Last Updated on December 29, 2021 at 5:53 pm

Reliance has been the ‘market engine’ ever since it came out with IPO during 1977; this is what many market veterans would like to remember it as. The company has been in the news recently when it completed the sale of about 10 per cent stake in its retail unit to a clutch of foreign investors for Rs 47,265 crore, taking the valuation of the conglomerate beyond 13 Lakh crores. Also, Antitrust body Competition Commission of India (CCI) last week cleared the conglomerate Reliance Industries’ $3.4 billion (or Rs. 24,713 crores) deal to buy Future Group’s retail assets, thwarting Amazon.com’s efforts to block the deal.

About the author: Ravi Kumar has a degree in Computer Engineering. He is interested in Behavioural Finance, Stock market, reading Indian History and Mythology. Disclaimer: No part of this article should be construed as investment advice. Also by the same author: (1) Is Tata Motors share a good buy? (2) Is IDFC First Bank share worth buying? (3) ITC Dividend Analysis (4) Should you sell ITC and book losses? (5) Stock analysis: Is Tata Consumer Products share worth a buy?

Given the strong news flow around the retail venture and the success of the Telecom venture [Jio] of the company, is RIL stock still a ‘value’ buy? Let’s take a look at the businesses of the company and dig into the financials before we arrive at any conclusion.

The company is engaged in the following businesses:

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Enjoy massive discounts on our robo-advisory tool & courses! 🔥

- Refining

- Petrochem

- Oil& Gas

- Retail

- Telecom

Let’s take a glance at how each business of the company is performing.

R&M [Refining & Marketing]

- Macro Trend: Global demand, economic activity impacted by Covid-19

- Crude Situation: High compliance to OPEC+ cuts reduced excess supply

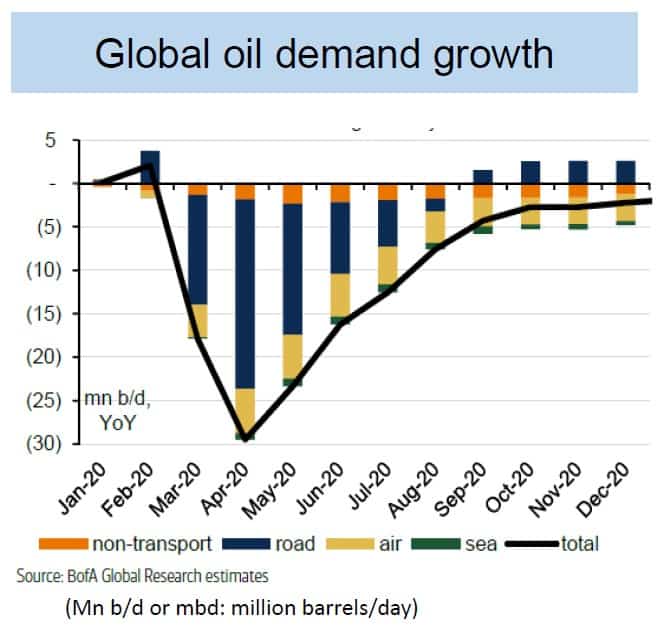

Global peak demand for oil crashed by >30% during March/April 2020. Overall performance impacted by demand shock leading to weak margins.

EBIDTA declined from 5896 Crores during Q2 FY2020 to 3002 Crores during Q2 FY2021 whereas the GRMs [Gross Refining Margins] declined from 9.4$/bbl to 5.7$/bbl.

Petrochemicals

- Macro Trend: Global demand, economic activity impacted by Covid-19 though Consumer durables and FMCG led growth visible in Q2 FY2021 due to increased housing spends in the US and China.

- Strong QoQ growth experienced in this particular business based on a recovery in continued demand from essential sectors like health & hygiene, FMCG, Automobile and Agriculture.

- EBIDTA declined from 8496 Crores during Q2 FY2020 to 5964 Crores during Q2 FY2021 whereas the EBIDTA margins declined from 23.2% to 20.1% for the same period.

