Last Updated on December 29, 2021 at 5:51 pm

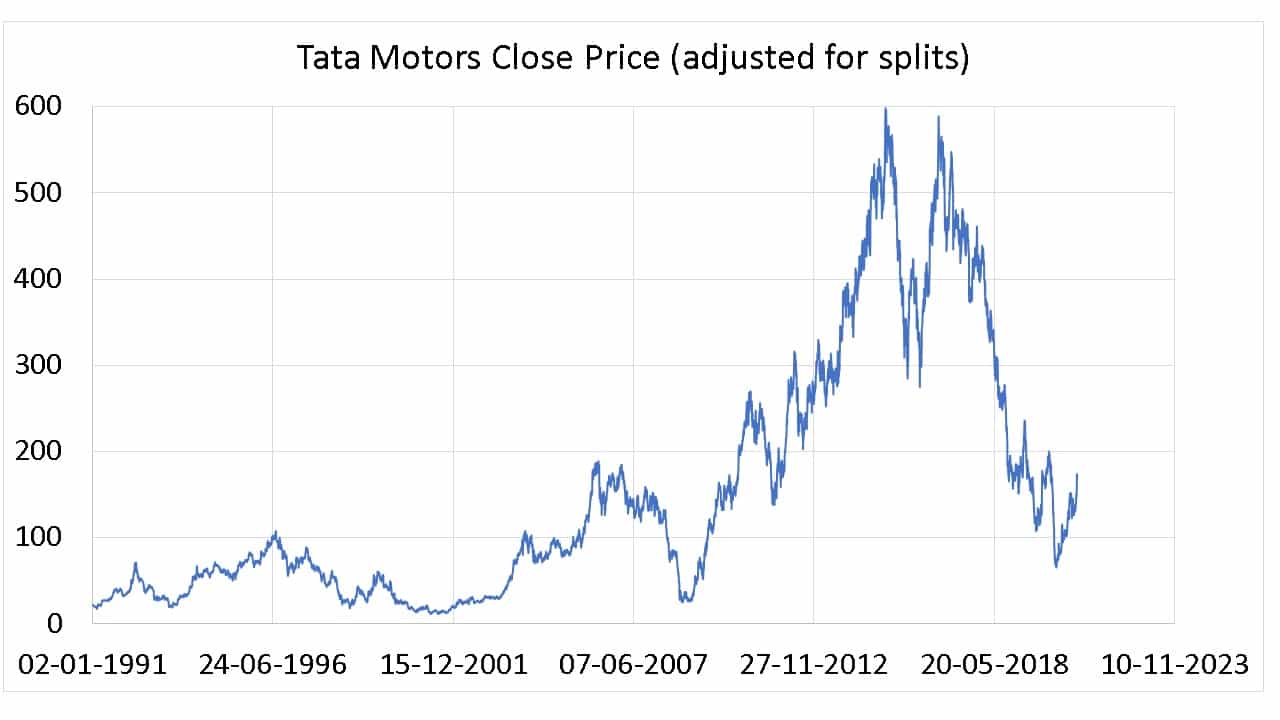

In this article, let us try and answer if Tata Motors share is a good buy. Investors holding on to Tata Motors stock haven’t got respite and stock has been seeing the levels last seen almost a decade ago but is it worth to hold onto the stock and that too in the automobile segment which is facing headwinds from all the sides.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is IDFC First Bank share worth buying? (2) ITC Dividend Analysis (3) Stock Analysis: Is Reliance Industries Ltd Worth Buying? (4) Stock analysis: Is Tata Consumer Products share worth a buy?

The stock has seen a 33% rally in just 1 month and more than 100% in the past 6 months to give a breather.

Let’s take a dig into the Tata Motors stock to understand what the company has gone through in the past decade and what that implies for long term investors.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

Tata Motors is a part of Tata Group, an Indian conglomerate. Its products include passenger cars, trucks, vans, coaches, buses, sports cars, construction equipment and military vehicles.

