Last Updated on February 12, 2022 at 6:15 pm

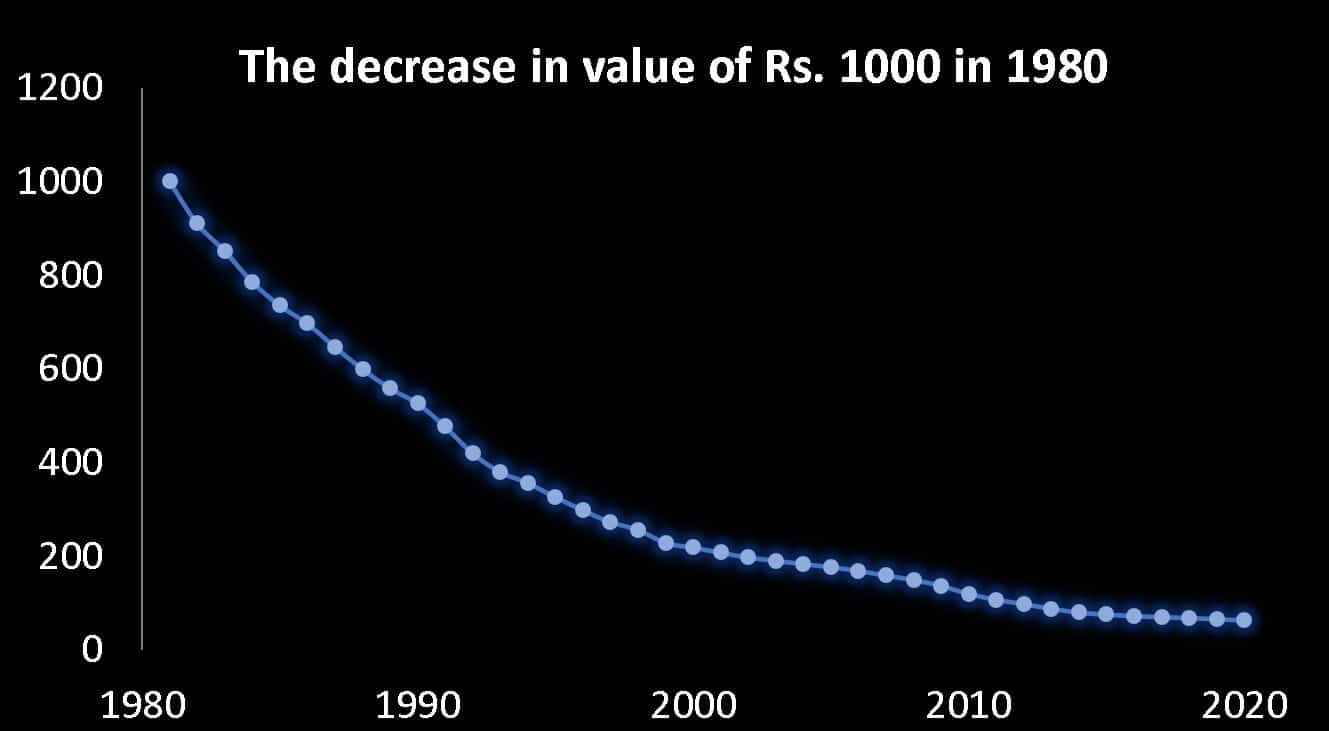

If you had Rs. 1000 in the year 1980, it would just be worth Rs. 63 in 2021 (down from Rs. 66 in 2020 and Rs. 68 in 2019) if we use the cost inflation index (CII) data published by the government. The trouble is this index is an underestimate and out lifestyle has changed (if not improved) with the help of technology. So actual inflation is a lot higher. How can we protect our hard-earned money? A discussion.

Many readers argue one should invert these numbers. That is a product (or service) costing Rs. 60-80 in 1980 is today priced close to Rs. 1000. This is doubt correct. However, the products we buy today are very different from the ones in 1980, and each has its own rate of inflation.

Although the cost inflation index does not represent how our expenses actually increase over a period of say five or ten years, it is enough for investors to appreciate the folly in investing in safe products. Rs. 1000 in 1980 would have been a handsome salary.

