Last Updated on October 1, 2023 at 4:39 pm

Worried about fluctuating stock market returns? Worried about sliding gold prices? Not sure how much to invest in equity or in gold? Here is an example of a portfolio based on an ingeniously simple notion that has proved to be remarkably stable irrespective of market conditions – stock/commodity/debt/currency markets!

The Permanent Portfolio in an alternative investing paradigm developed by Amercian investment adviser Harry Browne in 1981. The permanent portfolio comprises of stocks, bonds, cash and gold in equal proportions (25%)! This sounds bizarre because for long term goals most investment advisers would recommend (1) significant equity exposure. Typically 100-age. That is 65% equity allocation for a 35 year old and rest in debt. (2) little or no gold exposure (not more than 10%) (3) little or no cash.

How can such an unconventional portfolio allocation work for long term goals? The idea behind the permanent portfolio is fascinatingly simple. In his book, Fail-Safe Investing: Lifelong Financial Security in 30 Minutes, Browne writes about four possible economic conditions:

Prosperity when markets do exceedingly well

Prosperity when markets do exceedingly well- Recession a general slowdown in one or more aspects of the economy

- Inflation No need to explain this one, right?!

- Deflation Negative inflation. Believe it or not, has occurred in the past!

The idea of the permanent portfolio is to choose instruments which will do well in one or more of the above conditions. According to Browne these are:

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! 🔥Enjoy massive discounts on our robo-advisory tool & courses! 🔥

- Stocks When the markets do well. Direct equity or mutual funds. Even an index fund should do.

- Cash during recession. For example a liquid fund

- Gold during inflation

- Long Term Bonds during deflation and prosperity

Thus the permanent portfolio is: 25% Stocks, 25% Cash, 25% Gold and 25% bonds. To ensure “an investor is financially safe, no matter what the future brings”. Read more: The Permanent Portfolio Allocation

An ideal portfolio should provide returns that beat inflation with low volatility. Low volatility here means the compounded annual growth rate (CAGR) at the end of each investment year should not vary too much from the final CAGR. Why low volatility? Too much volatility will kill the fruits of compounding, that is why. The permanent portfolio has measured up to these two requirements in the US quite impressively for the last 40 years! For details: Performance and Historical Returns

Will this approach work in India? An expert is likely to say no for several reasons. (1) India is an emerging economy and equity exposure should be higher than 25% for portfolio returns to beat inflation (2) gold is not an effective hedge for inflation (at least in India) (3) ‘cash’ or liquid debt is unsuitable for long term growth. I am sure there are more. This is as far my thinking takes me. Feel free to add to this in the ‘comments’ section.