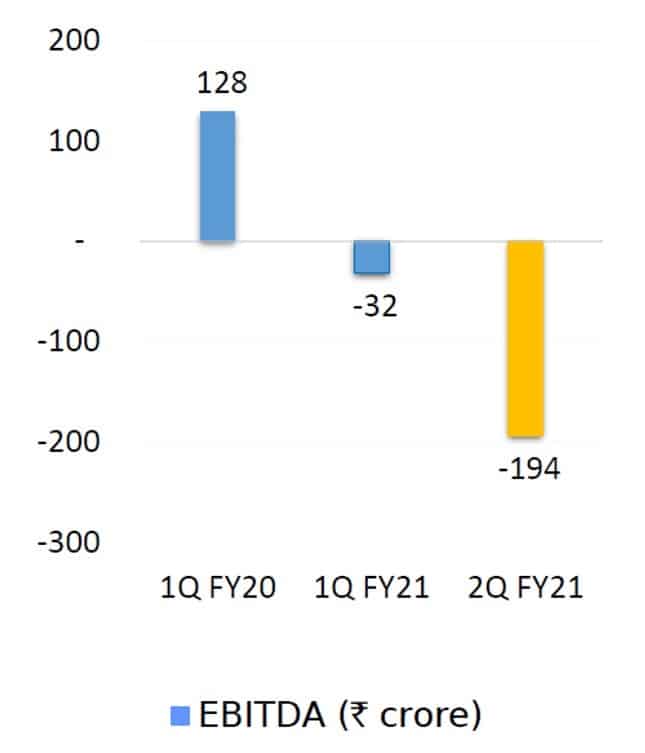

Oil & Gas

- Macro Trend: QoQ, as well as YoY performance, reflects weak US Shale profitability in the Apr-Jun quarter due to sharp (-34%) fall in realisations.

- Global peak demand for oil crashed by >30% during March/April 2020, which is visible in the financial key performance indicators across businesses of the company.

- EBIDTA declined from 128 Crores during Q2 FY2020 to -194 Crores during Q2 FY2021

Reliance Jio Infocomm Ltd

Key observations:

- The first operator outside China to cross 400 million subscribers in a single country market.

- The total customer base of 405.6 million as of September 2020; net addition of 7.3 million in Q2FY21

- The business has gained market share as well as profitability taking the company’s position in telecom business from new entrant to market leader.

- Revenue and EBIDTA both show healthy growth along with gains in market position.

What lies ahead in this sector

Key Observations:

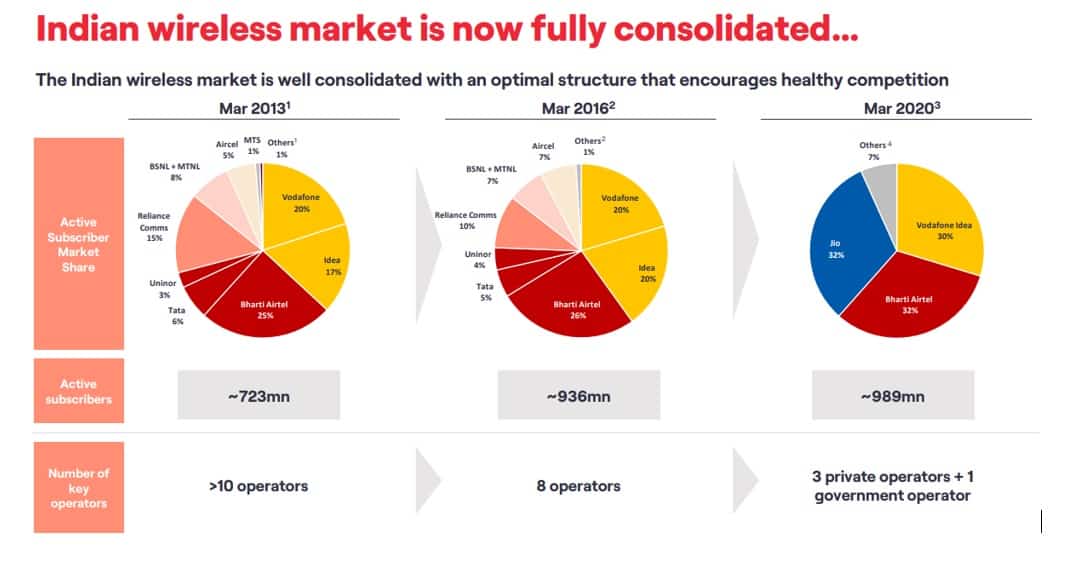

- The Indian telecom market has been through a prolonged period of consolidation in the past decade where some of the players had just to shut the shop.

- Few key players now dominate the market, and the market has gone from being a scattered presence of a few locally strong players, e.g. Hutch/Orange/Vodafone in Mumbai & NCR, and Aircel in TN to nationally present & dominant players.

- Market share of the key dominant players is now consolidating, and subscriber poaching [Mobile Number Portability] war is slowly subsiding.

