Last Updated on December 29, 2021 at 5:09 pm

These are the most popular (held by many funds) and least popular (held by one fund) stocks held by mutual funds (Oct 2019). We shall define most popular as a stock held by at least 100 mutual funds and least popular and a stock held by only one fund!

The following listing is for informational purposes only and should not be construed as a buy/sell indication or recommendation. As always, while the data is obtained from reliable sources (ACE MF), there could be errors or omissions in the listing. Freefincal or the author cannot be held liable for any gains/losses from the use of this data.

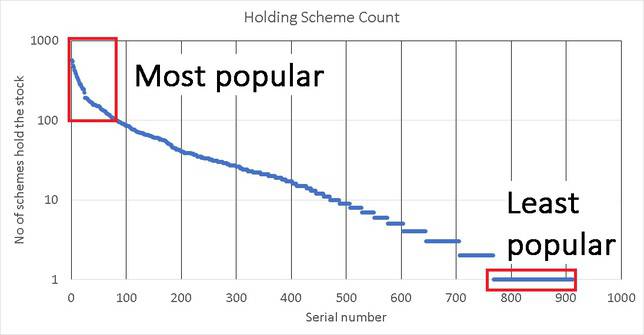

This is the pictorial depiction of the most and least popular stocks held by funds. A total of 84 stocks are by at least 100 schemes (this was 82 in Sep 2019). These are the most popular. A total of 142 stocks can be found in one scheme only (no change from Sep 2019).

Top Ten Most Popular Stocks as on Oct 31st 2019

| Company Name | Market Value (Cr.) | Holding Scheme Count |

| ICICI Bank Ltd. | 67904.5488 | 560 |

| HDFC Bank Ltd. | 80013.7404 | 539 |

| Axis Bank Ltd. | 38391.8194 | 489 |

| Larsen & Toubro Ltd. | 38491.4875 | 462 |

| Infosys Ltd. | 39816.9704 | 439 |

| State Bank Of India | 38163.3745 | 413 |

| Reliance Industries Ltd. | 48351.9632 | 400 |

| ITC Ltd. | 30458.4643 | 391 |

| Kotak Mahindra Bank Ltd. | 26839.5088 | 379 |

| Housing Development Finance Corporation Ltd. | 33542.2602 | 353 |

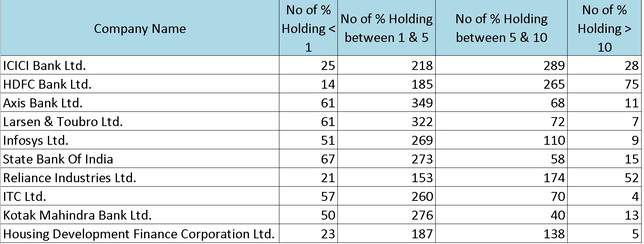

Holding Distribution of the top 10 stocks (Oct 2019)

List of most popular stocks held by mutual funds (Oct 31st 2019)

List of most popular stocks held by mutual funds (Oct 31st 2019)