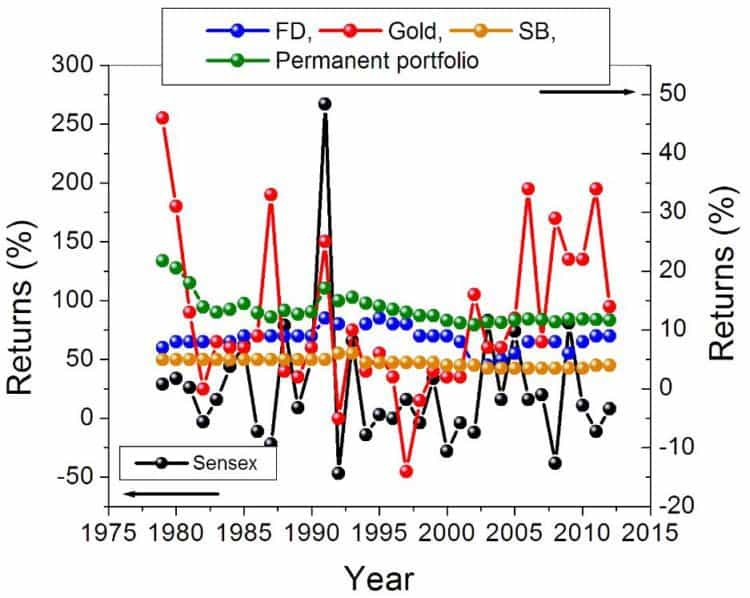

Why not check for ourselves? I have simulated the performance of the permanent portfolio by considering historical Sensex, gold, fixed deposits (instead of bonds) and savings bank returns (instead of money market instruments or liquid funds). One could simply add 1-2% to the SB interest rate to make it resemble a liquid fund. The allocation is 25% in each category, rebalanced each year as noted by Browne in Fail-Safe Investing. You can use the attached Excel file to analyze the performance of the permanent folio for any and every duration between 1979 and 2012 for SIP and lump sum investments.

Short term performance: The permanent portfolio has not always produced great returns for short durations. If you have started a SIP in 2009 you would got an impressive CAGR of 13.62% 3 years later. However if you had started it in 2000, you would have got only 2.2% 3 years later.

Five year returns are a little better. All investments made since 2000 would have yielded impressive double digit returns while investments started between 1992 and 1999 would have yielded dismal returns. If there is a period in time when multiple asset classes under perform simultaneously (for example gold and stocks in the mid 90s) the permanent portfolio fails to impress for short durations. Nothing to shout about though.The investing paradigm is not meant for short term investing (in my view!).

Long term performance: As the investment duration becomes longer, the benefits of the investment portfolio become clearer. The average CAGR of every possible 15 year SIP between 1979-2012 is an impressive 11.2% However SIPs started between 1986 – 1992 would have got only singe digit returns (lowest of 7.8% for a 15 year SIP started in 1986).

When the investment duration is increased to 20 years almost every duration has a double digit return or close to it (the lowest is 9.51%). For a 25 year duration the average CAGR is 11.2%. There are a total of nine 25 periods between 1979-2012. The highest CAGR is 11.48% and the lowest is 10.7%.

Thus for long investment durations (typically more than 20 years!) the permanent portfolio offers a return which is nearly independent of when you start the investment.

The most important feature of the permanent portfolio is its low volatility. That is the CAGR at the end of each investment year does not vary too much from the final CAGR. For example a lump sum investment in the permanent portfolio started in 1987 would have yielded a CAGR (geometric mean) of 11.9%. The arithmetic mean is 1.4% more than the CAGR. This difference between the two means can be considered as a measure of volatility.

If we compare this to a more common asset allocation in which we use 70% equity exposure and 30% debt (FD) exposure, the same lump sum investment started in 1987 would have yielded a CAGR of 15.1% for annual rebalancing. The volatility however is 3%. Thus the yearly returns of a permanent portfolio fluctuate considerably lower than a typical long term portfolio. Lower returns is the price one must pay for this low volatility. You can play with this rebalancing simulator to gauge the performance of conventional equity:debt portfolios.

Note: In the simulation I have used a SB account and added 2% to it so that returns resemble that from a liquid fund. This is not really necessary since it does not make a significant difference to long term returns.

What about risk? Assuming that the permanent portfolio minimizes volatility for long term investments, we need to consider risk. For long term investments the risk of importance is loss of value. That is the returns should comfortably beat inflation in order for any corpus to be effective. In this regard I am not too sure about the performance of permanent portfolio. While it does provide consistent returns of 10-11% for durations above 20 years or so, it is important to recognize that I have not included taxes in the calculation. I would think post-tax returns would hover around 8-9% for a net 11% pre-tax return. This just about equals inflation. Not a bad performance at all, but not great either.Not great because such a return may or may not be sufficient for a financial goal. It certainly good enough for someone with a frugal lifestyle with retirement 25 years away. A long term (~ 15 years) portfolio with (100-age)% in equity still remains the best bet (historically) for comfortably beating inflation.