- Key players of the market to decide the ARPU [Average Revenue per User] trend.

- Tariff hikes in the offing as key players focus on profitability going ahead. Source: Tariff hike needed as current rates unsustainable, says Airtels Mittals.

Key Observations:

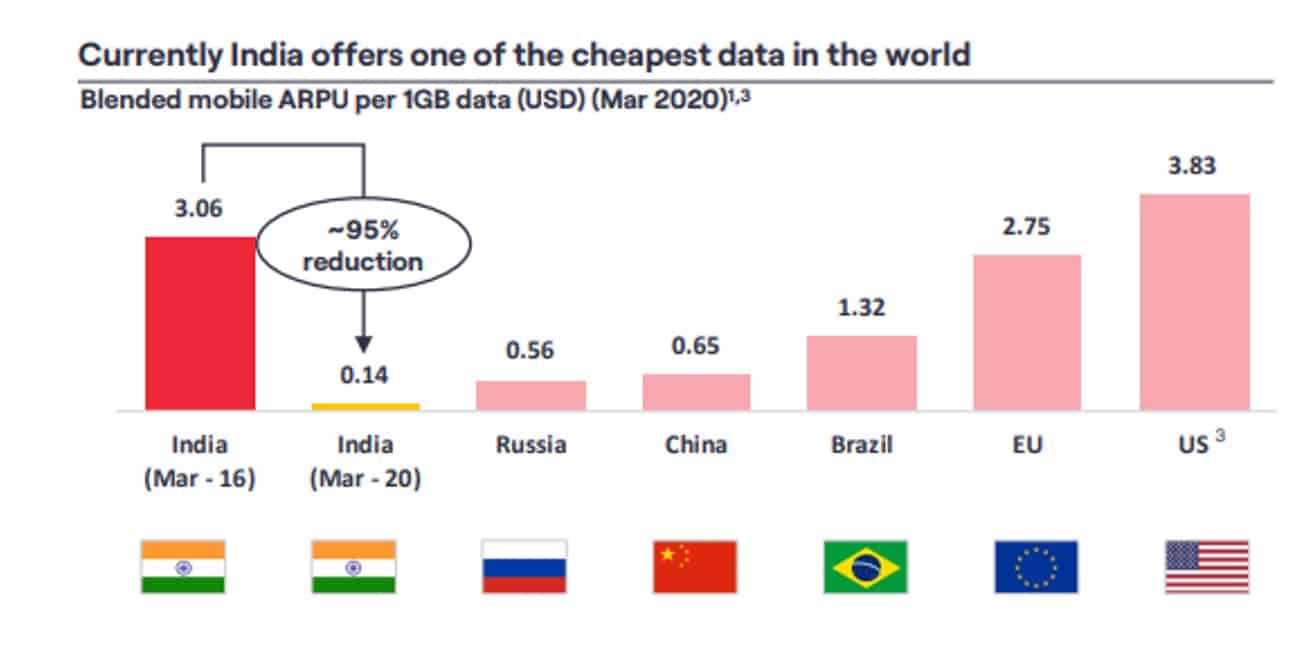

- Data led growth to be the key driver for future ARPU and earnings growth of the telecom service providers.

- Jio’s entry into the telecom market with one of the lowest 4G data rates triggered price wars among the major telecom service providers.

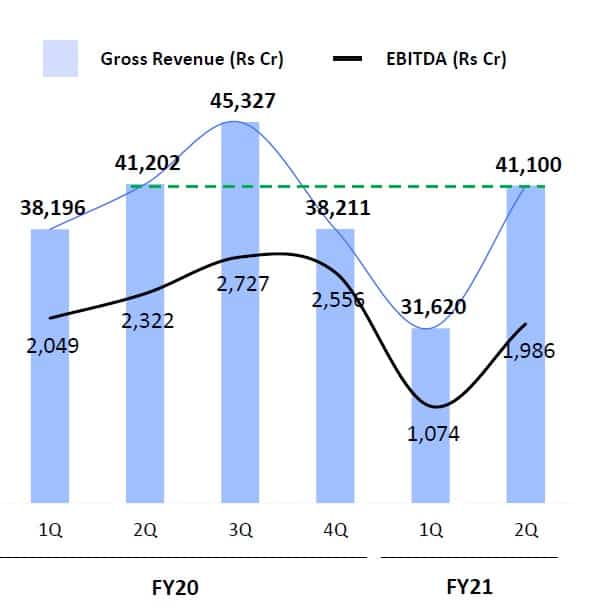

Reliance Retail

Key observations:

- Store functioning impacted, but the easing of lockdown restrictions to help the business recover.