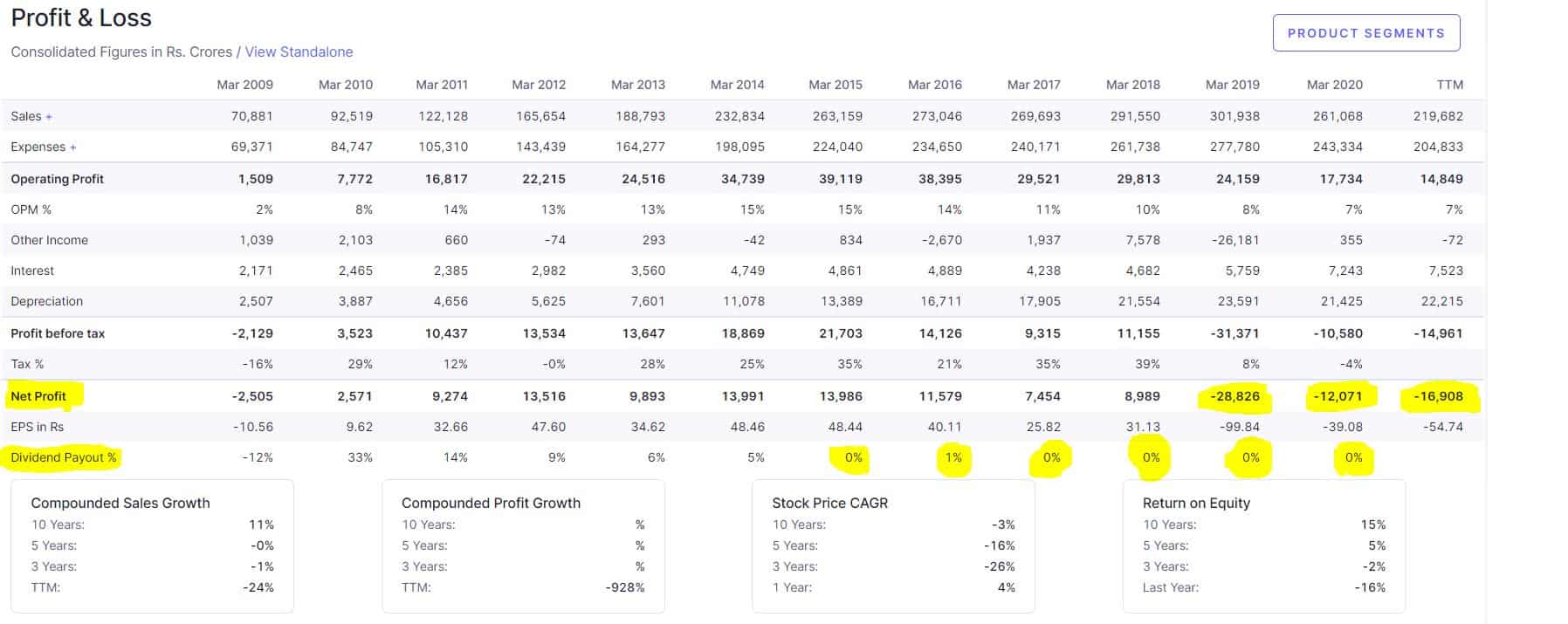

Key concerns the company has faced in the past which caused ‘long term pain’ to the investors.

- Automobiles are a CAPEX heavy industry, companies need to invest heavily into plants, technology, patents, machinery, equipment and even dealer networks to meet the end customer demands. All these require upfront investments that a company has to make to be up and running. Needless to say, if a company still manages to launch a successful product, there awaits tough competition to challenge the products on many fronts: be it a brand image, after-sales service, maintenance costs of the product, the resale value of the vehicles and product quality itself.

- On top of it, the ever-changing technological environment [emerging Electrical Vehicles] demands companies to consistently invest in emerging technologies to remain relevant in the market. Overall, this has led Tata Motors to become debt-heavy and the company hasn’t been able to even report profits in the past couple of years.