So why bother? The Indian investor should take the permanent portfolio seriously for several reasons:

- It is a good option for the investor with a volatile temperament. Many investor get jittery and all worked up when equities do badly for many years together. The (100-age) equity exposure formula may not be well suited for such investors. Panic is likely force them make dramatic mistakes and kill the power of compounding. The permanent portfolio with limited exposure in equity (and gold!) maybe better suited for such investors. Of course I am assuming such people look at the overall portfolio growth and not at individual asset classes! A little too much to expect?

- It is a fantastic illustration of how proper diversification can protect a portfolio. In the 2008 market crash the permanent portfolio fell only by a remarkable ~ 2%! The % allocation to each asset class need not be 25%. The key is to choose asset classes with little or no correlation in performance.

- It seems like a good option for someone in their mid-20s planning for retirement at 60.

- It is certainly a good option for the contended investor. Someone who does not worry about what returns others are making (others refer to friends and asset classes!). Someone who is clear about what return is required for his/her goals.

- As the Indian market evolves and (assuming) the economy develops, the gap between actively managed funds and index funds should narrow. Under such circumstances the permanent portfolio should offer much more consistent returns rivaling long term equity returns.

Who is it not for? It is certainly not for those constantly obsessed with returns. Not for those who wish to ‘build wealth’ (someone please explain to me what that means). Not for those who question the 25% allocation: Since gold has crashed, why should I not increase exposure in gold now? If I maintain 25% exposure in equity at all times? Will I not miss out on chances to invest more during market crashes?

Implementation: There are many ways in which a permanent portfolio can be constructed. Ways which are far more rewarding and maybe tax efficient than the one I have used for the simulation:

- 25% good large cap fund, 25% gold etf, 25% ‘income’ debt fund and 25% ‘liquid’ fund. (1/4 asset classes has no long term capital gains tax)

- 25% good large cap fund, 25% gold etf, 25% ‘income’ debt fund and 25% arbitrage fund. (2/4 asset classes has no long term capital gains tax)

- 15% good large cap fund, 10% good mid-cap fund, 25% gold etf, 25% ‘income’ debt fund and 25% ‘liquid’ fund

- Can you suggest ways in this can be done better?

What do you think about the permanent portfolio? Do you think it is suitable for Indian retail investors?

Download the permanent portfolio simulator: Indian Edition

Resources:

- Fail-Safe Investing

- The Harry Browne page on FB

- Permanent Portfolio Family of Funds

- Permanent Portfolio Book

- Permanent Portfolio from the Early Retirement Extreme (ERE) Wiki Page

- Independent Review of the Permanent Portfolio Fund (PRPFX)

- Recent performance of the Permanent Portfolio

Related articles

- Understanding the Nature of Stock Market Returns

- The What, Why, How and When of Portfolio Rebalancing With Calculators to Boot

- A Step-By-Step Guide to Long Term Goal-Based Investing – Part I

🔥Enjoy massive discounts on our courses, robo-advisory tool and exclusive investor circle! 🔥& join our community of 5000+ users!

Use our Robo-advisory Tool for a start-to-finish financial plan! ⇐ More than 1,000 investors and advisors use this!

New Tool! => Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility stock screeners.

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join over 32,000 readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email!

About The Author

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.

Dr M. Pattabiraman(PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over ten years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,000 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition is!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Our new course! Increase your income by getting people to pay for your skills! ⇐ More than 700 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner who wants more clients via online visibility or a salaried person wanting a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you! (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our new book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media Organization dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact information: letters {at} freefincal {dot} com (sponsored posts or paid collaborations will not be entertained)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.

Published by CNBC TV18, this book is meant to help you ask the right questions and seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle! Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is meant for young earners to get their basics right from day one! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)

This is an in-depth dive into vacation planning, finding cheap flights, budget accommodation, what to do when travelling, and how travelling slowly is better financially and psychologically, with links to the web pages and hand-holding at every step. Get the pdf for Rs 300 (instant download)