- Footfall severely impacted, which is now showing signs of recovery through commercial activity remains impacted and night curfews make a comeback in several parts of the country.

- Giant retail chains impacted more than smaller neighbourhood grocery stores.

- E-retailing or online delivery businesses gained market share in metropolitan areas.

- The Grocery segment remained more resilient than the Consumer Electronics, Fashion & lifestyle segment.

- Consumers focus more on essential goods and services than discretionary spending until commercial activities recover.

what excites investors about Retail business:

- The Company announced the acquisition of Future Group’s retail/wholesale, logistics/warehousing business.

- Completed acquisition/integration of Netmeds, Grab, Nowfloats, C-Square and Shopsense(Fynd)

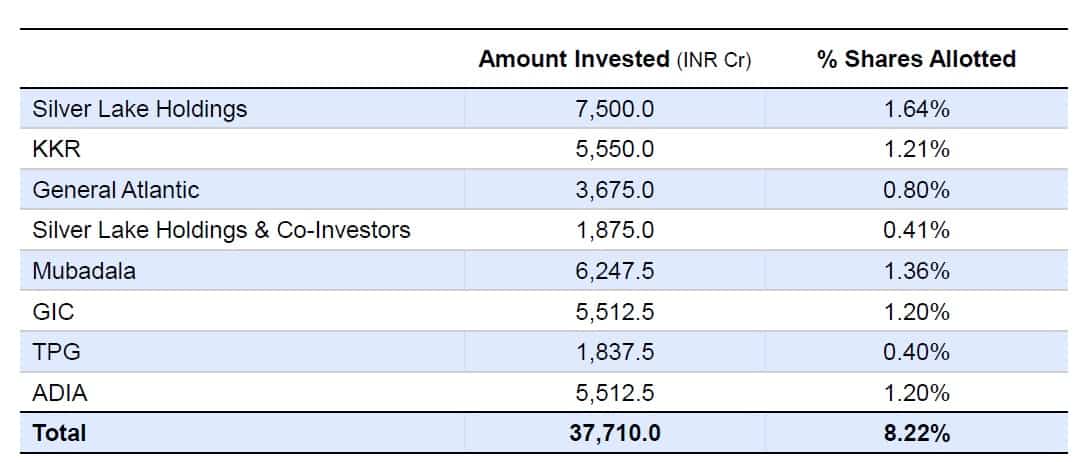

- Largest fundraiser in India in the consumer / retail sector from marquee global investors

