Last Updated on December 29, 2021 at 5:55 pm

The company which is popular among the railway travellers [Customers] for offering the convenience of online Railway ticketing facility is fancy of investors too ever since it came out with an IPO, and investors lapped up the IPO with 112 times oversubscription; just the way tatkal bookings happen at its popular website, i.e. www.irctc.co.in

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Should you sell ITC and book losses? (5) Stock analysis: Are Tata Consumer Products share worth a buy?

The company which holds the monopoly market share in the internet railway ticketing services and offers ‘value’ food services at the Railway trains/platforms offered meagre amount of shares in allotment to the investors during IPO [only if you are lucky to get allotment] as it was hugely oversubscribed. Investors find the future of the company bright given the business segments it is engaged in and the market share it holds in those business segments.

IRCTC, a Government of India Enterprise, was incorporated to upgrade, modernize and professionalize catering and hospitality services, to manage hospitality services at railway stations, on trains and other locations and to promote international and domestic tourism in India through public-private participation. It is under the administrative control of the Ministry of Railways (MOR). It is the only entity authorized by Indian Railways to provide Catering Services to railways, Online railway tickets and Packaged drinking water at railway stations and trains in India.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Let’s take a look at the businesses of the company before we arrive at any conclusion about its stock.

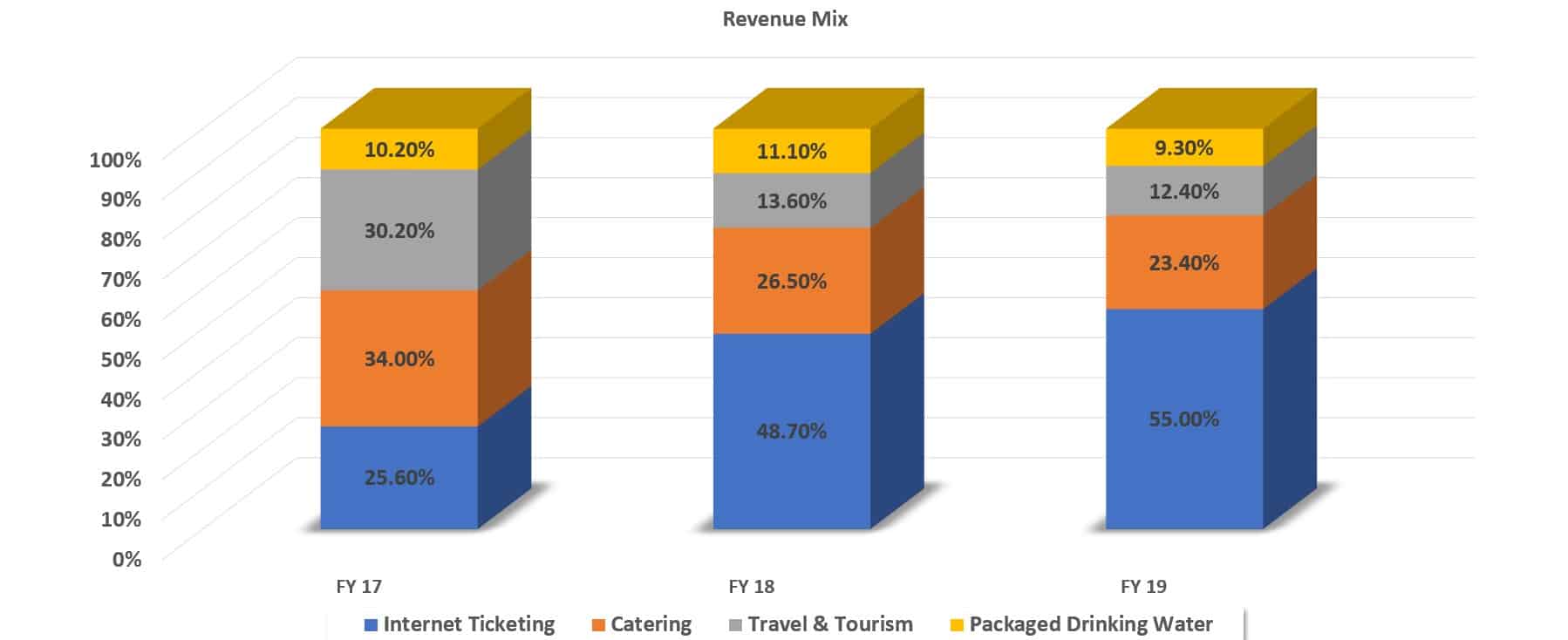

The company is engaged in the following businesses:

- Catering Services

- Travel and Tourism

- Internet Ticketing

- Packaged Drinking water

IRCTC Catering Services

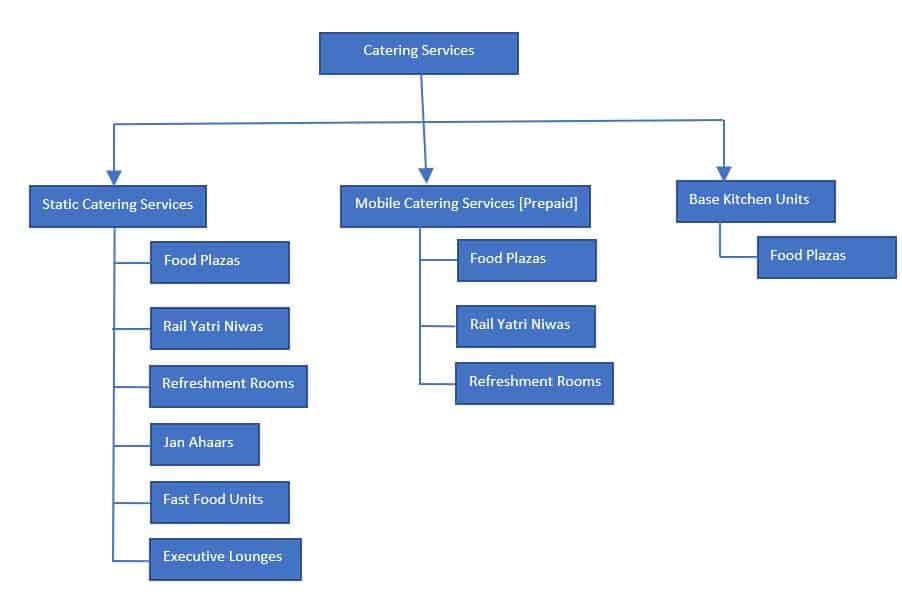

The Ministry of Railways came out with the Catering policy in 2017 which shifted the entire business of catering services at the Railway platforms as well as Trains to IRCTC, thus making the company a huge beneficiary of the catering business across the rails. Catering Policy 2017 detailed the catering services as below.

To know more on the volume of the business and adherence to quality standards maintained by IRCTC on food catering, watch the video: IRCTC Provides High-Quality Food In Railways At Low Prices