| Company Name | Holding Scheme Count |

| ICICI Bank Ltd. | 560 |

| HDFC Bank Ltd. | 539 |

| Axis Bank Ltd. | 489 |

| Larsen & Toubro Ltd. | 462 |

| Infosys Ltd. | 439 |

| State Bank Of India | 413 |

| Reliance Industries Ltd. | 400 |

| ITC Ltd. | 391 |

| Kotak Mahindra Bank Ltd. | 379 |

| Housing Development Finance Corporation Ltd. | 353 |

| Bharti Airtel Ltd. | 346 |

| Tata Consultancy Services Ltd. | 333 |

| Maruti Suzuki India Ltd. | 307 |

| NTPC Ltd. | 301 |

| Hindustan Unilever Ltd. | 293 |

| Bajaj Finance Ltd. | 289 |

| Sun Pharmaceutical Industries Ltd. | 276 |

| Ultratech Cement Ltd. | 275 |

| Mahindra & Mahindra Ltd. | 268 |

| Asian Paints Ltd. | 264 |

| Tech Mahindra Ltd. | 242 |

| HCL Technologies Ltd. | 242 |

| IndusInd Bank Ltd. | 233 |

| Bharat Petroleum Corporation Ltd. | 220 |

| Titan Company Ltd. | 219 |

| ICICI Lombard General Insurance Co Ltd. | 201 |

| GAIL (India) Ltd. | 201 |

| Tata Steel Ltd. | 193 |

| Vedanta Ltd. | 192 |

| Divis Laboratories Ltd. | 184 |

| Hero MotoCorp Ltd. | 182 |

| Power Grid Corporation Of India Ltd. | 175 |

| Nestle India Ltd. | 175 |

| The Federal Bank Ltd. | 174 |

| Coal India Ltd. | 171 |

| Hindalco Industries Ltd. | 170 |

| Hindustan Petroleum Corporation Ltd. | 165 |

| ACC Ltd. | 164 |

| Dr. Reddys Laboratories Ltd. | 164 |

| Cipla Ltd. | 163 |

| Bajaj Finserv Ltd. | 162 |

| Petronet LNG Ltd. | 162 |

| Voltas Ltd. | 160 |

| Grasim Industries Ltd. | 159 |

| Bajaj Auto Ltd. | 155 |

| SBI Life Insurance Company Ltd. | 153 |

| Container Corporation Of India Ltd. | 153 |

| Motherson Sumi Systems Ltd. | 149 |

| Britannia Industries Ltd. | 149 |

| Marico Ltd. | 148 |

| Indian Oil Corporation Ltd. | 148 |

| HDFC Life Insurance Co Ltd. | 146 |

| Tata Motors Ltd. | 142 |

| Oil & Natural Gas Corporation Ltd. | 141 |

| ICICI Prudential Life Insurance Company Ltd. | 137 |

| Shree Cement Ltd. | 136 |

| Bank Of Baroda | 135 |

| Aurobindo Pharma Ltd. | 135 |

| Dabur India Ltd. | 135 |

| City Union Bank Ltd. | 132 |

| Eicher Motors Ltd. | 130 |

| Cummins India Ltd. | 130 |

| Exide Industries Ltd. | 129 |

| Cholamandalam Investment & Finance Company Ltd. | 120 |

| Colgate-Palmolive (India) Ltd. | 120 |

| Siemens Ltd. | 120 |

| The Indian Hotels Company Ltd. | 119 |

| Ambuja Cements Ltd. | 117 |

| The Ramco Cements Ltd. | 116 |

| Max Financial Services Ltd. | 115 |

| Bharat Electronics Ltd. | 114 |

| Tata Global Beverages Ltd. | 112 |

| Lupin Ltd. | 111 |

| Mahindra & Mahindra Financial Services Ltd. | 110 |

| Tata Chemicals Ltd. | 109 |

| MRF Ltd. | 109 |

| United Breweries Ltd. | 108 |

| Yes Bank Ltd. | 107 |

| UPL Ltd. | 106 |

| Ashok Leyland Ltd. | 105 |

| Torrent Pharmaceuticals Ltd. | 104 |

| Crompton Greaves Consumer Electricals Ltd. | 103 |

| Aditya Birla Fashion and Retail Ltd. | 103 |

| Wipro Ltd. | 100 |

List of least popular stocks held by mutual funds in Oct 2019

| Scheme Name | Company Name |

| Aditya Birla SL Digital India Fund | SRPL Ltd. |

| Aditya Birla SL Equity Advantage Fund | Dharti Dredging & Infrastructure Limited |

