Last Updated on December 14, 2025 at 3:20 pm

Each December I take stock of how well my goal-based investment is moving along (or is it?) Since 2013, I have been publishing these audits. Here is this years edition with some analysis of my retirement and sons-education goals. The only reason I am sharing this is to advertise the benefits of goal based investing. Kindly do not think that I am bragging. I come from a humble background and continue to live a simple, frugal life. As explained below, I have been lucky.

Before we begin, this is the archive of personal finance audits published before:

In addition, I would like to the draw the attention of the reader to these two posts where I had plotted the growth of my equity retirement corpus.

- The rise and fall of my retirement corpus

- Animation: Gain or loss in my retirement portfolio (June 2008 to May 2017)

I lost the tracker file due to a computer crash. So for this year’s audit, I have not only recreated the growth of my retirement portfolio but also created a generic tool for anyone to use. This will be beta-tested among members of Facebook group Asan Ideas for Wealth before publication here. As regards the crash, I have now become wise and auto-synched my entire drive to Google drive (at extra cost).

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

So what happened this year?

In April 2017, I cut short my equity retirement portfolio and reduced it to three mutual funds (see below).

I also merged my son’s marriage goal with his education goal as I had not invested in it for many months (why? not enough money, that is why)

Then I rebalanced my son’s portfolio and reset it to 60% equity. Since I have a PPF account in his name, it was a simple matter of investing shifting from equity to PPF.

Again in December, I had to rebalance his portfolio again. This time, since PPF was unavailable, I put it in ICICI Equity arbitrage fund (this is debt-like in terms of risk and equity-like in terms of tax). Btw this is part of PlumbLine Dec 2017: my handpicked list of mutual funds – skin in the game and all that nonsense.

Other than that, I am two months short of investing for retirement as per my schedule – maintained since 2010 in this Excel: How tracking investments instead of expenses changed my life!

Why? No money again 🙂 Too many unexpected expenses.

2017 personal finance audit: Retirement

As I explained in last years audit, returns do not matter! Unless we are able to quantify the health of a portfolio in terms of our wants, there is no point in doing goal-based investing.

New investors can consider reading this: Review Your Financial Freedom Portfolio in Seven Easy Steps

I will consider two key questions:

1) How long can I draw an inflation-protected income if I retire today (age 43)? ~ 30 years (this assumes a pension from 80% annuitization of my NPS corpus) at 8% inflation and ~ 35 years at 6%.

Am I financially independent? I would like to think so. Sure, the corpus is not strong enough to last me till say, age 90, but I am not complaining.

2) How long can I draw an inflation-protected income if I retire as intended (age 65)? Well, beyond age 100. (this assumes a pension from 40% of the projected NPS corpus at 8% return)

If I can help it, I have no intention of retiring so it is clear that I do not need to invest for retirement if life was to play out like an Excel sheet. However, it is crucial to try and keep investing as I will explain in the next couple of days.

You can use the robo advisory template for your own audit The above two questions can also be answered by users of the automated mutual fund & goal tracker or with this monthly financial tracker.

My retirement portfolio

Equity mutual funds: 56%

PPF (self + spouse): 9%

NPS: 35% (please note NPS is mandatory for me and it is 85% bonds and 15% equity. I treat is 100% debt)

The equity folio is in:

HDFC Balanced + PPFAS Long Term Value Fund + Quantum Long Term Equity (approx equal exposure)

I do not invest via SIPS, but do invest each manually without looking at market movements. If your portfolio is Rs. 100 and you invest Rs. 1 a month, it is a waste of time and energy to worry about when to invest that Rs. 1. My only focus is on the Rs. 100 and reducing risk from it as best as I can.