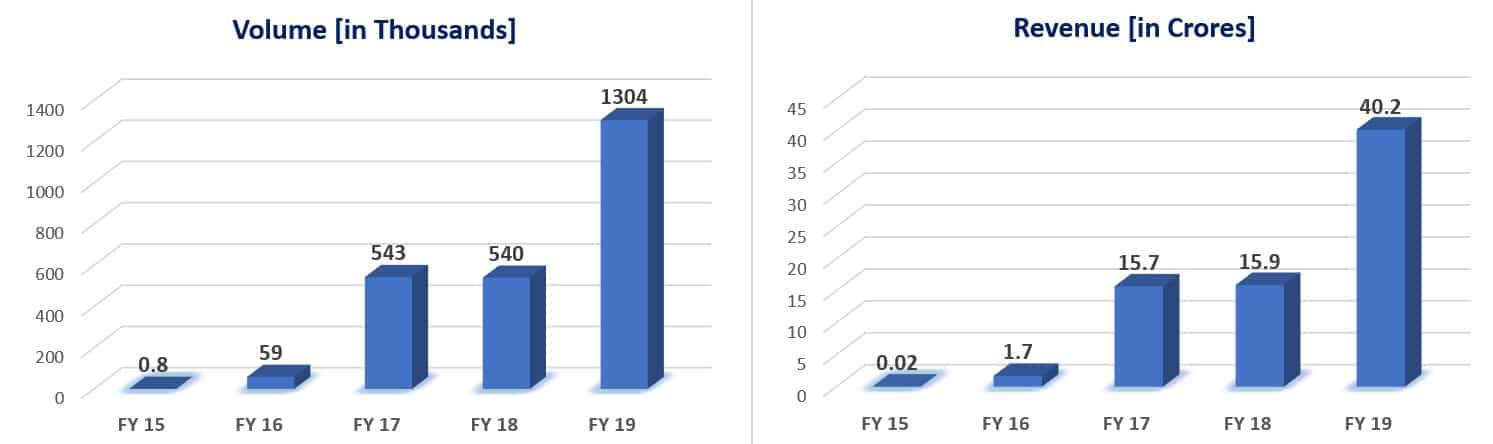

Internet Ticketing

Key observations:

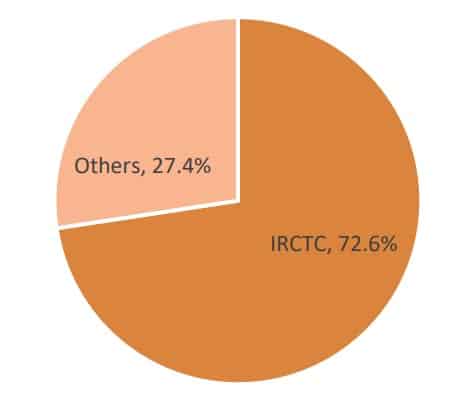

- Currently, IRCTC is the only authorized entity to offer online Railway Ticketing services

- Identified as one of the largest websites in terms of volume of traffic handled in the entire Asia Pacific region

- Some statistics [Pre-Covid]

- 70 Lakh Logins per day

- 5 Crores of transactions handled monthly

- Between FY14-19, online bookings have grown at a CAGR of 12.5 per cent

- 14 Lakhs of passengers travel across rails in India daily, Approx. 72% of bookings through the internet

Source: IRCTC files IPO draft papers, to offload 12.5 per cent

IRCTC levies services charges in the form of convenience fees on booking the tickets online in the range of:

- 15/- per ticket for non-AC travel

- 30/- per ticket for AC travel

During 2016, the charges were removed to promote digital banking, and IRCTC was reimbursed for the amount by the Ministry of Finance/Railways. However, the charges were reinstated w.e.f. September 2019 as convenience fees. See: IRCTC to restore service charges on E-tickets from Sep 1