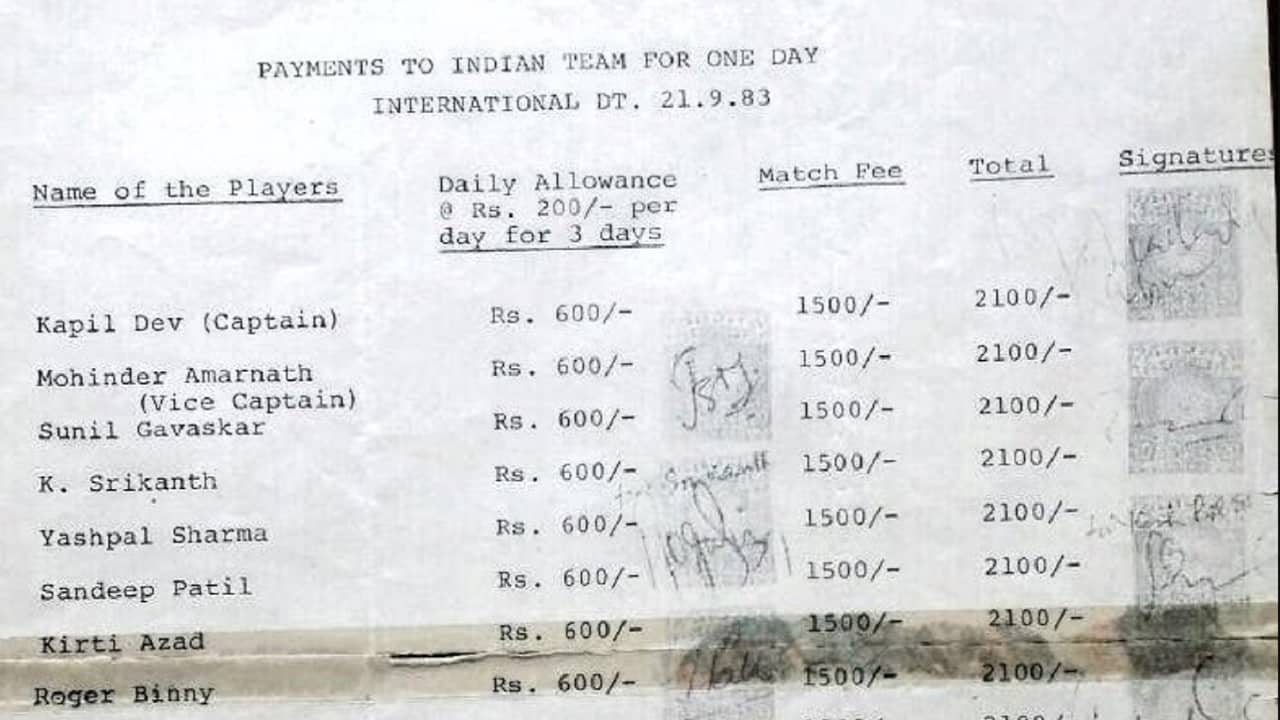

The Indian team of 1983 was only paid Rs. 2100 for the first day-night exhibition match which was played against Pakistan on 21 September 1983 at Nehru stadium New Delhi. This was just three months after their World cup win. Source: Journalist Makarand Waingankar via Twitter on Jul 16, 2019

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Inflation, even the tepid official inflation numbers have devalued spending power considerably.

CII is the index used for computing indexation benefits for long terms capital gains tax computation and is proportional to the consumer price index. However, it does not realistically represent the inflation in our expenses.

Show below is the CII data with a base of 100 in 2001-2002. This is the data to be used for the computation of LTCG from real estate, non-equity mutual funds etc.

