Last Updated on December 14, 2025 at 3:11 pm

It is time for my personal financial audit! Each December I take stock of my portfolio, investments and where I stand with respect to my goals. The idea behind this exercise is to encourage similar action among readers. My success (if I can call it that) is the residue of luck (therefore market-linked) and consistency and what follows is written with gratitude and not with the intention to boast.

Accountability: This is the archive of personal finance audits published before 2013 audit, 2014 audit, 2015 audit, 2016 audit, 2017 audit, 2018 audit. During the Dec 22 Chennai investor meet, I was asked about the fund used for retirement planning. Members of the audience remembered what they were faster than me!

Sharing portfolio details with readers brings in a new level of responsibility. I cannot make random purchases because that would look silly in the audit! After a decade of trial and error, this annual task checks if the “flow” in the right direction! Thank you.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

🔥Want to create a complete financial plan? Learn goal-based investing? Exclusive access to our DIY tools? Increase your income with your skills? Use this link to enjoy massive discounts on our robo-advisory tool & courses! 🔥

Developments in 2019 The biggest change is the growth of my direct stock portfolio. I rebalanced my son’s future goal portfolio a few weeks ago. Other than that, it has been a quiet year so far.

Retirement

Asset Allocation: Equity 57.6%, Fixed Income: 42.4%

Equity: Mutual funds: 93.7%, Stocks: 6.67% (up from 2% last year)

Fixed Income: NPS 82%, PPF (self, spouse): 18%

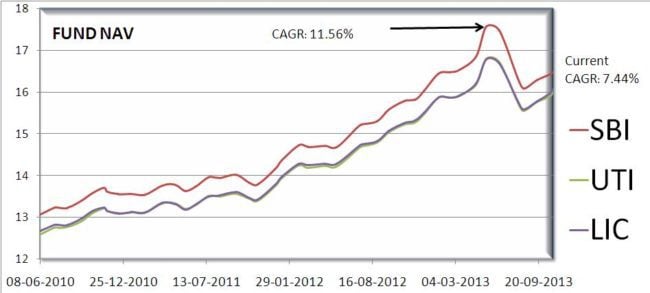

NPS Investments

This is the default set up of the NPS with 85% fixed income and 15% equity. Most of the fixed income is gilts.

SBI PENSION FUND SCHEME – CENTRAL GOVT 34.00%

UTI RETIREMENT SOLUTIONS PENSION FUND SCHEME- CENTRAL GOVT 33.00%

LIC PENSION FUND SCHEME – CENTRAL GOVT 33.00%

XIRR from 08-Mar-2010 to 24-Dec-2019 is 9.71% Note NPS contributions between Aug 2006 to Feb 2010 were kept in a holding account earning 8% a year until the NPS was “ready” and then invested into the NPS.

NPS was a bumpy ride with incidents such as this (overnight 2% increase in interest rate). Which is my investors should never forget that NPS are mutual funds subject to market risks

Mutual Fund Investments

- HDFC Balanced. XIRR: 11.24% (consolidated after the merger, using my tracker) Weight: 40.4%

- Parag Parikh Long Term Equity Fund XIRR: 13.8% Weight 37.4%

- Quantum Long Term Equity: XIRR 7.15% Weight: 21.9%

- Overall XIRR since inception: 11.6%

Last year all three funds were in equal proportions but due to Quantums prolonged underperformance, its weight has gone down without redeeming but by shifting investments. I am considering a shift from Quantum to ICIC Multi-Asset but I have still not finalised it.

Why not index funds? At my age (I am 45) and at my portfolio size, I value guaranteed lower volatility more than a chance of outperformance or low-cost market returns. It is for this reason, I prefer hybrid funds than index funds. Quantum has given me fantastic volatility protection but the dip in returns has been too much for too long.

Portfolio Analysis

I keep pointing out that “returns do not matter“. We need to evaluate what is the corpus actually worth.

- If X is my annual expense, my retirement corpus is about 31.4X. This means that I can beat inflation for 30-31 years if my retirement corpus earns a post-tax return equal to inflation. See video below for details.

