Last Updated on September 27, 2023 at 3:52 pm

A mutual fund Fixed Maturity Plan (FMP) is a closed-ended debt mutual fund. A discussion on how and when to choose FMPs.

A closed-ended mutual fund is one in which no purchase or redemption can be made after the new fund offer (NFO) period. The scheme has a fixed maturity date and unitholder can redeem from the AMC only after that date. These schemes are listed on the exchange and in principle can be bought and sold with a Demat account in the secondary market. However, this is unlikely and most closed-ended mutual funds do not have any liquidity.

Before we begin, You Can Be Rich With Goal-Based Investing -my new book with Subra(money.com) – published by CNBC TV 18 has a detailed account of equity and debt mutual fund selection. It is now available at a discount of 33% off for ₹267 (Amazon Prime members) and ₹307 for others. link to AmazonThis is most likley a weekend discount.

What is a Fixed Maturity Plan?

A fixed maturity plan is a one such closed-ended mutual fund which invested in fixed income securities – bonds offered by banks, PSUs, corporates, GOI, cash and even debt arbitrage. There is a wide spectrum of FMPs and only those that understand where the fund will invest should choose them or any mutual fund for that matter.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Although the NAV of the FMP will be marked-to-market – the value of bonds will fluctuate with supply and demand forces driven by interest rate and credit rating changes – the fund manager will typically not actively trade these bonds. She would buy the bonds and hold them until maturity.

Therefore, even if the NAV fluctuates (+ve or -ve), it will recover* when the bonds held in the portfolio mature. A dramatic example of this in an FMP can be found here: Debt Mutual Funds: NAV Recovery after Credit Rating Downgrade

* If the bond issuer does not default.

Therefore, as long as the fund manager has done her research well and chosen credit-worthy bonds, the risk associated with an FMP is lower than an open-ended debt mutual fund.

If I can afford to lock my money for the next 3-4 years (often only a gamble as future money needs are uncertain), then I can afford to choose an FMP that invests in PSU or corporate bonds that mature over that time period.

If there are no defaults (not rare!), then I can expect to earn the indicative yield mentioned in the scheme information document. Which us to:

Who Should Invest in FMPs?

Only an investor who is not lazy enough to download the scheme information document (SID) from the AMC website and understand the scheme

- the scheme objective

- intended asset allocation

- investment strategy

- risks

- indicate yield

And most investors are lazy. They want pre-packaged, sorry make that pre-digested information. Good luck finding that for an FMP NFO.

An FMP is less liquid than a fixed deposit. The money will be practically locked in until maturity. So tread with caution. FMPs are not suitable for most retail investors who have only a small investible surplus to spare.

In certain situations, an FMP makes sense. For example, say you have just become a parent or just got married and received a gift of say, Rs. 5000 or Rs. 10,000. This is not money that you going to depend on in future (if). Then you can put that in FMPs and keep rotating them IF that kind of asset allocation would be suitable for your future needs. Just an example. Don’t read too much into it.

Tax treatment of FMPs

Any mutual fund which holds less than 65% of Indian stocks on average over a year is a non-equity mutual fund as far as the income tax department is concerned. So is FMP.

The capital gains arising from units purchased less than or equal to 3 years ago will be added to income and taxed as per slab. Gains from units older than 3 years is taxed at a flat 20% (+cess) with indexed capital gain.

During periods of high-cost inflation, the gains from an FMP could be tax-free. By the same token, during periods of low inflation, the gains would be considerably less, even before tax. And after-tax not very different from FDs.

Where do FMPs invest?

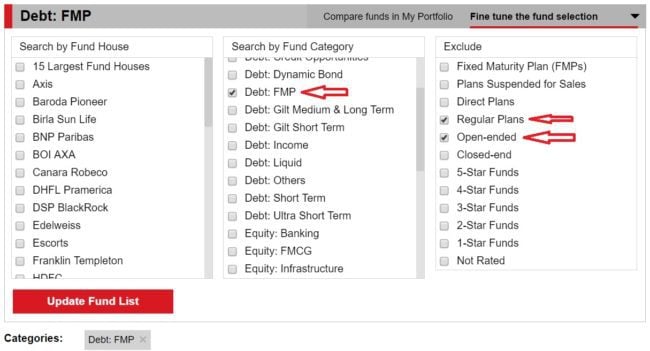

Anywhere and everywhere in the fixed income universe! To find out, go to

https://www.valueresearchonline.com/funds/fundselector/

and use the following settings: Exclude commission-based (regular) plans, open-ended plans (yes, there are open-ended FMPs too!! Also known as interval funds. More on this in a separate post)

You would then get a list of ongoing FMPs. You cannot invest in any of these!