Cost inflation Index From 2001

FY CII

2001-02 100

2002-03 105

2003-04 109

2004-05 113

2005-06 117

2006-07 122

2007-08 129

2008-09 137

2009-10 148

2010-11 167

2011-12 184

2012-13 200

2013-14 220

2014-15 240

2015-16 254

2016-17 264

2017-18 272

2018-19 280

2019-20 289

2020-21 301

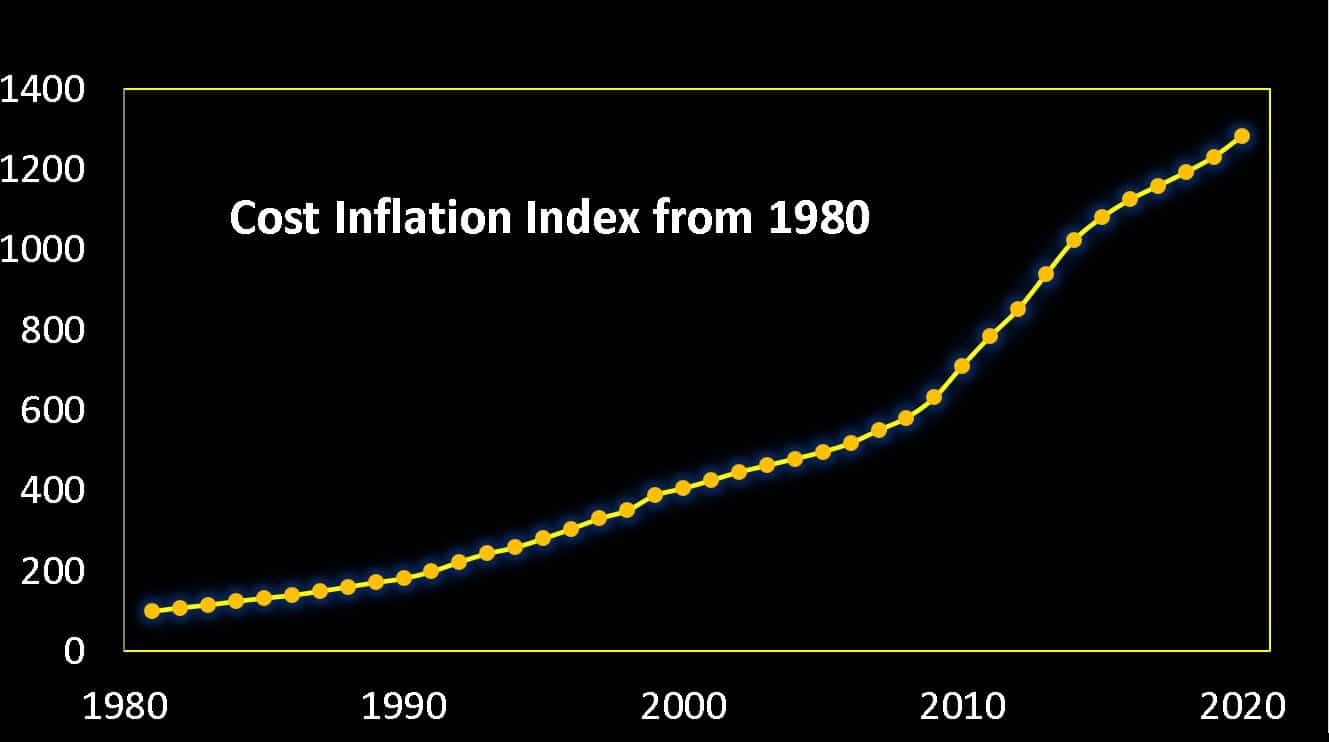

This is the cost inflation index data (CII) from 1980. In 2016, the base of the index was changed from 1980 to 2000 (above data), both scales have been integrated into a single index below. You can copy and paste into a spreadsheet.

Cost inflation Index From 1980

FY CII

1981-82 100

1982-83 109

1983-84 116

1984-85 125

1985-86 133

1986-87 140

1987-88 150

1988-89 161

1989-90 172

1990-91 182

1991-92 199

1992-93 223

1993-94 244

1994-95 259

1995-96 281

1996-97 305

1997-98 331

1998-99 351

1999-00 389

2000-01 406

2001-02 426

2002-03 447

2003-04 463

2004-05 480

2005-06 497

2006-07 519

2007-08 551

2008-09 582

2009-10 632

2010-11 711

2011-12 785

2012-13 852

2013-14 939

2014-15 1024

2015-16 1081

2016-17 1125

2017-18 1159

2018-19 1193

2019-20 1232

2020-21 1283

This is a year on year increase of 6.76% Imagine the inflation if lifestyle changes (due to needs or wants) is taken into account!

