Last Updated on December 29, 2021 at 5:52 pm

Investors face the dilemma whether to invest in the FMCG company Tata Consumer Products Limited at this juncture when the stock has already seen a huge rally of 300% in the past 5 years and if it’s still a ‘value buy’. The company [erstwhile Tata Global Beverages Limited] was in the news recently when the company was renamed as Tata Consumer Products Limited, following the merger of the consumer products business of Tata Chemicals with itself. Before we could answer that question, we need to dig into data to analyze further.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Should you sell ITC and book losses?

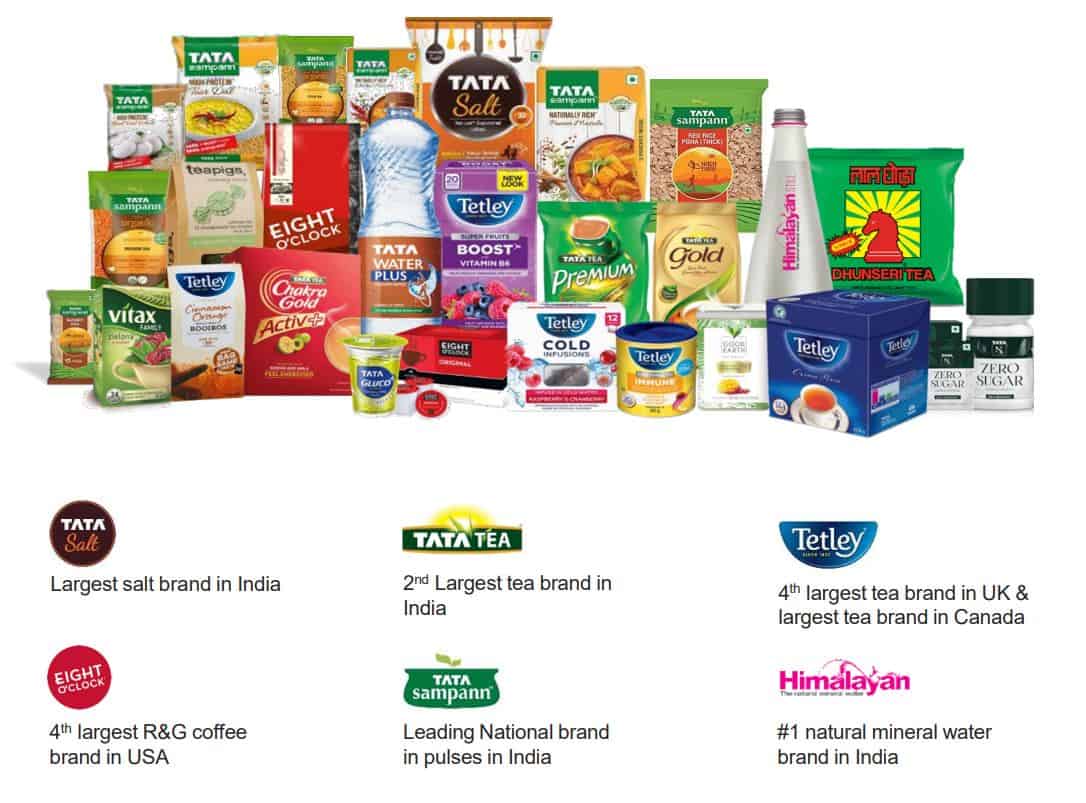

Let’s have a look at the businesses of the company. The company is the owner of some of the most iconic brands being served to almost every household daily throughout the world, i.e. Tata Tea, Tetley, Tata Salt, Tata Sampann, to name a few. These brands have an international presence, and market share is huge too providing the company clearly an advantage on the retail shelves due to the sheer brand recall and legacy that the company enjoys due to its parentage, i.e. ‘Tata’.

Tata Starbucks Ltd.

Apart from the brands that the company owns and operates, it is also in Joint Venture with the world’s most renowned coffee chain Starbucks through Tata Starbucks Limited which gives the company flavour of the QSR [Quick Service Restaurants] business. The Starbucks chain in India operates stores on the COCO model [Company Owned Company Operated], and the JV is 50:50 in nature. Starbucks is known for serving quality coffee ‘experience’ throughout the world. In India, they are present only with Tata Starbucks stores which gives the company Tata Consumer Products an advantage over the competition as the brand recall for Starbucks is the strongest among its peers. The image reflects 20-year returns of the Starbucks stock price.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Starbucks store count: 31256 worldwide. In October 2012, Starbucks opened its first store in India, measuring 4,500 sq ft in Elphinstone Building, Horniman Circle, Mumbai and it was well-received among the youth of the country too. Soon, the company began expanding the operations throughout the country esp. major cities and metropolitan areas. Currently, the store count stands <200.

Why the investor community gives too much weightage to the Starbucks operations when the store county is shy of 200 strength [store strength ~196 as of today] even after 8 years of launching the first store in Mumbai? It took 20 years of operations for Starbucks to reach 4400 stores in China, and this is what the investor community expects to be replicated sooner or later in another largely populated country, i.e. India.

Tata Starbucks reached an important milestone when the company achieved Rs. 500 Crore mark in annual revenues, translating to almost Rs. 2.5 Crores per store, which in a way is almost 3 times higher than the nearest competitor.

The Merger

Moving onto another ‘Game changer’ for the company Tata Consumer Products Ltd.

The company went thru the merger of the consumer products business of Tata Chemicals Ltd with Tata Global Beverages Ltd, and this led to the creation of Tata Consumer Products Ltd. Now, let’s understand the rationale behind this merger:

- Merger Ratio: “The swap ratio implies that the shareholders will receive 114 shares of Tata Global Beverages for every 100 shares held, thus valuing the consumer business at Rs 227 per share.”