- If I quit my job now, I can generate an inflation-protected income for about 35+ years with a bucket strategy (depending on market conditions)

Resources for early retirement

- E-book: How to retire early in India

- Review Your Financial Freedom Portfolio in Seven Easy Steps

- Key features of the freefincal robo advisory software template

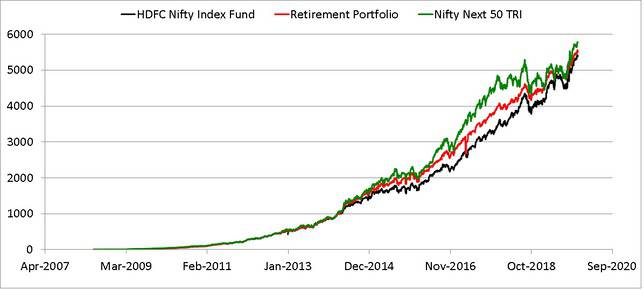

This is the growth of my retirement portfolio from 19th June 2008. You can get full details of my mutual fund journey here: Ten Years of Mutual Fund Investing: My Journey and lessons learned.

My portfolio is in red. The black line is an HDFC Nifty index fund with the same investment and same date. This would have given pretty much the same overall XIRR (113%) as my entire portfolio!!

My portfolio is in red. The black line is an HDFC Nifty index fund with the same investment and same date. This would have given pretty much the same overall XIRR (113%) as my entire portfolio!!

The green line is NIfty Next 50 TRI (same investments, same date). This would have returned 13% XIRR but clearly is a lot more volatile. Regular readers would recall that last year Nifty Next 50 was lower than my portfolio. So do not get any ideas other than the efficacy of a simple index fund. My hindsight can be your foresight.

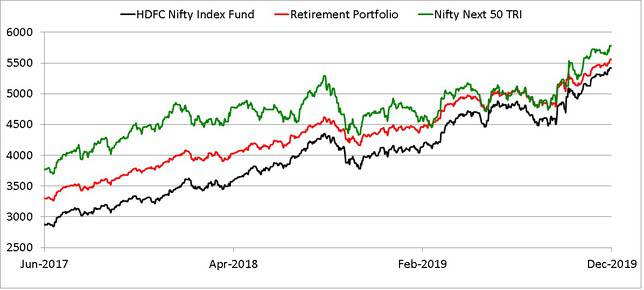

This is a closer look at the same graph.

This is the gain or loss in the portfolio. Please note that all numbers in the y-axis are normalised and have no specific meaning!

This is the gain or loss in the portfolio. Please note that all numbers in the y-axis are normalised and have no specific meaning!

After five years of “mutual fund Sahi Hai” investing, my grand gain was minus one lakh! It is good to know this only in hindsight! If I had bothered to do this calculation in Dec 2013, I might have pulled out before the big rally that changed my life.

After five years of “mutual fund Sahi Hai” investing, my grand gain was minus one lakh! It is good to know this only in hindsight! If I had bothered to do this calculation in Dec 2013, I might have pulled out before the big rally that changed my life.

The fall of the retirement portfolio from all-times compared with HDFC Nifty Index fund is shown below. During big falls, the portfolio has typically lower.

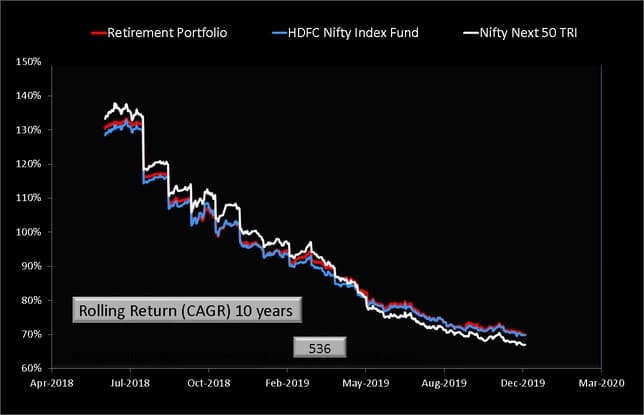

This is the rolling return over ten years (treat as absolute gain). Noticed how NIfty Next 50 has fallen. The portfolio has not significantly deviated from NIfty and just about managed to stay a “touch” above.

This is the rolling return over ten years (treat as absolute gain). Noticed how NIfty Next 50 has fallen. The portfolio has not significantly deviated from NIfty and just about managed to stay a “touch” above.