- A big chunk of revenues for the company come from JLR [Jaguar Land Rover] business and the primary market for the business in Europe, the Americas and China. The company faced severe headwinds due to the strict emissions control or ban imposed on diesel cars by the European countries. [Check Recent announcement: newer vehicles to be electric-only from 2030 in the UK] This led to analysts writing down stock valuations as well as companies losing customers on the diesel segment.

- Brexit: JLR business is driven from the UK and exports vehicles to customers located in the EU market, once Brexit becomes reality then companies operating out of the EU geography are expected to face pressure as the existing free trade agreements are bound to be reviewed or additional customs/taxes might come to haunt the companies.

- The domestic market in India didn’t give a breather to the company either when BS6 emissions came into force and companies relying heavily on Diesel technology had to offload BS4 stock within a stipulated time frame and give way to costlier BS6 vehicles. The market is taking time to absorb the BS6 technology-supported vehicles [cost escalations due to BS6 technology] and this is causing the companies esp. present in Diesel segment to face headwinds.

- Just when the company was battling on all the fronts, COVID-19 gave a blow to the entire automobile industry when all the commercial activity and movement of goods was halted, additionally, public transport became a no-go zone and buses suddenly came to halt. [Company is a market leader in the transport and logistics segment]

We have talked about most of the concerns the company faced and investors have been taking the brunt of this on the stock performance. The company is shying away from paying dividends from almost the past 6 years due to repayment of debts or reporting of losses in the books. Now, let’s look at what’s in store for the investors going ahead.

If you analyze the financial statements released by the company to the exchanges, the first thing you will notice is the improvement in the FCFs [Free Cash Flows]. The company had faced huge pressure on the books due to debt as well as due to heavy CAPEX that the company had to undergo, but now it appears there is a light end of the tunnel. Let’s go into each business of the company and see how it is performing:

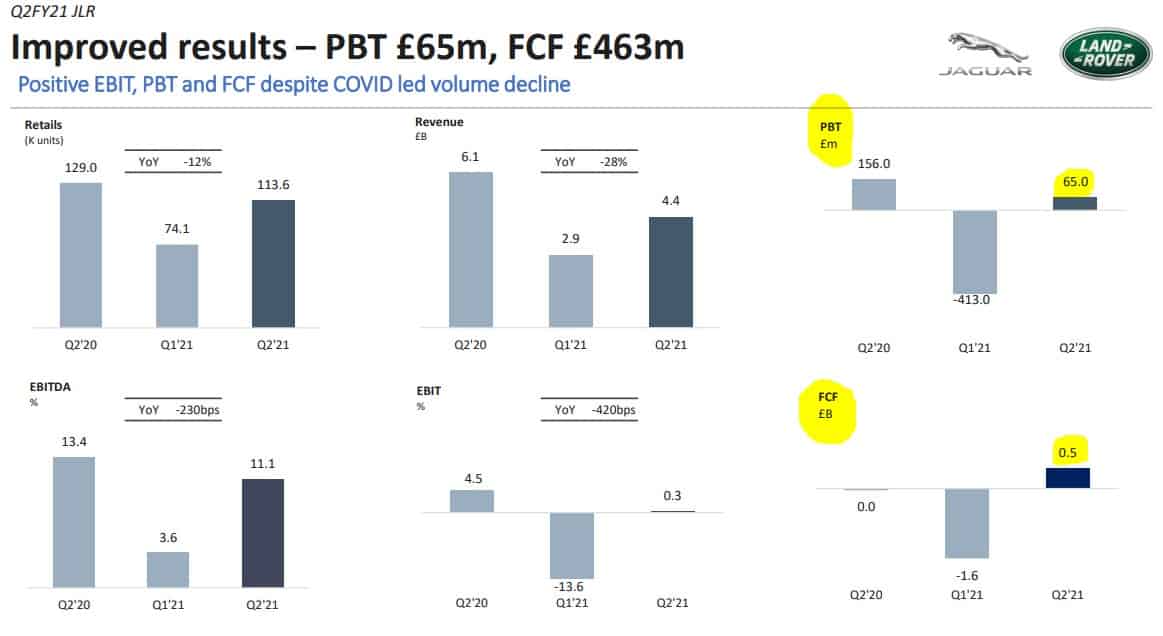

Jaguar Land Rover

Impressions

- Volume & Revenue: Significant improvement Q-o-Q across all markets; China sales up Y-o-Y; Other markets still below pre-Covid levels

- Profitability: Positive PBT of £65m and EBIT of 0.3% despite lower volumes YoY

- Cash Flows: Strong Positive FCF of £463m driven by working capital improvement and operational efficiencies.

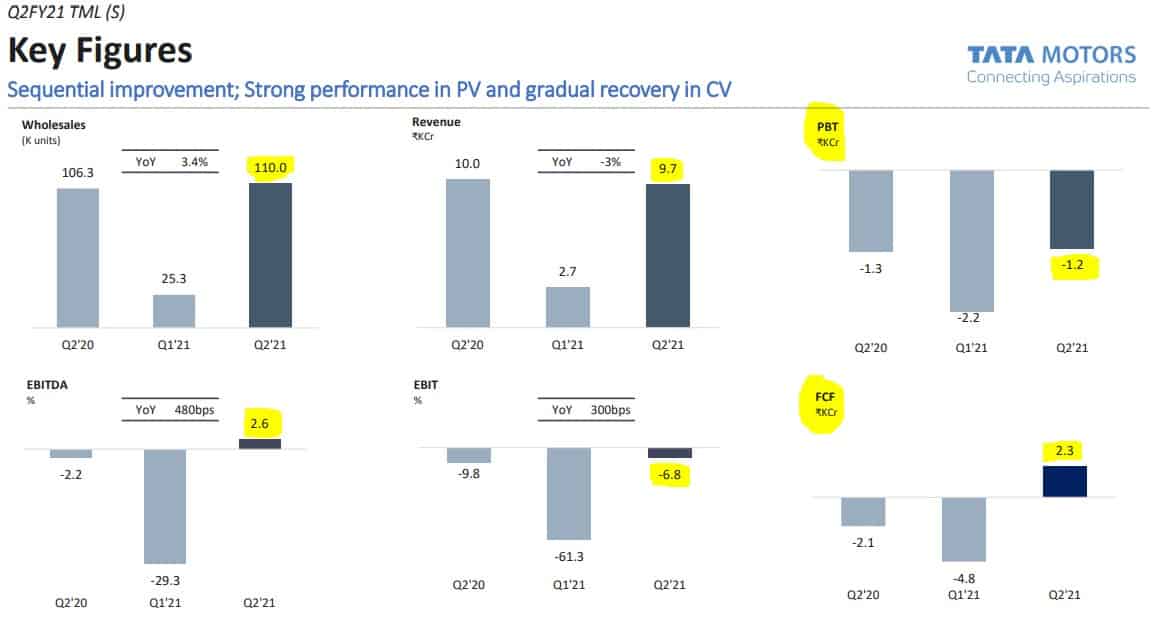

Tata Motors [Standalone Business]

Impressions

- Volume & Revenue: Significant improvement both on Q-o-Q and Y-o-Y basis.

- Profitability: EBITDA positive

- Cash Flows: Strong Positive FCF, driven by working capital improvement and operational efficiencies.