Do not waste time over analysing the returns they have made. Each FMP is different and so will be the returns be. Also, current bond yields would be very different. So unless you check the SID, you cannot get an approximate idea of the return expected from an FMP.

This exercise is to understand different types of FMPs and how returns can vary. Remember: When it comes to debt funds, higher the returns, lower the credit quality!

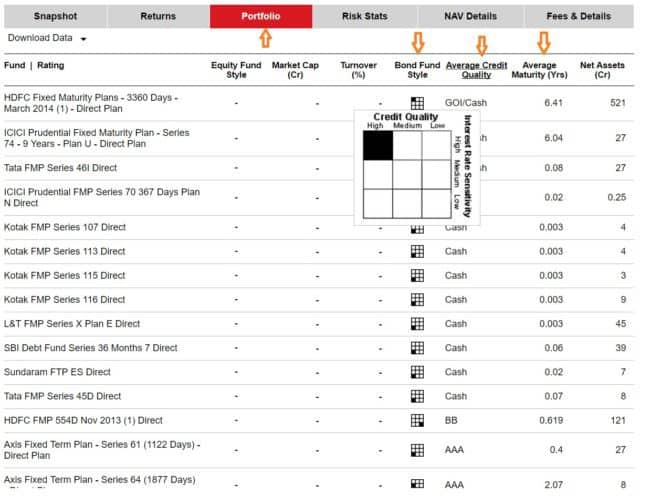

Now click on the portfolio tab in the above page.

Click on average (portfolio) maturity column – to arrange in ascending order. Notice that there are FMPs which are basically liquid funds with an average maturity of 0.003 Years (~ 1 day!!) to 6.41 years (long-term gilt funds + cash).

Click on average credit quality to arrange in ascending order. Cash or Gilt (GOI) to AAA to A.

Click on bond fund style and hover over the square to understand its placement.

You can download this data as a spreadsheet and play around with it too.

The tenure of the FMP need not match with the average portfolio maturity. The latter can be much less (not more). So within the holding period, the fund manager can use the gains from a matured bond and buy more that mature before the closing date of the fund.

There are no FMPs below (or equal to) 3Y today. Just in case, be sure to select one that matures in 1096 days or more. Not 1095 days (365 x 3) – then you will have to pay tax as per slab!

So once you are comfortable, you can decide what kind of FMP you would like to invest in.