- This merger paves the way for diversification into multiple product categories with high growth potential; ultimately tap the larger opportunity available in the Foods segment and not be limited only to the beverage category.

- Create a consumer company with leading Indian and International brands like Tata Salt, Tata Tea, Tetley, Eight O’Clock, and high growth potential brands like Tata Sampann and Tata Starbucks.

- Creation of a sizable Consumer company with enhanced scale and financial strength.

- This merger would ultimately lead to

- Cost synergies [Common salesman to sell the full portfolio]

- Increase in direct reach [tap the current distribution channel]

- Common channel to sell the full portfolio

- Tata Coffee is the subsidiary of Tata Consumer Products Ltd [formerly Tata Global Beverages] is another group company which is into tea and coffee plantation. It is also one of the largest integrated coffee players in the world.

- Tata Coffee owns 19 coffee estates spread over 18,244 acres, and its tea and other spices’ estates spread over 7,203 acres. Both these make Tata Coffee one of the largest integrated coffee plantation company in the world and gives it an added margin over other players.

- In recent times, Starbuckswhich made its India venture has an alliance with the Tata group and has entered into an agreement with Tata Coffee to source its coffee beans. This new alliance gives the company the necessary visibility in the wholesale market and acts as a strong selling point.

NourishCo

Recently, the company was in the news once again for the 100% acquisition of NourishCo [earlier launched as 50:50 JV with PepsiCo]. The JV was formed in 2010 as the two joined hands to develop and sell a range of healthy hydration beverages. NourishCo Beverages Limited sells hydration brands such as Himalayan mineral water, Tata Gluco Plus, and Tata Water Plus. Another move by the company to strengthen the branded beverages portfolio.

Financial Performance

Financial Performance

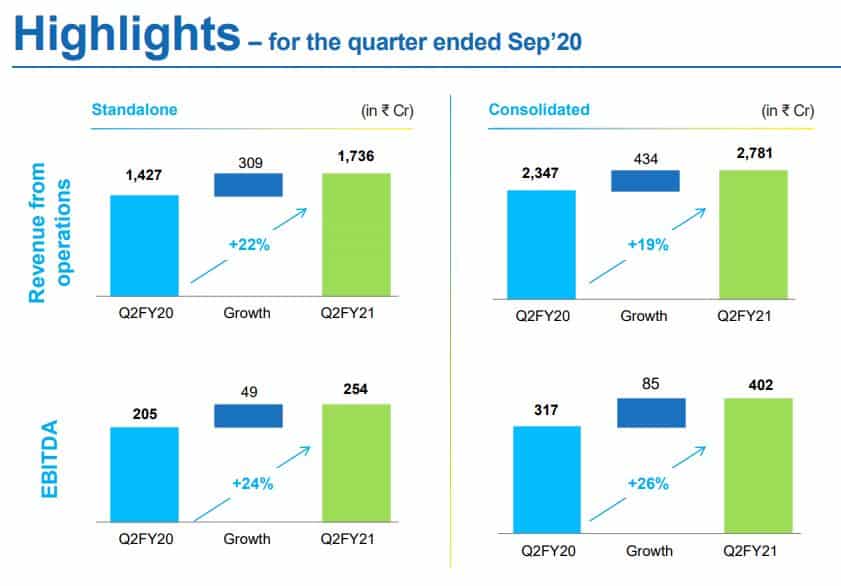

- The company has shown strong performance Y-o-Y basis on all key performance indicators.

- Despite the impact of COVID-19 impact on logistics, transportation, and commercial activities, the company managed to recover most of the operations due to deep distribution strength and wide reach across segments.

- The Beverages segment grew at a healthy pace of 32% in revenue terms and 33% in profitability terms.

- Foods segment [Post Merger with Consumer business] presented strong profitability due to the synergy of operations and cost efficiencies.

- The company raised Dividend to 2.7/- per share from 2.5/- per share [8% growth] and rewarded shareholders in line with growing business and profitability.

Valuation

- Valuations are a subjective phenomenon, and investors should not hold them captive to narratives set over the media; eventually, earnings are the driver of the stock prices, not vice versa. Currently, the stock of Tata Consumer trades at PE ~55, which is higher than some of its listed peers in the Tea/Coffee space.

- The company has gained traction in profitability due to synergies of operations after the merger of the consumer products business with itself however investors also need to be watchful of valuations granted to the businesses and raised expectations from the investor community.

- Due to the closure of commercial activities and restaurants esp. located in shopping malls, etc. have caused the loss of business to the QSRs [Quick Service Restaurants], and Tata Starbucks Ltd is not immune to this impact. The growth in business enjoyed in the past may not return until COVID-19, and its impacts are fully checked.

- The company has strengthened the branded beverages portfolio by buying out the NourishCo JV from PepsiCo, signalling the focus of the management towards the brands.

In summary, the company Tata Consumer Products Ltd is on a strong footing due to brands owned by the company at the domestic as well as international level. The company has also diversified the business into the foods segment apart from the beverages segment after the merger with the consumer products business of Tata Chemicals Ltd.

Despite the competition faced by the company at the local as well as national level due to the presence of unorganized players in the tea/coffee space, the scale of operations and deep distribution strength give the company an advantage over the competition.

The revenue and profitability of the company are growing at a healthy rate, and the company is well-positioned to tap the growing consumer markets of the country. If you are a long-term investor, then you can expect the stock price to reward the shareholders in line with the growing businesses and profitability of the company.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)