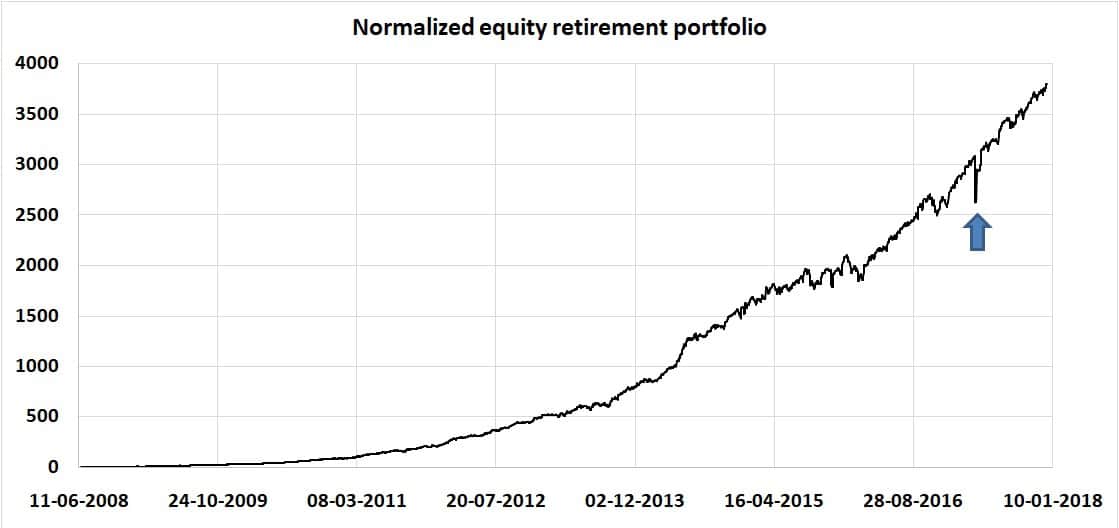

This is the new portfolio growth animation.

The arrow represents the redemption and transfer of mf units.

The reason why I have done reasonably well should be clear from the above graph: sheer dumb luck plus fortune plus an Information Diet( Less Information Can Make us More Informed)

Luck & fortune enabled me to invest as much as possible during the sideways market after the 2008 crash. The information diet helps me to invest without worrying about star ratings or market movements or what fund is hot at AIFW.

Luck & fortune kept huge crashes out of my/our way in the last 9ish years (this is of course in hindsight).

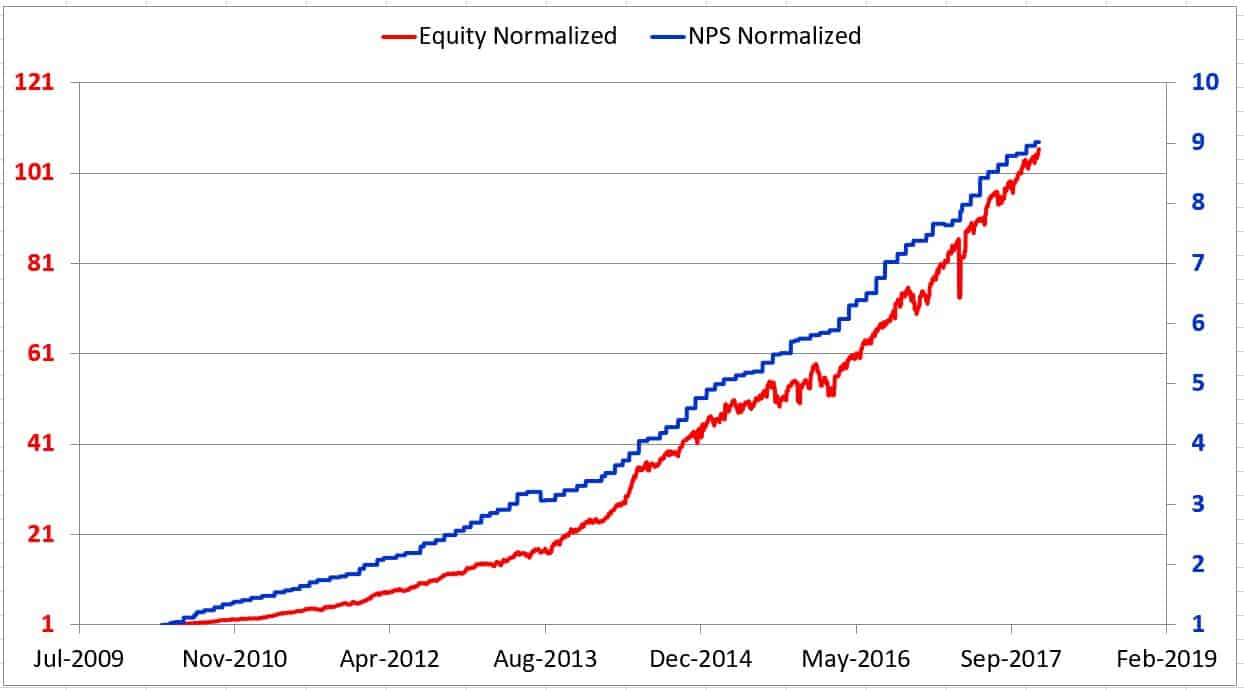

This is the equity portfolio after NPS investments were started. Amusingly, I started equity investing two years before NPS. My NPS contributions were earning 8% in an employer account until the NPS was ready to accept the money.

How about returns?

The current XIRR of my retirement equity portfolio is ~ 17%. NPS ~ 10%. PPF ~ 8% (just a guess).

PPFAS LTVF~ 19%; HDFC Balanced ~ 18%; QLTE ~ 15%

Naturally, that is pretty decent. but these numbers have no meaning without the proper context: how much is the corpus actually worth. That is what I have considered with those two question above – how long can I generate an inflation-protected income with the corpus. Those who are new to this idea may consult generating an inflation-protected income with a lump sum.

