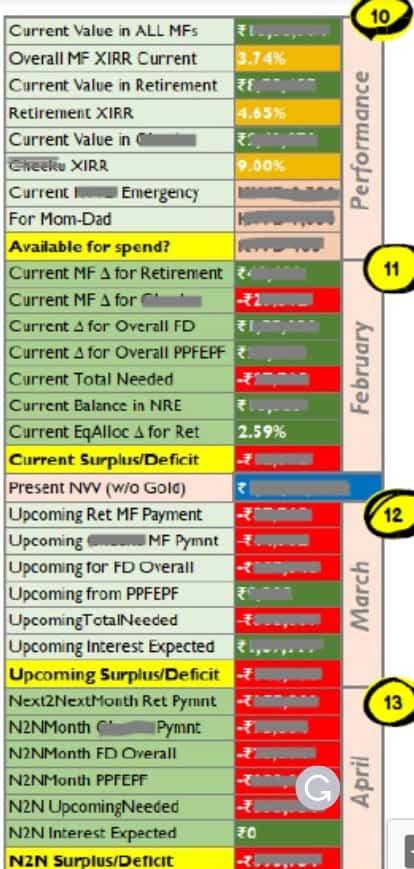

Part 10: This section gives me some numbers from performance perspectives. Green and oranges mean All is OK. Red cells mean something is down when compared to expected values. As the label suggests, it shows my current values and current XIRR of my retirement and second kid’s MF funds. These values are MF statements, which I get from the portal I invest through (Goalwise).

Three specific cells in this part are very dear to me. I am currently not in India, but I maintain some liquid funds in the local currency here. 60% of local currency SB account balance goes towards emergency (I also have an emergency fund in INR, in debt MFs); 30% of that goes towards my Mom-Dad fund (which I am saving for their health emergencies), and then the remaining 10% balance shows me the value I can spend on entertainment, leisure, toys, travels, electronics etc. Stuff that makes us happy. I have another account, from which I do monthly expenses and insurance payments, that balance is not shown OR tracked here. Salary comes in that account; I deduct these necessary funds and park it in SB account.

One of the cells in this part also tells my NW (without gold). Gold is for your image in the society (which is also important), but I do not consider it in my NW. I do not have any debt currently, so I am not tracking that either, but even if I had, I would not have tracked it because it would be, again, tracking my expenses.

Part 11, 12 and 13: These blocks show me how much surplus/deficit I am in the current month, AND I will be in the coming two months. Surplus and Deficit in what comparison? Well, when I compare my actual investments with the planned ones. As you can see, I am currently a deficit in Feb (see that red cell by the name “Current Surplus/Deficit”), but it’s OK, some of the investments I made last week are yet to be shown in statements, so I know in reality I am surplus in Feb.

“Surplus” means I have already invested more than required, in various instruments towards my retirement and second son’s education goal. I can see, I will be in deficit in March and April, and I know the delta amounts too, I can also see some earnings from FDs getting matured in April. So I know how much minimum I need to remit to India in the coming months. I also have SIPs from my India account towards Debt Fund for an emergency, but I do not track that and hence automated that.

I get the below answers by looking at this dashboard:

- Am I on track, in terms of my own investments, in different instruments, for my different goals? I.E. am I on track on the stuff I am supposed to do?

- Is it even required now to be on track? Are my MFs performing OK for me to be on track?

- If required to be on track, how much will I need in the current month, and the next two months for my different goal plans and emergency funds?

- How much I have till date in the local currency for an emergency? How much have I saved till date for Mom-Dad emergency?

- And finally, which is what I was always after, how much can I spend on other happiness-inducing activities without disturbing any of my other plans and emergency funds?

How did you make this? By googling and learning about a lot of formulas in XL. My main inputs are MF Statements, SB Account balances (which I manually input); and FD bookings (which I manually input), exchange and gold rates (which is directly from the web). How to extract that information into my plans, into my overall balances, calculations of maturity amounts, forecasting, automating the change of months etc. all are done using numerous XL formulas.

I will say the path does not matter; it is deeply personal; what I wanted answers some questions, which I was not getting by tracking expenses.

Lastly, I would like to thank Mr Pattabiraman and Mr PV Subramanyam to kindle my personal finance zeal. Grateful to have stumbled upon them on the internet, grateful for internet actually 🙂. There is a lot more to do for my personal finance journey, it’s going to be a never-ending ongoing journey, but I am happy that I started. Wish me luck and thanks for your time. All the best to you, Pulkit

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)