Last Updated on October 1, 2023 at 5:50 pm

Financial advisory can be divided into components. One which is generic advice, the kind available at the cost of only electricity and internet usage charges in blogs, forums and elsewhere. Then there is personal advice which can be obtained for a fee from a planner or free from your LIC agent uncle. Unfortunately, most confuse one component with the other, but let’s not open that Pandora’s Box today. Personal advice is personal and not much can be written about that. Generic advice on the other hand, is and must be (in my unimportant opinion) grounded in mathematics. That is the principles must be supported by consistent mathematics. All very well, what has this got to do with the post’s title?

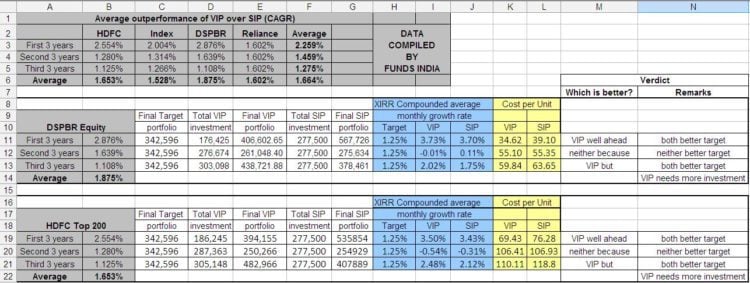

FundsIndia, a Chennai based mutual fund distributor recently published a report titled, “Value-averaging Investment Plan with Indian equity funds – An analysis”, authored by Srikanth Meenakshi and Shankar Bhatt. In this report, they claim that the value-averaging method (VIP) of making periodic investments in equity mutual funds has a higher compounded annual growth rate (CAGR) (~ 1.66%) than the systematic method (SIP) for a chosen set of representative conditions. The authors have approached the problem with an academic mindset and have been good enough to share the details of their results with no hidden formulae: FundIndia VIP Backtest (Can be downloaded as an Excel file).

Before we proceed, some quick definitions for those unfamiliar with SIP/VIP/CAGR

SIP: Investor buys units of a mutual fund for the same amount each month.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

VIP: Investor buys more MF units when the market (therefore the fund and therefore the investor’s portfolio) performs lower than expectation and vice versa. You can read more about this here. So you need to set an expected return, a min, nominal and maximum amount for monthly investment. The expected portfolio value is calculated with the nominal investment amount. You can read more about this in the report itself.

CAGR: Returns from an equity investment fluctuate every day. So to represent growth (or lack thereof) of the investment an average return is calculated. This average is not the usual average that we are used to (called arithmetic average) but a geometric average (This is because compounding represent a geometric progression).

Now getting back to the report, the more I stared at it (don’t ask why!) the more I became uncomfortable with the method used to arrive at the findings. The central result of the report is the uniform higher CAGR observed for VIP investments compared to SIP investments. To be brief the CAGR is obtained from the arithmetic average of the monthly difference in returns between VIP and SIP investments. Trouble is this method does not seem to reproduce standard results. For example if I have two recurring deposits, one with annual interest 10% and the other with 15%, the CAGR difference between the two is 5%. Whatever method I use to obtain CAGR for equity investments it should give me 5% for the RDs. The approach used in the report does not give me 5%.

So I wanted to see what others do to compute CAGR for VIP investments. Many use a standard feature available in Excel known as IRR or XIRR. Here is a terrific resource (You can read more about IRR/XIRR here). IRR/XIRR returns 5% for the RD example therefore consistency is not a problem. The point of the opening para is: If we wish to claim VIP is superior to SIP as generic financial advice then we must use consistent tools to do so. IRR/XIRR is a readily available tool to do this.

Using the NAV data used in the report I have calculated the returns from VIP and SIP investments using Excels IRR function. The Excel file can be found here. I discuss some results below.