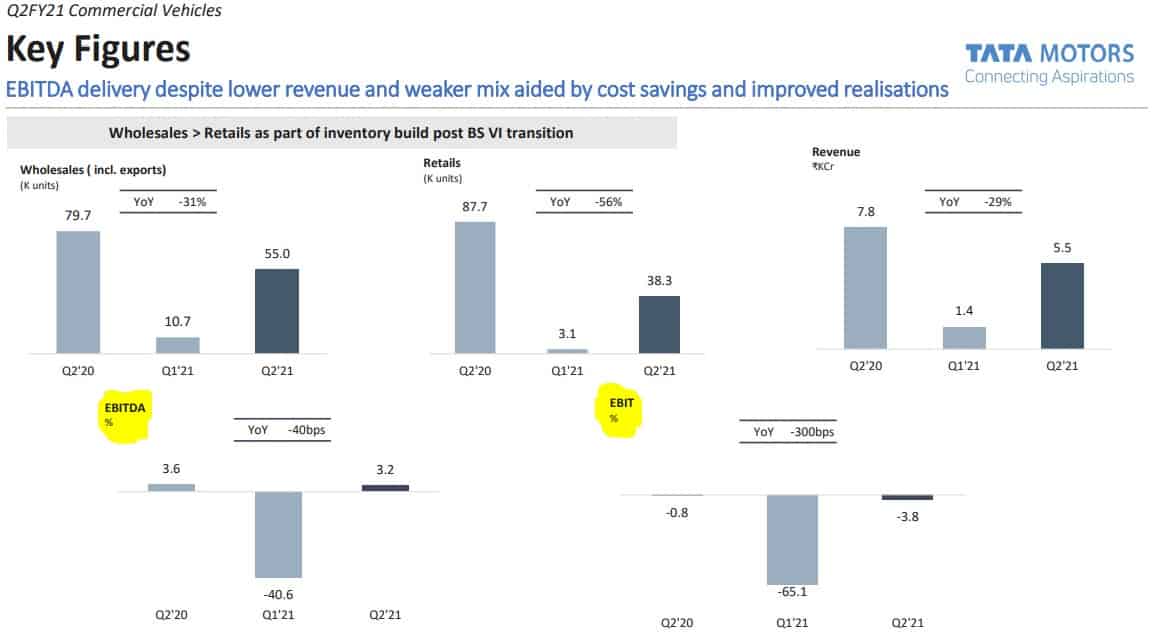

Commercial Vehicles

Impressions

- Volume & Revenue: Commercial vehicles operations significantly impacted due to COVID-19 as most commercial activities remain closed during the past 2 quarters