| Aditya Birla SL Equity Advantage Fund | Isprava Vesta Pvt Ltd. |

| Aditya Birla SL Equity Fund | Maestros Mediline Systems Ltd. |

| Aditya Birla SL Equity Fund | MMS Infrastructure Ltd. |

| Aditya Birla SL MNC Fund | Maruti Cottex Ltd. |

| Aditya Birla SL MNC Fund | SML Isuzu Ltd. |

| Aditya Birla SL MNC Fund | Sree Jayalakshmi Autospin Ltd. |

| Aditya Birla SL MNC Fund | Sri Venkatesha Mills Ltd. |

| Aditya Birla SL MNC Fund | Visakha Aqua Farms |

| Aditya Birla SL Small Cap Fund | Reliance Home Finance Ltd. |

| Axis Long Term Equity Fund | TTK Healthcare Ltd. |

| Baroda ELSS 96 | Transtream India.com Ltd. |

| Baroda Multi Cap Fund | Accord Cotsyn |

| Baroda Multi Cap Fund | Amex Carb. & Chem. |

| Baroda Multi Cap Fund | Kansal Fibres Ltd. |

| Baroda Multi Cap Fund | Royal Industries Limited |

| Baroda Multi Cap Fund | SIV Industries Ltd. |

| Baroda Multi Cap Fund | Soni Medicare Ltd. |

| BNP Paribas India Consumption Fund | GTPL Hathway Ltd. |

| BNP Paribas Multi Cap Fund | NR Agarwal Industries Ltd. |

| DSP Equity Opportunities Fund | City Online Services Ltd. |

| DSP Natural Res & New Energy Fund | South West Pinnacle Exploration Ltd. |

| DSP Small Cap Fund | Dwarikesh Sugar Industries Ltd. |

| DSP Small Cap Fund | Fiem Industries Ltd. |

| DSP Small Cap Fund | Kalyani Steels Ltd. |

| DSP Small Cap Fund | Lumax Auto Technologies Ltd. |

| DSP Small Cap Fund | Plastiblends India Ltd. |

| DSP Small Cap Fund | Vardhman Special Steels Ltd. |

| Edelweiss Small Cap Fund | Royal Orchid Hotels Ltd. |

| Edelweiss Tax Advantage Fund | TIL Ltd. |

| Franklin Build India Fund | Hindustan Media Ventures Ltd. |

| Franklin Build India Fund | Puravankara Ltd. |

| Franklin India Opportunities Fund | Chennai Interactive Business Services |

| Franklin India Smaller Cos Fund | Consolidated Construction Consortium Ltd. |

| Franklin India Smaller Cos Fund | HT Media Ltd. |

| HDFC Children’s Gift Fund | Jyoti Structures Ltd. |

| HDFC Housing Opp Fund-Sr 1-1140D-Nov 2017(1) | HPL Electric & Power Ltd. |

| HDFC Housing Opp Fund-Sr 1-1140D-Nov 2017(1) | Nila Infrastructures Ltd. |

| HDFC Infrastructure Fund | BL Kashyap & Sons Ltd. |

| HDFC Infrastructure Fund | Transformers & Rectifiers (India) Ltd. |

| HDFC Retirement Savings Fund-Hybrid-Debt Plan | Poddar Pigments Ltd. |

| HDFC Small Cap Fund | Everest Industries Ltd. |

| HSBC Small Cap Equity Fund | One Point One Solutions Ltd. |

| ICICI Pru Midcap Fund | Gammon Infrastructure Projects Ltd. |

| ICICI Pru Midcap Fund | KSK Energy Ventures Ltd. |

| ICICI Pru Multi-Asset Fund | Starlog Enterprises Ltd. |

| ICICI Pru Pharma Healthcare & Diagnostics (P.H.D) Fund- | Panacea Biotec Ltd. |