Packaged Drinking Water

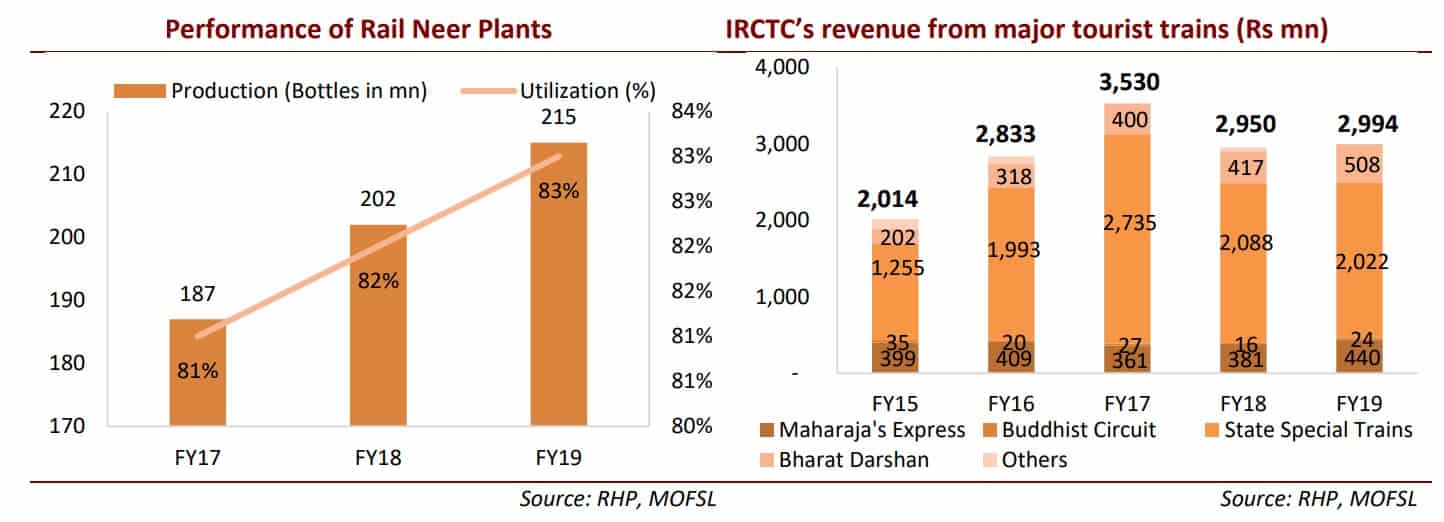

On the similar lines of the other business segments of the company, IRCTC is the only authorized entity to manufacture and distribute packaged drinking water on the railway stations and the trains.

Key Stats

- Company has 10 operational plants currently

- The cumulative capacity of over 11 Lakh litres per day

- Company has plans to set up additional 9 plants to cater to the rising demand.

Travel and Tourism

The company offers various tourism services including Luxury Trains Tours like Maharaja Express, Buddhist Circuit special trains, Bharat Darshan Special trains and many other Rail tour packages which offer complete end-to-end services. These services also include hotel bookings, car rental services, LTC Tours, event management services, land tour packages, domestic and international tour packages through their own portal www.irctctourism.com.

IRCTC made another first in the Indian Rail history by operating a ‘private’ train on Delhi-Lucknow track and received an overwhelming response from the customers. This was the first-time railways opened to the private tour operators and rightly, so customers well appreciated this move.

The USP of this initiative was:

- This was the first time that the passengers will be compensated if the train is delayed.

- In a first, the company is offering a complimentary travel insurance coverage of ₹25 lakh.

- There will be tea, coffee vending machines and water will be provided through RO machines for passengers on demand.

Gauging the public response, the company launched another ‘private’ train, this time on Ahmedabad-Mumbai route.

