Last Updated on February 6, 2022 at 8:23 pm

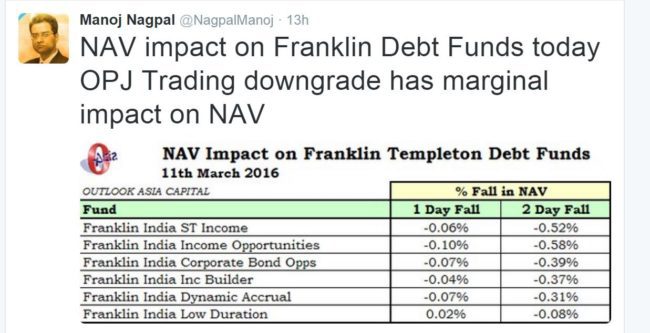

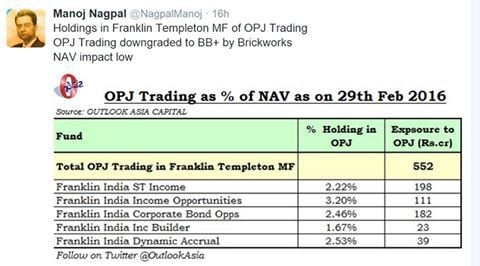

A method to choose debt mutual funds with no credit rating risk and low volatility or interest rate risk from a category known as short-term gilt funds – is discussed. This is post is a follow up to Debt Mutual Fund Investments: Minimizing Risk which referenced the fall in NAV of several Franklin Funds due to the downgrade and subsequent default and off-loading of JSPL bonds. Even before the dust settled on that, another bond held by many Franklin fund was downgraded by brickworthratings

Thanks again to Manoj Nagpal prompt and succinct tweets. Mint reports that Franklin has lost 512 Crore due to JSPL off-loading. From the report

“JSPL is going through some tough times because of external factors like Chinese slowdown and the failed auction of coal blocks. It did not default on any payments to Templeton. The sell-off, therefore, seems to be a panic reaction by Templeton,”

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Note that FMPs are not free from credit risk too. A few ICICI FMPs have JSPL bonds.

If such falls in NAV (which will impact returns) are not acceptable to you, then what is the alternative?

I usually recommend liquid funds and ultra short-term funds. However ultra short-term funds are not free from credit risk.

Short-term gilts could well be an alternative. I learnt to take this category seriously thanks to one my earliest and oldest (~87) readers, Mr. Raghu Ramamurthy. He is the inspiration behind this post Comparison: Short-term gilt vs. long-term gilt vs. Ultra short-term mutual funds

Before we explore this category, let us establish some ground rules

- Zero credit rating risk. That is, no risk of default. The only way to do this is to invest in government bonds.

- Minimal interest rate risk. Government bonds when purchased individually are free from both credit and interest rate risks. However, in debt mutual funds, all the bonds will be marked to market. That is, each day, the NAV will reflect their current value. This value will change with interest rate changes. When the interest rate fall, current bonds will become more valuable and the NAV will increase and viceversa when the rates fall.

- Longer the duration of the bond, the more volatile the price movement.

- Therefore to minimise interest fluctuations, the bond duration should be short. Hence short-term gilt funds. However, choosing one requires some care. Hence this post.

- The investment strategy of the chosen short-term gilt fund should be clear. In particular, the maximum duration of bonds allowed in the portfolio shoud be spelt out clearly in the scheme information document.

- Lower the maximum duration allowed, lowe the averate maturity of bonds in the portfolio and lower the modified duration (measure of sensitivity to interest changes measured in years!)

- When interest rates rise, the NAV of such fund will fall. However, the quantum of such a fall will typically be lower than long-term gilt funds and the time needed to recover will also be significanly shorter (days to weeks rather than months for long-term bonds). This too is measured by modified duration.

With these ground rules, let us head over to Value Research.

