Last Updated on December 29, 2021 at 12:59 pm

In this article, let us find out about the pros and cons of a virtual credit card or a virtual debit card and if they can replace real credit/debit cards. Digital Payments in the country have been on the rise since the last 2 to 3 years. New modes of payments have been rapidly adopted across the nation. However, more than 95% of trade in India is still offline.

According to a joint report by Omidyar, Bain & Company and Google, 160 million people transact online in India. 54 million people out of these 160 million, stopped transacting online after their first transactions owing to various reasons. One of the reasons why this population stopped transacting after their first online transaction is “Trust”. These first-time shoppers were concerned about their hard earned money being exposed online through Debit/Credit Cards/Internet Banking. The security of the hard earned money in the Digital Space is yet to be guaranteed. One of the solutions to the Security/Trust problems in Digital Payments is “Virtual Cards”. We will take a look at the What, Why, How etc for Virtual Cards.

What are Virtual Cards?

Virtual cards are just like your physical debit/credit cards, except for the fact that they are digital. They are created for a specific amount and for a specific time.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Why do I need a Virtual Card?

All of us deeply value our hard earned money. Virtual Cards are relatively secure payment options as compared to normal debit/credit cards because they are created only for a specific amount that the user wants and remain active only for short time (generally 2 days).

Suppose you want to buy an item for Rs. 5000/- today. You will generate a virtual card for Rs. 5000/- today at 11.00 am and make the payment by 11:15 am. They are made for a specific purpose and for a specific amount. In this way, you restrict the risk to the extent of the amount loaded in the Virtual Card.

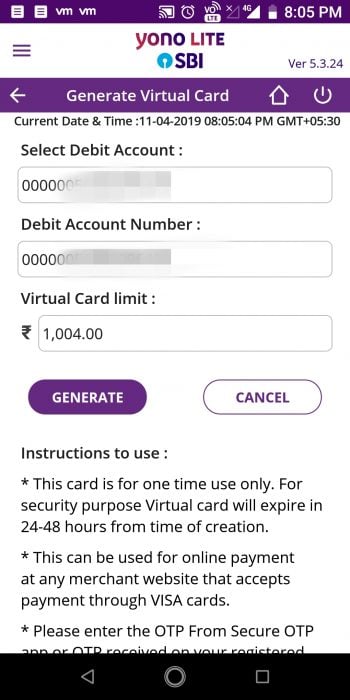

How to create a virtual card? Step by step guide

They can be created using:

- Internet Banking or

- Mobile Banking App of your Bank.

Majority of the banks today offer Virtual Cards. Below, is a step by step guide to creating a Virtual Card from one of the banks.

Step 1: Login to the Mobile Banking App from your Bank.

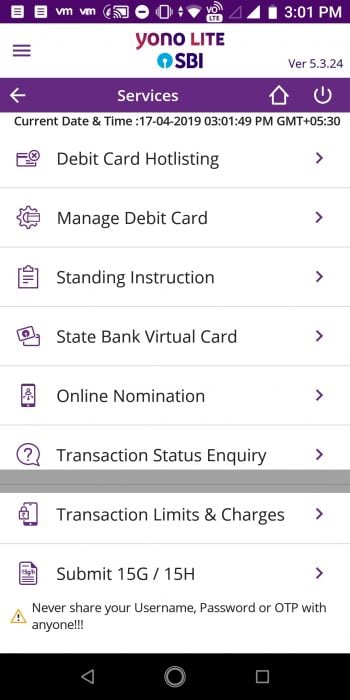

Step 2: Go to the services section of the App. Click on Generate Virtual Card.