If we invert this graph with a value of Rs. 1000 in 1980 we get the titular result.

Rs. one lakh today would be worth about Rs. 3000 after 30 years at unrealistic overall inflation of about 4%.

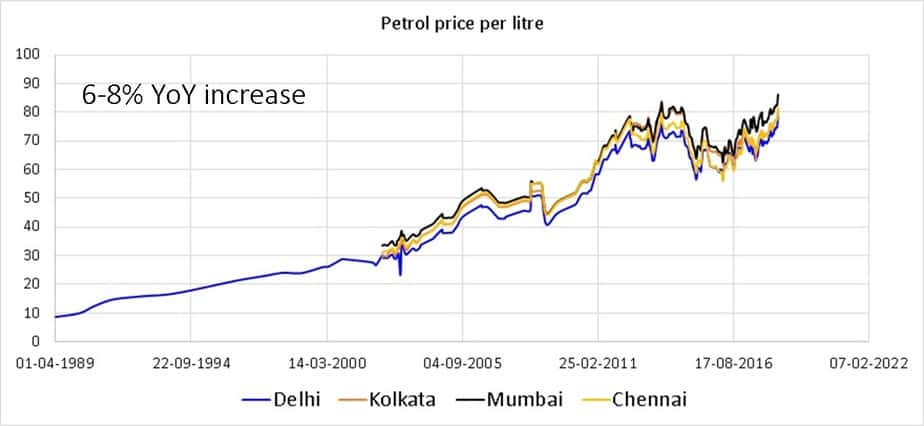

Fuel costs alone have increased by 6-8% over the last three decades. This means for any business to be profitable, the cost of their service or product should increase at a higher pace. Meaning, we need to shell out that much more. So we need to prepare for a long-term actual inflation of 6%.

This means Rs. one lakh today would be reduced to about Rs. 16,000 after 30 years. In other words, if our bare essential annual expenses are Rs. 20,000 today (leaving out EMIs, school fees etc.), we need about 1.15 lakh to account for just these expenses. We will have to include health-related expenses and lifestyle changes in the middle!

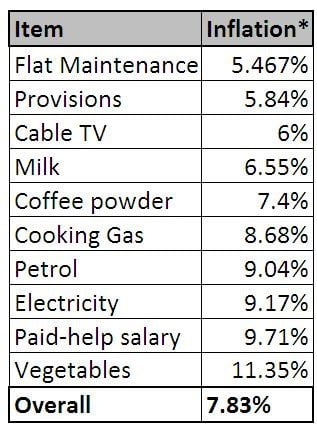

Personal inflation: an example

This is my family’s personal inflation as detailed before: Inflation in India: Some Real Numbers.

Notice the increase in fuel, electricity, paid-help and vegetables. All these contribute to the overall 8% number. However, this is for a frugal family that does not eat out. That does not go to malls or the cinema. We do not change smartphones, cars or television every few years. Inflation on necessities is 8% without considering lifestyle creep! Unless we take corrective steps, we would like the hamster running in the same place on a wheel (picture above)

Lessons from a cutting chai

Suppose you had Rs. 1 in 1990 and used 50 paise to drink a cup of tea on the road. You invest the remaining 50 paise and decide to drink a cuppa from that amount after 29-30 years. To so do, that Rs. 0.5 should have grown to Rs. 10! Meaning an after-tax return of about 11%.