Or my free e-book: E-book: How to retire early in India

This is the reason I keep saying, stop harping on returns. They are useless.

Bitcoin investing: Many are curious if I have invested in Bitcoin. The answer is no. I have no need for it. I hope the above numbers make it clear as to why I have no need for it. I also do not have the health or the age to handle the volatility. I am at a stage where my only goal going forward is to reduce risk in my corpus. I am not interested in “investing a small amount in Bitcoin”. That is chicken feed and I have better things to do with my time. I am generally stupid (ask my wife), but even I am not that stupid to waste my hard-invested corpus on such a volatile asset.

If I was not an academic, 20+ or even 30-something today, I would have most likely invested in BTC too. There is nothing wrong with it. If you want to get ahead, you need to take risks in life. Just that my time for risk-taking is over, unless it is purely education.

My son’s education

This is my second long-term goal. I should say this was a long-term goal. Now that he is almost 8 and will be finishing school in about 10 years, it has now become a medium-term goal. After the two rebalancing transactions mentioned above, the current asset allocation is ~ 60% in equity mutual funds and 40% in PPF + arbitrage.

Again the only question that matters is – how much is the corpus worth?

1) If my son were to join college, would I able to afford a basic undergraduate education (even if I have to pay a big capitation fee) – yes.

2) If my son were to join college, would I be able to afford what he wants (thankfully he does not want much,so) – yes.

The corpus is also enough to handle his schooling (which is extremely inexpensive) and perhaps JEE preparation (I would like him to try and learn to prepare for a competition exam). Remember that joke about when should your kid start studying for JEE? The answer is true – before she/he is born (more on that in a later post).

From wanting to be a vegetable seller, I am disappointed to say that he now wants to study astronomy (sigh! I cannot handle another physicist in the family). So the goal post keeps shifting here. We need to keep that in mind while evaluating this goal.

My desire is to keep investing and maintain the 40% debt allocation for at least a few more years and hopefully that alone is enough to fund for his college. Then after keeping a part of it for his marriage, I can shift the equity portion as a medical expense corpus 🙂 This is the reason why I will not invest in my child’s name. I get to spend my money the way I want.

Notice how plans change as we go along. That is why the inputs of any calculator should be refreshed from time to time.

All this may make you feel as if I have a lot of money to invest. No. the is time, not money. I have been investing for my son two months before he was born. That gave me an 18 year window to work(he will be 18 before he finishes school as he is Jan. born). Time is the ultimate currency and is even better than Bitcoin.

Son’education portfolio (XIRR ~ 16%)

Approximately equal allocation in HDFC Prudence (XIRR: 18%); ICICI Dynamic (XIRR: 15%); Mirae India Opportunities (~ 24% – don’t get excited it is a relatively recent investment)

What will I do if HDFC merges balanced with prudence (or vice versa)? I will continue to invest for retirement in “it” and stop investing for my son’s education and gradually shift or rebalance. Already both rebalancing transactions this year was from Prudence. So not a big deal.

So that is all for this year’s audit. You can use the robo advisory template to make up your financial and the automated financial tracker to automate the audit process.

The 2019 Lok Sabha elections

This December we have seen two events that will make the 2019 Lok Sabha elections a much closer contest than the 2014 one (the Gujarat elections and 2G verdict). This means one year from now, from the last quarter of 2018, the market will become edgy. So if your goals are close, you better be careful. I will keep a close eye on my son’s education portfolio and rebalance as necessary and even consider reducing equity to 40% until there is clarity about the new government. As the goal investment duration becomes smaller and smaller, tactical withdrawals become important.

Summary

The idea of this post is to share my thought process on portfolio management.

Today your goals may seem far from completion. The first step is to gauge how far away it is. So that you can get there, one step at a time.

If you have any questions about managing your portfolio, post them as comments below. Please do not try to make sense of my numbers presented above. They are no relevance to you. Also please do not ask me why I have chosen X or Y or Z fund – I have already made my thought process clear in several posts before. Choose quiet but, consistent performers

Do check out my books

| You Can Be Rich Too with Goal-Based Investing, my first book is now available at a 35% discount for Rs. 258. It comes with nine online calculators. Get it now. The kindle edition is only Rs. 199 |

| Gamechanger, my second book is now only Rs 199 (Kindle Rs. 99). Get it or gift it to a young earner |

| The ultimate guide to travel by Pranav Surya is a deep dive analysis into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, how travelling slowly is better financially and psychologically with links to the web pages and hand-holding at every step. Get the pdf for ₹199 (instant download) |

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)