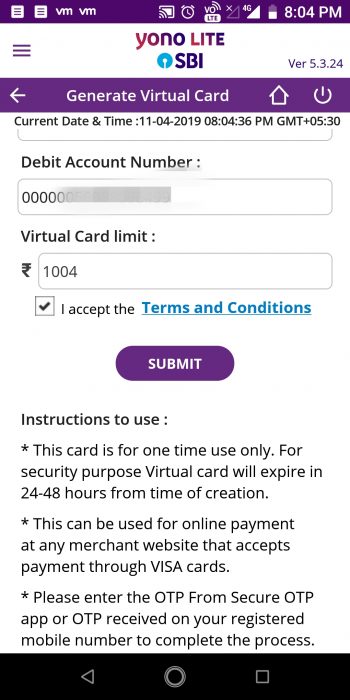

Step 3: Enter the desired amount & click Submit

Step 4: OTP will be generated. Submit it, to generate the card

Step5: Congratulations! Your virtual card will look as under:

Note:-

The expiry date mentioned on Card image may be different from the actual expiry date of the Virtual Card. The expiry date is only for the purpose of filling the field while doing a transaction. It may not reflect the actual expiry date of the card as it is generally 48 Hrs.

How and Why are Virtual Cards more secure?

- Loss is restricted to the amount in the debit card.

- Underlying Account/card details are not exposed. Hence, the card is protected against hacking and other frauds.

- Validity period is generally 2 days or the complete usage of the amount in the card, whichever earlier.

- Transactions through Virtual Cards are further secured through OTP

- The card generation is also secure, as it goes through PIN and OTP validation.

What are the Benefits of Virtual Cards?

- Instant issuance- no physical printing and despatch of the card.

- No issuance fee.

- Easy to use.

- Ideal, when you are making a payment on a lesser known website or a website on which you are not sure of the security standards followed.

- Rare instances where someone would have lost money to fraud in Virtual Cards. (Probably, no such instances reported in Media)

- Higher Flexibility- Choose the amount that you wish.

- Easy issuance- There is no requirement of physical paperwork.

- Generally, the amount for which the card is generated is marked as a lien in the account. The amount gets debited from the account only during the actual transactions. Hence, you do not lose interest even for 1 day if the card is not used.

- Many banks do not put a cap on the number of cards that can be generated in one day.

If the card is not required, it can be cancelled. The unutilized amount is credited back instantly in the account.

Which Banks have a facility of Virtual Card?

The apps of the following bank offer Virtual Cards

- M Clip by Bank Of Baroda

- Pockets by ICICI Bank

- 811 by Kotak Bank

- DigiBank by DBS

- PayZapp by HDFC Bank

- UDIO by RBL Bank

- Virtual card by State Bank

- Payapt by IDBI Bank

- DigiPurse by Union Bank

- Yes Pay by Yes Bank

(The list is not exhaustive and the order of listing is random)

In addition, International online transfer portals like Payoneer and Entropay also offer this. However, not all services can transfer money to these cards or accept them for payment.

What are the Limitations of Virtual Cards?

The features vary from bank to bank. In general, below are certain limitations (if one may consider them to be):-

- You cannot reload the same card.

- Some banks may issue only a Single-transaction Card. You may have to create the card, every time you want to use

Generally, they are for Domestic use only. (Valid for payment in INR in India, Nepal & Bhutan)

Current Scenario in Online Payments

Wallets/ “Pay Later” options from companies like Simpl, PayTm, Flipkart, LazzyPay are also ways to protect you against losses from cyber fraud. They are high on convenience. However, post introduction of KYC regulations, they have not been able to retain the high customer base they have had in the past. A large number of Incidents of frauds/failure in transactions from Wallets can be read on Twitter handles of these companies.

Tokenisation:

Considering that nothing is 100% safe/secure, RBI has made efforts to make Card Payments more secure by introducing “tokenisation” in normal debit/credit cards. Through ‘Tokenisation” a unique digital token will be issued by the bank which will contain masked details of the card. As a result, the card number will not be exposed while making a payment. It will take some time before the widespread adoption of ‘tokenisation’ technology in India.

Summary

So folks, till that time, if you do not mind putting in a little extra effort & time to generate a Virtual Card, it can be your insurance against cyber frauds!!

Note: This article was written in collaboration with a commissioned writer who is from the banking industry.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)