- Profitability: EBITDA improvement is seen due to operational efficiency

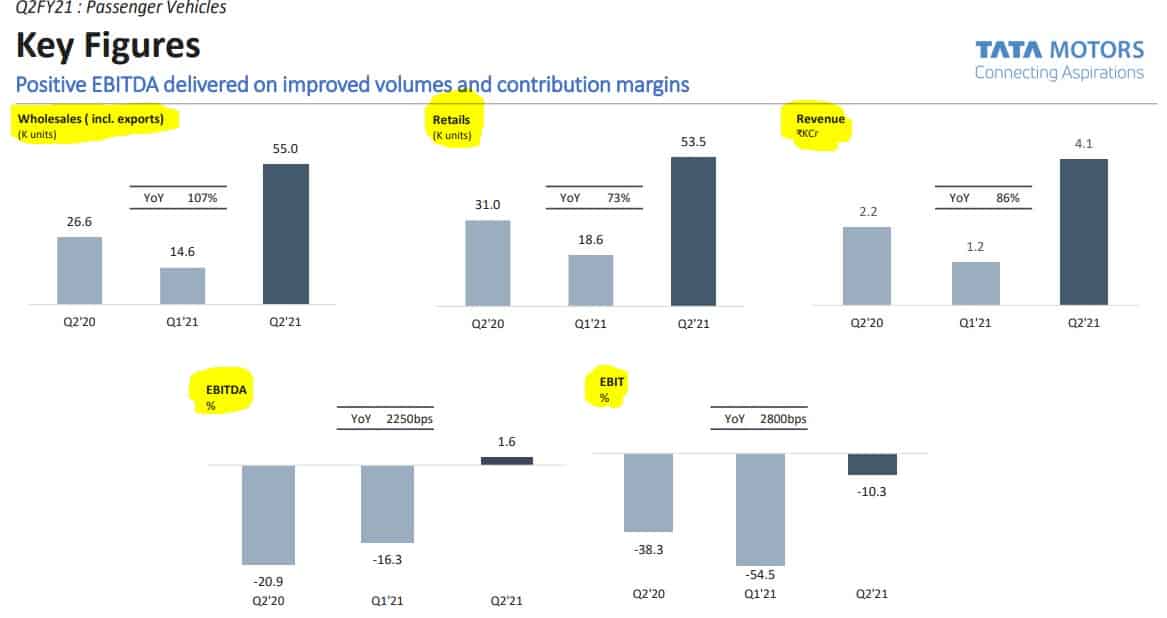

Passenger Vehicles

Impressions

- Volume & Revenue: Significant improvement both on Q-o-Q and Y-o-Y basis.

- Passenger Vehicles: Strong sales reported

- Wholesale units as well as retail units both experienced improvement in QoQ and YoY basis.

- Profitability: Revenue increased both on a QoQ and YoY basis.