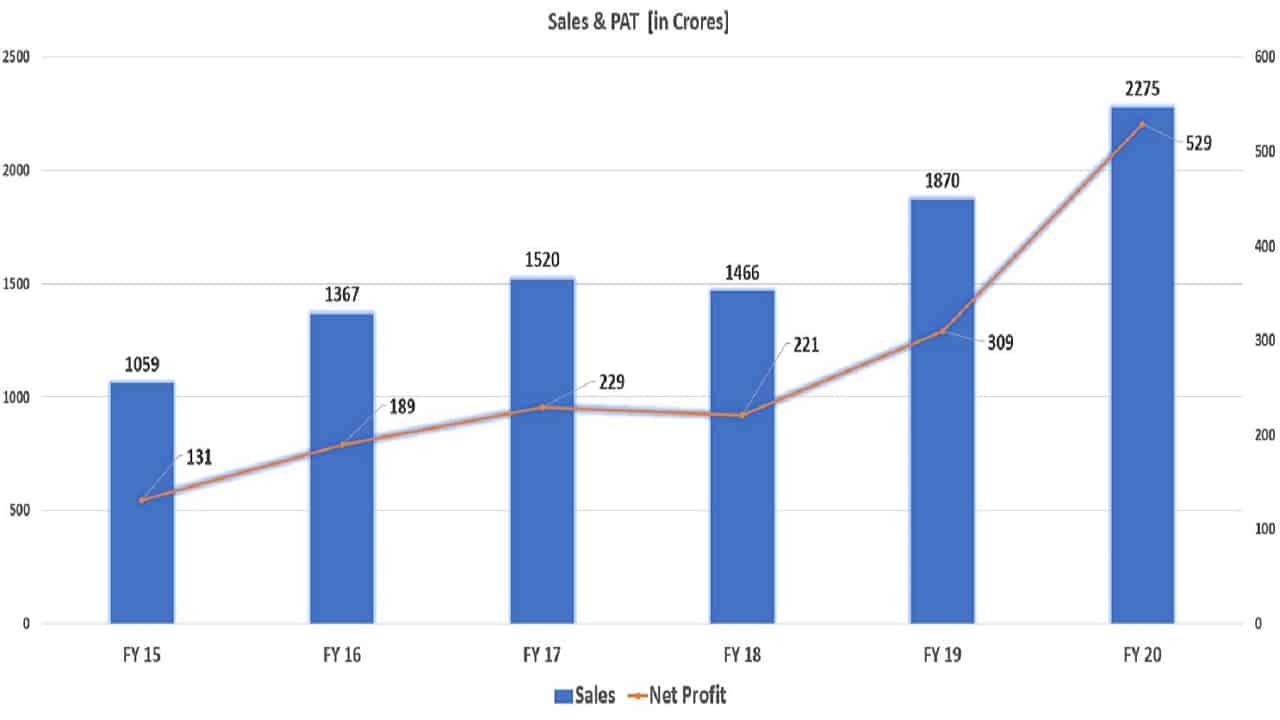

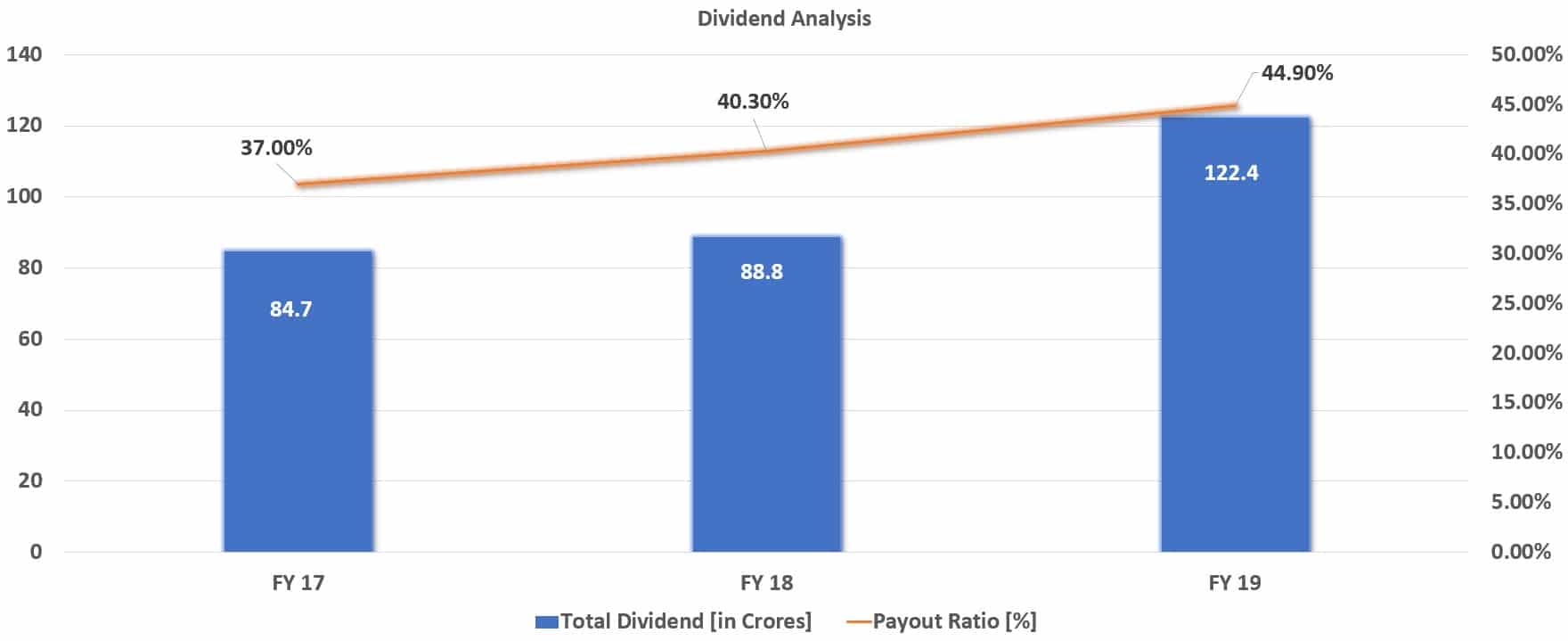

Financial Performance of IRCTC

Key Observations:

- The company has shown healthy growth in the past years due to growth across all business verticals.

- The company has virtually no competitor in online ticketing services and packaged drinking water segments.

- Private train initiative by the railways has paved the way for offering quality and time-bound services to the end customers, and customers have well appreciated this move too.

- The Tejas Express train runs for six days a week. Also, IRCTC spent an average of nearly Rs 14 lakh per day to operate the state-of-the-art private train and earned around Rs 17.50 lakh every day from the passenger fares.

- Source: India’s first private train IRCTC Lucknow-Delhi Tejas posts Rs 70 lakh profit in three weeks

- The company has a strong presence in the food catering services market by offering better food quality at affordable prices than before.

- Stringent quality controls maintained by the company by engaging Third Party audits.

- Installation of CCTV cameras at the ‘source,’ i.e. Kitchens

- Onboard billing through POS [Point of Sale] machines

Going Ahead: The pandemic [COVID-19] had left no stone unturned for the company in FY2021 when the train services came to a halt for the first time in history. Source: Never stopped operations even during wars: Indian Railways’ plea to citizens

The lockdown which started in the country during March’20 brought almost entire business operations to a halt when all the commercial activities were stopped temporarily. The company had to close the operations of the two trains as well.

“IRCTC has cancelled the Lucknow-New Delhi (82501/82502) Tejas Express from November 23 while the Ahmedabad-Mumbai (82901/82902) Tejas Express from November 24. Sources said that the occupancy of Tejas Express was around 25 to 40 per cent after the resumption of operation as against 50-80 per cent before the coronavirus lockdown.”