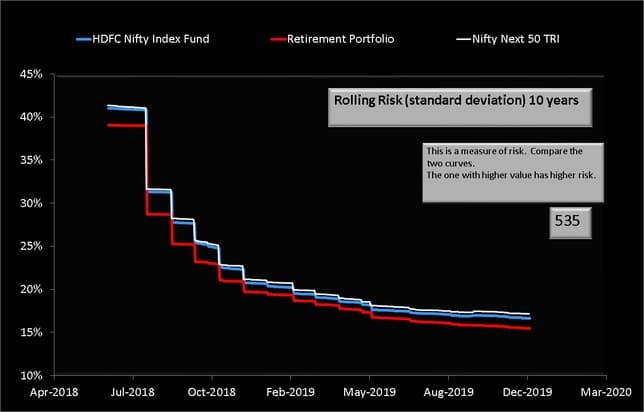

The rolling volatility over ten years is shown below. The portfolio has consistently been lower in volatility with a bit more return.

The rolling volatility over ten years is shown below. The portfolio has consistently been lower in volatility with a bit more return.

Stock portfolio

Stock portfolio

This is my experimental stock portfolio. Half of it is filled with low volatility stocks with positive momentum (not momentum stocks with low volatility!) and the other half with high dividend stocks. Kindly do not attempt to copy this. I have the luxury to fool around with this although as you can see I am playing it fairly safe.

| Symbol | Holdings Buy Value |

| HINDUNILVR | 28% |

| HDFCBANK | 24% |

| ASIANPAINT | 11% |

| COLPAL | 9% |

| INFY | 4% |

| TCS | 4% |

| ITC | 3% |

| HINDPETRO | 3% |

| DABUR | 3% |

| COALINDIA | 2% |

| PIDILITIND | 2% |

| IOC | 2% |

| VEDL | 2% |

| MARICO | 2% |

| WIPRO | 1% |

Child’s Education

I have been investing for my son’s future since Dec 2009 (a month before he was born). Then it was an 18-year old goal and now it has become an 8-year old goal. So more caution becomes necessary.

Asset allocation

- Equity 60.3%

- Fixed income 39.6%

Equity:

- HDFC Prudence. XIRR 13.6% Weight: 29.2%

- Mirae Large Cap Fund XIRR 13%. Weight 38.3%

- ICICI Dynamic (ICICI Multi-asset fund) XIRR 12% Weight: 32.5% (will increase weight going forward)

- Overall portfolio XIRR 11.8%

Debt:

- PPF (in his name) + I also use my mothers PPF (which doubles as her tax planning instrument). However, none of the PPF accounts is maxed out. I prefer to pay a little exta tax for my mother than lock money up in PPF

- ICIC Equity arbitrage XIRR 6.8%. This is used for rebalancing and gradually accumulate the corpus as the goal nears.

Analysis: my son’s future needs

The 40% fixed income allocation is now enough to fund a UG degree comfortably plus a little bit PG perhaps. My son is not yet 10. Going forward, my goal is to increase the fixed income allocation so that the cost of UG + PG degree is taken care as per current expenses. If I can manage this for as long as possible, there is no reason to worry about a market crash close to the goal deadline.

I have shown that a step-wise reduction in equity well before the goal deadline is a simple way to reduce risk and achieve a target corpus, but you can also play it by the ear if you have some confidence.

I am perhaps a good example of how a person’s risk appetite increases as net worth increases.

What do I expect in 2020?

As mentioned in this recent post – Return difference of Nifty 50 vs Nifty 50 Equal-weight index at an all-time high – suggesting the possibility of a correction if not a crash. Corrections are worse than a crash as they will take longer to recover from.

With respect to retirement, my goal is to stay close to 10-11% XIRR and reduce risk even further. The same is also true for my son’s education portfolio.

The only disadvantage with my stock portfolio is I might be holding these stocks in mutual funds as well, but not much can be done about it. Let us see how it pans out.

If you any questions or comments, please use the comment box below.

Use our Robo-advisory Tool to create a complete financial plan! ⇐More than 3,000 investors and advisors use this! Use the discount code: robo25 for a 20% discount. Plan your retirement (early, normal, before, and after), as well as non-recurring financial goals (such as child education) and recurring financial goals (like holidays and appliance purchases). The tool would help anyone aged 18 to 80 plan for their retirement, as well as six other non-recurring financial goals and four recurring financial goals, with a detailed cash flow summary.

🔥You can also avail massive discounts on our courses and the freefincal investor circle! 🔥& join our community of 8000+ users!

Track your mutual funds and stock investments with this Google Sheet!