Over to the Scheme Information Document

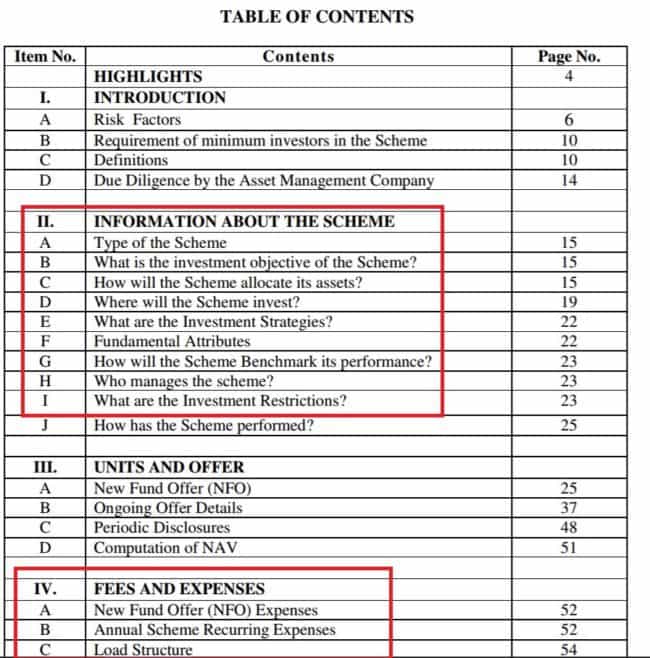

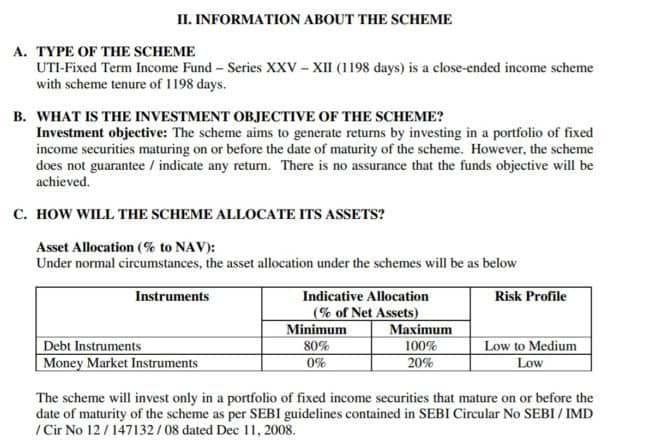

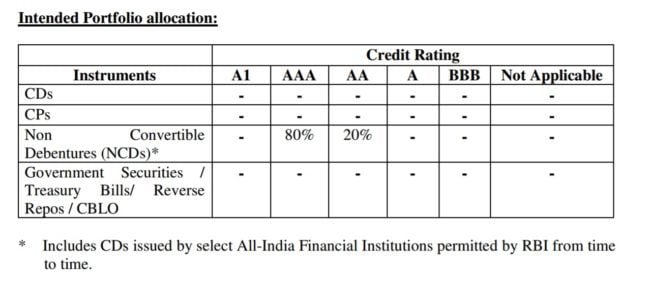

Here are some extracts from the (randomly chosen)SID of UTI FTIF Series XXV-XII _1198 days.

Reading suggestion from the table of contents.

Fundamental attributes

How to Estimate FMP Returns

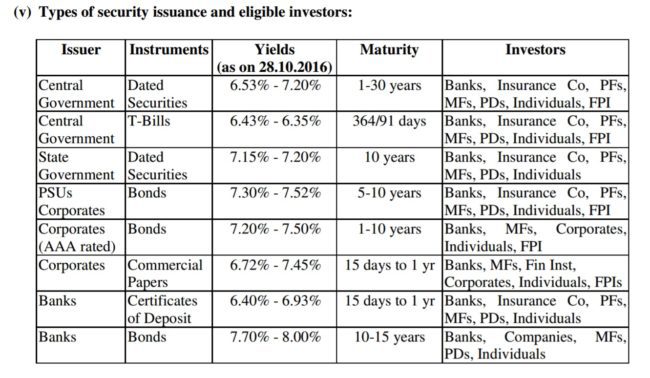

If you knew where the FMP would be investing, it is easy to make a conservative estimate of returns. The following two snapshots from the SID are crucial.

The scheme can invest in both Bank, PSU and corporate NCDs of AAA (80%) and AA quality. So I see that 1Y corporate AAA bond have a yield (IRR) of ~ 7.2%.

Therefore, I can assume that the FMP would offer a return of about 7% conservatively. Whether this return is good enough (compared to an FD) or if should consider another FMP etc. are questions that I need to ask and answer from a personal perspective (Speaking of which, I value liquidity of a portfolio above all else and will not use FMPs).

In conclusion, FMPs can be used intelligently by an informed user who understands the pros and cons of the instrument.

What should investors new to debt funds do?

Stay away from any debt fund with an average maturity profile greater than one year.

Read more:

Debt Mutual Funds: Risk vs. Reward

How to choose debt mutual funds with no credit risk and low volatility

You Can Be Rich Too

My new book with PV Subramanyam, published by CNBC TV 18

The book comes with 9 online calculator modules to create your own financial plan.

It also has detailed selection guides for equity and debt mutual funds.

Amazon Weekend discount: 33% off for ₹267 (Amazon Prime members) and ₹307 for others

Kindle (₹ 244.30)

Infibeam ₹ 280 with Coupon BS10

Googe Play Books App Store (₹ 244.30)

What Readers Say

- Simple and powerful This book empowers the reader with the concepts in easy to understand & simple form. Those who have been reading blogs of both authors would know that they are not only good with finance domain but also have a knack of simplifying the methods of investing for their readers. This book by them is a gem of financial knowledge for people who are starting to invest or want to get better at it. The presentation and the thought process with calculators is extremely powerful.The book should be read & calculators used simultaneously to understand the concepts well. The calculators when used with real inputs will show you where you are & where you need to reach for each of your goals. Don’t ignore these numbers.Learnings from Chapters 7 to 11 will help you avoid going off path & saving your money from financially hazardous products. With discipline & right approach suggested here you wouldn’t need a financial advisor to build wealth.

- This is perfect book on personal finance. Very nicely explained about taxation about debt mutual fund. Topics like early investing and asset allocation are very well explained. – Mahesh Deshmukh

- Highly Recommended For anyone who wishes to take control of his/her finance this book is a must read. Very simply put, even an amateur in finance will be able to understand and implement. The author genuinely attempts to inculcate the habit of investing among the people who have the ability to invest but refrain from doing it, either due to lack of time , interest or understanding!. The message from the book is ” Investment done without setting a goal/ objective is like leaving for a trip without knowing the destination, not everytime the end result will be promising. Hence, it’s important to invest in a planned & disciplined manner.” A read is highly recommended ????

- A must book for everyone who wants to take control of personal finance. Nice explanation of how a debt mutual fund works. Bonds trading and indexation benefits in high inflation years were something new I learnt. After reading this book you will be able to easily choose any funds, because you will know what that fund does or how that fund works

Read all reviews here: Amazon Reviews

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)