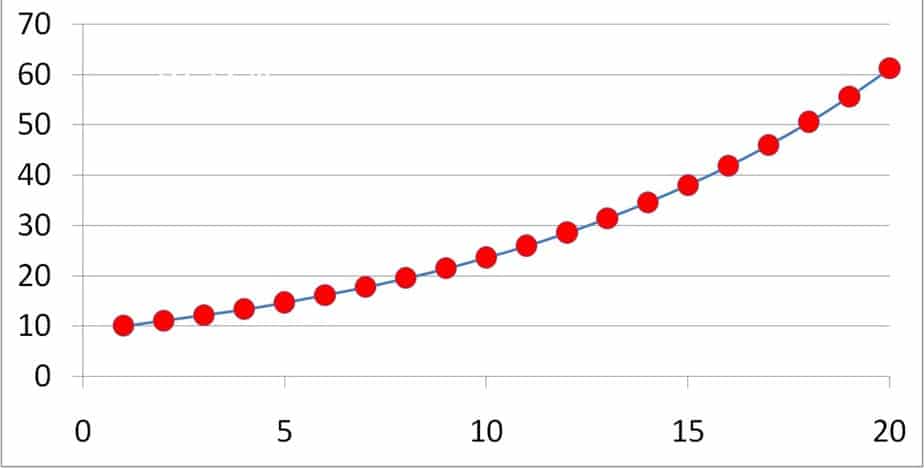

After 20 years, tea on the street will cost about Rs. 60. If take Rs. 20 today and drank a cuppa with and invested the remaining Rs. 10, to drink cutting chai after 20 years, the post-tax return required is Rs. 60. If we choose not to take and stick to a safe return of 7%, then we need to invest 80% more!! That is Rs. 18 to drink tea after 20 years!

Would you rather invest 80% more to get safe returns or would you rather take some risk, learn to manage it and invest a reasonable amount?

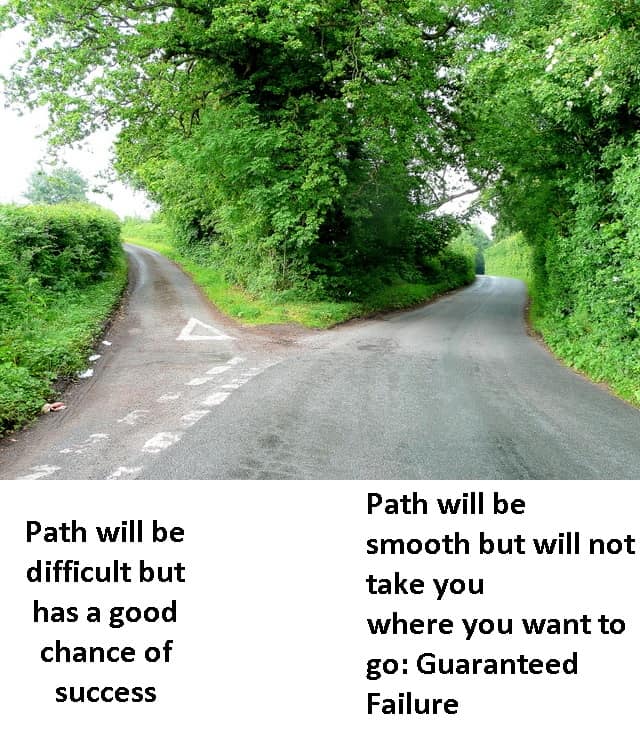

This situation is a lot like a fork in the road. If you have to choose between guaranteed failure (if we do not invest enough) and a chance of success (if the risk is managed right)

How to protect our money? What is the solution?

There is no option. Unless long term portfolios contain at least 60% of equity (rest in fixed income), you will not be able to beat inflation. Your purchasing power will keep going down and will hurt bad when your income drops to zero, aka retirement. Therefore, start as soon as possible, invest as much as possible and build a portfolio with good equity exposure as quickly as possible. There is no other practical option.

Merely investing in equity alone will not solve the problem. Long-term investing in equity will not always be successful. See for example: What return can I expect from a Nifty 50 SIP over the next 10 years?

- We need a plan to increase our income, build a second income stream that would outpace our salary and last a lifetime.

- We need to manage risk systematically, in particular, craft the right variable asset allocation plan which would help us meet our future goal no matter what the market conditions.

- We need to create a financial plan that accommodates this risk management or variable asset allocation from day one so that we do not fall short on investments later.

- We need to stick to the plan; increase investments as much as possible each year; manage risk systematically in a goal-based manner each year.

A higher income, the right investments, and active risk management is the only way to protect inflation degrading the future value of our networth.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)