We also publish monthly equity mutual funds, debt and hybrid mutual funds, index funds, and ETF screeners, as well as momentum and low-volatility stock screeners.

You can follow our articles on Google News

We have over 1,000 videos on YouTube!

Join our WhatsApp Channel

- Do you have a comment about the above article? Reach out to us on Twitter: @freefincal or @pattufreefincal

- Have a question? Subscribe to our newsletter using the form below.

- Hit 'reply' to any email from us! We do not offer personalised investment advice. We can write a detailed article without mentioning your name if you have a generic question.

Join 32,000+ readers and get free money management solutions delivered to your inbox! Subscribe to get posts via email! (Link takes you to our email sign-up form)

About The Author

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.

Dr M. Pattabiraman (PhD) is the founder, managing editor and primary author of freefincal. He is an associate professor at the Indian Institute of Technology, Madras. He has over 13 years of experience publishing news analysis, research and financial product development. Connect with him via Twitter(X), LinkedIn, or YouTube. Pattabiraman has co-authored three print books: (1) You can be rich too with goal-based investing (CNBC TV18) for DIY investors. (2) Gamechanger for young earners. (3) Chinchu Gets a Superpower! for kids. He has also written seven other free e-books on various money management topics. He is a patron and co-founder of “Fee-only India,” an organisation promoting unbiased, commission-free, AUM-independent investment advice.Our flagship course! Learn to manage your portfolio like a pro to achieve your goals regardless of market conditions! ⇐ More than 3,500 investors and advisors are part of our exclusive community! Get clarity on how to plan for your goals and achieve the necessary corpus no matter the market condition!! Watch the first lecture for free! One-time payment! No recurring fees! Life-long access to videos! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence.

Increase your income by getting people to pay for your skills! ⇐ More than 800 salaried employees, entrepreneurs and financial advisors are part of our exclusive community! Learn how to get people to pay for your skills! Whether you are a professional or small business owner seeking more clients through online visibility, or a salaried individual looking for a side income or passive income, we will show you how to achieve this by showcasing your skills and building a community that trusts and pays you. (watch 1st lecture for free). One-time payment! No recurring fees! Life-long access to videos!

Our book for kids: “Chinchu Gets a Superpower!” is now available!

Must-read book even for adults! This is something that every parent should teach their kids right from their young age. The importance of money management and decision making based on their wants and needs. Very nicely written in simple terms. - Arun.Buy the book: Chinchu gets a superpower for your child!

How to profit from content writing: Our new ebook is for those interested in getting a side income via content writing. It is available at a 50% discount for Rs. 500 only!

Do you want to check if the market is overvalued or undervalued? Use our market valuation tool (it will work with any index!), or get the Tactical Buy/Sell timing tool!

We publish monthly mutual fund screeners and momentum, low-volatility stock screeners.

About freefincal & its content policy. Freefincal is a News Media organisation dedicated to providing original analysis, reports, reviews and insights on mutual funds, stocks, investing, retirement and personal finance developments. We do so without conflict of interest and bias. Follow us on Google News. Freefincal serves more than three million readers a year (5 million page views) with articles based only on factual information and detailed analysis by its authors. All statements made will be verified with credible and knowledgeable sources before publication. Freefincal does not publish paid articles, promotions, PR, satire or opinions without data. All opinions will be inferences backed by verifiable, reproducible evidence/data. Contact Information: To get in touch, please use our contact form. (Sponsored posts or paid collaborations will not be entertained.)

Connect with us on social media

- Twitter @freefincal

- Subscribe to our YouTube Videos

- Posts feed via Feedburner.

Our publications

You Can Be Rich Too with Goal-Based Investing

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.

Published by CNBC TV18, this book is designed to help you ask the right questions and find the correct answers. Additionally, it comes with nine online calculators, allowing you to create custom solutions tailored to your lifestyle. Get it now.Gamechanger: Forget Startups, Join Corporate & Still Live the Rich Life You Want

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.

This book is designed for young earners to get their basics right from the start! It will also help you travel to exotic places at a low cost! Get it or gift it to a young earner.Your Ultimate Guide to Travel

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)

This is an in-depth exploration of vacation planning, including finding affordable flights, budget accommodations, and practical travel tips. It also examines the benefits of travelling slowly, both financially and psychologically, with links to relevant web pages and guidance at every step. Get the PDF for Rs 300 (instant download)