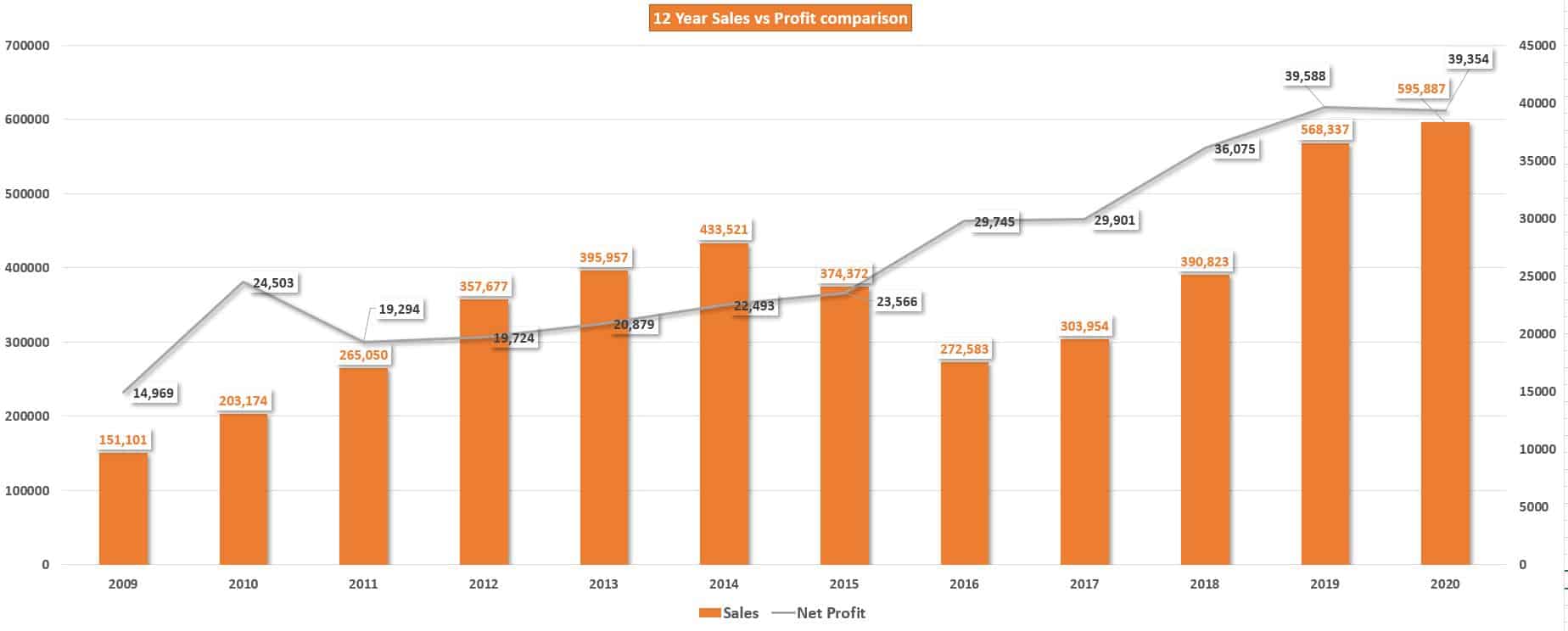

Overall Financial performance of the company over a decade

Key Observations:

- The Company diversified into Retail and Telecom businesses, and it took almost a decade for these businesses to become strong players with a national presence.

- Retail and Telecom have gained significant market share in their respective categories against key competitors. Still, investors should prefer to keep an eye on profitability, given the tough competition and heavy CAPEX.

- Telcom business is readying itself for the launch of 5G as the business requires consistent investments to remain technology ready in short ‘relevant’. Partners with Jio, Airtel for 5G-ready networks, aims to cut per-bit data cost: Cisco’s Sanjay Kaul.

- Company’s core ‘cash cow’ business [Petchem and Refining] impacted by COVID-19 and weakness in global peak oil demand.

- Retail business has grown to become national, but margins remain low, given a tough competition and aggressive pricing by competitors.

- Jio: ARPUs to grow as data rates currently lowest in the world. Subscriber poaching is now subsiding as the telecom market reaches maturity levels in most parts of the country except pockets in rural areas.

- Fundraising activity in Retail venture helped the company to command premium valuations and reduce overall debt.

- “A stake sale to BP for the petro-retail joint venture (JV) is also expected to conclude in FY21 and bring in about ₹7,000 crores to the kitty.” Source: Reliance Industries is apparently net-debt free, but actually it is not so

Looking Ahead: What lies in store for investors?

There are signs of aftershocks from COVID-19 [Pandemic] on the Petchem and Refining businesses, as clearly visible in the quarterly financial reports. The company has a strong focus to reduce overall debt position in the books which caught the eyes of the investors. However, the commercial activities are yet to resume at pre-covid levels, and until that happens, businesses related to Oil, Petchem and Marketing spaces are bound to suffer.

Long term investors should expect the company to reap benefits of the growth in Consumer retail and telecom businesses and rewards investors on similar lines; however, investors should also keep an eye on the valuations front.

Though valuations are subjective phenomena, and investors should not hold them captives to the narratives set over in the media space.

Reliance Industries Ltd. can be compared on the valuations front with its peers across Oil & Gas, Retail and Telecom businesses. Investors across the globe use SOTP [sum of the parts] valuations to arrive at the fair price of the companies which are present in many related or unrelated businesses, in short, ‘Conglomerates’.

Given the valuations of Rs 13 Lakh Crores, the SOTP methodology gives more than Rs. 5 Lakhs Crores to Jio and its platform business alone. Source: Jio Platforms valuation surged to $65 billion in the time of pandemic – here’s how

However Bharti Airtel [Leading Telecom operator] is valued at 2.5 Lakh Crore Rs. and the advantage Bharti Airtel enjoys is the presence in the corporate segment, which brings in the biggest chunk of more loyal and premium [Postpaid & VAS] customers. Jio is yet to make a mark in the corporate segment of the telecom market. Note: Bharti Airtel is the leading telecom operator in 18 countries including India, Sri Lanka, Bangladesh and the African continent.

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 7000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 2,500 investors and advisors use this!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: To get in touch, use this contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)