Last Updated on October 1, 2023 at 9:16 pm

Nippon India Nifty Smallcap 250 Index Fund is an open-ended scheme that will track the Nifty Smallcap 250 Index. Should passive investors add this to their portfolio? Should one invest in a small cap index fund instead of an actively managed small cap fund? If one does choose this index fund, how should they invest? A discussion.

For an investor holding Nifty 50 and Nifty Next 50 index funds (or active hybrid or large and midcap oriented funds), the introduction of a midcap or a smallcap index fund seems like an exciting development. They could now buy more of the market with zero overlap. Investing in Nippon India Nifty Smallcap 250 Index Fund seems like an obvious choice.

We need to dig deeper to understand if a small cap index investment makes sense. When you buy Nifty, you are invested in 50 stocks (and most of your money in the top 10) which are established businesses. The failure rate here is non-zero but the lowest.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

The small cap segment is filled with business relatively young and relatively less robust and relatively more likely to fail. Buying the market – that is buying all 250 of such stocks makes little sense even intuitively. When we are worried about tracking error of Nifty or Sensex index funds, imagine the task before the small cap index fund manager!

This is a segment where the impact cost is huge. That is, try and buy or sell large quantities of a small cap stock then the mismatch between buying and selling price would be significant. During volatile market conditions, the fund can deviation significantly from the benchmark.

Even if we assume active small cap fund managers have beat the benchmark due to luck and not skill, we cannot discount the fact that they have up to 20% freedom to hold cash or large caps or midcaps or a mix of these and about one-fifth the number of stocks in Nifty Smallcap 250 index. This is an expensive cushion (higher expense ratio) but a cushion nonetheless.

Active Smallcap Funds vs Nifty Smallcap 250 Index

Let us consider the performance of 13 funds which are currently labelled as small cap funds. Almost all of them would have been small cap and mid cap oriented funds before May 2018. Quant Small Cap Fund was a debt fund in its previous avatar and hence ignored in this study. Small cap funds from BOI AXA, Canara Robeco, Edelweiss, IDBI, Invesco India, Principal and Tata do not have a five-year history and hence excluded.

| Fund | No of rolling return entries Fund (5 years) | No of times fund has outperformed index (5 years) | rolling return outperformance Consistency Score (5 years) |

| Franklin India Smaller Companies Fund – Direct – Growth | 676 | 676 | 100% |

| DSP Small Cap Fund – Direct Plan – Growth | 675 | 675 | 100% |

| HSBC Small Cap Equity Fund – Growth Direct | 675 | 657 | 97% |

| Kotak-Small Cap Fund – Growth – Direct | 675 | 675 | 100% |

| Nippon India Small Cap Fund – Direct Plan Growth Plan – Growth Option | 675 | 675 | 100% |

| Sundaram Small Cap Fund – Direct Plan – Growth Option | 675 | 499 | 74% |

| Aditya Birla Sun Life Small Cap Fund – Growth – Direct Plan | 672 | 672 | 100% |

| ICICI Prudential Smallcap Fund – Direct Plan – Growth | 660 | 322 | 49% |

| SBI Small Cap Fund – Direct Plan – Growth | 459 | 459 | 100% |

| Axis Small Cap Fund – Direct Plan – Growth | 446 | 446 | 100% |

| L&T Emerging Businesses Fund – Direct Plan – Growth | 339 | 339 | 100% |

| Union Small Cap Fund – Direct Plan – Growth Option | 316 | 240 | 76% |

| HDFC Small Cap Fund – Direct Growth Plan | 307 | 307 | 100% |

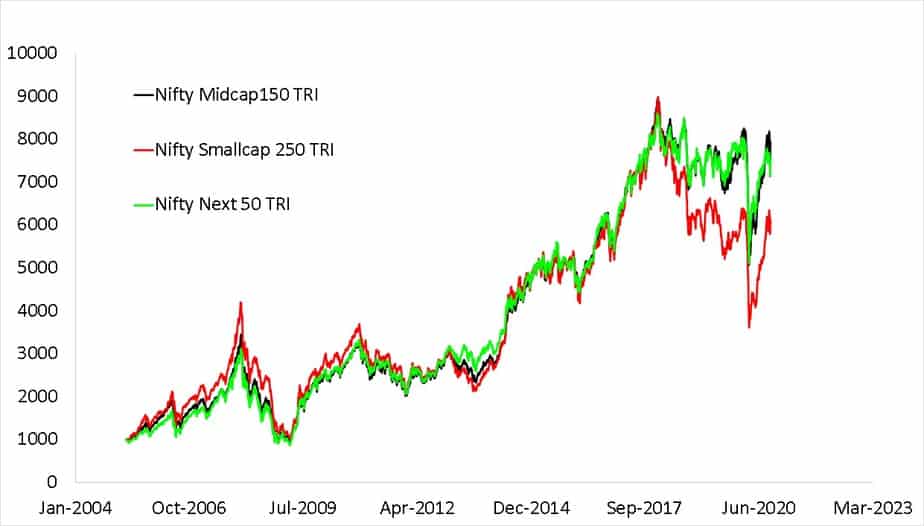

Nifty Smallcap 250 vs Nifty Midcap 150 vs Nifty Next 50

For those who wish to have further proof, 1367 10-year data points are presented below.

Passive fans are better off sticking to their Nifty Next 50 index funds.

How to invest in smallcap funds?

Now that we have established that Nippon India Nifty Smallcap 250 Index Fund can be happily avoided, how should one invest in this category? The best way to invest in small cap stocks would be to avoid all small cap funds and simply buy the “new” multicap fund (after they realign) with 25% small cap exposure.

The worst kind of unsubstantiated notion that gets peddled around is, more small cap exposure would result in more returns in the long term. This is peddled by sales guys seeking higher profit margins. See: Large Cap vs Mid Cap vs Small Cap Funds: Which is better for long term investing?

This brings us to the worst way to invest in small cap funds – via the great SIP. See: Why a SIP in Small Cap Mutual Funds is a waste of money and time.

To summarize, avoid this NFO; avoid all small cap funds, at the very least avoid systematic (aka blind) investing in small cap funds. Tactical investing is an option for those with conviction and discipline: Do not use SIPs for Small Cap Mutual Funds: Try this instead! Also see: Is it time to book profits from Small Cap Mutual Funds?

Announcement: The new course, How to get people to pay for your skills is now open! The course content is available in an exclusive Facebook Group where the course videos are hosted. The early-bird discount price (one-time) is Rs. 2000 – this is 60% off the full price of Rs. 5000. Sign up via: How to get people to pay for your skills: A guide to win trust and build income. The discount is applicable until October 5th 9 am.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)