| ICICI Pru S&P BSE 500 ETF | Centrum Capital Ltd. |

| ICICI Pru S&P BSE 500 ETF | Eveready Industries (India) Ltd. |

| ICICI Pru S&P BSE 500 ETF | GIC Housing Finance Ltd. |

| ICICI Pru S&P BSE 500 ETF | Inox Wind Ltd. |

| ICICI Pru S&P BSE 500 ETF | Jaiprakash Associates Ltd. |

| ICICI Pru S&P BSE 500 ETF | JSW Holdings Ltd. |

| ICICI Pru S&P BSE 500 ETF | Meghmani Organics Ltd. |

| ICICI Pru S&P BSE 500 ETF | Reliance Communications Ltd. |

| ICICI Pru S&P BSE 500 ETF | SREI Infrastructure Finance Ltd. |

| ICICI Pru S&P BSE 500 ETF | United Bank of India |

| ICICI Pru Smallcap Fund | Matrimony.Com Ltd. |

| ICICI Pru Technology Fund | Ampersand Software Applications Ltd |

| ICICI Pru Technology Fund | Nucleus Software Exports Ltd. |

| IDFC Equity Opportunity-4 | Jindal Drilling & Industries Ltd. |

| IDFC Tax Advt(ELSS) Fund | Praxis Home Retail Ltd. |

| ITI Multi-Cap Fund | Geojit Financial Services Ltd. |

| Kotak Equity Opp Fund | SRM Radiant Infotech Ltd |

| L&T India Value Fund | Zuari Agro Chemicals Ltd. |

| Mirae Asset Emerging Bluechip | GOCL Corporation Ltd. |

| Nippon India Capital Builder Fund-IV-C | Monte Carlo Fashions Ltd. |

| Nippon India Power & Infra Fund | BGR Energy Systems Ltd. |

| Nippon India Small Cap Fund | Polyplex Corporation Ltd. |

| Nippon India Small Cap Fund | Seya Industries Ltd. |

| Nippon India Small Cap Fund | Vindhya Telelinks Ltd. |

| Nippon India Value Fund | Innoventive Industries Ltd. |

| Nippon India Value Fund | Zuari Global Ltd. |

| PGIM India Midcap Opp Fund | CMI FPE Ltd. |

| PGIM India Midcap Opp Fund | Sharda Motor Industries Ltd. |

| Principal Dividend Yield Fund | Bannari Amman Sugars Ltd. |

| Principal Dividend Yield Fund | Crystal Cable Industries Ltd. |

| Principal Dividend Yield Fund | Minerava Holdings |

| Principal Dividend Yield Fund | Sandur Laminates Ltd. |

| Principal Dividend Yield Fund | Tirrihannah Co Ltd. |

| Principal Multi Cap Growth Fund | Balmer Lawrie Freight Containers Ltd. |

| Principal Multi Cap Growth Fund | Crescent Finstock Ltd. |

| Principal Multi Cap Growth Fund | Milestone Global Ltd. |

| Principal Multi Cap Growth Fund | Noble Brothers Impex Ltd. |

| Principal Multi Cap Growth Fund | Precision Fastners Ltd. |

| Principal Multi Cap Growth Fund | Sangam Health Care Products Ltd. |

| Principal Personal Tax saver Fund | Punjab Wireless Systems Limited |

| Principal Small Cap Fund | Cosmo Films Ltd. |

| Quant Small Cap Fund | Sumitomo Chemical India Pvt. Ltd. |

| Quantum India ESG Equity Fund-Direct Plan | Hemisphere Properties India Ltd. |

| SBI Large & Midcap Fund | Gayatri Bio Organics Ltd. |

| SBI Large & Midcap Fund | Padmini Technologies Ltd. |

| SBI LT Advantage Fund-I | Triton Valves Ltd. |

| SBI LT Advantage Fund-IV | GKW Ltd. |

| SBI Magnum Midcap Fund | Mangalam Cement Ltd. |

| SBI Small Cap Fund | Pilani Investment & Industries Corporation Ltd. |

| SBI Technology Opp Fund | Indbazaar Com Ltd |

| Sundaram Rural and Consumption Fund | Astec Lifesciences Ltd. |

| Taurus Starshare (Multi Cap) Fund | Wellwin Industry Ltd. |

| UTI CCF – Savings Plan | Hanuman Tea Company Ltd. |

| UTI CCF – Savings Plan | Willard Storage Battery Ltd |

| UTI Core Equity Fund | BS Refrigerators Ltd. |

| UTI Equity Fund | Kothari Industrial Corporation Ltd. |

| UTI Equity Fund | Modern Syntex (India) Ltd. |

| UTI Equity Fund | MTZ Polyfilms Ltd. |

| UTI Equity Fund | Nihon Nirman Ltd |

| UTI Equity Fund | Spartek Ceramics India Ltd. |

| UTI Mastershare | Shubh Shanti Services Ltd |

| UTI MEPUS | Autopal Industries Ltd. |

| UTI MEPUS | Jaswal Granites Ltd |

| UTI MEPUS | Shree Vindhya Paper Mills Ltd. |

| UTI Mid Cap Fund | Deldot Systems Ltd |

| UTI Regular Savings Fund | Damania Capital Markets Ltd |

| UTI Regular Savings Fund | Filaments India Ltd. |

| UTI Regular Savings Fund | Geekay Exim (India) Ltd. |

| UTI Regular Savings Fund | Telephone Cables Ltd. |

| UTI Retirement Benefit Pension | Collabera Solutions Pvt Ltd |

| UTI Retirement Benefit Pension | Information Technologies (India) Ltd. |

| UTI ULIP | Aruna Mills Company Ltd |

| UTI ULIP | Dhar Cement Ltd. |

| UTI ULIP | Dhar Textile Mills Ltd. |

| UTI ULIP | Eastern Medikit Ltd. |

| UTI ULIP | Euro Cotspin Ltd |

| UTI ULIP | Indian Steel Rolling Mills Ltd |

| UTI ULIP | Infrastructure Leasing & Financial Services Ltd. |

| UTI ULIP | Jaipur Syntex Ltd |

| UTI ULIP | Mahendra Petrochemicals Ltd. |

| UTI ULIP | Marwar Hotels Ltd |

| UTI ULIP | Nutan Mills Ltd |

| UTI ULIP | Omega Laboratories Ltd. |

| UTI ULIP | Parasrampuria Synthetics Ltd. |

| UTI ULIP | Poysha Industrial Company Ltd |

| UTI ULIP | Raipur Manufacturing Company Ltd |

| UTI ULIP | Serene Industries Ltd. |

| UTI ULIP | Shukra Jewellery Ltd. |

| UTI ULIP | SRM Energy Ltd. |

| UTI Value Opp Fund | Elbee Services Ltd. |

| UTI Value Opp Fund | GPI Textiles Ltd |

| UTI Value Opp Fund | JMP Castings Ltd. |

| UTI Value Opp Fund | Modern Insulators Ltd. |

| UTI Value Opp Fund | USG Tech Solutions Ltd. |

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)