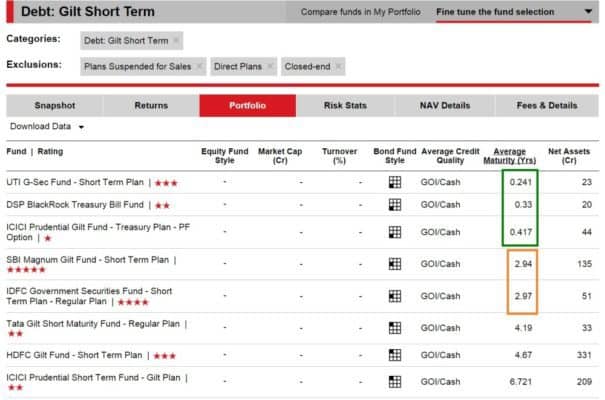

First, please allow me to sing my usual tune: why you should ignore mutual fund star ratings

This category has only 8 distinct funds, 16 if you count the direct plan options. Too small to justify the use of a bell curve to assign star ratings.

Now look at the average maturiy of bonds in the folio. They range from 0.24 years to 6.7 years. The biggest flaw in star ratings is to relatively grade dissimilar objects like here.

Incidentally, the direct plan option of many funds now have a higher star rating than regular plan options due to higher returns. This is a significant publically visible manifestation of outperformance. If want help choosing mutual funds, Pay for Financial Advice, But Insist on Direct Mutual Fund Plans.

Only the fund marked in green will satify the low interest rate risk we desire. The ones marked in orange will have intermediate interest rate risk and the other high risk. In fact, in the medium and long -term category, one can find funds with less than 6 years average maturity.

If you like those three funds, the next step is to understand the investment strategy.

UTI G-sec Fund

Extract from the AMC site

- The UTI G-Sec Fund endeavors to offer stable and regular returns along with a decent capital appreciation over a period of time for those investors who invest with a long term horizon.

- The fund does not invest in state government securities and generally has a low portfolio churn.

- The UTI G-Sec STP aims at low volatility of returns by investing inshort term gilts.

- The maximum average maturity of the portfolio is caped at 3 years.

That is a clear, easy to understand mandate. However, if some bonds have an average maturity of 3 years, then the interest rate sensitivity will be a bit high. This fund is in general suitable for long-term (well above 3) goals. Its current average maturity and modified duration are however quiet small.

“The scheme aims to generate income through investments in central and state government securities of various maturities. Provident Funds, Pension Funds, Superannuation Funds, Gratuity Funds and such other entities are eligible to make investments in the fund. The scheme seeks to generate steady and consistent return from a basket of government securities across various maturities through proactive fund management aimed at controlling Interest rate risk. The investment plan will invest in gilt including T-Bills with medium to long maturity, with average maturity of the portfolio normally not exceeding 8 years”.

This is an extract from VR as the ICICI fund page and the SID is not as clear.

As far as ICICI MF is concerned, short-term is less than 8 years. This again is technically unsuitable for our needs, but perhaps can be used very long-term goals. However as above, its current average maturity and modified duration are however quiet small.

This is the only fund left in the green rectangle.

“An Open ended Money Market Mutual Fund Scheme in Income Category seeking to generate income through investment in a portfolio comprising of Treasury Bills and other Central Government Securities with a residual maturity less than or equal to 1 year.”

Says the DSP BR fund page. Now, this I like. Such a fund can be used for any duration from say, 2-3 years and above.

While any of the three funds mentioned satisfy our requirements of low-interest rate risk, the spread in such risk is still high. It is important to recognise this before choose one such fund.

Other funds in this category can also be considered for long-term goals but will react more to interest rate movements.

Fund sin this category do not have large AUMs perhaps because not many people are aware of this.

Note: No credit risk and low rate risk does not mean steay returns. The bonds yields will flutuate according to market demands, in addition to rate changes. Returns are likely to be sedate rather than spectacular.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)