“IRCTC reported a net loss of Rs 24.60 crore in the quarter ended June 2020 against a profit of Rs 72.33 crore a year ago, hurt by Covid-19-induced lockdown.” Source: IRCTC Q1 results: Company reports net loss of Rs 25 crore due to lockdown

From the past few months, the commercial activities have started to resume in a controlled manner; however, the impact of COVID-19 on railways as a sector is still visible. Railways have been contributing to the freight load factor more than ever due to pressure on-road transportation, but passenger load factor has not shown any significant improvement.

Though airlines have been slowly given respite since the regulatory measures are stronger on Airlines than Railways due to

- Strict monitoring of passenger safety

- Covid testing

- Sanitization levels

- Crowd management

- Social Distancing

We would like to believe that the impact of the pandemic is temporary and commercial activities would resume once again when normalcy returns, till then IRCTC as a company won’t be able to enjoy the earnings as it had enjoyed in the past.

What lies ahead for the investors

IRCTC has benefitted from the regulatory regime in the past and suffered too. Still, overall the tide has been in its favour wherein the company virtually enjoyed a monopoly in the business segment it operates in. The regulatory risk overhang will remain on a few accounts:

- Regulators may allow private operators/internet companies to enter the online ticketing services; currently, there is no immediate threat on this front, but given the presence and success of the internet companies in digital banking and ticketing platforms, this risk cannot be discounted.

- The success of the online ticketing services solely lies in the hands of the technology platforms that the company has deployed. The company had faced severe criticism in the past for not meeting peak load factor [like Festive demand, Tatkal bookings etc.]