The report claims a uniformly higher CAGR for the VIP-mode. In some cases I find the CAGR difference to be much lower than claimed, in some case much higher and in some cases opposite (SIP outperforms VIP)! If we must choose between the two, then, I think the comparison must be made not just with returns.

First we should be clear about the purpose of investing: to attain financial goals. Thus the expected return, the nominal monthly investment and the final target portfolio should match our goal expectations (in part at least). This is important to evaluate which method is better.

The report is based on a study in which four mutual funds were considered for three 3-year periods (ie. 12 such studies) and the same funds were also studied over a 5-year period, thus a total of 16 such studies.

The compiled results can be downloaded here as a excel file.Here is a partial snapshot and some conclusions.

(a) 10 out of 16 times both SIP and VIP modes did better than the target portfolio value

(a) 10 out of 16 times both SIP and VIP modes did better than the target portfolio value

(b) 5 out of 16 times neither SIP nor VIP did better. Thus using a VIP does not guarantee success.

(c) Only once did VIP alone better the target portfolio. The point is if you can achieve your financial goal with VIP you are likely to do it with SIP as well!

(d) Only 4 /16 times the total VIP investment is significantly lower than the total SIP investment (VIP inv. is only 63-73% of SIP inv.). This is an impressive victory for the VIP mode.

(e) 7/16 times total VIP inv. is marginally higher than SIP inv. So no guarantee of this as well. Three out of those 7 times in a losing cause (target not achieved)

(f) Coming to returns: 12/16 times VIP has higher CAGR than SIP. However 10 of those 12 times both VIP and SIP do better than the target portfolio. Only once does SIP fall short and once both do!

(g) 4/16 times VIP has lower CAGR than SIP and all of them in a losing cause (VIP and SIP fall short of target)

Let me stop here. Perhaps more can be said. Do let me know your observations.

In contrast the FundsIndia report claims that VIP outperforms SIP all 16 times! Note: My study is based on the NAV information given in their report. The total VIP/SIP amounts invested and final portfolio values are all the same in both cases. Only the target portfolio differs by a small amt (~ 1%) due to a minor difference in calculation and will in no way change the above conclusions.

So what now? First let us understand that the report was made with a singular aim: to promote FundsIndia’s value-added VIP service (it is a value addition no doubt there). If you are asking which is better wrt Indian equity funds then I would say it is not conclusive yet. Perhaps one should do this study for more number of years. I am working on a comparison with historic Sensex returns. Perhaps that will throw some light … perhaps.

The more important question is should I VIP or SIP? On the face of it there is nothing wrong with a VIP and it is certainly a good concept. However, using it depends on ones investing style. If I were to use a single index fund for investing then by all means I should do a VIP. In the long run I am likely to invest lesser than a SIP for at least the same kind of returns. This approach is not practical if use more than 2 MFs. For each MF I will have to specify a max. investment amount. For a VIP to work effectively the maximum investment amt. should be quite higher than the nominal amt. (wrt to which target portfolio value is determined). So I need to ensure regular cash flow. Obviously this gets tougher with more such schemes. Personally I would like to spread my eggs around a little bit. So I would prefer investing in about 4-5 schemes to limit my down-side risk (more important than returns). So a VIP is not suitable for me. Perhaps my style is less than optimal, perhaps it is not. I don’t care. I am comfortable with it and will like to stick to it. So you before you align yourself with their report or my results understand your personal situation and use a style which suits you best. Remember hindsight is always 20:20. Once you choose a suitable style you are never going to know the result of the other choice. Nor should you bother to find out. If you are new to mutual fund investing and have just started investing, VIP can be a good option. If you are yet to begin then you have no business reading about VIP! Get your KYC done and get started. You can worry about VIP later.

To conclude, I have nothing against FundsIndia or their report or against VIP. My point is if you want to make a judgement you should choose consistent techniques and fundamental yardsticks. Whatever the results, choices depend on personal circumstances. The key is to remain contended with those choices. An ‘intelligent investor’ is necessarily a ‘contended investor’.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)