- EBITDA improvement is seen due to operational efficiency

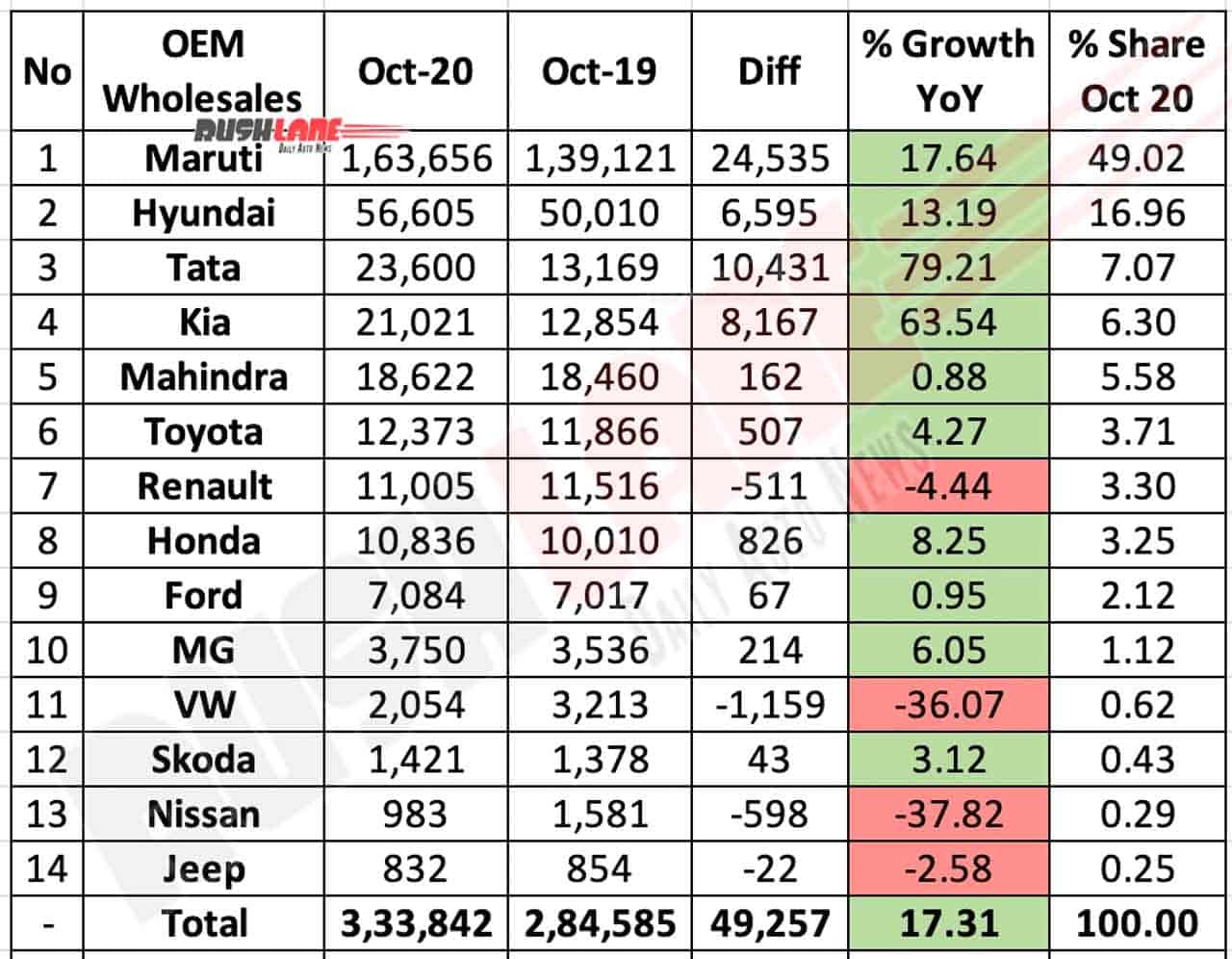

Another important aspect that should catch investors attention is the improvement in market share for passenger vehicles: The passenger car division of the company has been able to move the needle and increase the market share due to various factors ranging from new product launches to renewed product dealer feedback mechanism. This effort made by the company is starting to reflect in the passenger car division where the company now stands 3rd largest car manufacturer in the domestic market by sales figures.

The numbers for October FY2020 are not representative for the entire FY 2020-21 but still present the direction in which the company is proceeding. The company not only gained market share but also showed significant improvement in passenger car sales figures, which implies the trust shown by customers again towards the company’s vehicles.

Another key aspect which is of interest to the investors is the promoters shareholding pattern in the stock of the company. The promoter shareholding of the company has improved in the past 1 year which reflects the confidence shown by the promoter group towards the business of the company.

Let us now summarize:

- The company has been focusing on reducing debt, improving operational efficiency, and generation of free cash flows, as stated by the management in the recent events:

- The company has been in the news recently for all the right reasons where Tata Motors Chairperson N Chandrasekaran said the company would be debt-free in the next coming three years. Source: Tata Motors shares gain 8.5% on the company’s goal to bring debt to near zeros

- A recovery in key markets of Jaguar and Land Rover —the US, Europe, China, the UK — coupled with cost curtailment efforts and tightly controlled capital expenditure will help Tata Motors group generate free cash flow at the business level and reduce debt to near-zero level, P B Balaji, chief financial officer, said at a recent investor meet organised by Motilal Oswal.

- Pickup in domestic sales volume and improvement in market share is already visible in the recent sales data of FY2020.

- Tata Motors has been focussing a lot on the safety aspects of the passenger vehicles that too in the country which ranks on top in terms of road accidents and deaths related to road accidents. The results are visible where Nexon and Altroz both ranked 5 stars in terms of NCAP ratings on safety standards. Tata Nexon went a step ahead by becoming India’s first ever 5 stars rated car on safety standards.

- “Tata Motors’ luxury brand – Jaguar Land Rover (JLR) has turned free cash flow positive in Q2FY21 on the back of a 53 per cent QoQ rise in retail volumes, said CLSA in a report. China and UK markets are driving the recovery now.”

- “After struggling in China and dealing with uncertainty around Brexit, JLR initiated a 2.5 billion-pound cost-cutting drive that has already featured thousands of job losses worldwide. The plan, called Charge, has now been expanded to target savings of 5 billion pounds by March 2021, it said.”

- Company has made investments into the Electric Vehicle technology through subsidiaries and group companies both on the domestic front thru Passenger car division [Nexon EV, Tigor EV] as well as in global markets through JLR [I-Pace].

Investors holding onto the stock as part of a long term portfolio can give more time to stock to perform and should also bear in mind, the automobile is a CAPEX heavy industry and faces tough challenges from competition and technology front.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)