- Though the company worked towards upgrading its platform and came out with some impressive results as well, the future success solely lies in the constant innovation and technology upgradation.

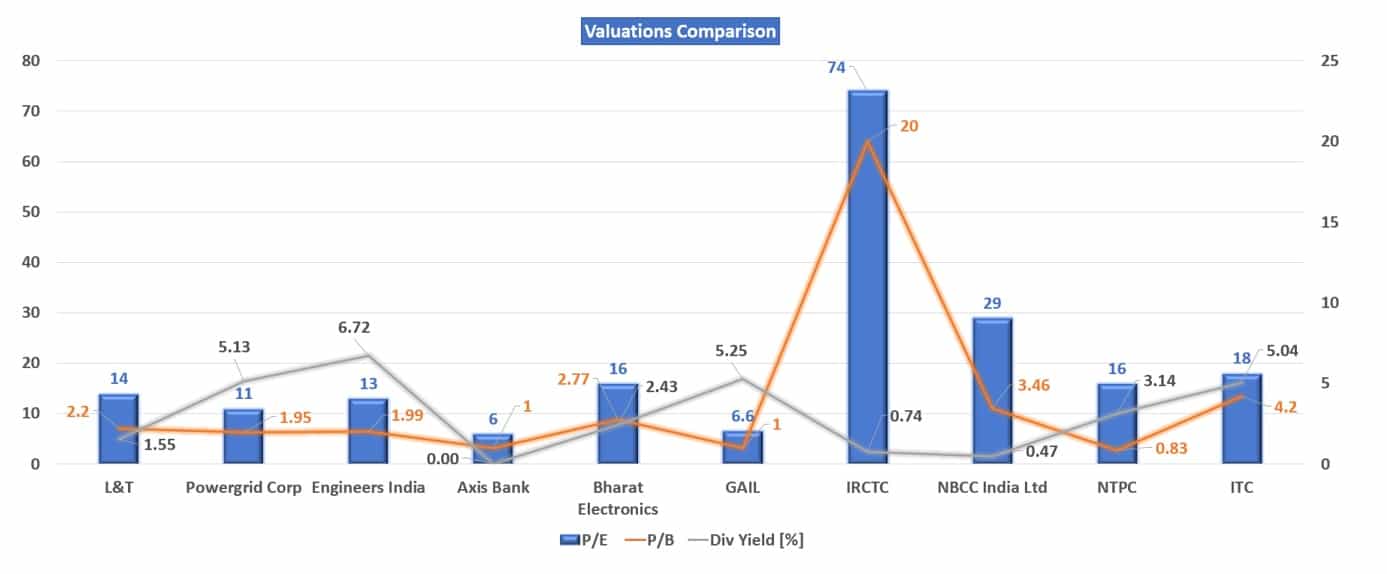

IRCTC Valuation

The company belongs to the PSU universe as per the classification of the companies and let us take comparison of the PSUs listed on stock exchanges on the key valuation parameters.

The stock of the company trades at P/E ~75 [Price Earnings ratio], and we believe investors should not gauge valuations solely based on P/E as the earnings of the company have been volatile in the current financial year.

However, one factor that should catch the attention of the investors is the P/B [Price to Book ratio]. The stock of the company trades at the ~20 times P/B ratio.

[The price-to-book ratio compares a company’s market value to its book value. The market value of a company is its share price multiplied by the number of outstanding shares. The book value is the net assets of a company.]

The stock of the company trades at the premium valuations given the P/B Ratio and the Dividend yield it offers in comparison to its listed peers in PSU spectrum. Govt To Sell Up To 20% Stake In IRCTC Via OFS; Stock Nosedives 13%

Conclusion

Investors willing to make an entry into the stock hoping to ride the theme around Indian Railways should also take a look at the valuations at which the stock trades. Existing investors should also keep a note of the earnings flow and news flow around the company and its businesses; as the railways as a sector has been battered by the COVID-19 pandemic. Existing investors might be in for the long haul as the stock price discounts future earnings growth and recovery already.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)